by Calculated Risk on 10/22/2008 07:41:00 PM

Wednesday, October 22, 2008

WSJ: Banks may see record credit card losses

From David Reilly at the WSJ Heard on the Street: Credit Card Losses May Scale New Peak

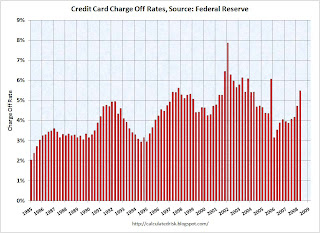

... A broader range of consumers now carry cards, and many run consistent credit balances to fund their lifestyles. This has led to successively higher peaks over the years in credit card charge-off rates.The Federal Reserve reported that the credit card charge-off rate was 5.47% at the end of Q2. As Reilly notes, third quarter data hasn't been released yet, but will certainly be higher based on reports from financial institutions:

The danger is that the current financial downturn results in a new, far-higher peak charge-off rate that leads to unexpectedly large losses at banks and other card issuers.

American Express said on its earnings call Monday that its loss rate had increased to 6.1% in September, compared with 5.9% for the quarter overall, and that it expected losses to grow to the end of the year. J.P. Morgan, meanwhile, forecast that its credit card loss rate could climb to 7% by the end of 2009, compared with about 5% in the third quarter.

Click on graph for larger image.

Click on graph for larger image.This graph shows the consumer credit card charge-off rate by quarter starting with 1985.

Note the spike in 2005 was because of the change to the bankruptcy law (Bankruptcy Abuse Prevention and Consumer Protection Act of 2005).

The record charge-off rate was 7.85% in Q1 2002 according to the Fed.

It seems reasonable to expect at or near record credit card charge-off rates during this recession.

Credit-Rating Companies `Sold Soul'

by Calculated Risk on 10/22/2008 05:23:00 PM

From Bloomberg: Credit-Rating Companies `Sold Soul,' Employees Said

Employees at Moody's Investors Service told executives that issuing dubious creditworthy ratings to mortgage-backed securities made it appear they were incompetent or ``sold our soul to the devil for revenue,'' according to e-mails obtained by U.S. House investigators.Barry Ritholtz has some excerpts of an IM conversation between two S&P analysts:

Rahul Dilip Shah: btw: that deal is ridiculousHere is the House Oversight Committee transcript from April 2007.

Shannon Mooney: I know right ... model def does not capture half of the risk

Rahul Dilip Shah: we should not be rating it

Shannon Mooney: we rate every deal

Shannon Mooney: it could be structured by cows and we would rate it

Calpers Loses More than 20% Since June

by Calculated Risk on 10/22/2008 02:41:00 PM

From the WSJ: U.S. Pension Benefit Guaranty Loses at Least $3 Billion

The U.S. Pension Benefit Guaranty Corporation [PBGC] lost at least $3 billion in stock investments in the 11 months through August ... It is likely that losses will be "substantially worse" after September results are reported, the committee said.And on Calpers:

...

The committee says the losses came in the agency's "trust fund," which holds the assets of terminated plans that have been turned over to the PBGC.

[T]he California Public Employees' Retirement System ... said a decline of more than 20% in its assets since June 30 may lead to increased employer contributions to the fund of 2% to 4% starting in July 2010 and July 2011.The PBGC problems might lead to a bailout and will likely lead to higher insurance premiums for pension plans. The Calpers problems are part of a larger looming pension deficit and retirement funding crisis.

At least retirees can rely on the equity in their homes ... (OK, sorry for the snark).

Credit Crisis Indicators: Mostly unchanged

by Calculated Risk on 10/22/2008 02:28:00 PM

First on the LIBOR from Bloomberg: Libor for Dollars Slides After Fed Offers Cash to Mutual Funds

The London interbank offered rate, or Libor, that banks charge each other for such loans dropped 29 basis points to 3.54 percent, the British Bankers' Association said. ... The Libor-OIS spread, a measure of cash scarcity, fell below 250 basis points for the first time since Sept. 30.

``The funding situation has improved and will probably continue to improve, but what will surprise is the length of time it will take,'' said Patrick Bennett, a currency strategist at Societe Generale SA in Hong Kong.

A good sign would be if the daily volatility subsides, and the yield moves up closer to the Fed funds rate, or about 1.25%.

Here is a list of SFP sales. No new announcements today, but this will take some time. No Progress.

During a recession, this spread usually increases because the risk of default for lower quality paper increases. However the recent values (over 400 bps) are far in excess of normal. If the credit crisis eases, I'd expect a significant decline in this spread.

This is a disappointment, and it looks like it will take some time for the credit markets to thaw. Meanwhile the economic and earning news is still grim ...

Roubini on CNBC

by Calculated Risk on 10/22/2008 12:16:00 PM

Roubini on the economy "the worst is still ahead of us", 9 min 45 sec:

More Roubini (starts at 4 minute mark) "most important key point is this not just a liquidity crisis, this is a credit and solvency crisis.", "next time bomb significant increase in default rates for corporates", 9 min 20 secs:

Roubini on stock market "keep things in cash", 3 min 45 secs:

FDIC Seeks Office Space in SoCal

by Calculated Risk on 10/22/2008 10:59:00 AM

From the LA Times: FDIC seeking office space in Southern California

The Federal Deposit Insurance Corp. plans soon to sign a major lease of office space in Orange County, probably in Irvine, where as many as 600 people would liquidate the assets of troubled banks and thrifts based in California and other Western states.A little good news for office space - although not the best source for demand.

The agency needs 200,000 square feet of space and has looked at locations across Southern California, FDIC spokesman David Barr said.

"It's a temporary office -- three to five years is what we're looking at," Barr said Tuesday. "We hope to find the space within the next few weeks."

Wachovia $23.7 Billion Loss

by Calculated Risk on 10/22/2008 09:16:00 AM

From Reuters: Wachovia Reports $23.9 Billion Loss for Third Quarter

Wachovia on Wednesday posted a $23.9 billion third-quarter loss, a record for any United States lender in the global credit crisis ... The loss totaled $11.18 per share, and stemmed mostly from an $18.7 billion write-down of good will because asset values declined, as well as a big increase in reserves for soured loans.

...

Much of Wachovia’s troubles stem from a fast-deteriorating $118.7 billion portfolio of “Pick-a-Pay” option adjustable-rate mortgages it largely took on when it bought the California lender Golden West Financial for $24.2 billion in 2006.

Wachovia said it now expects cumulative losses on that 438,000-loan portfolio of $26.1 billion, or 22 percent, up from the 12 percent it had forecast in July.

Tuesday, October 21, 2008

Zion National Park

by Calculated Risk on 10/21/2008 10:56:00 PM

For those interested, here are a few pictures from our trip to Zion National Park.

The first two photos are of the Narrows hike. This is where the Virgin River flows through a slot canyon into the upper reaches of Zion Canyon. The walls of the slot canyon reach up to 2000 feet high in places, and at times the canyon narrows to just 20 to 30 feet wide.

The right photo is a little grainy (the canyon is dark at times), and shows several hikers in the canyon for perspective. The river is the trail, and over half the time you are hiking in water.

Photo credit: Lucy A.

|  |

The second set of photos is of Angels Landing. The photo on the left shows the upper steep section with 1000' drops on both sides of the trail. If you expand the photo you can barely see two climbers on the face of Angels Landing (in red square).

The right photo shows some old blogger hanging on to the safety chains while hiking to the summit of Angels Landing.

|  |

Mervyn King: A 'long march' out of recession

by Calculated Risk on 10/21/2008 08:31:00 PM

From The Times: Mervyn King warns of Britain's 'long march' out of recession

Britain is on the brink of recession and faces an extended and painful economic downturn, the Governor of the Bank of England said last night. Mervyn King admitted for the first time that “it now seems likely that the economy is entering a recession”. He told families and business to prepare for a prolonged period of hardship.Here is the story from Bloomberg: King Says Bank of England Will Act as Recession Seems Likely

“We now face a long, slow haul to restore lending to the real economy, and hence growth of our economy, to more normal conditions,” he said.

A squeeze on take-home pay, soaring living costs and the decline in consumer credit increased the risk of “a sharp and prolonged slowdown”. He said: “Over the past month, the economic news has probably been the worst in such a short period for a very considerable time.”

``The age of innocence -- when banks lent to each other unsecured for three months or longer at only a small premium to expected policy rates -- will not quickly, if ever, return,'' King said. ``I hope it is now understood that the provision of central bank liquidity, while essential to buy time, is not, and never could be, the solution to the banking crisis, nor to the problems of individual banks.''Usually when the Fed Chairman and the BofE Governor are talking recession, both countries have been in recession for some time!

...

``Not since the beginning of the First World War has our banking system been so close to collapse,'' King said.

...

Investors overseas may also be less willing to put their money in the U.K., King said. ``Unless they are replaced by other forms of external finance, the adjustments in the trade deficit and exchange rate will need to be larger and faster than would otherwise have occurred, implying a larger rise in domestic saving and weaker domestic spending in the short run.''

O.C. Office Vacancy Rate hits 14.85%

by Calculated Risk on 10/21/2008 06:26:00 PM

From Jon Lansner at the O.C. Register: O.C. office glut grows to post-9/11 slump levels

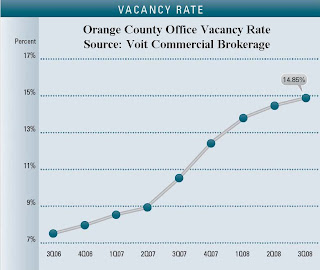

Empty office space in Orange County jumped to 14.85% this quarter up from 10.53% in the third quarter a year ago, reports Voit Commercial Brokerage.

"This increase is a result of the new construction coupled with a slowing economy, as financial markets correct,” writes Voit’s Jerry Holdner.

Still he says things aren’t as bad as they were in the first quarter of 2002, when office vacancies hit 17.2%.

Click on graph for larger image in new window.

This graph shows the quarterly Orange County office vacancy rate since Q3 2006. (See Voit report page 4 for annual vacancy rates starting in 1998).

Note: the y-axis does not start at zero.

In 2007 the rapid increase in the vacancy rate was due to a huge increase in new space combined with negative absorption as a number of Orange County financial companies (like New Century) went under. New construction has slowed, but the absorption rate is still negative as the economy is in recession.

From the Voit report:

During the first three quarters of 2008, Orange County has added just over 1.55 million square feet of new office development, most of which was in the Airport and South County submarkets. The record year for new development was 1988, when 5.7 million square feet of new space was added to Orange County, and vacancy rates were approximately 24%. We are a long way from those records.So the vacancy rate is a long way from the peak during the S&L crisis. And builders have slowed down on new construction:

Total space under construction checked in at 292,139 square feet at the end of the third quarter, which is almost 90% lower than the amount that was under construction this same time last year. It is estimated that a total of 1.7 million square feet of new construction will be completed this year, most of which has already been delivered. This will put less upward pressure on the recent rise in the vacancy rate.But even with less new construction, the vacancy rate has continued to climb due to a negative net absorption rate:

Net absorption for the county posted a negative 361,184 square feet for the third quarter of 2008, giving the office market a total of 1.37 million square feet of negative absorption for the first three quarters of this year. Last year Orange County had a total of 947,370 square feet of negative absorption. This negative absorption can be attributed to the credit crunch and finance companies consolidating.Because of the concentration of subprime lenders in Orange County, the office space market was hit earlier than other areas of the country. In response, builders cut new construction dramatically. The rest of the country should follow Orange County and I expect a significant decline in new office construction over the next 18 months based on the architects survey and tighter lending standards.