by Calculated Risk on 10/06/2008 06:02:00 PM

Monday, October 06, 2008

This American Life: On the Bailout

Another Frightening Show About the Economy

Alex Blumberg and NPR's Adam Davidson—the two guys who reported our Giant Pool of Money episode—are back, in collaboration with the Planet Money podcast. They'll explain what happened this week, including what regulators could've done to prevent this financial crisis from happening in the first place.This is an excellent discussion and includes a discussion of the commercial paper market. BTW, the WSJ reports today that the Fed is considering intervening in the financial CP market: Fed Looks to Ease Strains in Commercial-Paper Market

U.S. officials are examining ways to ease deepening strains in the commercial paper market, which have been hit by an unwillingness among money market investors to hold risky assets.Alex at American Life was kind enough to mention Calculated Risk at the conclusion of The Giant Pool of Money, and he mentioned us in the following articles (thanks Alex!):

The move could involve the Federal Reserve making an unusual foray into unsecured lending.

Daring to Say Loans Made No Sense

Deep Reporting, Engaging Stories on This American Life

BofA Cuts Dividend in Half, Sees Further Weakening

by Calculated Risk on 10/06/2008 04:21:00 PM

From BofA: Bank of America Announces Third Quarter Earnings and Capital Raising Initiatives

Bank of America Corporation today reported third quarter 2008 net income of $1.18 billion, or $0.15 per share, down from $3.70 billion, or $0.82 per share, a year earlier.And a few key excerpts:

...

The company intends to sell common stock with a target of raising $10 billion. In addition, the Board of Directors has declared a quarterly dividend on common stock of $0.32 to be paid on December 26, 2008 to shareholders of record on December 5, 2008. Assuming the current number of issued and outstanding shares, the reduction from $0.64 paid in recent quarters would add more than $1.4 billion to capital each quarter.

"These are the most difficult times for financial institutions that I have experienced in my 39 years in banking," said Kenneth D. Lewis, chairman and chief executive officer. "We believe it is prudent to raise capital to very substantial levels in this uncertain environment. Both economic and financial market conditions have changed significantly in the last two months. We were willing to operate at capital levels over the short-term that were good, but not at our targeted levels, given projections two months ago. We now believe it is important to be at or near our 8 percent Tier 1 capital ratio target given the recessionary conditions and outlook for still weaker economic performance which we expect to drive higher credit losses and depress earnings. We believe that achieving higher capital levels today will position our company to provide credit to those consumers and businesses that are attracted to our strength and stability.

emphasis added

Reflecting deteriorating economic conditions, the consumer credit card business experienced a decrease in purchase volumes, slowing repayments and increased delinquencies during the quarter.And delinquencies are spreading:

Increased loss and delinquency trends first experienced in the home equity and homebuilder portfolios have now spread into the first mortgage, unsecured consumer lending and credit card portfolios. Deterioration has been more pronounced in California and Florida, which have been hit harder by home price depreciation and rising unemployment than in other markets. Commercial losses in sectors other than real estate and small business also increased, but remain below normalized ranges.

FDIC’s Bair Expects Wachovia Deal Today

by Calculated Risk on 10/06/2008 03:28:00 PM

From the WSJ Real Time Economics: FDIC’s Bair: Wachovia Deal ‘Today’; Tougher Regulation Needed

Speaking Monday before the National Association for Business Economics, [Federal Deposit Insurance Corp. Chairman Sheila] Bair said the FDIC wasn’t driving the negotiations between Wachovia and its two suitors, Citigroup and Wells Fargo, though it is talking with all parties.

...

“We’re all working together with regulators…to come at a solution and outcome that serves the public interest and I think we will have one today,” Bair said.

Mall and Strip Center Vacancy Rates Rise Sharply

by Calculated Risk on 10/06/2008 12:19:00 PM

From the WSJ: Mall Vacancies Grow as Retailers Pack Up Shop

For strip centers and other open-air shopping venues, the vacancy rate climbed to 8.4% in the third quarter from 8.1% in the second quarter. That marks the highest rate since 1994, according to Reis. Meanwhile, retailers' closures outpaced new leases by 2.8 million square feet in U.S. strip centers in the third quarter, the third consecutive quarterly net decline. It is the first nine-month period of so-called negative net absorption since Reis started tracking the data in 1980.

...

The vacancy rate at malls in the top 76 U.S. markets rose to 6.6% in the third quarter, up from 6.3% in the previous quarter, to its highest level since late 2001, according to Reis.

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the strip mall vacancy rate since Q2 2007. Note that the graph doesn't start at zero to better show the change.

Q2 2008: Mortgage Equity Withdrawal Plunges to Near Zero

by Calculated Risk on 10/06/2008 11:13:00 AM

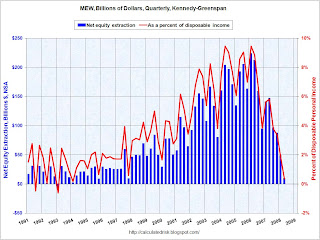

Here are the Kennedy-Greenspan estimates (NSA - not seasonally adjusted) of home equity extraction for Q2 2008, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q2 2008, Dr. Kennedy has calculated Net Equity Extraction as $9.5 billion, or 0.3% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

Last week the Bank of England reported that MEW was slightly negative in the UK in the 2nd quarter.

Less equity extraction means less consumption over the next few quarters. I'll have more on this later ...

DOW Breaks 10K, Party Like It's 1999

by Calculated Risk on 10/06/2008 10:02:00 AM

DOW under 10K. From March 29, 1999 (15 sec CNBC Promo):

Fed to Begin Paying Interest on Reserves, Expands Loan Program

by Calculated Risk on 10/06/2008 08:22:00 AM

From the Fed: Board announces that it will begin to pay interest on depository institutions required and excess reserve balances

The Federal Reserve Board on Monday announced that it will begin to pay interest on depository institutions' required and excess reserve balances.

...

The Financial Services Regulatory Relief Act of 2006 originally authorized the Federal Reserve to begin paying interest on balances held by or on behalf of depository institutions beginning October 1, 2011. The recently enacted Emergency Economic Stabilization Act of 2008 accelerated the effective date to October 1, 2008.

...

Substantial Further Increases in Term Auction Facility Auctions

The sizes of both 28-day and 84-day Term Auction Facility (TAF) auctions will be boosted to $150 billion each, effective with the 84-day auction to be conducted Monday.

60 Minutes: Wall Street's Shadow Market

by Calculated Risk on 10/06/2008 01:49:00 AM

A discussion of Credit Default Swaps with an interview with Jim Grant on CBS 60 Minutes ...

Sunday, October 05, 2008

Wachovia Battle: Appellate Court Rules for Wells Fargo

by Calculated Risk on 10/05/2008 09:41:00 PM

The AP is reporting tonight that the Appellate Division of the New York State Supreme Court threw out the lower court order favoring Citigroup (to temporarily halt the Wells Fargo acquisition of Wachovia). (hat tip Kevin)

The AP is also reporting that documents filed with the court reveal that the FDIC had informed Wachovia that the bank would be seized last Monday if a deal wasn't reached immediately.

The WSJ reports: Fed Pushes to Resolve Wachovia Deal Dispute

In a sign that U.S. officials are concerned about the increasingly volatile situation, officials from the Federal Reserve were pushing hard for Citigroup and Wells Fargo to reach a compromise. That effort could result in essentially carving up the Charlotte, N.C., bank between its two suitors, these people said.The Fed is still working weekends.

Report: UK Government Considering Plan to Recapitalize Banks

by Calculated Risk on 10/05/2008 07:39:00 PM

From the Telegraph: Financial crisis: Government could take shares in high street banks

Alistair Darling, the Chancellor, could give the banks billions of pounds in return for shares in an emergency bailout plan to be enacted if the financial crisis worsens, The Daily Telegraph has learnt.This is more like the Swedish solution, or the RFC in the U.S. during the Depression, as opposed to the TARP.

The Treasury has drawn up detailed plans for the scheme, which would put taxpayers' money at risk.

...

The Treasury plan to take shares in major high street banks will be discussed by the council.