by Calculated Risk on 9/09/2008 10:04:00 AM

Tuesday, September 09, 2008

Pending Home Sales Index Declines

From the NAR: Near-Term Home Sales to Stay in Narrow Range

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in July, fell 3.2 percent to 86.5 from an upwardly revised reading of 89.4 in June, which had risen 5.8 percent from May. The July index remains 6.8 percent below July 2007 when it stood at 92.8.The Pending Home Sales index leads existing home sales by about 45 days, so this suggests existing home sales in September will be off slightly.

For some graphs comparing existing home sales to pending home sales, see: Do Existing Home Sales track Pending Home Sales? The answer is yes - they do track pretty well.

Fannie, Freddie Get Special IRS Tax Rule

by Calculated Risk on 9/09/2008 09:35:00 AM

From CFO.com: Fannie, Freddie Get Tax Pass, Too (hat tip Alain)

Treasury Secretary Henry Paulson ... had the IRS issue Notice 2008-76, which essentially allows the two government-sponsored enterprises to retain all of their [net-operating losses] NOLs, despite a change of control of ownership, tax expert Robert Willens told CFO.com.Not a big deal - but another interesting aspect of the Paulson Plan.

Under the tax code — specifically Section 382 — NOLs are severely limited when there is a change of control. The rule is in place to prevent acquiring companies from buying up targets just to gain access to their NOLs. The NOLs for Fannie and Freddie are substantial. Over the last four quarters, Fannie and Freddie recorded about $14 billion in aggregate losses.

In essence, Paulson changed tax law so that the two lenders aren't paying more in taxes to the government as a result of that same government becoming their controlling investor. ...

"I am not saying that the IRS ruling is a good thing, or a bad thing, it is just unusual," asserts Willens. "Then again, this is a very unusual situation."

Monday, September 08, 2008

Bove on WaMu: Problem is Simple, Too Many Bad Loans

by Calculated Risk on 9/08/2008 09:41:00 PM

"The problem is very simple. They made a lot of bad loans and they are absorbing high levels of loan losses. The solution for their problem is to find some mechanism for reducing the bad loans. That can't be done by a new CEO."From the WSJ: WaMu Placed on Probation Amid Management Shakeup (the "probation" headline refers to the Memorandum of Understanding with the OTS)

Richard Bove, banking analyst with Ladenburg Thalmann & Co. Inc.

WaMu has $53 billion in option adjustable-rate mortgages ... Of the $53 billion in option ARMs, $14 billion of these are to the riskiest segment in mortgage lending, subprime borrowers.Bove's comments remind me of former IMF chief economist Ken Rogoff's comment last month (see the BBC: US bank 'to fail within months' )

WaMu also has $62 billion in home-equity loans ...

Mr. Bove predicts that WaMu will lose $40 billion over the next three years on its loan portfolio. If the economy weakens further and losses are even higher, he said, "the future of the company is questionable."

"We're not just going to see mid-sized banks go under in the next few months," said Mr Rogoff, who held the IMF role between 2001 and 2004.

"We're going to see a whopper, we're going to see a big one, one of the big investment banks or big banks."

Wells Fargo to take Fannie & Freddie Related Write-Down

by Calculated Risk on 9/08/2008 05:24:00 PM

From the WSJ: Wells Fargo Says It Will Take Third-Quarter Write-Down On Fannie, Freddie Holdings

Wells Fargo & Co. said ... its perpetual preferred investments in Fannie and Freddie are included in securities available for sale at a cost of $336 million and $144 million, respectively. Those securities now trade at 5% to 10% of their original value.The F&F confessional is open.

Housing: It's about prices ...

by Calculated Risk on 9/08/2008 12:56:00 PM

"Our economy and our markets will not recover until the bulk of this housing correction is behind us."So when will the "bulk of this housing correction" be behind us? Right now prices are still too high.

Treasury Secretary Hank Paulson, Sept 7, 2008

Here are a few ways to look at house prices: real prices (inflation adjusted), price-to-rent ratio, and price-to-income ratio.

The first graph compares real and nominal Case-Shiller Home Prices through Q2 2008 (real is current index adjusted using CPI less Shelter).

Click on graph for larger image in new window.

Click on graph for larger image in new window.In real terms (red line), the Case-Shiller National Home price index is off 25% from the peak. Real prices are now back to the Q4 2002 level (nominal prices are back to mid-2004).

This suggests real prices, based on the Case-Shiller index, could fall substantially, perhaps 15% to maybe even 30% more. This decline would probably be some combination of falling nominal prices and more inflation. And prices could definitely overshoot to the downside.

The second graph shows the price to rent ratio (Dec 1982 = 1.0) for both the OFHEO House Price Index and the Case-Shiller National Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used. This graph is from this earlier post.

The second graph shows the price to rent ratio (Dec 1982 = 1.0) for both the OFHEO House Price Index and the Case-Shiller National Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used. This graph is from this earlier post.Data is available quarterly for the Case-Shiller National Index starting in 1987. For this graph, the price-to-rent ratio for Case-Shiller in Q1 1987 was set to the OFHEO price-to-rent for Q1 1987.

Looking at the price-to-rent ratio based on the Case-Shiller index, the adjustment in the price-to-rent ratio is probably 60% complete as of Q2 2008 on a national basis. This ratio will probably continue to decline with some combination of falling prices, and perhaps, rising rents. And the ratio may overshoot too.

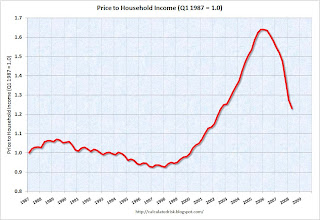

The third graph shows the price-to-income ratio and is based off the Case-Shiller index, and the Census Bureau's median income Historical Income Tables - Households.

The third graph shows the price-to-income ratio and is based off the Case-Shiller index, and the Census Bureau's median income Historical Income Tables - Households.Using national median income and house prices provides a gross overview of price-to-income (it would be better to do this analysis on a local area). However this does shows that the price-to-income is still too high, and that this ratio needs to fall another 20% or so. Once again this could be a combination of falling prices and rising incomes (Note: this uses nominal incomes, and even if real incomes are stagnate or declining, nominal incomes are rising).

So by these three measures, prices have a ways to fall.

And finally, as long as inventory levels are substantially above normal (especially inventories of distressed properties), prices will probably continue to decline. So this graph is very useful:

The final graph shows the 'months of supply' metric for existing homes for the last six years.

The final graph shows the 'months of supply' metric for existing homes for the last six years.Months of supply increased to 11.2 months. A normal range is 5 to maybe 8 months. Until the months of supply decreases to the normal range, prices will continue to fall.

How much longer will prices fall? How much further will prices decline? No one knows, but these graphs suggest we still have a ways to go.

WaMu: Memorandum of Understanding with OTS

by Calculated Risk on 9/08/2008 11:59:00 AM

Via MarketWatch:

WaMu also announced that it has entered into a Memorandum of Understanding (MOU) with the Office of Thrift Supervision (OTS) concerning aspects of the bank's operations, principally in several areas of its risk management and compliance functions, including its Bank Secrecy Act compliance program. In addition, WaMu has committed to provide the OTS an updated, multi-year business plan and forecast for its earnings, asset quality, capital and business segment performance. The business plan will not require the company to raise capital, increase liquidity or make changes to the products and services it provides to customers.This might have contributed to the CEO's ouster.

In a Word . . .

by Anonymous on 9/08/2008 11:12:00 AM

Paul Krugman would like us all to get straight on the difference between "nationalization" and "deprivatization."

I wish Professor Krugman well in his endeavor, but I'm still waiting for the mainstream press to get clear on the difference between an "asset" and a "liability." Here's USA Today, headlined "Taxpayers take on trillions in risk in Fannie, Freddie takeover":

Freddie Mac and Fannie Mae combined own or guarantee $5.4 trillion in outstanding mortgage debt. The government's decision to place both agencies into a conservatorship — in essence, taking on responsibility for that debt by wresting control from the corporations — is an historic move.I'm sure some regular readers of this blog think it's silly to be concerned about the level of ignorance and inanity appearing in USA Today, but I'm guessing that most voters get their information about things like the Fannie/Freddie deprivatization from headlines in the mainstream press, not the Financial Times or the Wall Street Journal. So the claim that $5.4 trillion in mortgages represent net liabilities of Fannie and Freddie, instead of assets, and that these are now liabilities of the taxpayers, is going to become one of those things that a lot of people "know" and quite possibly the only thing they "know" about this subject. Eradicating that "knowledge" is going to be tough.

Norris on Fannie and Freddie: G-Fee vs. Taxpayer Losses

by Calculated Risk on 9/08/2008 09:24:00 AM

Floyd Norris wonders in the NY Times which master the new Fannie and Freddie will serve: The Dilemma of Fannie and Freddie

In recent months, Fannie and Freddie raised the fees they charged to purchase or guarantee loans. ... Now the new managers of Fannie and Freddie will have to decide how they want to run enterprises controlled by the government.For a discussion of how GSE MBS works (and g-fees) see Tanta's MBS for UberNerds I: GSE Pass-Throughs

Lowering fees and buying large numbers of mortgages would serve as an economic stimulus, but could increase the ultimate cost to the government if the housing market gets worse. Raising fees, and being cautious in lending, could prolong the housing slump. Being generous in restructuring loans could help borrowers, but cost the enterprises money.

Henry M. Paulson Jr. ... tried to assure the public that the enterprises would follow both courses, an indication that the need to serve multiple masters remains. On one side, he promised that “the primary mission of these enterprises now will be to proactively work to increase the availability of mortgage finance, including by examining the guaranty fee structure with an eye toward mortgage affordability.”

On the other side, he said Fannie and Freddie “will no longer be managed with a strategy to maximize common shareholder returns, a strategy which historically encouraged risk-taking.”

It may not be easy to take less risk while lending more and charging lower fees.

Sunday, September 07, 2008

Fannie and Freddie Press Conference Videos

by Calculated Risk on 9/07/2008 10:18:00 PM

In three parts (all about 10 minutes each).

"Our economy and our markets will not recover until the bulk of this housing correction is behind us."

Treasury Secretary Hank Paulson, Sept 7, 2008 (see part 2)