by Anonymous on 10/23/2008 01:30:00 PM

Thursday, October 23, 2008

IndyMac-FDIC Mortgage Modification Plan: Still in the Real World

I wrote a snotty post at the end of August after Sheila Bair's plan for "affordability modifications" of the former IndyMac loans was announced, the burden of snot wisdom of which was my prediction that Bair was going to discover that it's a lot harder than she thinks to get successful mortgage modifications done on a wide scale in a very short period of time. However, I did express the hope that the Bair plan would prove remarkably successful and indicated my willingness to eat my words should it prove necessary.

Looks like I'll have to stick to my usual dry toast and bananas after all. As Housing Wire reports:

In testimony Thursday on Capitol Hill, Federal Deposit Insurance Corp. chairman Sheila Bair provided the first public update on the FDIC’s loan modification program put into place at IndyMac Federal Bank since it was introduced roughly two months ago. The agency took over IndyMac in July, and announced the loan modification program on Aug. 20; Bair has said that FDIC analysts estimated that 40,000 or so of the 60,000 mortgages more than 60 days in arrears at IndyMac would qualify for a loan modification under the program. . . .So, in two months, just under 40% of borrowers estimated to be eligible have received written mod offers, and of those, just over 20% have responded. We still don't know how many actual modifications that will be, since income verification is still pending on the accepted offers. Nor do we know how many more borrowers have become "eligible" (i.e., 60 days delinquent) since the August estimate.

“Through this week, IndyMac Federal has mailed more than 15,000 loan modification proposals to borrowers, and has called many thousands more in continuing efforts to help avoid unnecessary foreclosures,” she said. “While it is still early in our implementation of the program, over 3,500 borrowers have accepted the offers and many more are being processed.”

Accepting the FDIC’s offer involves signing a modification agreement and mailing in a check for the new payment amount, along with information needed to verify income. It’s unclear how many of the 3,500 that have accepted the offer will ultimately see their loans modified based on verification of their income. Bair did not comment further on the specifics of the modification program in her remarks to the Senate on Thursday.

Certainly 3,500 modifications successfully completed in two months is better than nothing. Then again, I don't think IndyMac's modification rate prior to the FDIC takeover was exactly "nothing," either. Bair doesn't address that, so we still don't know if the FDIC's "expedited" approach has really been measurably better than what IndyMac was already doing. At best, it's probably only marginally better, which wouldn't be so much of a problem if Bair hadn't spent so much time earlier in the year scoring cheap rhetorical points about uncooperative servicers not doing enough to help. In any event, the Bair Plan doesn't seem likely to bring the mortgage crisis to a screeching halt by year-end.

And do note that Bair herself, in her testimony, does not trot out the fashionable line that the delays are all due to securitization rules and red tape:

“Initially, the program was applied only to mortgages either owned by IndyMac Federal or serviced under IndyMac Federal’s pre-existing securitization agreements, which provided sufficient flexibility,” she said in prepared remarks to the Senate Committee on Banking, Housing and Urban Affairs. “However, with their agreement, we are now applying the program to many delinquent loans owned by Freddie Mac, Fannie Mae, and other investors.”That suggests to me it isn't the fact that the loans are securitized that is the major problem. It also suggests that the program is moving out of subprime and well into prime territory in order to find borrowers who can and want to arrive at a 38% mortgage-payment-to-income ratio. I guess that's progress; if you apply the program to borrowers who are, as a class, more likely to be able to afford their mortgages anyway, you do get more successful modifications. But something tells me that's not quite what we all had in mind.

On a personal note: I was in the hospital earlier this week, and I'll be in and out for treatment on an out-patient basis tomorrow and early next week. It's chemo again, unfortunately. Even though I did leave the hospital with better pain pills than I had (yay!), I have no idea when I'll be able to post again. I suspect that if you keep your expectations at or below zero for the next week or so, you're unlikely to be disappointed. And now it's nap time . . .

Roubini: Panic may lead to market shutdown

by Calculated Risk on 10/23/2008 11:56:00 AM

Click image for video. This is a 47 minute talk (for those with the time). Note: if clicking on the photo doesn't work, check out the Bloomberg site. |

From Bloomberg: Roubini Says `Panic' May Force Market Shutdown

Hundreds of hedge funds will fail and policy makers may need to shut financial markets for a week or more as the crisis forces investors to dump assets, New York University Professor Nouriel Roubini said.

``We've reached a situation of sheer panic,'' Roubini, who predicted the financial crisis in 2006, told a conference of hedge-fund managers in London today. ``There will be massive dumping of assets'' and ``hundreds of hedge funds are going to go bust,'' he said.

...

``Systemic risk has become bigger and bigger,'' Roubini said at the Hedge 2008 conference. ``We're seeing the beginning of a run on a big chunk of the hedge funds,'' and ``don't be surprised if policy makers need to close down markets for a week or two in coming days,'' he said.

Report: Foreclosures Rise Sharply in Q3 (year over year)

by Calculated Risk on 10/23/2008 09:50:00 AM

Update: HousingWire has much more: Foreclosures Stalled by Local Legislation in September

“Much of the 12 percent decrease in September can be attributed to changes in state laws that have at least temporarily slowed down the pace at which lenders are moving forward with foreclosures,” said James J. Saccacio, chief executive officer of RealtyTrac.From Bloomberg: Foreclosure Filings Rose 71% in Third Quarter as Prices Fell

“Most significantly, SB 1137 in California took effect in early September and requires lenders to make contact with borrowers at least 30 days before filing a Notice of Default. In September we saw California NODs drop 51 percent from the previous month, and that drop had a significant impact on the national numbers given that California accounts for close to one-third of the nation’s foreclosure activity each month.”

A total of 765,558 U.S. properties got a default notice, were warned of a pending auction or were foreclosed on in the quarter, the most since records began in January 2005, [RealtyTrac] said in a statement today. Filings rose 3 percent from the second quarter and fell 12 percent in September from August as state laws created to keep people in homes slowed the pace of defaults.This is a record - but RealtyTrac has only been tracking foreclosure data since 2005. I prefer to use the California numbers from DataQuick to follow foreclosure activity because they have a longer data series. DataQuick will probably release data for Q3 any day now.

Weekly Unemployment Claims: 478,000

by Calculated Risk on 10/23/2008 09:34:00 AM

From the Dept of Labor:

In the week ending Oct. 18, the advance figure for seasonally adjusted initial claims was 478,000, an increase of 15,000 from the previous week's revised figure of 463,000. It is estimated that the effects of Hurricane Ike in Texas added approximately 12,000 claims to the total. The 4-week moving average was 480,250, a decrease of 4,500 from the previous week's revised average of 484,750.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims and the four week moving average. The four week moving average is at 480,250.

Some of the recent increase in unemployment claims is a result of Hurricane Ike and should be temporary, but the four week moving average of weekly unemployment claims is at a recession level and continues to indicate significant weakness in the labor market.

Wednesday, October 22, 2008

Bryce National Park

by Calculated Risk on 10/22/2008 11:14:00 PM

For those interested, here are a few pictures from our trip to Bryce National Park. Click on photo for larger image in new window.

Click on photo for larger image in new window.

Photo credit: Pattie A.

The first photo is from the Fairlyland trail in Bryce National Park. This is about an easy 8 mile loop walk through the hoodoos with incredible formations and colors. It is like being at Thunder Mountain in Disneyland!

|  |

| The above photo shows more hoodoos at Bryce. |

The photo on the right is of an ancient blogger enjoying the hoodoos on the Fairyland trail.

We arrived at Bryce around mid-morning and hiked until late in the day. For those traveling to Bryce and hoping for the best lighting, I suggest trying to arrive before sunrise and driving to Bryce point; the Silent City will probably be awesome in the early morning light.

Pulte Homes: "environment worsened significantly"

by Calculated Risk on 10/22/2008 09:03:00 PM

From Reuters: Pulte loss narrows, says housing market worsened

Pulte said it would not forecast fourth-quarter results because of poor visibility in its industry and the wider economy.If Q3 was "significantly worse", how will they describe Q4? (with higher mortgage rates and the impact from the credit crisis).

"The homebuilding operating environment significantly worsened during the third quarter of 2008," Chief Executive Richard Dugas said in a statement. "Uncertainty and volatility in the capital markets, higher unemployment, and a weaker economy provided further downward pressure."

emphasis added

WSJ: Banks may see record credit card losses

by Calculated Risk on 10/22/2008 07:41:00 PM

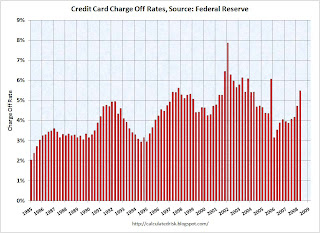

From David Reilly at the WSJ Heard on the Street: Credit Card Losses May Scale New Peak

... A broader range of consumers now carry cards, and many run consistent credit balances to fund their lifestyles. This has led to successively higher peaks over the years in credit card charge-off rates.The Federal Reserve reported that the credit card charge-off rate was 5.47% at the end of Q2. As Reilly notes, third quarter data hasn't been released yet, but will certainly be higher based on reports from financial institutions:

The danger is that the current financial downturn results in a new, far-higher peak charge-off rate that leads to unexpectedly large losses at banks and other card issuers.

American Express said on its earnings call Monday that its loss rate had increased to 6.1% in September, compared with 5.9% for the quarter overall, and that it expected losses to grow to the end of the year. J.P. Morgan, meanwhile, forecast that its credit card loss rate could climb to 7% by the end of 2009, compared with about 5% in the third quarter.

Click on graph for larger image.

Click on graph for larger image.This graph shows the consumer credit card charge-off rate by quarter starting with 1985.

Note the spike in 2005 was because of the change to the bankruptcy law (Bankruptcy Abuse Prevention and Consumer Protection Act of 2005).

The record charge-off rate was 7.85% in Q1 2002 according to the Fed.

It seems reasonable to expect at or near record credit card charge-off rates during this recession.

Credit-Rating Companies `Sold Soul'

by Calculated Risk on 10/22/2008 05:23:00 PM

From Bloomberg: Credit-Rating Companies `Sold Soul,' Employees Said

Employees at Moody's Investors Service told executives that issuing dubious creditworthy ratings to mortgage-backed securities made it appear they were incompetent or ``sold our soul to the devil for revenue,'' according to e-mails obtained by U.S. House investigators.Barry Ritholtz has some excerpts of an IM conversation between two S&P analysts:

Rahul Dilip Shah: btw: that deal is ridiculousHere is the House Oversight Committee transcript from April 2007.

Shannon Mooney: I know right ... model def does not capture half of the risk

Rahul Dilip Shah: we should not be rating it

Shannon Mooney: we rate every deal

Shannon Mooney: it could be structured by cows and we would rate it

Calpers Loses More than 20% Since June

by Calculated Risk on 10/22/2008 02:41:00 PM

From the WSJ: U.S. Pension Benefit Guaranty Loses at Least $3 Billion

The U.S. Pension Benefit Guaranty Corporation [PBGC] lost at least $3 billion in stock investments in the 11 months through August ... It is likely that losses will be "substantially worse" after September results are reported, the committee said.And on Calpers:

...

The committee says the losses came in the agency's "trust fund," which holds the assets of terminated plans that have been turned over to the PBGC.

[T]he California Public Employees' Retirement System ... said a decline of more than 20% in its assets since June 30 may lead to increased employer contributions to the fund of 2% to 4% starting in July 2010 and July 2011.The PBGC problems might lead to a bailout and will likely lead to higher insurance premiums for pension plans. The Calpers problems are part of a larger looming pension deficit and retirement funding crisis.

At least retirees can rely on the equity in their homes ... (OK, sorry for the snark).

Credit Crisis Indicators: Mostly unchanged

by Calculated Risk on 10/22/2008 02:28:00 PM

First on the LIBOR from Bloomberg: Libor for Dollars Slides After Fed Offers Cash to Mutual Funds

The London interbank offered rate, or Libor, that banks charge each other for such loans dropped 29 basis points to 3.54 percent, the British Bankers' Association said. ... The Libor-OIS spread, a measure of cash scarcity, fell below 250 basis points for the first time since Sept. 30.

``The funding situation has improved and will probably continue to improve, but what will surprise is the length of time it will take,'' said Patrick Bennett, a currency strategist at Societe Generale SA in Hong Kong.

A good sign would be if the daily volatility subsides, and the yield moves up closer to the Fed funds rate, or about 1.25%.

Here is a list of SFP sales. No new announcements today, but this will take some time. No Progress.

During a recession, this spread usually increases because the risk of default for lower quality paper increases. However the recent values (over 400 bps) are far in excess of normal. If the credit crisis eases, I'd expect a significant decline in this spread.

This is a disappointment, and it looks like it will take some time for the credit markets to thaw. Meanwhile the economic and earning news is still grim ...