by Calculated Risk on 10/22/2008 12:16:00 PM

Wednesday, October 22, 2008

Roubini on CNBC

Roubini on the economy "the worst is still ahead of us", 9 min 45 sec:

More Roubini (starts at 4 minute mark) "most important key point is this not just a liquidity crisis, this is a credit and solvency crisis.", "next time bomb significant increase in default rates for corporates", 9 min 20 secs:

Roubini on stock market "keep things in cash", 3 min 45 secs:

FDIC Seeks Office Space in SoCal

by Calculated Risk on 10/22/2008 10:59:00 AM

From the LA Times: FDIC seeking office space in Southern California

The Federal Deposit Insurance Corp. plans soon to sign a major lease of office space in Orange County, probably in Irvine, where as many as 600 people would liquidate the assets of troubled banks and thrifts based in California and other Western states.A little good news for office space - although not the best source for demand.

The agency needs 200,000 square feet of space and has looked at locations across Southern California, FDIC spokesman David Barr said.

"It's a temporary office -- three to five years is what we're looking at," Barr said Tuesday. "We hope to find the space within the next few weeks."

Wachovia $23.7 Billion Loss

by Calculated Risk on 10/22/2008 09:16:00 AM

From Reuters: Wachovia Reports $23.9 Billion Loss for Third Quarter

Wachovia on Wednesday posted a $23.9 billion third-quarter loss, a record for any United States lender in the global credit crisis ... The loss totaled $11.18 per share, and stemmed mostly from an $18.7 billion write-down of good will because asset values declined, as well as a big increase in reserves for soured loans.

...

Much of Wachovia’s troubles stem from a fast-deteriorating $118.7 billion portfolio of “Pick-a-Pay” option adjustable-rate mortgages it largely took on when it bought the California lender Golden West Financial for $24.2 billion in 2006.

Wachovia said it now expects cumulative losses on that 438,000-loan portfolio of $26.1 billion, or 22 percent, up from the 12 percent it had forecast in July.

Tuesday, October 21, 2008

Zion National Park

by Calculated Risk on 10/21/2008 10:56:00 PM

For those interested, here are a few pictures from our trip to Zion National Park.

The first two photos are of the Narrows hike. This is where the Virgin River flows through a slot canyon into the upper reaches of Zion Canyon. The walls of the slot canyon reach up to 2000 feet high in places, and at times the canyon narrows to just 20 to 30 feet wide.

The right photo is a little grainy (the canyon is dark at times), and shows several hikers in the canyon for perspective. The river is the trail, and over half the time you are hiking in water.

Photo credit: Lucy A.

|  |

The second set of photos is of Angels Landing. The photo on the left shows the upper steep section with 1000' drops on both sides of the trail. If you expand the photo you can barely see two climbers on the face of Angels Landing (in red square).

The right photo shows some old blogger hanging on to the safety chains while hiking to the summit of Angels Landing.

|  |

Mervyn King: A 'long march' out of recession

by Calculated Risk on 10/21/2008 08:31:00 PM

From The Times: Mervyn King warns of Britain's 'long march' out of recession

Britain is on the brink of recession and faces an extended and painful economic downturn, the Governor of the Bank of England said last night. Mervyn King admitted for the first time that “it now seems likely that the economy is entering a recession”. He told families and business to prepare for a prolonged period of hardship.Here is the story from Bloomberg: King Says Bank of England Will Act as Recession Seems Likely

“We now face a long, slow haul to restore lending to the real economy, and hence growth of our economy, to more normal conditions,” he said.

A squeeze on take-home pay, soaring living costs and the decline in consumer credit increased the risk of “a sharp and prolonged slowdown”. He said: “Over the past month, the economic news has probably been the worst in such a short period for a very considerable time.”

``The age of innocence -- when banks lent to each other unsecured for three months or longer at only a small premium to expected policy rates -- will not quickly, if ever, return,'' King said. ``I hope it is now understood that the provision of central bank liquidity, while essential to buy time, is not, and never could be, the solution to the banking crisis, nor to the problems of individual banks.''Usually when the Fed Chairman and the BofE Governor are talking recession, both countries have been in recession for some time!

...

``Not since the beginning of the First World War has our banking system been so close to collapse,'' King said.

...

Investors overseas may also be less willing to put their money in the U.K., King said. ``Unless they are replaced by other forms of external finance, the adjustments in the trade deficit and exchange rate will need to be larger and faster than would otherwise have occurred, implying a larger rise in domestic saving and weaker domestic spending in the short run.''

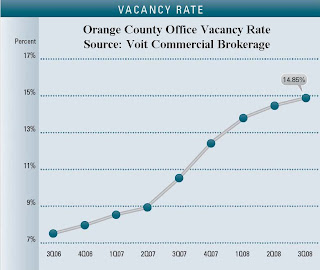

O.C. Office Vacancy Rate hits 14.85%

by Calculated Risk on 10/21/2008 06:26:00 PM

From Jon Lansner at the O.C. Register: O.C. office glut grows to post-9/11 slump levels

Empty office space in Orange County jumped to 14.85% this quarter up from 10.53% in the third quarter a year ago, reports Voit Commercial Brokerage.

"This increase is a result of the new construction coupled with a slowing economy, as financial markets correct,” writes Voit’s Jerry Holdner.

Still he says things aren’t as bad as they were in the first quarter of 2002, when office vacancies hit 17.2%.

Click on graph for larger image in new window.

This graph shows the quarterly Orange County office vacancy rate since Q3 2006. (See Voit report page 4 for annual vacancy rates starting in 1998).

Note: the y-axis does not start at zero.

In 2007 the rapid increase in the vacancy rate was due to a huge increase in new space combined with negative absorption as a number of Orange County financial companies (like New Century) went under. New construction has slowed, but the absorption rate is still negative as the economy is in recession.

From the Voit report:

During the first three quarters of 2008, Orange County has added just over 1.55 million square feet of new office development, most of which was in the Airport and South County submarkets. The record year for new development was 1988, when 5.7 million square feet of new space was added to Orange County, and vacancy rates were approximately 24%. We are a long way from those records.So the vacancy rate is a long way from the peak during the S&L crisis. And builders have slowed down on new construction:

Total space under construction checked in at 292,139 square feet at the end of the third quarter, which is almost 90% lower than the amount that was under construction this same time last year. It is estimated that a total of 1.7 million square feet of new construction will be completed this year, most of which has already been delivered. This will put less upward pressure on the recent rise in the vacancy rate.But even with less new construction, the vacancy rate has continued to climb due to a negative net absorption rate:

Net absorption for the county posted a negative 361,184 square feet for the third quarter of 2008, giving the office market a total of 1.37 million square feet of negative absorption for the first three quarters of this year. Last year Orange County had a total of 947,370 square feet of negative absorption. This negative absorption can be attributed to the credit crunch and finance companies consolidating.Because of the concentration of subprime lenders in Orange County, the office space market was hit earlier than other areas of the country. In response, builders cut new construction dramatically. The rest of the country should follow Orange County and I expect a significant decline in new office construction over the next 18 months based on the architects survey and tighter lending standards.

DataQuick: 42% of California Bay Area Sales from Foreclosures

by Calculated Risk on 10/21/2008 03:17:00 PM

From DataQuick: Bay Area home sales up 45% over '07; median price falls to $400K

Bay Area home sales soared last month above the record-low levels of a year ago, marking the largest gain in over six years. The median sale price did the opposite, diving to $400,000 - 40 percent below its summer 2007 peak - as more sales shifted to lower-cost inland markets laden with foreclosures.The inland areas have seen the most foreclosure activity and largest price declines. The increase in sales (prior to the recent wave of the credit crisis) suggests prices are closer to the eventual bottom in the inland areas than for the higher priced areas.

...

Although sales rose in some coastal communities in September, it was the region's less expensive inland markets that pushed sales up so sharply.

...

DataQuick's September sales reflect closed escrows, meaning buyers made their purchase decisions in mid-to-late summer, before the worst of the economic news hit in recent weeks. Statistics over the next month will begin to show how housing demand has fared this fall.

...

[N]early 42 percent of all existing homes sold across the Bay Area last month had been foreclosed on at some point in the prior 12 months, up from 36.1 percent in August and 6.9 percent a year ago. Foreclosures tend to sell at a discount and are concentrated in relatively affordable neighborhoods.

...

Foreclosure activity is at or near record levels ...

We have to be careful with median prices because so much of the activity is foreclosure resales in lower prices areas, and this distorts the mix of houses being sold and lowers the median price.

Credit Crisis Indicators: More Progress

by Calculated Risk on 10/21/2008 02:00:00 PM

I'm tracking a few credit market indicators daily.

The U.S. economy is already in a recession, but without some improvement in the credit markets, the recession would be even worse. Fortunately there has been some improvement in the credit markets since the announcement early last week of Treasury equity investments in several major financial institutions. However there is still a long way to go ...

Click on graph for larger image in new window.

This graph shows the high, low, and the close for the three month treasury bill since the beginning of the year.

A good sign would be if the daily volatility subsides, and the yield moves up closer to the Fed funds rate, or about 1.25%.

The yield is increasing, but the daily volatility is still very high.

Here is a list of SFP sales. No new announcements today, but this will take some time. No Progress.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

This is the spread between high and low quality 30 day nonfinancial commercial paper. During a recession, this spread usually increases because the risk of default for lower quality paper increases. However the recent values (over 400 bps) are far in excess of normal. If the credit crisis eases, I'd expect a significant decline in this spread.

MSC Industrial Comments on Economy

by Calculated Risk on 10/21/2008 01:45:00 PM

MSC Industrial Supply (MSC) supplies industrial products to industrial customers. They had some interesting comments today on their conference call about the economy (hat tip Brian):

MSC: “In the last several weeks, customers' sentiment has turned dramatically downwards. Here are a few of the things we have recently heard and I'll quote a few of them. One quote is our new orders are down substantially in the last few weeks. Another is that corporate has told us to reduce inventory. What we have also heard is make due with what you have. And finally, another quote is capital expenditures are on hold. Customers are concerned about the economy and the lack of available credit. They're reducing inventories, orders, and order size and there has been a trend toward deferring capital expenditures. There is a lack of visibility and until that improves, customers will continue to act in this manner. This has affected the smaller manufacturers and machine shops that still make up a significant portion of MSC sales to a greater extent than our larger customers.”More real economy cliff diving.

Analyst: In terms of the environment we're dealing with here today, I am interested in all of your opinions, your viewpoint in terms of how does this current environment look to you relative to past downturns with we have seen.

MSC: David, we view this time as unprecedented in history. The economy is undergoing a huge change, how that is going to shake out all remains to be seen, but I think what is important to know is it's a huge change that, frankly, no one had a chance to see coming, so we than specifically in our customer base there is a tremendous amount of fear that is gripping customers and evidenced by what we have seen the last couple of weeks in October, almost buying paralysis, that is really the way that we think about it, and frankly, in speaking with so many customers what we see happening.... if you go back to 9/11, pre-9/11, the economy was coming down in fact on a sequential basis over a period of many, many months, it slowed down and then there was the obvious tragic event of 9/11. What is has happened here with the credit crisis is while the economy was by no means booming, it was kind of rolling along and we almost think that what typically would have taken six, seven, eight, 9, 12 months to start to come down happened almost literally overnight. If you think about the ISM being in a flat 49-ish, 50 range for many, many months throughout the year to have it swoon as it did in September at 43, which, by the way, as I am sure you know is at 9/11 levels. From all the time that the ISM has been tracked, I don't believe it's been a point where the ISM measurement ever dropped off the cliff as fast. Even pre-9/11, the ISM was drifting downward to ultimately hit that level but it was not at kind of the steady state where it was, which is, you know, with the slower economy but, frankly, with the latest measurements showing was that things fell off a cliff.

One more thing to also note that our customer base is much more diversified [from the 9/11 period]. Very different from back then. We were just getting started with our large customer segment, for example, when where today the large customer segment is a much larger and vibrant part of our growth equation and that will, as it's already shown, will help to diversify us from that small to midsize manufacturing customer where the pressure on them is just enormous.

emphasis added

LIBOR Continues to Decline

by Calculated Risk on 10/21/2008 09:37:00 AM

From the WSJ: Libor's Move Downward Continues

According to data from the British Bankers' Association, three-month U.S. dollar Libor dropped to 3.83375%, the lowest since September 26, from Monday's fixing of 4.05875%. The rate has shed nearly 100 basis points since peaking at 4.81875% on October 10.The TED spread has dropped to 2.61 this morning. This is still above the peaks of the previous waves of the credit crisis: in August 2007 the TED spread peaked at around 2.4, in Dec 2007 at about 2.2, and in March of 2008 at just over 2.0. There is still a long way to go.

The one-month rate fell to 3.5275% Tuesday from Monday's 3.75125%.

...

The three-month BOR/OIS spread narrowed to 271.4 basis points from around 293 basis points Monday as tensions eased.

Also this just shows some loosening in the credit markets - an important step - but the economic data in general suggests the U.S. recession is still getting worse.