by Calculated Risk on 10/03/2008 10:05:00 AM

Friday, October 03, 2008

Bailout: House Votes at 12:30 PM ET

From Bloomberg: Financial-Rescue Bill Gains Support Before House Vote

At least eight lawmakers, including Republican Zach Wamp of Tennessee and Democrat Emanuel Cleaver of Missouri, now say they would support the measure. Four others say they may switch their ballots before the House votes again, at about 12:30 p.m. today on the bill, which failed by a dozen votes on Sept. 29.For those that want to watch online, here is the C-Span live video.

And here is a live video from CNBC.

Employment Declines by 159,000 in September

by Calculated Risk on 10/03/2008 08:30:00 AM

From the BLS:

Nonfarm payroll employment declined by 159,000 in September, and the unemployment rate held at 6.1 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Employment continued to fall in construction, manufacturing, and retail trade, while mining and health care continued to add jobs.

Click on graph for larger image.

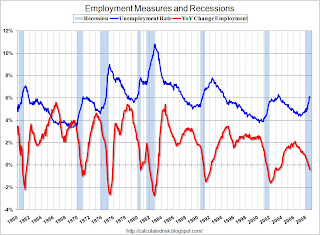

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 159,000 in September.

The unemployment rate was steady at 6.1 percent.

Year over year employment is now negative (there are over half million fewer Americans employed in Sept 2008 than in Sept 2007). This is another very weak employment report.

Wells Fargo to Buy Wachovia

by Calculated Risk on 10/03/2008 08:14:00 AM

From MSNBC: Wells Fargo will buy rival bank Wachovia (hat tip Stephen)

In an abrupt change of course, Wachovia Corp. said Friday it will be acquired by Wells Fargo & Co. in a $15.1 billion all-stock deal, wiping out Wachovia’s previous plan to sell its banking operations to rival suitor Citigroup Inc.From the WSJ: Wells Fargo to Buy Wachovia

A key difference is that the Wachovia deal will be done without government assistance, while the Citigroup deal would have been done with the help of the Federal Deposit Insurance Corp.

The Wells Fargo offer is for $7 a share in stock, based on Thursday's closing price, 79% above where Wachovia shares finished. Wells Fargo also will assume Wachovia's preferred stock and debt.This is a huge surprise, but this deal makes much more sense than the deal with Citigroup. This also takes the FDIC off the hook.

Greece Guarantees All Deposits

by Calculated Risk on 10/03/2008 12:16:00 AM

From the Guardian: Greece's deposit guarantee deepens EU financial rift (hat tip Yal)

Greece joined Ireland in offering to guarantee savings in domestic banks.Apparently there was some discussion of a Euro-TARP, but it doesn't appear to be going anywhere.

George Alogoskoufis, the Greek finance minister, said deposits "in all banks that operate in Greece" would be "absolutely guaranteed", amid signs that savers were becoming restless.

The move by a second eurozone country presented a big challenge to European leaders meeting at an emergency summit tomorrow in Paris to hammer out a coordinated response to the threat of meltdown among European banks.

Thursday, October 02, 2008

Land Selling for Pennies on the Dollar

by Calculated Risk on 10/02/2008 11:08:00 PM

From the WSJ: Developer Sells Land Dirt Cheap To Reap Tax Benefits

Horton two weeks ago sold about 2,000 house lots in Desert Hot Springs ... for $7.8 million, according to county records. William Shopoff, a land investor ... estimates Horton paid about $110 million for the land before [spending on improvements].The reason Horton is selling now - for pennies on the dollar - is to obtain a tax refund by applying the losses to prior profits. Earlier this year I reported on a deal at 15 cents on the dollar for the same reason.

Horton also recently sold a four-acre parcel in Escondido, near San Diego, for $4.4 million, about 25% of what it paid for the property in 2005, according to the county assessor.

This is the common patten in a housing bust - typically land prices decline much more than house prices (on a percentage basis) - because houses can be rented, whereas land has to be held for years before realizing a return.

Zuckerman on Charlie Rose

by Calculated Risk on 10/02/2008 08:07:00 PM

From Charlie Rose: A discussion about the economy with Mort Zuckerman & Andrew Ross Sorkin

Fed: AIG Drawdown Rises to $61.3 Billion

by Calculated Risk on 10/02/2008 04:37:00 PM

Update: from Dow Jones: US Fed Discount Window Borrowing Continues To Hit New Highs

The Fed on Thursday said total borrowing at the discount window, including both depository institutions and primary dealers, rose more than 50% to $409.52 billion Wednesday from $262.34 billion in the prior week.The Fed is peddling as fast as they can.

...

Separately, the Fed said a loan to troubled insurer American International Group Inc. (AIG) on Wednesday totaled $61.28 billion...

Credit Stress

by Calculated Risk on 10/02/2008 02:03:00 PM

"The credit window is closed."The TED spread is at a record 3.62.

Jim Press, president of Chrysler LLC

And from Bloomberg: Libor Soars, Commercial Paper Slumps as Credit Freeze Deepens

The Libor- OIS spread, the difference between the three-month dollar rate and the overnight indexed swap rate, widened to a record 260 basis points today. It was 197 basis points a week ago and 79 basis points a month ago.The NY Times quoted Chairman Bernanke as saying on Friday, Sept 19th:

...

The market for commercial paper plummeted $94.9 billion to $1.6 trillion for the week ended Oct. 1 as banks and insurers were unable to find buyers for the short-term debt ...

"If we don’t do this, we may not have an economy on Monday."Well, we still have an economy, but it is clearly in tatters ...

BofA: Fed May Lose $6 Billion on Bear Assets

by Calculated Risk on 10/02/2008 12:15:00 PM

From Bloomberg: Fed May Lose Out on Bear Assets, Bank of America Says

The Fed will announce its quarterly estimate of the fair value of Maiden Lane LLC's $30 billion of holdings that JPMorgan Chase & Co. considered too risky when it acquired Bear Stearns in March, Bank of America analysts Jeffrey Rosenberg and Hans Mikkelsen wrote in a client note. The central bank valued the assets at $29 billion as of June 30, according to the report.Just sell them to Paulson ... problem solved.

``With the worsening in mortgage markets since last quarter, we estimate a range of $2 billion to $6 billion of unrealized losses,'' the New York-based analysts wrote.

More on Auto Sales

by Calculated Risk on 10/02/2008 11:37:00 AM

Professor Hamilton at Econbrowser always does a great job summarizing auto sales, see: Auto sales deteriorate further

All the graphs show a sharp decline in September - as Jim Hamilton writes:

"U.S. auto sales have been dismal for most of this year. And they just took a turn for the worse."Perhaps the most telling is this graph on import car sales. Import car sales have been the one bright spot all year because importers offered more fuel efficient models. But look at September 2008:

Hamilton concludes:

"All of which is consistent with the view that the U.S. economy has been in recession and took a sharp turn for the worse last month."