by Calculated Risk on 9/12/2008 11:30:00 AM

Friday, September 12, 2008

Paulson: No Government Funds for Lehman

From Reuters: Paulson "adamant" no goverment funds for Lehman: source

Treasury Secretary Henry Paulson is "adamant" that no government money be used in any deal that resolves the crisis at Wall Street investment bank Lehman Brothers ...We will see.

Mortgage Pig™ Fights Back

by Anonymous on 9/12/2008 10:25:00 AM

I have been fighting the impulse to break my "no political posts" rule for days now, even though Mortgage Pig™ and I have been taking this all very personally. But Krugman finally pushed me over the edge.

Retail Sales Decline

by Calculated Risk on 9/12/2008 09:07:00 AM

From the WSJ: Retail Sales Tumbled in August

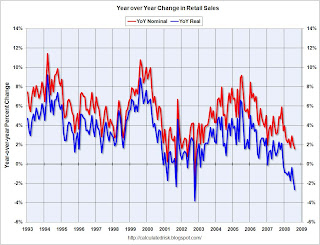

Retail sales decreased by 0.3%, the Commerce Department said Friday. ... Sales were revised sharply downward for July, decreasing 0.5%; originally, Commerce said July sales dipped 0.1%. June sales had gone up a mere 0.1%.This graph shows the year-over-year change in nominal and real retail sales since 1993.

Click on graph for larger image in new window.

Click on graph for larger image in new window.To calculate the real change, the monthly PCE price index from the BEA was used (August PCE prices were estimated based on the increases for the last 3 months).

Although the Census Bureau reported that nominal retail sales increased 1.5% year-over-year (retail and food services increased 2.6%), real retail sales declined by 2.6% (on a YoY basis).

The stimulus checks appeared to help consumer spending in Q2, but Q3 is off to a very weak start. This weakness in retail sales is probably because of the weak job market and less mortgage equity withdrawal (MEW) by homeowners (the Home ATM is empty!).

Retail sales are a key portion of consumer spending and real retail sales are now indicating recession.

Thursday, September 11, 2008

WaMu: $4.5 Billion in Loan Loss Provisions, Fitch Downgrades

by Calculated Risk on 9/11/2008 07:08:00 PM

Press release: WaMu Provides Update on Expectations for Third Quarter Performance

From Fitch: Fitch Downgrades Washington Mutual to 'BBB-'; Outlook Negative

WaMu expects the third quarter provision to be approximately $4.5 billion, down from $5.9 billion in the second quarter, but nearly two times expected charge-offs, resulting in an expected increase of approximately $1.8 billion in the allowance for loan losses at quarter end. Residential mortgage provisions are expected to be approximately $3.4 billion, down approximately $2.1 billion from second quarter residential mortgage provision of approximately $5.5 billion. Offsetting this decrease is an expected $600 million increase in the card provision, the majority of which is the result of credit card securitizations maturing in the ordinary course and returning to the balance sheet. The company expects its total loan loss reserve to increase from $8.5 billion at June 30th to approximately $10.3 billion at the end of the third quarter.

Fitch Ratings has downgraded the long- and short-term Issuer Default Ratings (IDRs) of Washington Mutual, Inc. ... The Rating Outlook is Negative.Update: from reader Nemo: How big is WaMu?

Today's actions reflect Fitch's expectation for continuing asset quality challenges amidst market conditions that are considered the most difficult in several decades for U.S. retail banks, particularly those with a concentration in residential mortgage assets.

WaMu has posted significant quarterly losses for the past three quarters, primarily as a result of a sharp rise in credit loss provisioning during the past year. ... WaMu announced today that it expects the provision for third-quarter 2008 (3Q08) to start showing evidence of that anticipated trend with a substantially lower provision (estimated at approximately $4.5 billion) in 3Q'08 versus the 2Q'08 provision of $5.9 billion.

... Fitch believes that the flexibility to add to capital is now significantly constrained in light of market conditions.

WaPo: Treasury and Fed Assisting in Sale of Lehman

by Calculated Risk on 9/11/2008 05:50:00 PM

From the WaPo: U.S. Government Assisting in Sale of Lehman Brothers (hat tip Maven)

The Treasury Department and the Federal Reserve are helping Lehman Brothers put itself up for sale. The details are not finalized, but sources familiar with the matter say the purchase is expected to be completed and announced this weekend before Asian markets open Monday morning.Another working weekend for Paulson.

WSJ: Lehman in Sales Talks

by Calculated Risk on 9/11/2008 04:23:00 PM

From the WSJ: Lehman Brothers in Sales Talks; B of A Seen As a Potential Suitor

Lehman Brothers Holdings Inc. is actively shopping itself to potential suitors, including Bank of America Corp., people familiar with the matter said Thursday.Everyone wants the JPM / Bear deal structure.

...

But potential buyers remain wary about plugging holes in Lehman's balance sheet, and are increasingly looking to the U.S. government to help backstop future losses ... It remains unclear whether the U.S. Treasury or Federal Reserve would take such steps, as was done when the government assisted J.P. Morgan Chase & Co. in its Bear Stearns takeover in March.

Bank of America, which is holding preliminary discussions about a transaction, appeared to be Lehman's best hope on Thursday afternoon. BofA may only do a Lehman deal if it is encouraged by the federal government ...

Hatzius: An Estimate of Mortgage Credit Losses

by Calculated Risk on 9/11/2008 03:59:00 PM

From Jan Hatzius, Goldman Sachs chief economist presented at the Brookings conference today: Beyond Leveraged Losses: The Balance Sheet Effects of the Home Price Downturn. Here is a short excerpt on estimating mortgage credit losses (note that Goldman is now forecasting prices to decline another 10%):

If nominal home prices remain at their 2008 Q2 level until mid-2009, before reverting to a +3% annualized trend, our model implies that mortgage credit losses realized in the 2007-2012 period will total $473 billion. If nominal home prices fall another 10% through the middle of 2009, the model projects losses of $636 billion. Finally, if prices drop another 20%, predicted losses increase to $868 billion. Moreover, the table suggests that losses peak in the third quarter of 2008 if home prices are flat going forward; in the fourth quarter of 2008 if prices drop another 10%; and in the second quarter of 2009 if prices drop another 20%.

Bloomberg: Senators Ask Fannie / Freddie to Freeze Foreclosures

by Calculated Risk on 9/11/2008 03:04:00 PM

From Bloomberg: Senators Ask Fannie, Freddie to Freeze Foreclosures

U.S. Senate Banking Committee members urged Fannie Mae and Freddie Mac, the mortgage lenders placed under federal control this week, to freeze foreclosures on loans in their portfolios for at least 90 days.I suppose the goal is work out more modifications ... nothing else will change in 90 days.

Lower Mortgage Rates, But More Lenders Require 15% Down Payment

by Calculated Risk on 9/11/2008 01:12:00 PM

Update: Here are the new guidelines from Fannie Mae (hat tip MaxedOutMama)

NOTE THAT THE 85% LTV applies to cash out refis. Purchase Money Mortgage (new purchase) is still 95% LTV (or 5% down payment).

From Peter Viles at L.A. Land: 10% down? Forget it, it's now 15%

Good news from the government takeover of Fannie and Freddie: Mortgage rates are falling. Bad news for borrowers short on cash: You need more cash to get a mortgage.Peter excerpts from an L.A. Times story by Scott Reckard: Mortgage rates are plunging -- for those who qualify

[L]enders spooked by free-falling home prices and surging foreclosures have imposed tougher lending standards. ... most banks this week immediately adopted new guidelines that Fannie Mae said it would implement next year.Here is the current mortgage product info from Fannie Mae. Does someone have a link to the guidelines for next year?

Among them: Home purchasers must put down at least 15% of the purchase price, up from 10%.

Bloomberg: Lehman Said to be in Talks with Potential Buyers

by Calculated Risk on 9/11/2008 12:38:00 PM

UPDATE: From Reuters: Goldman Sachs is not buying Lehman - sources

From Bloomberg: Lehman Said to Be in Talks With Potential Buyers as Shares Drop

Lehman Brothers Holdings Inc. entered into talks with potential buyers of the securities firm after Moody's Investors Service said the company must find a ``stronger financial partner'' and the shares plummeted.Yves Smith at Naked Capitalism broke this earlier: Lehman End Imminent

Bankers from other firms are reviewing Lehman's books today, people with knowledge of the situation said ...

I heard this rumor from two sources, that Lehman is in its final day or two and Goldman is willing to buy the firm, and the second source, who volunteered the information, is sufficiently well plugged in that I trust the reading. This came from a former senior employee:A couple friends of mine from LEH trading desk called me this a.m. to say that mgmt has taken employees aside to let them know that the end should come in next 24-48 hours. Ratings agencies apparently told them that the steps were not sufficient to prevent a d/g, and LEH mgmt asked them to hold off for a day or so to give them a chance to resolve situation (with sale of company).

Apparently GS is willing buyer, but is buyer of last resort from LEH's perspective, b/c they would keep very few LEH employees.