by Calculated Risk on 10/16/2008 11:15:00 AM

Thursday, October 16, 2008

Oil Below $70 per Barrel

From AFP: Oil price hits 15-month low under $68

Oil prices slumped further on Thursday, with Brent crude briefly sliding close to 67 dollars a barrel and the lowest level for more than 15 months, as slowing energy demand took its toll, traders said.The free fall continues. At least this will help with inflation and take some pressure off consumer spending.

Crude oil futures were down more than 50 percent from record highs of above 147 dollars reached in July ...

Industrial Production: Cliff Diving

by Calculated Risk on 10/16/2008 09:17:00 AM

From MarketWatch: U.S. Sept industrial output down 2.8%, biggest since Dec '74

The output of the nation's factories, mines and utilities plunged 2.8% in September, the Federal Reserve said Thursday. This is the biggest decline in output since December 1974. ... A strike at Boeing Co had a negative impact on production, as did Hurricane Gustav and Hurricane Ike. ... Capacity utilization fell to 76.4% from 78.7%.More evidence of a sharp slowdown in the U.S. economy in September.

Write Downs: Citi $4.4 Billion, Merrill $9.5 Billion

by Calculated Risk on 10/16/2008 08:50:00 AM

From the WSJ: Citigroup Posts Fourth Straight Loss

Citigroup Inc. swung to a third-quarter loss -- its fourth straight quarter in the red -- as it wrote down another $4.4 billion in securities and banking and blamed weak revenues across all businesses on "the impact of a difficult economic environment and weak capital markets."And on Merrill: Merrill's Net Loss Widens on $9.5 Billion in Write-Downs

Merrill Lynch & Co., which is set to be acquired by Bank of America Corp. in February, posted a wider third-quarter loss amid another $9.5 billion in write-downs of troubled assets.The confessional is still busy!

The company, which already posted some $40 billion in subprime-related write-downs, said it has made "significant progress in balance sheet and risk reduction," having cut 98% of its exposures to U.S. Alt-A mortgages.

Weekly Unemployment Claims

by Calculated Risk on 10/16/2008 08:37:00 AM

From the DOL: Unemployment Insurance Weekly Claims Report

In the week ending Oct. 11, the advance figure for seasonally adjusted initial claims was 461,000, a decrease of 16,000 from the previous week's revised figure of 477,000. It is estimated that the effects of Hurricane Ike in Texas added approximately 12,000 claims to the total. The 4-week moving average was 483,250, an increase of 750 from the previous week's unrevised average of 482,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims. The four week moving average is at 483,250.

Some of the recent increase in unemployment claims is a result of Hurricane Ike and should be temporary, but the four week moving average of weekly unemployment claims is at a recession level and continues to indicate significant weakness in the labor market.

NY Times: House Prices Far From Bottom

by Calculated Risk on 10/16/2008 12:30:00 AM

From Vikas Bajaj at the NY Times provides an overview: Home Prices Seem Far From Bottom

Home prices across much of the country are likely to fall through late 2009, economists say, and in some markets the trend could last even longer depending on the severity of the anticipated recession.Yes, house prices are still too high.

In hard-hit areas like California, Florida and Arizona, the grim calculus is the same: More and more homes are going up for sale, but fewer and fewer people are willing or able to buy them.

Wednesday, October 15, 2008

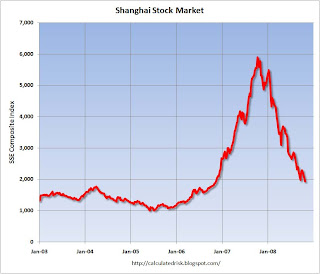

Asian Market Cliff Diving

by Calculated Risk on 10/15/2008 11:10:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Shanghai SSE composite index has now lost more than two-thirds from the peak (still trading). This is the lowest level since late 2006.

And it's not just the Shanghai composite - it's an Asian market rout:

The Hang Seng is off 6.6%.

The Nikkei 225 is off 9.6%.

The Seoul Composite is off close to 6.8%.

CNN: Culprits of the Collapse

by Calculated Risk on 10/15/2008 09:17:00 PM

CNN is running a series called Culprits of the Collapse. They are naming their top ten culprits.

The problem I have with this piece is it centers on Greenspan's monetary policy and ignores Greenspan's far larger mistake; opposing oversight when many people were pointing out the extremely lax lending standards.

Bernanke: Fed may Consider Asset Bubbles

by Calculated Risk on 10/15/2008 06:03:00 PM

Here are a few comments from the Q&A. The official stance of the Fed has been to ignore asset bubbles - others have argued that the Fed must consider asset prices as part of monetary policy. This has been an area of significant research in recent years for obvious reasons.

Here are some comments from Greenspan in 2002 after the stock bubble:

If the bursting of an asset bubble creates economic dislocation, then preventing bubbles might seem an attractive goal. But whether incipient bubbles can be detected in real time and whether, once detected, they can be defused without inadvertently precipitating still greater adverse consequences for the economy remain in doubt.I don't think significant asset bubbles are really that hard to identify.

...

If the postmortem of recent monetary policy shows that the results of addressing the bubble only after it bursts are unsatisfactory, we would be left with less-appealing choices for the future. In that case, finding ways to identify bubbles and to contain their progress would be desirable, though history cautions that prospects for success appear slim.

Alan Greenspan, Issues for Monetary Policy, December 19, 2002

Here are Bernanke's comments from Bloomberg: Bernanke Weighs Limiting Consolidation, Asset Bubbles (hat tip James)

Federal Reserve Chairman Ben S. Bernanke said the central bank will consider discarding its long- standing aversion to interfering with asset-price bubbles and warned that the banking business may be concentrated in too few companies.

Officials should review how supervision and interest rates can minimize the ``dangerous phenomenon'' of bubbles in housing, stocks and other assets that risk bringing the financial system and economy down with them when they burst, Bernanke said.

``There is no doubt that as we emerge from the current crisis that we are all going to look very hard at that issue and what can be done about it,'' he told the Economic Club of New York in his broadest remarks on future regulatory changes since the credit crisis deepened last month.

S&P may downgrade $280 billion of Alt-A

by Calculated Risk on 10/15/2008 05:26:00 PM

From Bloomberg: S&P Reviews $280.1 Billion of Alt-A Mortgage Debt

Standard & Poor's said it may downgrade $280.1 billion of Alt-A mortgage securities, the most that the ratings company has identified in a single announcement for bonds backed by the loans.The beat goes on.

The debt may be cut in part because S&P has boosted estimates for losses on each foreclosure on Alt-A loans with at least five years of fixed rates to 40 percent, from 35 percent ...

``There has been a persistent rise in the level of delinquencies among the Alt-A mortgage loans supporting these transactions,'' S&P analysts Scott Davey and Ernestine Warner said in the statement.

More Cliff Diving Today

by Calculated Risk on 10/15/2008 04:16:00 PM

Dow off 7.9%

S&P 500 off 8.5%

NASDAQ off 9.0%

The recession is deepening (and was deepening before the most recent wave of the credit crisis). And there is no significant sign of improvement in the credit markets. All the economic news will be bad for some time ... and after the September retail report this morning, I expect Q3 PCE (to be released Oct 30th) to be strongly negative - and GDP to decline too.