by Calculated Risk on 10/24/2008 04:11:00 PM

Friday, October 24, 2008

Bank Failure: Alpha Bank & Trust, Alpharetta, GA

From the FDIC: Stearns Bank, National Association Acquires the Insured Deposits of Alpha Bank & Trust, Alpharetta, GA

Alpha Bank and Trust, Alpharetta, Georgia, was closed today by the Georgia Department of Banking and Finance, and the Federal Deposit Insurance Corporation (FDIC) was named receiver.This is a pretty small bank, but it is amazing that this will cost the Deposit Insurance Fund $158 million.

...

As of September 30, 2008, Alpha Bank & Trust had total assets of $354.1 million and total deposits of $346.2 million. Stearns Bank did not pay the FDIC a premium for the right to assume the failed bank's insured deposits.

At the time of closing, there were approximately $3.1 million in uninsured deposits held in approximately 59 accounts that potentially exceeded the insurance limits.

...

In addition to assuming the failed bank's insured deposits, Stearns Bank, N.A. will purchase approximately $38.9 million of Alpha's assets. The FDIC will retain the remaining assets for later disposition.

The transaction is the least costly resolution option, and the FDIC estimates that the cost to its Deposit Insurance Fund will be $158.1 million. The last bank to fail in Georgia was Integrity Bank, Alpharetta, on August 29, 2008. Alpha Bank & Trust is the sixteenth FDIC-insured institution to be closed this year.

Port Traffic Declines Sharply in September

by Calculated Risk on 10/24/2008 02:29:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

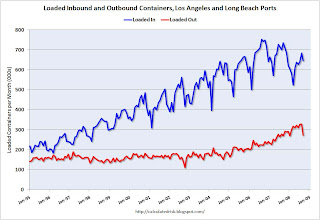

This graph shows the combined loaded inbound and outbound traffic at the ports of Long Beach and Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic should be peaking for the year as retailers prepare for the holiday season. Inbound traffic is off from August, and about 12% below last September.

Outbound traffic fell off a cliff in September, and is 17% below August 2008, and at about the same level as a year ago.

From the WSJ: Reliance on Exports Hurts Asia

The meltdown in Asian stock prices on Friday stemmed in part from the growing realization that the heavy reliance on exports that has driven Asia's powerful growth is now turning into the its worst enemy.So much for decoupling. It's hard to believe this comes as a surprise ...

The evaporation of consumer spending in the U.S. and Europe is starting to hit deeply at Asian manufacturing titans that thrive on sales to the rest of the world, and that are now rapidly scaling down their capital spending.

Credit Crisis Indicators: mostly worse

by Calculated Risk on 10/24/2008 01:48:00 PM

From Bloomberg: Libor for Overnight Dollars Rises as Recession Concern Mounts

The London interbank offered rate, or Libor, that banks charge for such loans climbed 7 basis points to 1.28 percent today, British Bankers' Association said. It gained for the first time in 10 days yesterday. The comparable rate for U.K. pounds jumped 19 basis points to 4.75 percent. The Libor-OIS spread, a measure of cash scarcity, widened by the most since Oct. 10.

The Fed is expected to lower rates next week by anywhere from 25 bps to even 75 bps, but I'd still like to see the three month treasury closer to 1.0% (or whatever the Fed Funds rate is next week). The effective Fed Funds rate is aoubt 0.80%, so this isn't horrible.

Here is a list of SFP sales. Three days without an announcement, so maybe the Fed is easing up a little. possible progress.

During a recession, this spread usually increases because the risk of default for lower quality paper increases. However the recent values (over 400 bps) are far in excess of normal. If the credit crisis eases, I'd expect a significant decline in this spread.

Another disappointing day in the credit markets.

DOT: U.S. Vehicles Miles Driven Off Sharply in August

by Calculated Risk on 10/24/2008 11:54:00 AM

The Dept of Transportation reports on U.S. Traffic Volume Trends:

Travel on all roads and streets changed by -5.6% (-15.0 billion vehicle miles) for August 2008 as compared with August 2007. Travel for the month is estimated to be 253.7 billion vehicle miles.

Click on graph for larger image in new window.

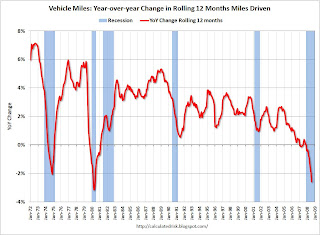

Click on graph for larger image in new window.This graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove seasonality.

By this measure, vehicle miles driven are off 2.6% YoY, and the decline in miles driven is worse than during the early '70s oil crisis - and almost as bad as the 1979-1980 decline.

From the WSJ: Oil Prices Drop, Despite OPEC Cut

Crude-oil futures Friday fell to their lowest point since May 2007, with concerns of a global recession overwhelming an Organization of Petroleum Exporting Countries decision to trim output.This is clear demand destruction.

Light, sweet crude for December delivery was recently down $4.38, or 6.5%, at $63.46 a barrel on the New York Mercantile Exchange. Brent crude on the ICE Futures exchange fell $4.19 to $61.73 a barrel.

Nymex crude is off more than $80 from July's record highs. Oil's speedy reversal pushed OPEC to convene an emergency meeting in Vienna early Friday, where the cartel pledged to cut 1.5 million barrels a day from its production quota of 28.8 million barrels a day, effective Nov. 1.

Existing Home Sales, NSA

by Calculated Risk on 10/24/2008 11:11:00 AM

Here is another way to look at existing homes sales - Not Seasonally Adjusted: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales were higher in September 2008 than in September 2007 - the first time the year-over-year sales have increased since November 2005.

However sales in September 2007 were impacted by the credit crisis that started in August 2007. The current wave of the credit crisis will probably impact sales reported in October and November (existing homes sales are reported at the close of escrow).

There have been 3.82 million sales so far in 2008, and sales are currently on pace for about 4.9 million total this year - the lowest annual sales since 1997. The second graph shows inventory by month starting in 2002.

The second graph shows inventory by month starting in 2002.

Inventory levels were flat for years (during the bubble), but started increasing at the end of 2005.

Inventory levels increased sharply in 2006 and 2007, but have only increased slightly in 2008. In fact inventory for August and September 2008 are slightly below the levels of last year. This might indicate that inventory levels are close to the peak for this cycle (and have peaked for 2008), however there is probably a substantial shadow inventory – homeowners wanting to sell, but waiting for a better market - so existing home inventory levels will probably stay elevated for some time.

Existing Home Sales Increase in September

by Calculated Risk on 10/24/2008 10:00:00 AM

From NAR: Existing-Home Sales Rise on Improved Affordability

Existing-home sales – including single-family, townhomes, condominiums and co-ops – rose 5.5 percent to a seasonally adjusted annual rate of 5.18 million units in September from a level of 4.91 million in August, and are 1.4 percent higher than the 5.11 million-unit pace in September 2007.

...

Total housing inventory at the end of September fell 1.6 percent to 4.27 million existing homes available for sale, which represents a 9.9-month supply² at the current sales pace, down from a 10.6-month supply in August.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in September 2008 (5.18 million SAAR) were higher than in September 2007 (5.11 million SAAR). This is the first time sales have increased for any month year-over-year since November 2005.

It's important to note that a large percentage of these sales were foreclosure resales (banks selling foreclosed properties). NAR economist Yun suggested that "distressed sales are currently 35 to 40 percent of transactions". Distressed sales include foreclosure resales and short sales. Although these are real transactions, this means activity (ex-foreclosures) is running around 3 million units SAAR.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.266 million in September, from a revised all time record of 4.57 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was probably the peak for inventory this year.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.266 million in September, from a revised all time record of 4.57 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was probably the peak for inventory this year. This decline was the normal seasonal pattern.

Most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Some houses in the foreclosure process are listed as short sales - so those would be counted too.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply declined to 9.9 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply).

I expect sales to fall further over the next few months, although I think inventory has peaked for the year. I'll have more on existing home sales later.

PNC to Acquire National City

by Calculated Risk on 10/24/2008 09:23:00 AM

Press Release: PNC to Acquire National City

The PNC Financial Services Group, Inc. and National City Corporation today announced that they have signed a definitive agreement for PNC to acquire National City for $2.23 per share, or an aggregate fixed amount of approximately $5.2 billion in PNC stock. Additionally $384 million of cash is payable to certain warrant holders. ...National City was probably the largest regional U.S. bank in serious trouble.

PNC plans to issue to the U.S. Treasury $7.7 billion of preferred stock and related warrants under the TARP Capital Purchase Program subject to standard closing requirements.

Limit Down

by Calculated Risk on 10/24/2008 09:14:00 AM

From MarketWatch: S&P 500 futures contract triggers circuit breaker

The Chicago Mercantile Exchange's circuit-breaker rules went into effect Friday as plunging S&P 500 and Nasdaq 100 futures contracts reached pre-specified limits.This follows a night of cliff diving in Asia and Europe.

The CME limits the S&P 500 futures to a drop of a 60 points and the Nasdaq 100 futures to a drop of 85 points during electronic action.

As an example, the FTSE 100 is off 8.3% as the U.K. economy contracts:

The Office for National Statistics said Friday that the economy contracted a far-bigger-than-expected 0.5% in the third quarter, compared with zero growth in the second quarter. It is the first time the economy has contracted since the second quarter of 1992 and the biggest drop since the fourth quarter of 1990.Should be an interesting day ...

Thursday, October 23, 2008

Fed Marks Down Bear Stearns Assets by $2.7 Billion

by Calculated Risk on 10/23/2008 08:09:00 PM

The Fed has marked down the Bear Stearns assets from $29,526 million to $26,802 million this week. This is a mark down of $2.7 billion or 9.2%. The Fed is now underwater by a little over $2 billion plus lost interest.

Today:

2. Information on Principal Accounts of Maiden Lane LLCLast week:

Millions of dollars

Oct 22, 2008

Net portfolio holdings of Maiden Lane LLC (1) 26,802 Outstanding principal amount of loan extended by the Federal Reserve Bank of New York (2) 28,820 Accrued interest payable to the Federal Reserve Bank of New York (2) 205 Outstanding principal amount and accrued interest on loan payable to JPMorgan Chase & Co. (3) 1,175

2. Information on Principal Accounts of Maiden Lane LLC

Millions of dollars

Oct 15, 2008

Net portfolio holdings of Maiden Lane LLC (1) 29,526 Outstanding principal amount of loan extended by the Federal Reserve Bank of New York (2) 28,820 Accrued interest payable to the Federal Reserve Bank of New York (2) 195 Outstanding principal amount and accrued interest on loan payable to JPMorgan Chase & Co. (3) 1,174

How is Tanta?

by Calculated Risk on 10/23/2008 07:08:00 PM

Whenever Tanta doesn't post for a few days, I receive several emails asking about the health of my good friend and co-blogger. Thanks to everyone for your thoughts and concern.

As long term readers know, Tanta is a former bank officer and mortgage lending specialist who is on extended medical leave recovering from cancer.

Tanta posted earlier today: IndyMac-FDIC Mortgage Modification Plan: Still in the Real World

Tanta's health is a private matter, however in her post she disclosed:

On a personal note: I was in the hospital earlier this week, and I'll be in and out for treatment on an out-patient basis tomorrow and early next week. It's chemo again, unfortunately. Even though I did leave the hospital with better pain pills than I had (yay!), I have no idea when I'll be able to post again. I suspect that if you keep your expectations at or below zero for the next week or so, you're unlikely to be disappointed. And now it's nap time ...I spoke with Tanta yesterday and she was in good spirits and sounded better than she has in some time. Obviously is it bad news that Tanta has to endure chemo again, but I prefer to remember that she suffered through chemo last year and returned as good as ever.

Please no tips. This isn't a cry for sympathy and Tanta has assured me she doesn't need financial help.

Thanks to everyone for your thoughts.