by Calculated Risk on 9/12/2008 02:42:00 PM

Friday, September 12, 2008

Hurricane Ike

Not sure if I should be watching the Weather Channel or CNBC.I feel the same way. Hopefully this graphic is helpful. It's from Stormpulse.com. As Ike approaches Texas, this will show the radar images of the storm.

Atrios, Sept 12, 2008

Powered by hurricane-tracking software from Stormpulse.com.

Update: The Oil Drum has a nice discussion of the possible impact on oil and gasoline production: Hurricane Ike, Energy Infrastructure, Refineries and Damage Models Thread

Here are some other excellent sites to track hurricanes:

National Hurricane Center

Weather Underground Note: See Jeff Master's blog.

The American Banker: WaMu in "advanced discussions" with JPMorgan Chase

by Calculated Risk on 9/12/2008 01:35:00 PM

Update from WSJ: WaMu CEO Brings in Former Aide

A person close to the company also discounted suggestions Friday that serious talks are underway between WaMu and J.P. Morgan Chase & Co. ...From The American Banker: JPMorgan Chase in Advanced Talks to Buy Wamu: Sources

JPMorgan Chase is in advanced discussions to buy Wamu, sources said Friday. While a deal has not been struck, and could fall apart, talks are ongoing at the highest levels ...

Secondary Market: Lehman 6 Month Notes Priced to Yield 34%

by Calculated Risk on 9/12/2008 12:25:00 PM

Just to see if investors were buying Lehman bonds in anticipation of a deal this weekend - with some anticipation that the debt holders would be made whole - I checked some of the bond pricing in the secondary market (offered for resale, not by Lehman).

The 6 month Lehman Brothers notes due March 13, 2009 are being offered at a yield to maturity (annualized) of 34%.

The one year senior notes due August 15, 2009 are being offered at a yield to maturity of 36%.

I'd say debt investors are not sanguine.

Mortgage defaults Spike in Inland Empire

by Calculated Risk on 9/12/2008 12:08:00 PM

This article is interesting because some analysts following California's Inland Empire housing market were pointing to the declines in foreclosure activity for the last two months as a possible sign that the market was nearing a bottom.

From the Press Enterprise: Inland defaults change direction, rising after two months of declines

Mortgage defaults ... spiked in Riverside and San Bernardino counties in August after a two-month decline, smashing hopes that the flood of home foreclosures might be about to ebb.There is more coming. And the Alt-A defaults are just starting to increase. From Bloomberg: Alt-A Mortgages Next Risk for Housing Market as Defaults Surge

In Riverside County, total foreclosure-related filings were up 58 percent from a year ago and 39 percent from July, while in San Bernardino County, total filings increased 98 percent from August 2007 and 34 percent from the month before.

Almost 16 percent of securitized Alt-A loans issued since January 2006 are at least 60 days late, data compiled by Bloomberg show. Defaults will accelerate next year and continue through 2011 as these loans hit their three- and five-year reset periods,

according to RealtyTrac Inc., an Irvine, California-based foreclosure data provider.

...

About 3 million U.S. borrowers have Alt-A mortgages totaling $1 trillion, compared with $855 billion of subprime loans outstanding, according to Inside Mortgage Finance ...

Paulson: No Government Funds for Lehman

by Calculated Risk on 9/12/2008 11:30:00 AM

From Reuters: Paulson "adamant" no goverment funds for Lehman: source

Treasury Secretary Henry Paulson is "adamant" that no government money be used in any deal that resolves the crisis at Wall Street investment bank Lehman Brothers ...We will see.

Mortgage Pig™ Fights Back

by Anonymous on 9/12/2008 10:25:00 AM

I have been fighting the impulse to break my "no political posts" rule for days now, even though Mortgage Pig™ and I have been taking this all very personally. But Krugman finally pushed me over the edge.

Retail Sales Decline

by Calculated Risk on 9/12/2008 09:07:00 AM

From the WSJ: Retail Sales Tumbled in August

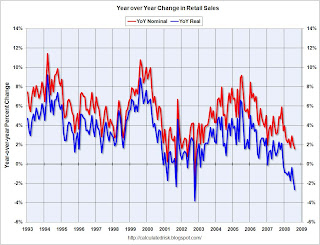

Retail sales decreased by 0.3%, the Commerce Department said Friday. ... Sales were revised sharply downward for July, decreasing 0.5%; originally, Commerce said July sales dipped 0.1%. June sales had gone up a mere 0.1%.This graph shows the year-over-year change in nominal and real retail sales since 1993.

Click on graph for larger image in new window.

Click on graph for larger image in new window.To calculate the real change, the monthly PCE price index from the BEA was used (August PCE prices were estimated based on the increases for the last 3 months).

Although the Census Bureau reported that nominal retail sales increased 1.5% year-over-year (retail and food services increased 2.6%), real retail sales declined by 2.6% (on a YoY basis).

The stimulus checks appeared to help consumer spending in Q2, but Q3 is off to a very weak start. This weakness in retail sales is probably because of the weak job market and less mortgage equity withdrawal (MEW) by homeowners (the Home ATM is empty!).

Retail sales are a key portion of consumer spending and real retail sales are now indicating recession.

Thursday, September 11, 2008

WaMu: $4.5 Billion in Loan Loss Provisions, Fitch Downgrades

by Calculated Risk on 9/11/2008 07:08:00 PM

Press release: WaMu Provides Update on Expectations for Third Quarter Performance

From Fitch: Fitch Downgrades Washington Mutual to 'BBB-'; Outlook Negative

WaMu expects the third quarter provision to be approximately $4.5 billion, down from $5.9 billion in the second quarter, but nearly two times expected charge-offs, resulting in an expected increase of approximately $1.8 billion in the allowance for loan losses at quarter end. Residential mortgage provisions are expected to be approximately $3.4 billion, down approximately $2.1 billion from second quarter residential mortgage provision of approximately $5.5 billion. Offsetting this decrease is an expected $600 million increase in the card provision, the majority of which is the result of credit card securitizations maturing in the ordinary course and returning to the balance sheet. The company expects its total loan loss reserve to increase from $8.5 billion at June 30th to approximately $10.3 billion at the end of the third quarter.

Fitch Ratings has downgraded the long- and short-term Issuer Default Ratings (IDRs) of Washington Mutual, Inc. ... The Rating Outlook is Negative.Update: from reader Nemo: How big is WaMu?

Today's actions reflect Fitch's expectation for continuing asset quality challenges amidst market conditions that are considered the most difficult in several decades for U.S. retail banks, particularly those with a concentration in residential mortgage assets.

WaMu has posted significant quarterly losses for the past three quarters, primarily as a result of a sharp rise in credit loss provisioning during the past year. ... WaMu announced today that it expects the provision for third-quarter 2008 (3Q08) to start showing evidence of that anticipated trend with a substantially lower provision (estimated at approximately $4.5 billion) in 3Q'08 versus the 2Q'08 provision of $5.9 billion.

... Fitch believes that the flexibility to add to capital is now significantly constrained in light of market conditions.

WaPo: Treasury and Fed Assisting in Sale of Lehman

by Calculated Risk on 9/11/2008 05:50:00 PM

From the WaPo: U.S. Government Assisting in Sale of Lehman Brothers (hat tip Maven)

The Treasury Department and the Federal Reserve are helping Lehman Brothers put itself up for sale. The details are not finalized, but sources familiar with the matter say the purchase is expected to be completed and announced this weekend before Asian markets open Monday morning.Another working weekend for Paulson.

WSJ: Lehman in Sales Talks

by Calculated Risk on 9/11/2008 04:23:00 PM

From the WSJ: Lehman Brothers in Sales Talks; B of A Seen As a Potential Suitor

Lehman Brothers Holdings Inc. is actively shopping itself to potential suitors, including Bank of America Corp., people familiar with the matter said Thursday.Everyone wants the JPM / Bear deal structure.

...

But potential buyers remain wary about plugging holes in Lehman's balance sheet, and are increasingly looking to the U.S. government to help backstop future losses ... It remains unclear whether the U.S. Treasury or Federal Reserve would take such steps, as was done when the government assisted J.P. Morgan Chase & Co. in its Bear Stearns takeover in March.

Bank of America, which is holding preliminary discussions about a transaction, appeared to be Lehman's best hope on Thursday afternoon. BofA may only do a Lehman deal if it is encouraged by the federal government ...