by Calculated Risk on 10/03/2008 07:40:00 PM

Friday, October 03, 2008

Goldman Sachs Forecasts "Deeper" Recession

From Rex Nutting at MarketWatch: More severe recession now forecast by Goldman Sachs

The U.S. recession will be "significantly deeper" than they previously thought, Goldman Sachs economists predicted Friday in a research note. ... The unemployment rate will likely rise to 8% by the end of next year from 6.1% currently.Goldman is now forecasting Q3 2008 real GDP growth at 0.0%, with PCE at minus 2.5% (annualized as reported by BEA). This is similar to my two month estimate for PCE, see Estimating PCE Growth for Q3 2008. Both PCE and investment will be negative in Q3, but net exports, private inventories and government spending will probably all show positive growth in Q3. So GDP may be close to zero.

A major change in the Goldman outlook is the increase in the unemployment rate to 8% in 2009 (their previous forecast was for unemployment reaching 7% in 2009).

One of the features of recent recessions is that the unemployment rate kept rising for 18 months to two years after the recession officially ended. This suggests that the peak unemployment rate (for this cycle) might not happen until 2011, even if the recession ends in late 2009 - scary. I'll have some more thoughts on unemployment soon.

Note that this is the headline unemployment number. Other measures of unemployment are much higher: See Krugman: The track record

IRS Tax Change Helps Wells Fargo Acquire Wachovia

by Calculated Risk on 10/03/2008 04:12:00 PM

For purposes of Code Sec. 382(h), any deduction properly allowed after an ownership change of a corporation that is a bank with respect to losses on loans or bad debts, including any deduction for a reasonable addition to a reserve for bad debts, shall not be treated as a built-in loss or a deduction attributable to periods before the change date. This guidance does not affect the application of any provision of the IRC except Code Sec. 382. Banks may rely on this guidance until further guidance is issued.This new rule apparently allows Wells Fargo to accelerate the use of Wachovia's huge write-downs as an offset to their own income, saving Wells Fargo a substantial amount in taxes over the next several years.

In an email memo sent yesteryday, the law firm Wachtell, Lipton, Rosen & Katz noted:

As part of the federal government’s ongoing comprehensive response to the current credit crisis, the Treasury Department and the Internal Revenue Service have acted decisively to ameliorate the impact of Section 382 of the Internal Revenue Code in the context of bank mergers and acquisitions and capital raising by banks and others. In an environment where asset quality concerns are giving potential bank acquirors and investors pause about engaging in acquisitions or supplying badly needed equity capital, these steps are likely to significantly enhance the risk/reward calculus by facilitating the deductibility of losses.This IRS change probably motivated Wells Fargo to acquire Wachovia. This is another way to help recapitalize the banking system.

Note: according to the WSJ Law blog, Wells Fargo was advised by Wachtell, Lipton, Rosen & Katz in the Wachovia deal.

Paulson Statement on Bailout Plan

by Calculated Risk on 10/03/2008 02:24:00 PM

Paulson Statement on Emergency Economic Stabilization Act:

By acting this week, Congress has proven that our Nation’s leaders are capable of coming together at a time of crisis, even at a critical stage of the political calendar, to do what is necessary to stabilize our financial system and protect the economic security of all Americans.Other than helping attract private capital by cleaning up the institutions' balance sheets, I'm not sure how this plan helps the financial system recapitalize. Hopefully Mr. Paulson doesn't intend to pay a premium, not just to the current market value, but to current book value, for the toxic assets. But how else could the plan help the financial system recapitalize?

The American people will appreciate the leadership of their elected representatives and senators who took bold action to help stem a severe credit crunch that threatens to cost many jobs and undermine access to credit for working Americans.

This bill contains a broad set of tools that can be deployed to strengthen financial institutions, large and small, that serve businesses and families. Our financial institutions are varied – from large banks headquartered in New York, to regional banks that serve multi-state areas, to community banks and credit unions that are vital to the lives of our citizens and their towns and communities. Each institution has its own unique benefits, and their collective strength makes our financial system more resilient, and more innovative. The challenges our institutions face are just as varied – from holding illiquid mortgage backed securities, to illiquid whole loans, to raising needed capital, to simply facing a crisis of confidence. This diversity of institutions and challenges requires that we deploy the tools in this rescue package, in combination with the tools the Fed, the Treasury, the FDIC and other bank regulators already have, in a variety of ways that addresses each of these needs and restores the ability of our financial system to fuel our broader economy.

There is no one-size-fits-all solution to alleviating the stress in our financial system. Each situation will be different and we must implement these new programs with a strategy that allows us to adapt to changing circumstances and conditions, and attract private capital. The broad authorities in this legislation, when combined with existing regulatory authorities and resources, gives us the ability to protect and recapitalize our financial system as we work through the stresses in our credit markets.

We will move rapidly to implement the new authorities, but we will also move methodically. In the coming days we will work with the Federal Reserve and the FDIC to develop strategies that deploy these tools in an expedited and methodical way to maximize effectiveness in strengthening the financial system, so it can continue to play its necessary and vital role supporting the U.S. economy and American jobs. Transparency throughout this process will be important, and I look forward to providing regular updates as we move ahead to implement this strategy.

Emphasis added

Bailout: Bill Passes House

by Calculated Risk on 10/03/2008 01:22:00 PM

Vote: 263 Yes to 171 No

Fed Chairman Bernanke statement:

I applaud the action taken by the Congress. It demonstrates the government's commitment to do what it takes to support and strengthen our economy. The legislation is a critical step toward stabilizing our financial markets and ensuring an uninterrupted flow of credit to households and businesses.The TED spread (from Bloomberg) is at 3.83.

The Federal Reserve will continue to work closely with the Treasury as it undertakes these new initiatives. We will continue to use all of the powers at our disposal to mitigate credit market disruptions and to foster a strong, vibrant economy.

Bailout: The House Vote is Scheduled for about 12:30PM ET

by Calculated Risk on 10/03/2008 11:43:00 AM

Here is the live feed from C-SPAN.

Here is the CNBC feed.

Citigroup Demands Wells Fargo and Wachovia Halt Merger

by Calculated Risk on 10/03/2008 11:02:00 AM

From Bloomberg: Citigroup Demands Wachovia, Wells Fargo Terminate Merger Deal

Citigroup Inc. demanded that Wells Fargo & Co. and Wachovia Corp. terminate a $15.1 billion takeover agreement announced today, saying it breached an exclusive deal the New York-based company reached earlier this week.From the FDIC: FDIC Chairman Sheila Bair Comments on Agreement to Merge by Wells Fargo and Wachovia

...

``Citi has substantial legal rights regarding Wachovia and this transaction,'' the New York-based company said in a statement. ``Wachovia's agreement to a transaction with Wells Fargo is in clear breach of an exclusivity agreement between Citi and Wachovia.''

"Since the close of our bidding process, Wells has apparently re-assessed its position and come forth with this new offer that does not require FDIC assistance. ...The Wells Fargo deal seems to make more sense, and appears better for Wachovia stakeholders and U.S. taxpayers. Maybe there will be some sort of breakup fee for Citi.

"The FDIC stands behind its previously announced agreement with Citigroup. The FDIC will be reviewing all proposals and working with the primary regulators of all three institutions to pursue a resolution that serves the public interest."

Bailout: House Votes at 12:30 PM ET

by Calculated Risk on 10/03/2008 10:05:00 AM

From Bloomberg: Financial-Rescue Bill Gains Support Before House Vote

At least eight lawmakers, including Republican Zach Wamp of Tennessee and Democrat Emanuel Cleaver of Missouri, now say they would support the measure. Four others say they may switch their ballots before the House votes again, at about 12:30 p.m. today on the bill, which failed by a dozen votes on Sept. 29.For those that want to watch online, here is the C-Span live video.

And here is a live video from CNBC.

Employment Declines by 159,000 in September

by Calculated Risk on 10/03/2008 08:30:00 AM

From the BLS:

Nonfarm payroll employment declined by 159,000 in September, and the unemployment rate held at 6.1 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Employment continued to fall in construction, manufacturing, and retail trade, while mining and health care continued to add jobs.

Click on graph for larger image.

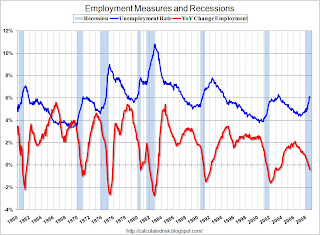

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 159,000 in September.

The unemployment rate was steady at 6.1 percent.

Year over year employment is now negative (there are over half million fewer Americans employed in Sept 2008 than in Sept 2007). This is another very weak employment report.

Wells Fargo to Buy Wachovia

by Calculated Risk on 10/03/2008 08:14:00 AM

From MSNBC: Wells Fargo will buy rival bank Wachovia (hat tip Stephen)

In an abrupt change of course, Wachovia Corp. said Friday it will be acquired by Wells Fargo & Co. in a $15.1 billion all-stock deal, wiping out Wachovia’s previous plan to sell its banking operations to rival suitor Citigroup Inc.From the WSJ: Wells Fargo to Buy Wachovia

A key difference is that the Wachovia deal will be done without government assistance, while the Citigroup deal would have been done with the help of the Federal Deposit Insurance Corp.

The Wells Fargo offer is for $7 a share in stock, based on Thursday's closing price, 79% above where Wachovia shares finished. Wells Fargo also will assume Wachovia's preferred stock and debt.This is a huge surprise, but this deal makes much more sense than the deal with Citigroup. This also takes the FDIC off the hook.

Greece Guarantees All Deposits

by Calculated Risk on 10/03/2008 12:16:00 AM

From the Guardian: Greece's deposit guarantee deepens EU financial rift (hat tip Yal)

Greece joined Ireland in offering to guarantee savings in domestic banks.Apparently there was some discussion of a Euro-TARP, but it doesn't appear to be going anywhere.

George Alogoskoufis, the Greek finance minister, said deposits "in all banks that operate in Greece" would be "absolutely guaranteed", amid signs that savers were becoming restless.

The move by a second eurozone country presented a big challenge to European leaders meeting at an emergency summit tomorrow in Paris to hammer out a coordinated response to the threat of meltdown among European banks.