by Calculated Risk on 11/01/2008 07:57:00 PM

Saturday, November 01, 2008

Chrysler Renault-Nissan Talks Halt, Cerberus Prefers GM

From Detroit News: Chrysler-Nissan talks halt

Talks between the Renault-Nissan alliance and Cerberus Capital Management LP have stopped as both sides acknowledged Cerberus's preference to conclude a deal for Chrysler LLC with General Motors Corp. ... viewing it as financially more advantageous and also better for the U.S. auto industry.The WSJ hints that a deal may be imminient:

Speculation continues to swirl that Cerberus is looking to make a move on Chrysler as early as Tuesday but has run into problems in lobbying for federal aid.And the impact of a merger could be significant:

News of a GM-Chrysler merger has chilled automotive workers throughout the country. Such a partnership would result in the closing of seven of Chrysler's 14 U.S. factories and ... As many as 200,000 jobs could be cut ...

The Possible Impact of Contracting Manufacturing in China

by Calculated Risk on 11/01/2008 04:48:00 PM

From Bloomberg: China Manufacturing Contracts as Crisis Trims Exports

The Purchasing Managers' Index fell to a seasonally adjusted 44.6 last month from 51.2 in September, the China Federation of Logistics and Purchasing said today ... That was the lowest since the gauge was launched in July 2005. A reading below 50 reflects a contraction, above 50 an expansion.As China tries to stimulate their economy, this could have an adverse impact on U.S. interest rates. Let me explain ...

China's cabinet has pledged extra infrastructure spending to stimulate the world's fourth-biggest economy amid the global slowdown. ... ``The government needs effective stimulus measures to spur growth,'' said Wang Qian, a Hong Kong-based economist at JPMorgan Chase & Co. ``The external economic outlook is worsening rapidly.''

Manufacturing contracted in July for the first time since the survey began in 2005. It also shrank in August. The October index was a record low.

First, here is an excerpt from a post I wrote in March 2005:

There is a strong correlation between increases in mortgage debt and increases in the trade deficit. Although the correlation is high, it is very possible that there is no direct linkage, instead the same economic causes that led to higher trade deficits also led to more household borrowing. However, in recent years, with the dramatic increases in mortgage borrowing (far exceeding the increases in GDP) it is reasonable to expect that some of that money is flowing to imports.This led me to correctly predict that as the housing bust picked up steam in the U.S., the trade deficit would peak as a percent of GDP. I also mused about another potential impact of a declining trade deficit - rising intermediate to long term interest rates in the U.S. Here are some diagrams I presented in early 2005:

The implications are important: if the housing market slows down, it will negatively impact both the domestic economy and the economies of our export driven trading partners: China, Japan, S. Korea and others.

Perhaps we have seen a Virtuous Cycle as depicted in the following diagram:

Click on graph for larger image in new window.

Click on graph for larger image in new window.Starting from the top ... lower interest rates have led to an increase in housing prices. And those higher housing prices have led to an ever increasing equity withdrawal by homeowners. ... it is reasonable to assume that a large percentage of this equity withdrawal has flowed to consumption, increasing both GDP and imports over the last few years. ... it appears mortgage equity withdrawal has been a meaningful contributor to the ever widening trade and current account deficits.

To finance the current account deficit, foreign Central Banks (CBs) have been investing heavily in dollar denominated securities. Some analysts have suggested that these investments have lowered interest rates by between 40 bps and 200 bps (Roubini and Setser: "Will the Bretton Woods 2 Regime Unravel Soon? The Risk of a Hard Landing in 2005-2006")

If these analysts are correct, and foreign CB intervention is lowering treasury yields, then this has also lowered mortgage interest rates ... and the cycle repeats. The result: a Virtuous Cycle with higher housing prices, more consumption and lower interest rates.

As a result of the rapidly increasing housing prices, we are now seeing significant speculation, excessive leverage and poor credit quality of new homebuyers; all the signs of an overheated market. ... What happens if the housing market cools down?

The Vicious Cycle

The following diagram depicts the possible unwinding of the current cycle.

In the possible vicious cycle that I diagrammed, lower home prices would lead to lower equity withdrawal (equity withdrawal has collapsed, see: Q2 2008: Mortgage Equity Withdrawal Plunges to Near Zero) and this would lead to a slow down in GDP growth and lower imports.

In the possible vicious cycle that I diagrammed, lower home prices would lead to lower equity withdrawal (equity withdrawal has collapsed, see: Q2 2008: Mortgage Equity Withdrawal Plunges to Near Zero) and this would lead to a slow down in GDP growth and lower imports.GDP in the U.S. is now contracting, and imports are falling and the trade deficit is shrinking. And as foreign CB invest less in dollar denominated assets (and also try to stimulate their domestic economies) this could lead to higher interest rates for intermediate and long term U.S. assets. As I noted in 2005, the result could be a vicious cycle with higher intermediate and long term rates further depressing the U.S. housing market and consumption.

Although this is very speculative, higher intermediate and long term interest rates in the U.S. for a short period wouldn't be helpful during a recession. This is something to think about as the Chinese economy slows ...

Citigroup: $1.4 Billion in Losses from Credit Card Securitization

by Calculated Risk on 11/01/2008 11:42:00 AM

From the Citigroup 10-Q filed with the SEC on Oct 31st (hat tip Ray):

In the third quarters of 2008 and 2007, the Company recorded net gains (losses) from securitization of credit card receivables of ($1,443) million and $169 million, and ($1,398) million and $747 million during the first nine months of 2008 and 2007, respectively.And Citigroup on Credit Reserves:

The $2.3 billion build in North America Consumer primarily reflected a weakening of leading credit indicators, including higher delinquencies on first mortgages, unsecured personal loans, credit cards and auto loans. Reserves also increased due to trends in the U.S. macroeconomic environment, including the housing market downturn and rising unemployment rates.It is more than just possible that loss rates will exceed their historical peaks during the current recession - it appears highly probable.

...

As the environment for consumer credit continues to deteriorate, the Company has taken many actions to manage risks such as tightening underwriting criteria and reducing credit lines. However, credit card losses may continue to rise well into 2009, and it is possible that the Company's loss rates may exceed their historical peaks.

emphasis added

Click on graph for larger image.

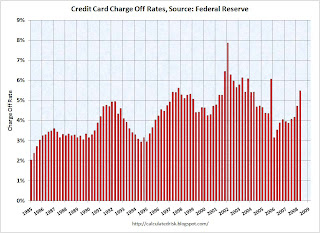

Click on graph for larger image.This graph shows the consumer credit card charge-off rate by quarter starting with 1985. The Federal Reserve reported that the credit card charge-off rate was 5.47% at the end of Q2.

Note the spike in 2005 was because of the change to the bankruptcy law (Bankruptcy Abuse Prevention and Consumer Protection Act of 2005).

The record charge-off rate was 7.85% in Q1 2002 according to the Fed. Q3 data will be released soon.

Ben Bernanke, Please Send Me Some Green!

by Calculated Risk on 11/01/2008 08:08:00 AM

Ben Bernanke, Please Send Me Some Green! (2 min 19 secs)

IndyMac Mod Update

by Calculated Risk on 11/01/2008 05:00:00 AM

Back in August, Tanta wrote: FDIC Mod Plan: Welcome to the Real World

I'm going to go out on a limb here and suggest that the FDIC's plan for modifying IndyMac loans is, overall, a great thing. I am glad it is happening and I truly look forward to snickering over the results.And snicker she did just last week: IndyMac-FDIC Mortgage Modification Plan: Still in the Real World

The WSJ has another update: FDIC Plan Tests Limits of Leniency

The new entity, called IndyMac Federal Bank, has become a laboratory test of whether the FDIC's program can keep people in their homes. While it has already seen some success, the agency has also run into obstacles familiar to private lenders and loan servicers. The upshot: there are no easy solutions to the foreclosure crisis.Is anyone other than Sheila Bair surprised that so few borrowers responded? These were called 'liars loans' for a reason!

...

The agency found plenty of bad loans to work with. IndyMac's specialty was Alt-A mortgages, a category that frequently includes loans made with little or no documentation and exaggerated borrower incomes.

...

[T]he FDIC has sent letters to ... 19,000 borrowers for whom it had no recent financial information. It asked them to get in touch with IndyMac and provide financial information to determine if they qualify for a fast-track modification. So far, just 10% have responded, less than what the FDIC would like to see.

P.S. Tanta is home and recovering from her treatment this week. Hopefully she will feel up to posting next week.

Court Filing: Plaintiff Objects to Surety Bond due to Credit Crisis

by Calculated Risk on 11/01/2008 12:12:00 AM

In this case, the court ruled for the plaintiff and awarded a multi-million dollar judgment. What makes this interesting is that in this court filing, the Plaintiff objects to the bond issued by CNA Surety’s subsidiary, Western Surety, on the grounds that no one knows what an A.M. Best's rating means any more, especially a rating that is 10 months old.

The argument is fascinating reading (from page 3 through 8) and shows another possible impact of the credit crisis.

Friday, October 31, 2008

FDIC Bank Failures

by Calculated Risk on 10/31/2008 09:33:00 PM

Just to put the 17 bank failures this year into perspective, here are insured bank failures by year since the FDIC was founded: Click on graph for larger image in new window.

Click on graph for larger image in new window.

Of course the size of the failed banks, and the cost to the FDIC, also matter.

The failure today, Freedom Bank, was a small bank by asset size ($287 million). Still the size of the cost to the FDIC is pretty amazing compared to the size of the bank (cost estimated at between $80 million and $104 million). Many analysts expect over 100 bank failures. Dr. Roubini expects "hundreds of banks" to fail in the cycle. If so, we are just getting started.

Note: there are 8,451 FDIC insured banks as of Q3 2008.

Bank Failure #17: Freedom Bank, Bradenton, Florida

by Calculated Risk on 10/31/2008 06:41:00 PM

From the FDIC: Fifth Third Bank Acquires All the Deposits of Freedom Bank, Bradenton, Florida

Freedom Bank, Bradenton, Florida, was closed today by the Commissioner of the Florida Office of Financial Regulation, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Fifth Third Bank, Grand Rapids, Michigan, to assume all of the deposits of Freedom Bank.Happy Halloween!

...

As of October 17, 2008, Freedom Bank had total assets of $287 million and total deposits of $254 million. Fifth Third agreed to assume all the deposits for a premium of 1.16 percent. In addition to assuming the failed bank's deposits, Fifth Third will purchase approximately $36 million of assets. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be between $80 million and $104 million. Fifth Third's acquisition of all deposits was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. The last failure in Florida was First Priority Bank, Bradenton, which was closed on August 1, 2008. Freedom Bank is the seventeenth FDIC-insured institution to be closed this year.

IMF to Bailout Pakistan

by Calculated Risk on 10/31/2008 04:34:00 PM

Form the Telegraph: Pakistan to receive $9bn from IMF in fight against bankruptcy

Pakistan is to receive a $9bn (£5.5bn) bail-out loan from the International Monetary Fund as the country has three weeks to stave off bankruptcy. ... The IMF agreed in principle to a billion dollar economic stabilisation plan for Pakistan during a week-long meeting with Pakistani officials in Dubai ... Pakistan needs at least $4bn to avoid defaulting on its foreign debts ...Iceland, Hungary, Ukraine and Pakistan ... the list is growing.

Credit Crisis Indicators: Some Progress

by Calculated Risk on 10/31/2008 02:17:00 PM

The London interbank offered rate, or Libor, for three month loans in dollars slid 0.16 point to 3.03 percent, the 15th consecutive drop, according to the British Bankers' Association.The rate peaked at 4.81875% on Oct. 10.

Usually the 3 month trades below the target Fed Funds rate by around 25 bps, so this is too low with the Fed funds rate at 1.0%. However, the effective Fed Funds rate is even lower (0.36% yesterday), so a 3 month yield of 0.42% is in the right range. I'd like to see the effective funds rate closer to the target rate.

I'd like to see the spread move back down to 1.0 or lower - at least below 2.0.

Here is a list of SFP sales. No announcement today. no progress.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper - and increasing the spread between AA and A2/P2 CP. So this indicator is a little misleading right now. Still, if the credit crisis eases, I'd expect a significant decline in this spread.

The LIBOR is down and the TED spread is off a little, but the A2P2 spread is at a record high probably because of the Fed buying CP - so there is some progress.