by Calculated Risk on 10/30/2008 09:32:00 PM

Thursday, October 30, 2008

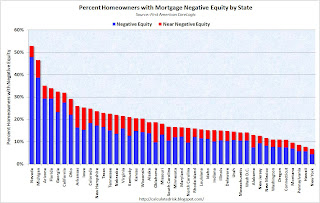

Report: Almost Half of Nevada Homeowners Underwater

The WSJ reports on a new report from First American CoreLogic that estimates 48% of homeowners with a mortgage in Nevada owe more than their homes are worth. The WSJ reports that First American CoreLogic estimates 18% of homeowners with a mortgage nationwide are underwater.

Using the Census Bureau 2007 estimate of 51.6 million households with mortgages, 18% would be 9.3 homeowners with negative equity. This is less than the recent estimate from Moody's Economy.com of 12 million households underwater. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the percent of homeowners with mortgages underwater by state (data from First American CoreLogic via the WSJ)

Note: there is no data for Maine, Mississippi, North Dakota, South Dakota, Vermont, West Virginia and Wyoming.

It's interesting that the two worst states are Nevada and Michigan - one a bubble state, the other devastated by a poor economy. That pattern continues - everyone expects the bubble states of Arizona, Florida and California to be near the top of the list, and Ohio too because of the weak economy - but what about Arkansas, Iowa and even Texas?

The housing problems are everywhere.

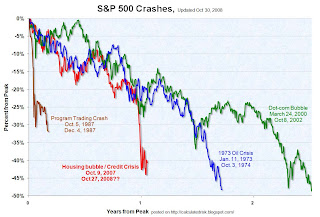

Comparing Stock Market Crashes

by Calculated Risk on 10/30/2008 07:22:00 PM

Fed Holds $145.7 Billion in Commercial Paper as of Oct 29

by Calculated Risk on 10/30/2008 04:47:00 PM

The Fed released the weekly balance sheet report today. The Fed reported that the Commercial Paper Funding Facility LLC holds $145.7 billion in 16 to 90 day commercial paper.

From Bloomberg: Fed Buys $145.7 Billion of Commercial Paper in Start of Program

The Federal Reserve bought commercial paper valued at $145.7 billion in the first days of the program aimed at backstopping the market, indicating the central bank is generating most of this week's record gains in short-term corporate borrowing.

The central bank extended $144.8 billion of loans as of yesterday to a unit that paid $143.9 billion for the debt, the Fed's weekly balance-sheet report said today.

Fed's Yellen: "Economy Contracting Significantly"

by Calculated Risk on 10/30/2008 03:57:00 PM

From San Francisco Fed President Dr. Janet Yellen: The Mortgage Meltdown, Financial Markets, and the Economy. Excerpt on the economic outlook:

[R]ecent data on the economy have been deeply worrisome. Data released this morning reveal that the economy contracted slightly in the third quarter. For the fourth quarter, it appears likely that the economy is contracting significantly. Mainly for this reason, inflationary risks have diminished greatly."It appears likely that the economy is contracting significantly". Strong words from a Fed president. Q4 is going to be ugly.

...

For consumers, the credit crunch is one of several negative factors accounting for the decline in spending in recent months. Consumer credit is costlier and harder to get: loan rates are up, loan terms are tougher, and increasing numbers of borrowers are being turned away entirely. This explains, in part, the exceptional weakness we have seen in auto sales. In addition, of course, employment has now declined for nine months in a row, and personal income, in inflation-adjusted terms, is virtually unchanged since April. Furthermore, household wealth is substantially lower as house prices have continued to fall and the stock market has declined sharply.

Business spending, too, is feeling the crunch in the form of a higher cost of capital and restricted access to credit. ... Some of our business contacts report that bank lines of credit are more difficult to negotiate, and many indicate that they have become cautious in managing liquidity, in committing to capital spending projects that can be deferred, and even in extending credit to customers and other

counterparties. Nonresidential construction also is headed lower largely because of the financial crisis; the market for commercial mortgage-backed securities, a mainstay for financing large projects, has all but dried up.

...

Until recently, weakness in domestic final demand was offset by a major boost from exporting goods and services to our trading partners. Unfortunately, economic growth in the rest of the world has slowed noticeably. ... As a result, exports will not provide as much of an impetus to growth as they did earlier in the year.

emphasis

added

PCE: Worse in September

by Calculated Risk on 10/30/2008 03:12:00 PM

Just a quick note: Real Personal Consumption Expenditures (PCE) declined 3.1% (annualized) in Q3 according to the BEA Q3 Advance GDP report. This was the first decline since 1992, and real PCE was less in Q3 2008 than in Q3 2007!

This also suggests that spending declined sharply in September (or that earlier months were revised down).

My "two month" estimate for PCE in Q3 was -2.4%, and two Fed researchers proposed another method that forecast PCE of -2.3%.

Either way, the quarterly decline of -3.1% suggests that the decline in consumer spending was even worse in September than for July and August, and assuming no downward revision for the previous months, this indicates a decline of -4.4% (annual rate) for September compared to June.

Note: when comparing months, the headline number will be to the previous month (August in this case), but the better comparison - for comparing to the quarterly data - is to compare to the monthly data of the same month of the previous quarter (third month in Q2 or June).

The BEA will release the numbers for September tomorrow morning, and they will probably be ugly.

Cliff Diving du jour: Insurance Companies

by Calculated Risk on 10/30/2008 02:07:00 PM

From MarketWatch: Hartford Financial loses over half its market value

The company reported a big third-quarter loss late Wednesday and said that it couldn't gauge the amount of extra capital it has because of market volatility.Harford is off 51%

Assurant Inc is off 25%

Prudential Financial is off 22%

CIGNA Corp is off 22%

Office Vacancy Rate vs. Unemployment

by Calculated Risk on 10/30/2008 12:27:00 PM

One of the key components of non-residential structure investment is construction of new offices. When the supplemental data is released for Q3 GDP, I expect it will show that office investment started to decline in the most recent quarter - and I expect office investment will decline significantly over the next year.

The following graphs show office vacancy rate vs. unemployment (hat tip Will). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the office vacancy rate vs. the quarterly unemployment rate and recessions.

Changes in the unemployment rate and the office vacancy rate are highly correlated. As the unemployment rate continues to rise over the next year or more, we'd expect the office vacancy rate to rise too. And this will discourage investment in new office structures - and put significant pressure on office rents and prices. The second graph shows the relationship between the office vacancy rate and the unemployment rate using data starting in Q1 1991. The unemployment rate is from the BLS and the office vacancy rate is from REIS.

The second graph shows the relationship between the office vacancy rate and the unemployment rate using data starting in Q1 1991. The unemployment rate is from the BLS and the office vacancy rate is from REIS.

I've added the polynomial trend line (with R^2 of 0.88). The two most recent quarters are marked in red.

This suggests that office vacancy rates are currently below the expected level, and vacancy rates will probably increase sharply over the next year.

Credit Crisis Indicators: Mixed

by Calculated Risk on 10/30/2008 10:56:00 AM

According to data from the British Bankers' Association, three-month U.S. dollar Libor fell to 3.1925% from Wednesday's fixing of 3.42%. The rate peaked at 4.81875% on Oct. 10.

The 3 month yield was close to zero for a few days, so this is still some improvement from the worst of the credit crisis. Usually the 3 month trades below the target Fed Funds rate by around 25 bps, so this is too low with the Fed funds rate at 1.0%. Update: however, the effective Fed Funds rate is even lower (0.67% yesterday), so a 3 month yield of 0.48% is in the right range.

I'd like to see the spread move back down to 1.0 or lower - at least below 2.0.

Here is a list of SFP sales. No announcement today. no progress.

During a recession, this spread usually increases because the risk of default for lower quality paper increases. However the recent values (over 400 bps) are far in excess of normal. If the credit crisis eases, I'd expect a significant decline in this spread. The high for the A2P2 spread was 4.66, and there has been no progress here.

The LIBOR is down and the TED spread is off a little, but the A2P2 spread is at a record high - so there is some progress in some areas, and none by other measures.

Investment in Structures: Residential vs. Non-Residential

by Calculated Risk on 10/30/2008 09:09:00 AM

The following graph shows residential investment compared to investment in non-residential structures as a percent of GDP since 1960. All data from the BEA.

Note: Residential investment is primarily single family structures, multi-family structures, commissions, and home improvement. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The recent housing boom and bust is very clear (in red).

Residential investment was 3.3% of GDP in Q3 2008, the lowest level since 1982 (just under 3.2%).

Non-residential investment in structures increased to almost 4% of GDP in Q3. This investment is slowing down right now (the Census Bureau has reported declines in non-residential investment for the last two months), and investment in non-residential structures will almost certainly be negative in Q4.

The positive contributions to GDP were exports, government spending, and investment in non-residential structures. Non-residential structures will be negative in Q4, and exports are slowing - so Q4 GDP will probably be much worse than Q3.

Note: I'll have much more on non-residential investment in offices, malls and hotels when the underlying details are released in a few days.

Q3 GDP Declines 0.3%

by Calculated Risk on 10/30/2008 08:30:00 AM

From the BEA: GROSS DOMESTIC PRODUCT: THIRD QUARTER 2008 (ADVANCE)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- decreased at an annual rate of 0.3 percent in the third quarter of 2008 ...PCE declined -3.1% (annualized). This is the first decline in consumer spending since 1991.

The decrease in real GDP in the third quarter primarily reflected negative contributions from personal consumption expenditures (PCE), residential fixed investment, and equipment and software that were largely offset by positive contributions from federal government spending, exports, private inventory investment, nonresidential structures, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

Private investment declined -1.9%. I'll have some graphs on investment shortly.