by Calculated Risk on 10/08/2008 08:34:00 PM

Wednesday, October 08, 2008

Daily Show Moment of Zen: Debt Clock

From my brother:

"Politics is the art of looking for trouble, finding it everywhere,And unrelated from the Daily Show (15 seconds):

diagnosing it incorrectly, and applying the wrong remedies."

Groucho Marx

Paulson and Capitalization

by Calculated Risk on 10/08/2008 06:55:00 PM

There has been some more discussion today that the Emergency Economic Stabilization Act (EESA) allows for a UK type recapitalization plan (see Krugman: To do, not to do). The UK plan is more along the lines recommended by most economists, and many economists are looking for any hint that the TARP might become a recapitalization plan.

Krugman points us to Justin Fox at Time: Treasury prepares for a TARP-and-switch. And it's a good thing, too

Did anybody else notice that when Hank Paulson was describing in his press conference today what the Emergency Economic Stabilization Act enables Treasury to do, the first thing he listed was "to inject capital into financial institutions"?Here is Paulson's prepared statement:

Specifically, the EESA empowers Treasury to use up to $700 billion to inject capital into financial institutions, to purchase or insure mortgage assets, and to purchase any other troubled assets that the Treasury and the Federal Reserve deem necessary to promote financial market stability.Paulson clarified this somewhat in the Q&A (transcript from CQ Politics)

emphasis added

QUESTION: The EESA program, do you think it will help -- the purchasing program, troubled asset relief program, will it help much to rebuild the capital base of the financial institutions?That seems to imply that the institutions will be better able to raise capital after the TARP buys the dodgy assets - as opposed to suggesting the TARP will inject capital into the institutions.

PAULSON: Yes. Yes, that is -- that’s what’s -- what’s critical. There is -- capital has been reluctant to come into certain financial institutions, because a lack of visibility, in terms of the uncertainty, in terms of the value of -- of some of these assets.

So the -- the -- the prime motivation is to lead to the recapitalization and the stronger capitalization of the -- of the industry.

And another question:

QUESTION: Mr. Secretary ... Is it conceivable ... that the Treasury might have to take far more far-reaching measures and, in particular, might that include the U.S. do some sort of recapitalization of its banking system?And that comment is ambiguous.

PAULSON: Yes, I’m not going to speculate on all the things we -- we may have to do. I would simply say we have a broad range of authorities and tools in the -- in the TARP. And so we -- we’ve emphasized the purchase of the liquid assets, but we have a broad range of authorities. And I’m confident we have the authorities we need to -- to work with going forward here.

Here is a comment from Rep. Barney Frank (hat tip Brian):

In implementing the powers provided for in the Emergency Economic Stabilization Act of 2008, it is the intent of Congress that Treasury should use Troubled Asset Relief Program (TARP) resources to fund capital infusion and asset purchase approaches alone or in conjunction with each other to enable financial institutions to begin providing credit again, and to do so in ways that minimize the burden on taxpayers and have maximum economic recovery impact. Where the legislation speaks of ``assets'', that term is intended to include capital instruments of an institution such as common and preferred stock, subordinated and senior debt, and equity rights.Maybe people are seeing what they want to see, but it'd be nice if the TARP was more oriented towards increasing capital.

emphasis added

Fed Expands Loans to AIG

by Calculated Risk on 10/08/2008 04:51:00 PM

The Federal Reserve Board has authorized the Federal Reserve Bank of New York to borrow securities from certain regulated U.S. insurance subsidiaries of the American International Group (AIG), under section 13(3) of the Federal Reserve Act.

Under this program, the New York Fed will borrow up to $37.8 billion in investment-grade, fixed-income securities from AIG in return for cash collateral. These securities were previously lent by AIG’s insurance company subsidiaries to third parties.

As expected, drawdowns to date under the existing $85 billion New York Fed loan facility have been used, in part, to settle transactions with counterparties returning these third-party securities to AIG. This new program will allow AIG to replenish liquidity used in settling those transactions, while providing enhanced credit protection to the New York Fed and U.S. taxpayers in the form of a security interest in these securities.

Paulson to Discuss G7 Crisis Coordination at 3 PM ET

by Calculated Risk on 10/08/2008 02:35:00 PM

From Reuters: US' Paulson to discuss G7 financial coordination

The Bush administration said U.S. Treasury Secretary Henry Paulson at a news conference on Wednesday will discuss coordinated actions by wealthy industrialized countries to ease financial system stress.Here is the CNBC feed.

...

The news conference is scheduled for 3 p.m.

And a live feed from C-SPAN. (updated: C-Span2)

The Adjustment Process

by Calculated Risk on 10/08/2008 12:14:00 PM

When I started this blog (Jan 2005), I was concerned about excessive speculation in housing and extremely loose lending practices. It appeared that housing starts and new home sales would fall significantly. I forecast record foreclosures and significant declines in home prices. Many of us wondered who the eventual bagholders would be for all the bad loans. I was also concerned about the extent of equity extraction from homes (the home ATM), and I believed that the coming housing bust would lead the economy into a recession.

This blog was a daily dose of doom and gloom!

Here was how former Fed Chairman Paul Volcker described the situation in Feb 2005:

"Under the placid surface, at least the way I see it, there are really disturbing trends: huge imbalances, disequilibria, risks – call them what you will. Altogether the circumstances seem to me as dangerous and intractable as any I can remember, and I can remember quite a lot.I'm frequently asked if I'm more concerned today than I was in 2005. There are reasons for concern: the credit markets have seized up, many financial institutions are insolvent, consumer spending and investment in commercial real estate is starting to decline, export growth appears to be slowing, the unemployment rate is rising ... and the economy is clearly in a recession.

...

We are buying a lot of housing at rising prices, but home ownership has become a vehicle for borrowing as much as a source of financial security."

There are huge and scary downside risks today, but I'm actually more sanguine now than I was in 2005. If you think back to 2005, we were standing at the precipice, and there was no where to go but over the cliff.

Here is a look at some of the data. Where would you rather be?

Click on graph for larger image in new window.

Click on graph for larger image in new window.Housing starts have collapsed by more than half since 2005. This decline seemed obvious and inevitable in 2005, and now most of the adjustment has already happened.

Which was better for the economy looking forward? To be standing at the edge (in 2005) or to be much nearer the bottom in 2008?

Here is a similar graph for new home sales. Just like for housing starts, new home sales have collapsed by more than half since 2005.

Here is a similar graph for new home sales. Just like for housing starts, new home sales have collapsed by more than half since 2005.The good news is starts of single family homes built for sale have fallen below new home sales, and new home inventory is declining (although existing home inventory is still near record levels). Once again the bulk of the adjustment is now behind us.

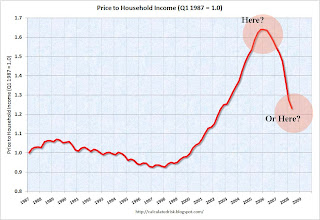

The third graph shows price-to-income using the Case-Shiller national index through Q2 2008.

The third graph shows price-to-income using the Case-Shiller national index through Q2 2008. Although I believe there are more price declines ahead (and therefore more homeowners with negative equity and more foreclosures), prices are much more reasonable today than in 2005.

The price adjustments were inevitable, and progress is being made.

The fourth graph shows Mortgage Equity Withdrawal (MEW) or the Home ATM. It was scary in 2004, 2005 and even in 2006 as homeowners supplemented their income by using the equity in their homes. This amounted to around 9% of disposable personal income in some quarters.

The fourth graph shows Mortgage Equity Withdrawal (MEW) or the Home ATM. It was scary in 2004, 2005 and even in 2006 as homeowners supplemented their income by using the equity in their homes. This amounted to around 9% of disposable personal income in some quarters.It was obvious this had to stop and now it has. The decline in MEW will impact consumer spending, but this was a necessary step towards fixing household balance sheets.

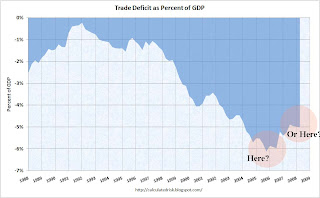

And the final graph shows the trade deficit as a percent of GDP. The trade deficit peaked in 2005 too, and would have fallen even faster except for the huge increase in oil prices.

And the final graph shows the trade deficit as a percent of GDP. The trade deficit peaked in 2005 too, and would have fallen even faster except for the huge increase in oil prices.Now that oil prices are falling, this adjustment in the trade deficit will probably accelerate. The trade deficit doesn't need to fall to zero, but 5% or 6% of GDP was unsustainable.

It's easy to get caught up in the day to day financial crisis and recession news - and this blog will continue to bring you the doom and gloom of the worsening recession. But it's important to remember that even though the adjustment process is painful, progress is being made.

Here is something to ponder from the Seattle Times in 1990: Experts: Bank Crisis Risks Turning Recession Into Depression (hat tip John)

People are starting to make nervous jokes about pulling their money out of shaky U.S. banks and stashing it under their mattresses instead.The financial crisis is worse today than in 1990, and there are many problems ahead (like less consumer spending and business investment), but I believe progress is being made.

But the banking crisis is no joke.

It is real - so real it risks turning the emerging recession into the biggest economic nightmare since the Great Depression of the 1930s.

``My own view of this tends to be apocalyptic - that we are on the threshold of a '30s-like experience,'' said David Cates, chairman of Ferguson & Co., bank consultants based in Dallas.

``The banking system is under tremendous strain. Should it begin to unravel, recession could easily become an economic disaster,'' said a recent editorial in Business Week magazine.

Pending Home Sales Index Rises in August

by Calculated Risk on 10/08/2008 10:00:00 AM

From the NAR: Pending Home Sales up Strongly

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in August, jumped 7.4 percent to 93.4 from an upwardly revised reading of 87.0 in July, and is 8.8 percent higher than August 2007 when it stood at 85.8. The index is at the highest level since June 2007 when it stood at 101.4.Existing home sales are reported at the close of escrow, pending home sales are reported when contracts are signed. The Pending Home Sales index leads existing home sales by about 45 days, so this suggests existing home sales in October will be up somewhat.

This is data before the most recent credit crunch in September.

For some graphs comparing existing home sales to pending home sales, see: Do Existing Home Sales track Pending Home Sales? The answer is yes - they do track pretty well.

Fed Funds Rate Cut 50 bps, Global Rate Cuts

by Calculated Risk on 10/08/2008 08:28:00 AM

Some easing of global monetary conditions is therefore warranted. Accordingly, the Bank of Canada, the Bank of England, the European Central Bank, the Federal Reserve, Sveriges Riksbank, and the Swiss National Bank are today announcing reductions in policy interest rates. The Bank of Japan expresses its strong support of these policy actions.

...

The Federal Open Market Committee has decided to lower its target for the federal funds rate 50 basis points to 1-1/2 percent. The Committee took this action in light of evidence pointing to a weakening of economic activity and a reduction in inflationary pressures.

Incoming economic data suggest that the pace of economic activity has slowed markedly in recent months. Moreover, the intensification of financial market turmoil is likely to exert additional restraint on spending, partly by further reducing the ability of households and businesses to obtain credit. Inflation has been high, but the Committee believes that the decline in energy and other commodity prices and the weaker prospects for economic activity have reduced the upside risks to inflation.

UK: £50 Billion Recapitalisation, £200 Billion Special Liquidity Schemes

by Calculated Risk on 10/08/2008 02:39:00 AM

Chancellor Alistair Darling statement:

After consultation with the Bank of England and the Financial Services Authority, the Government announces that it is bringing forward specific and comprehensive measures to ensure the stability of the financial system and to protect ordinary savers, depositors, businesses and borrowers.

In summary the proposals announced today are intended to:Provide sufficient liquidity in the short term; Make available new capital to UK banks and building societies to strengthen their resources permitting them to restructure their finances, while maintaining their support for the real economy; and Ensure that the banking system has the funds necessary to maintain lending in the medium term.

In these extraordinary market conditions, the Bank of England will take all actions necessary to ensure that the banking system has access to sufficient liquidity. In its provision of short term liquidity the Bank will extend and widen its facilities in whatever way is necessary to ensure the stability of the system. At least £200 billion will be made available to banks under the Special Liquidity Scheme.

Until markets stabilise, the Bank will continue to conduct auctions to lend sterling for three months, and also US dollars for one week, against extended collateral. It will review the size and frequency of those operations as necessary.

Bank debt that is guaranteed under the Government’s guarantee scheme will be eligible in all of the Bank’s extended-collateral operations. The Bank next week will bring forward its plans for a permanent regime underpinning banking system liquidity, including a Discount Window facility.

In addition the Government is establishing a facility, which will make available Tier 1 capital in appropriate form (expected to be preference shares or PIBS) to “eligible institutions”. Eligible institutions are UK incorporated banks (including UK subsidiaries of foreign institutions) which have a substantial business in the UK and building societies.

However applications are invited for inclusion as an eligible institution from any other UK incorporated bank (including UK subsidiaries of foreign institutions). In reviewing these applications the Government will give due regard to an institution’s role in the UK banking system and the overall economy.

Following discussions convened by HM Treasury, the following major UK banks and the largest building society have confirmed their participation in a Government-supported recapitalisation scheme.

These institutions comprise:

Abbey

Barclays

HBOS

HSBC Bank plc

Lloyds TSB

Nationwide Building Society

Royal Bank of Scotland

Standard Chartered

These institutions have committed to the Government that they will increase their total Tier 1 capital by £25bn. This is an aggregate increase and individual increases will vary from institution to institution. In order to facilitate this process the Government is making available £25bn to be drawn on by these institutions if desired to assist in this process as preference share capital or PIBS and is also willing to assist in the raising of ordinary equity if requested to do so. The above institutions have committed to the Government that this will be concluded by the end of the year.

In addition to this, the Government stands ready to provide an incremental minimum of £25bn of further support for all eligible institutions, in the form of preference shares, PIBS or, at the request of an eligible institution, as assistance to an ordinary equity fund-raising.

The amount to be issued per institution will be finalised following detailed discussions. If the Government is to provide the capital, the issue will carry terms and conditions that appropriately reflect the financial commitment being made by the taxpayer. In reaching agreement on capital investment the Government will need to take into account dividend policies and executive compensation practices and will require a full commitment to support lending to small businesses and home buyers.

The Government will take decisive action to reopen the market for medium term funding for eligible institutions that raise appropriate amounts of Tier 1 capital.

Specifically the Government will make available to eligible institutions for an interim period as agreed and on appropriate commercial terms, a Government guarantee of new short and medium term debt issuance to assist in refinancing maturing, wholesale funding obligations as they fall due.

Subject to further discussion with eligible institutions, the proposal envisages the issue of senior unsecured debt instruments of varying terms of up to 36 months, in any of sterling, US dollars or Euros. The current expectation is that the guarantee would be issued out of a specifically designated Government-backed English incorporated company. The Government expects the take-up of the guarantee to be of the order of £250bn, and will keep this under review alongside ongoing monitoring of capital positions and lending volumes.

To qualify for this support the relevant institution must raise Tier 1 capital by the amount and in the form the Government considers appropriate whether by Government subscription or from other sources. It is being made available immediately to the eight institutions named above in recognition of their commitment to strengthen their aggregate capital position.

The Government has informed the European Commission of these proposals and is actively talking to other countries about extending these proposals and has committed to work together with them to strengthen the international system.

The Government is moving ahead immediately with the internationally agreed proposal for colleges of supervision and other measures to improve supervision of the system. After discussions with the major economies at the G7 meeting on Friday, the Government and other countries agreed on the need for a meeting at heads of Government level.

Tuesday, October 07, 2008

Homeowners with Negative Equity

by Calculated Risk on 10/07/2008 11:41:00 PM

From the WSJ: Housing Pain Gauge: Nearly 1 in 6 Owners 'Under Water'

About 75.5 million U.S. households own the homes they live in. After a housing slump that has pushed values down 30% in some areas, roughly 12 million households, or 16%, owe more than their homes are worth, according to Moody's Economy.com.This is close to my estimate of homeowners with negative or no equity. These homeowners are at risk for default if they experience a negative event (like divorce or health problems) or they simply decide to mail in the keys. The number will probably rise to 20 million or more by the time house prices bottom.

The Export Slowdown

by Calculated Risk on 10/07/2008 08:18:00 PM

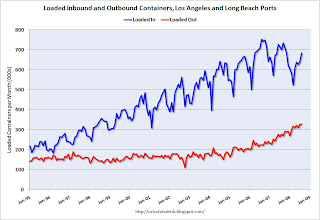

This graph shows the combined loaded inbound and outbound traffic at the ports of Long Beach and Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic grew quickly for a number of years, but appears to be declining (there is a strong seasonal component). Inbound traffic is off about 6% from 2007 (using the last two months of July and August).

Outbound traffic was flat for years, but has been increasing the last few years. Outbound traffic is up 20% from 2007.

However it appears export growth will be slowing. From the WSJ: Slowing Export Machine Is Starting to Sputter

Export growth is expected to fall sharply in coming months ... Many U.S. producers are already seeing a slump in new orders ... The outlook has dimmed so quickly that economists are having a hard time keeping their projections current.

...

The upshot is that exports will no longer serve as the counterweight to weakness in the domestic economy. Over the past year, real goods exports surged by $114 billion, or 12%, up across every major category. They now make up nearly 13.5% of gross domestic product, the highest percentage since World War II.

The second graph shows imports and exports as a percent of GDP since 1947 through Q2 2008.

The second graph shows imports and exports as a percent of GDP since 1947 through Q2 2008.Over the years, both exports and imports have increased as a percent of GDP. Exports now make up almost 13.5% of GDP (imports as a percent of GDP are at 18.5%). With the decline in oil prices - and the weaker U.S. economy - imports as a percent of GDP will probably decline over the next year.

With the global slowdown, export growth will also slow, and might even decline too. This has been a key source of strength for the U.S. economy, and especially for manufacturing employment.