by Calculated Risk on 10/14/2008 04:31:00 PM

Tuesday, October 14, 2008

LA Times: Retailers cutting back on holiday hiring

Andrea Chang at the LA Times writes: Retailers cutting back on holiday hiring

A recent survey of more than 1,000 managers responsible for hiring hourly workers found that each manager planned on hiring an average of 3.7 seasonal employees this year, roughly 33% less than the 5.6 workers they hired during last year's holiday period.

...

Last year there were 618,000 holiday hires in the retail sector in November and December, according to the National Retail Federation [NRF]. But that number is likely to be significantly lower this year, said Daniel Butler, vice president of retail operations with the group.

He predicted that holiday hiring numbers would drop to 2001 levels, when consumers reined in their spending after 9/11. Retailers made just 402,500 holiday hires that year.

Click on graph for larger image in new window.

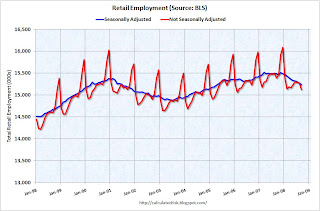

Click on graph for larger image in new window.This graph shows the Seasonally Adjusted (SA) and Not Seasonally Adjusted (NSA) retail employment from the Bureau of Labor Statistics (BLS).

NOTE: Y-axis doesn't start at zero to better show the change.

Usually retailers start hiring seasonal workers in October (maybe 15% of the temporary holiday workforce) and add over 700 thousand total seasonal employees. Based on the above survey and the forecast from the NRF, retailers will probably only add around 400 to 450 thousand seasonal employees this holiday season.

In early 2007, I was repeatedly asked "Where is the consumer bust?" I answered: "This is just Act II ... but if the play unfolds as I suspect it might, Hamlet dies in Act V". The consumer would be the last to go.

Well, Hamlet is now dead. The consumer recession has arrived just in time for the holidays.

Roubini Sees Worst Recession in 40 Years

by Calculated Risk on 10/14/2008 02:57:00 PM

Click image for video. |

From Bloomberg: Roubini Sees Worst Recession in 40 Years, Rally's End

Nouriel Roubini, the professor who predicted the financial crisis in 2006, said the U.S. will suffer its worst recession in 40 years, causing the rally in the stock market to ``sputter.''

``There are significant downside risks still to the market and the economy,'' Roubini, 50, a New York University professor of economics, said in an interview with Bloomberg Television. ``We're going to be surprised by the severity of the recession and the severity of the financial losses.''

The economist said the recession will last 18 to 24 months, driving unemployment to 9 percent, and already depressed home prices will fall another 15 percent.

...

``The stock market is going to stop rallying soon enough when they see the economy is really tanking,'' Roubini added.

Up in Smoke?

by Calculated Risk on 10/14/2008 12:53:00 PM

The front page (pdf) of the LA Times offers this amusing juxtaposition of the bailout and the California wildfires (hat tip Jim)

Click on photo for larger image in new window.

Research: Housing Busts and Household Mobility

by Calculated Risk on 10/14/2008 12:01:00 PM

Early this year I wrote:

Less worker mobility [due to negative equity] is kind of like arteriosclerosis of the economy. It lowers the overall growth potential.In a new research paper, Fernando Ferreira, Joseph Gyourko (both from Wharton) and Joseph Tracy (New York Fed) quantify the impact of negative equity on household mobility: Housing Busts and Household Mobility, NBER, © 2008

Perhaps as many as 15 to 20 million households will be saddled with negative equity by 2009. Even if most of these homeowners don't "walk away", there might still be a negative impact on the economy due to less worker mobility.

How do housing busts affect residential mobility? The current market downturn has raised fears that local communities will suffer as social capital is depleted due to foreclosures forcing defaulting homeowners to move. One recent media report indicates that 220,000 homes were lost to foreclosure just during the second quarter of 2008, which is nearly triple the number over the same time period in 2007. Default-induced moves always are the first mobility-related impact observed during a downturn, but they need not be the last or the most importantly economically. In fact, much previous research indicates that factors such as falling home prices or rising interest rates that typically are associated with housing market declines can ‘lock-in’ people to their homes—reducing, not raising mobility.And their conclusion:

Having negative equity in one’s home reduces mobility rates ... by nearly 50 percent from its baseline level according to our estimates. That the net impact of negative equity is to reduce, not raise, mobility certainly does not mean that defaults and foreclosures are insignificant consequences of this condition. However, it does signify that the preponderant effect is for owners to remain in their homes for longer periods of time, not to default and move to another residence.The economic impact from less household mobility isn't quantified in the paper.

Finally, reduced mobility has its own unique set of consequences which have not been clearly identified or discussed in the debate about the current housing crisis. Substantially lower household mobility is likely to have various social costs including poorer labor market matches, diminished support for local public goods, and lesser maintenance and reinvestment in the home.

emphasis added

To size the problem: According to the Census Bureau, from 2005 to 2006, approximately 1.7 million owner-occupied households, moved to a different county or state. If approximately 1 in 6 households (the same proportion as with negative equity according to Moody's) will not accept a transfer now because of depressed home values that would be almost 300,000 households per year that will be reluctant to accept job transfers.

This will not only impact the earning potential of these households, but this could also impact the performance of various companies. A significant majority of households that migrate have incomes above the median - and negative equity situations will limit the ability of companies to transfer these senior employees. Less household mobility could be a signficant drag on the economy for several years.

Volcker: "Considerable" U.S. Recession

by Calculated Risk on 10/14/2008 09:27:00 AM

From IHT: Volcker warns of "considerable recession" in US

"I've seen a lot of crisis, but I've not seen anything quite like this one," Volcker said in a speech in Singapore. "I don't think we can escape damage to the real economy. I think we almost inevitably face a considerable recession."Once we see a thaw in the credit markets (right now the credit markets have improved only slightly), then I'll update my forecast on housing, the economy and unemployment.

...

"These kinds of measures — government guarantees and interventions — are really distasteful," said Volcker, who was Fed chief from 1979 to 1987. "However distasteful, I'm afraid they were necessary in this emergency to restore some sense of stability and confidence."

...

"Those banks have been nationalized, overtly or not overtly, which is something that hasn't happened before in the history of developed countries," Volcker said. "How to wean them from government support? That is the challenge of the future."

Joint Statement by Treasury, Federal Reserve, and FDIC

by Calculated Risk on 10/14/2008 08:42:00 AM

Press conference any minute. Here is the CNBC feed.

From the Fed:

The following statement was made by Treasury Secretary Henry M. Paulson, Jr, Federal Reserve Chairman Ben Bernanke and FDIC Chairman Sheila C. Bair:

Today we are taking decisive actions to protect the U.S. economy, to strengthen public confidence in our financial institutions, and to foster the robust functioning of our credit markets. These steps will ensure that the U.S. financial system performs its vital role of providing credit to households and businesses and protecting savings and investments in a manner that promotes strong economic growth in the U.S. and around the world. The overwhelming majority of banks in the United States are strong and well-capitalized. These actions will bolster public confidence in our system to restore and stabilize liquidity necessary to support economic growth.

Last week, the President’s Working Group on Financial Markets announced that the U.S. government would deploy all of our tools in a strategic and collaborative manner to address the current instability in our financial markets and mitigate the risks that instability poses for broader economic growth. This past weekend, we and our G7 colleagues committed to a comprehensive global strategy to provide liquidity to markets, to strengthen financial institutions, to prevent failures that pose systemic risk, to protect savers, and to enforce investor protections.

We welcomed the steps announced by our European colleagues this weekend to implement the action plan, and ensure financial institutions in Europe can finance economic growth. Today we are implementing our strategy with three important actions.

First, Treasury is announcing a voluntary capital purchase program. A broad array of financial institutions is eligible to participate in this program by selling preferred shares to the U.S. government on attractive terms that protect the taxpayer. Second, after receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Paulson signed the systemic risk exception to the FDIC Act, enabling the FDIC to temporarily guarantee the senior debt of all FDIC-insured institutions and their holding companies, as well as deposits in non-interest bearing deposit transaction accounts. Regulators will implement an enhanced supervisory framework to assure appropriate use of this new guarantee.

We are pleased to announce that nine major financial institutions have already agreed to participate in both the capital purchase program and the FDIC guarantee program. We appreciate that these healthy institutions are taking these steps to strengthen their own positions and to enhance the overall performance of the U.S. economy. By participating in these programs, these institutions, along with thousands of others to come, will have enhanced capacity to perform their vital function of lending to U.S. consumers and businesses and promoting economic growth. They have also committed to continued aggressive actions to prevent unnecessary foreclosures and preserve homeownership.

Third, to further increase access to funding for businesses in all sectors of our economy, the Federal Reserve has announced further details of its Commercial Paper Funding Facility (CPFF) program, which provides a broad backstop for the commercial paper market. Beginning October 27, the CPFF will fund purchases of commercial paper of 3 month maturity from high-quality issuers.

Together these three steps significantly strengthen the capital position and funding ability of U.S. financial institutions, enabling them to perform their role of underpinning overall economic growth. These actions demonstrate to market participants here and around the world the strength of the U.S. government’s commitment to take all necessary steps to unlock our credit markets and minimize the impact of the current instability on the overall U.S. economy. The actions taken today are a powerful step toward restoring the health of the global financial system.

Paulson Press Conference at 8:30AM ET

by Calculated Risk on 10/14/2008 01:42:00 AM

Update: Here is the CNBC feed.

Bloomberg:

Paulson, Federal Reserve Chairman Ben S. Bernanke and FDIC Chairman Sheila Bair scheduled a press conference at 8:30 a.m. today in Washington.

Paul Krugman Nobel Prize News Conference

by Calculated Risk on 10/14/2008 01:02:00 AM

Edward Glaeser: Honoring Paul Krugman

EconomistsView has several Krugman pieces today. How Bubbles Happen, "Thoughts about Thinking", In Defense of Macroeconomics, "The Accidental Theorist" and more.

Krugman: A bit of autobiography

Monday, October 13, 2008

Capital Injection Dollars Announced

by Calculated Risk on 10/13/2008 09:39:00 PM

From the NY Times: U.S. Investing $250 Billion in Banks

Citigroup and JPMorgan Chase were told they would each get $25 billion; Bank of America and Wells Fargo, $20 billion each (plus an additional $5 billion for their recent acquisitions); Goldman Sachs and Morgan Stanley, $10 billion each, with Bank of New York Mellon and State Street each receiving $2 to 3 billion. Wells Fargo will get $5 billion for its acquisition of Wachovia, and Bank of America the same for amount for its purchase of Merrill Lynch.

... The government will purchase perpectual preferred shares in all the largest U.S. banking companies. The shares will notbe dilutive to current shareholders, a concern to banking chie executives, because perpetual preferred stock holders are paid a dividend, not a portion of earnings.

The capital injections are not voluntary...

U.S. to Buy Stakes in ...

by Calculated Risk on 10/13/2008 07:42:00 PM

From the WSJ:

[T]he government is set to buy preferred equity stakes in nine top financial institutions ... It's unclear how much would be invested in each institution. The move is designed to remove any stigma that might come with a government investment.I only count seven.

Banks receiving government funds include Goldman Sachs Group Inc., Morgan Stanley, J.P. Morgan Chase & Co., Bank of America Corp., Citigroup Inc., Wells Fargo & Co. and Bank of New York Mellon.

Not all of the banks involved are happy with the move, but agreed under pressure from the government.