by Calculated Risk on 10/29/2008 03:34:00 PM

Wednesday, October 29, 2008

More Swap Lines from the Fed

Today, the Federal Reserve, the Banco Central do Brasil, the Banco de Mexico, the Bank of Korea, and the Monetary Authority of Singapore are announcing the establishment of temporary reciprocal currency arrangements (swap lines). These facilities, like those already established with other central banks, are designed to help improve liquidity conditions in global financial markets and to mitigate the spread of difficulties in obtaining U.S. dollar funding in fundamentally sound and well managed economies.Next up, $30 billion for the Bank of CR & Tanta.

...

These new facilities will support the provision of U.S. dollar liquidity in amounts of up to $30 billion each by the Banco Central do Brasil, the Banco de Mexico, the Bank of Korea, and the Monetary Authority of Singapore.

These reciprocal currency arrangements have been authorized through April 30, 2009.

The FOMC previously authorized temporary reciprocal currency arrangements with ten other central banks: the Reserve Bank of Australia, the Bank of Canada, Danmarks Nationalbank, the Bank of England, the European Central Bank, the Bank of Japan, the Reserve Bank of New Zealand, the Norges Bank, the Sveriges Riksbank, and the Swiss National Bank.

Fed Funds Rate Cut 50 bps to 1.0%

by Calculated Risk on 10/29/2008 02:15:00 PM

FOMC statement:

The Federal Open Market Committee decided today to lower its target for the federal funds rate 50 basis points to 1 percent.

The pace of economic activity appears to have slowed markedly, owing importantly to a decline in consumer expenditures. Business equipment spending and industrial production have weakened in recent months, and slowing economic activity in many foreign economies is damping the prospects for U.S. exports. Moreover, the intensification of financial market turmoil is likely to exert additional restraint on spending, partly by further reducing the ability of households and businesses to obtain credit.

In light of the declines in the prices of energy and other commodities and the weaker prospects for economic activity, the Committee expects inflation to moderate in coming quarters to levels consistent with price stability.

Recent policy actions, including today’s rate reduction, coordinated interest rate cuts by central banks, extraordinary liquidity measures, and official steps to strengthen financial systems, should help over time to improve credit conditions and promote a return to moderate economic growth. Nevertheless, downside risks to growth remain. The Committee will monitor economic and financial developments carefully and will act as needed to promote sustainable economic growth and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Elizabeth A. Duke; Richard W. Fisher; Donald L. Kohn; Randall S. Kroszner; Sandra Pianalto; Charles I. Plosser; Gary H. Stern; and Kevin M. Warsh.

In a related action, the Board of Governors unanimously approved a 50-basis-point decrease in the discount rate to 1-1/4 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of Boston, New York, Cleveland, and San Francisco.

emphasis added

Report: GM-Chrysler Major Acquisition Issues Resolved

by Calculated Risk on 10/29/2008 01:16:00 PM

From Reuters: Major issues resolved in GM-Chrysler talks-sources

General Motors and Cerberus Capital have resolved the major issues in a proposed GM-Chrysler merger but the final form of any deal will depend on the financing and government support available ... As GM seeks some $10 billion in U.S. government aid to support the deal, Chrysler owner Cerberus is in its own set of intense discussions with banks to refinance $9 billion of Chrysler debt ...This deal will make GM the number one auto maker again - at least for a little while. GM has fallen further behind Toyota, see WSJ: GM's Vehicle Sales Fell 11% in 3rd Quarter

GM ... sold 2.11 million vehicles in the [third] quarter. That pushed GM, until recently the world's largest auto maker by sales, further behind Toyota Motor Corp., which last week reported third-quarter global sales of 2.24 million vehicles ...

Credit Crisis Indicators

by Calculated Risk on 10/29/2008 12:51:00 PM

While we wait for the Fed ...

The 3 month yield was close to zero for a few days, so this is still a significant improvement from the worst of the credit crisis. Usually the 3 month trades below the Fed Funds rate by around 25 bps, so this is reasonable if the Fed cuts rates to 0.75%, but the yield is too low if the Fed cuts 50 bps to 1.0%.

I'd like to see the spread move back down to 1.0 or lower - at least below 2.0.

Here is a list of SFP sales. No announcement today. no progress.

During a recession, this spread usually increases because the risk of default for lower quality paper increases. However the recent values (over 400 bps) are far in excess of normal. If the credit crisis eases, I'd expect a significant decline in this spread. The high for the A2P2 spread was 4.66, and there has been little progress here.

No thaw today.

New Home Sales: Shift to FHA Financing

by Calculated Risk on 10/29/2008 10:08:00 AM

According to the Census Bureau, 17% of new homes sold in Q3 2008 were financed with FHA loans. This is up from an average of 4% in the 2005 through 2007 period.

This huge percentage increase in FHA loans was partially driven by Downpayment Assistance Programs (DAPs). These programs allowed the seller to provide the buyer with the downpayment by funneling the money through a charity.

DAPs have been eliminated (finally!) as of Oct 1st.

Eliminating DAPs is a positive for the economy and housing. FHA loans using DAPs had significantly higher default rates than when the buyers actually made a down-payment, and DAPs encouraged appraisal fraud.

Although good for housing and the economy in the long term, eliminating DAPs might impact new home sales in the fourth quarter of 2008. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows new home sales by percent financing type. The percent of FHA loans increased dramatically in 2008, and this was probably driven by DAPs.

The second graph shows the same information but by the number of units sold. Of the 118,000 homes sold in Q3 2008, 20,000 were bought using FHA financing.

Of the 118,000 homes sold in Q3 2008, 20,000 were bought using FHA financing.

This compares to 7,000 FHA financed homes in Q3 2007 out of 181,000 new homes sold.

The number and percent of FHA loans will probably decline in Q4 2008, and this will probably impact about 10% of potential home buyers.

LIBOR Slowly Declines

by Calculated Risk on 10/29/2008 09:08:00 AM

From Bloomberg: Libor Declines on Central Bank Cash Funding, Fed Rate Outlook

The London interbank offered rate, or Libor, that banks charge each other for three-month loans in dollars fell 5 basis points today to 3.42 percent, its 13th straight decline, according to the British Bankers' Association.But the TED spread has increased slightly because the 3 month treasury yield has declined - perhaps because traders think the Fed might cut the Fed Funds rate by 75 bps today.

...

"The strains in money markets are beginning to ease, but only at a glacial pace," said Nick Stamenkovic, a fixed-income strategist in Edinburgh at RIA Capital Markets.

Mathew Padilla at Google Talk

by Calculated Risk on 10/29/2008 01:59:00 AM

I frequently link to Mathew Padilla's outstanding writing at the Orange County Register.

Matt co-authored a book on the mortgage crisis: "Chain of Blame".

His blog, "Mortgage Insider" is available at: www.ocregister.com/mortgage

This is 45 minute talk. Matt knows his stuff, but he was a little nervous at the beginning of this talk ...

Tuesday, October 28, 2008

NY Times: Lenders Begin to Curb Credit Cards

by Calculated Risk on 10/28/2008 10:42:00 PM

From Eric Dash at the NY Times: As Economy Slows, Lenders Begin to Curb Credit Cards

Lenders wrote off an estimated $21 billion in bad credit card loans in the first half of 2008 as more borrowers defaulted on their payments. With companies laying off tens of thousands of workers, the industry stands to lose at least another $55 billion over the next year and a half, analysts say. Currently, the total losses amount to 5.5 percent of credit card debt outstanding, and could surpass the 7.9 percent level reached after the technology bubble burst in 2001.

“If unemployment continues to increase, credit card net charge-offs could exceed historical norms,” Gary L. Crittenden, Citigroup’s chief financial officer, said.

Click on graph for larger image.

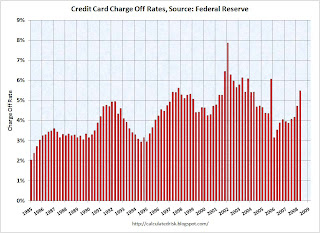

Click on graph for larger image.This graph shows the consumer credit card charge-off rate by quarter starting with 1985.

Note the spike in 2005 was because of the change to the bankruptcy law (Bankruptcy Abuse Prevention and Consumer Protection Act of 2005).

The record charge-off rate was 7.85% in Q1 2002 according to the Fed and a new record will probably set during this recession.

To add to the story, here is a comment from the Capital One conference call two weeks ago:

We have tightened underwriting standards across the boar. In our US card business we have gotten more conservative. We have begun to reduce credit lines. We have continued to tweak our underwriting models and to the recalibrate models this may be unstable. We have adapted our models and approaches as the economic environment has changed and we are intervening judgmentally even more than our models would indicate.No Home ATM. No credit cards. What is a debt addicted U.S. consumer to do?

S&P Case-Shiller: Real Prices for Selected Cities

by Calculated Risk on 10/28/2008 07:10:00 PM

Earlier today I posted the following graph showing the price declines from the peak for each city included in S&P/Case-Shiller indices. Click on graph for larger image in new window.

Click on graph for larger image in new window.

In Phoenix and Las Vegas home prices have declined about 36% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are only off about 3% from the peak.

For the most part, the size in the percentage price decline is related to the size of the price bubble for each area. The second graph shows real prices for cities at the extremes - Las Vegas and Charlotte, and Chicago in the middle. This shows real prices (adjusted with CPI less Shelter) for three cities. Las Vegas had a huge price increase in the early '00s, and now prices are falling rapidly.

This shows real prices (adjusted with CPI less Shelter) for three cities. Las Vegas had a huge price increase in the early '00s, and now prices are falling rapidly.

Charlotte had a small price bubble, and prices have only declined a few percent. It appears prices in the bubbly areas (like Las Vegas) are still too high, but prices are already close to normal for Charlotte.

WSJ: Bailout might Include Privately Held Banks

by Calculated Risk on 10/28/2008 06:02:00 PM

From the WSJ: Treasury May Expand Financial Rescue to Non-Publicly Traded Banks

Treasury Department officials ... met with representatives from the banking industry Tuesday to discuss expanding the Troubled Asset Relief Program to make mutually held, family-owned and other private banks eligible for federal funds.The line is getting longer ...

...

Non-public banks are typically more conservatively run and may be more ready to lend money back into the financial system ... The banking industry's trade group estimates that as many as 6,500 closely held financial institutions aren't eligible for the capital program under the current rules ... because their structure doesn't permit them to issue preferred shares that the Treasury would buy.