by Calculated Risk on 9/06/2008 06:35:00 PM

Saturday, September 06, 2008

More Fannie and Freddie

First, several people sent me this article from the NY Times. I'm skeptical of the accusation of accounting issues causing the deal to be rushed. Notice the phrase "not necessarily in violation of accounting rules" - I doubt Freddie violated any accounting rules this time:

From the NY Times: Loan Giant Overstated the Size of Its Capital Base (hat tip Sam & Devang)

The government’s planned takeover of Fannie Mae and Freddie Mac, expected to be announced as early as this weekend, came together hurriedly after advisers poring over the companies’ books for the Treasury Department concluded that Freddie’s accounting methods had overstated its capital cushion, according to regulatory officials briefed on the matter.And another update from the WSJ: Treasury to Outline Fan-Fred Plan

...

The company had made decisions that, while not necessarily in violation of accounting rules, had the effect of overstating the companies’s capital resources and financial stability.

The U.S. Treasury is expected to announce early Sunday afternoon details of a plan under which regulators will effectively take temporary control over government-sponsored mortgage investors Fannie Mae and Freddie Mac.

The Treasury won't necessarily make a large injection of capital immediately into the ailing companies ...

Dividends on the companies' preferred stock are likely to be suspended, people familiar with the plan say, and those on common shares to be eliminated. Any injection of capital by the Treasury would likely greatly reduce or wipe out the value of common shares currently outstanding.

Rep. Frank Confirms Treasury Plan

by Calculated Risk on 9/06/2008 03:01:00 PM

From the WSJ: Frank Confirms Treasury Intervention To Shore Up Fannie Mae, Freddie Mac

Rep. Barney Frank (D., Mass.) [chairman of the House Financial Services Committee] said in a statement Saturday that Mr. Paulson "intends to use the powers that Congress provided it" in a law passed in July to keep Fannie Mae and Freddie Mac stable and functioning. But Mr. Frank said he didn't "know the details of the proposed interventions,"With all this publicity, the plan will have to be announced Sunday.

Fannie and Freddie

by Calculated Risk on 9/06/2008 09:08:00 AM

More details will leak out today, but the plan will probably be announced Sunday afternoon a few hours before the Asian markets open. (like with Bear Stearns). I wonder if the Fed will make some sort of announcement too ...

Stories (some contradictory on the Preferred shares):

Bloomberg: Paulson Plans to Bring Fannie, Freddie Under Government Control

WSJ: U.S. Near Deal on Fannie, Freddie

WaPo: U.S. Nears Rescue Plan For Fannie And Freddie

NY Times: U.S. Rescue Seen at Hand for 2 Mortgage Giants

LA Times: Fannie, Freddie takeover possible

Friday, September 05, 2008

WSJ: Fannie, Freddie to be put in `Conservatorship'

by Calculated Risk on 9/05/2008 09:20:00 PM

Update2: WaPo says preferred protected: Fannie Mae, Freddie Mac to be Put Under Federal Control, Sources Say

Under the plan, the federal government would place the firms in a legal state known as conservatorship, the sources said. The value of the company's common stock would be diluted but not wiped out while the holdings of other securities, including company debt and preferred shares, would be protected by the government.That makes more sense than the NY Times article.

Update: Here is the NY Times story: U.S. Plans Takeover of Fannie and Freddie

Senior officials from the Bush administration and the Federal Reserve on Friday informed top executives of Fannie Mae and Freddie Mac, the mortgage-finance giants, that the government is preparing a plan to seize the two companies and place them in a conservatorship ...A little thread music:

Under a conservatorship, most if not all of the remaining value of the common and preferred shares of Fannie and Freddie would be worth little or nothing, and any losses on mortgages they own or guarantee could be paid by taxpayers.

The WSJ has update their story: U.S. Near Deal on Fannie, Freddie

The Treasury Department is putting the finishing touches to a plan designed to shore up Fannie Mae and Freddie Mac ... a move that would essentially result in a government takeover of the mortgage giants.This weekend will be interesting.

The plan is expected to involve putting the two companies into the conservatorship of their regulator, the Federal Housing Finance Agency ...

It is also expected to involve the government injecting capital into Fannie and Freddie. ... Daniel H. Mudd, chief executive of Fannie Mae, and Richard Syron, his counterpart at Freddie Mac, are expected to step down from their posts eventually.

Bank Failure: Silver State Bank, Henderson, Nevada

by Calculated Risk on 9/05/2008 09:15:00 PM

From the FDIC: Nevada State Bank Acquires the Insured Deposits of Silver State Bank, Henderson, Nevada

Silver State Bank, Henderson, Nevada, was closed today by the Nevada Financial Institutions Division, and the Federal Deposit Insurance Corporation (FDIC) was named Receiver. To protect the depositors, the FDIC entered into a Purchase and Assumption Agreement with Nevada State Bank, Las Vegas, Nevada, to assume the Insured Deposits of Silver State Bank.Another one bites the dust.

...

As of June 30, 2008, Silver State Bank had total assets of $2.0 billion and total deposits of $1.7 billion. Nevada State Bank agreed to purchase the insured deposits for a premium of 1.3 percent. At the time of closing, there were approximately $20 million in uninsured deposits held in approximately 500 accounts that potentially exceeded the insurance limits. This amount is an estimate that is likely to change once the FDIC obtains additional information from these customers.

Silver State Bank also had approximately $700 million in brokered deposits that are not part of today's transaction.

...

The transaction is the least costly resolution option, and the FDIC estimates that the cost to its Deposit Insurance Fund is between $450 and $550 million. Silver State Bank is the second bank to fail in Nevada in 2008. First National Bank of Nevada, Reno failed on July 25, 2008. This year, a total of eleven FDIC-insured institutions have been closed.

More on MBA Delinquency Data

by Calculated Risk on 9/05/2008 06:33:00 PM

Yes, Fannie and Freddie is the big story today (and this weekend). And DSL and BKUNA are interesting too.

But Housing Wire has more on the MBA Foreclosure and Delinquency data released today: MBA: Prime ARMs Set Tone for Troubled Mortgages in Q2

Jay Brinkmann, the MBA’s newly-named chief economist, managed to irk more than a few servicing managers we spoke with by suggesting that the woes in the two most troubled U.S. states throughout the housing mess were masking improvements elsewhere — and then using two states that have seen foreclosures artificially lowered by recent legislation to make his point.Of course the bigger MBA story was the shift towards Prime ARM foreclosures.

“Massachusetts showed a very large drop in foreclosure starts, perhaps signaling a bottom,” Brinkmann said in the group’s press statement.

...

There’s one big problem with his logic: during Q2, both Massachusetts and Maryland in particular saw highly-publicized changes in notice requirements that significantly extended the borrower default notice period from 30 to 90 days in each state. ...

“Of course foreclosure starts have slowed since [the two states] extended demand letters,” said one servicing manager, who asked not to be identified by name. ...

A senior vice president at a large subprime servicer, who asked not to be named, said that the suggestion of a market bottom in Massachusetts was “just plain ludicrous.”

“We’re already starting to see a sharp increase within the state as the effect of the new notice period wears off,” he said.

OTS Reclassifies BankUnited Regulatory Capital Status

by Calculated Risk on 9/05/2008 05:12:00 PM

Press Release: BankUnited FSB Receives Notification from the Office of Thrift Supervision

BankUnited Financial Corporation (NASDAQ:BKUNA - News), parent company of BankUnited FSB, announced that it received notification today that the Office of Thrift Supervision has reclassified the Bank’s regulatory capital status from well-capitalized to adequately capitalized although the Bank’s capital ratios exceed the statutory threshold for well-capitalized institutions. As a result, the Bank is subject to restrictions on accepting brokered deposits.Just last week, in a SEC 10-Q filing, BankUnited expressed concern that the OTS might impose additional restrictions on BankUnited, and that these restrictions might have "a material adverse effect on BankUnited’s financial position and operations".

OTS Issues Cease-and-Desist Order to Downey Financial

by Calculated Risk on 9/05/2008 05:06:00 PM

From the WSJ: Regulators Tell Downey Financial To Raise Capital, Hire CEO

The Office of Thrift Supervision ... has issued a cease-and-desist order that formally requires the [Downey] to raise capital, name a new chief executive, and take other actions aimed at shoring up its operations, these people said.Looks grim for Downey.

...

The bank has $13.4 billion of assets, with 169 branches in California and five in Arizona. It is the nation's 10th-largest thrift as measured by assets.

WSJ: Treasury Close to Final Fannie & Freddie Plan

by Calculated Risk on 9/05/2008 04:55:00 PM

From the WSJ: Treasury Is Close to Finalizing Plan to Backstop Fannie, Freddie

Precise details of Treasury's plan couldn't be learned. The plan is expected to involve a creative use of Treasury's new authority to make a capital injection into the beleaguered giants.Another Sunday announcement (like for Bear Stearns)?

...

An announcement could come as early as this weekend.

MBA: Prime ARMs to Dominate Foreclosures

by Calculated Risk on 9/05/2008 01:45:00 PM

“Subprime ARM loans accounted for 36 percent of all foreclosures started and prime ARMs, which include option ARMs, represented 23 percent. However, the increase in prime ARMs foreclosure starts was greater than the combined increase in fixed-rate and ARM subprime loans. Thus the foreclosure start numbers will likely be increasingly dominated increasingly by prime ARM loans."Here is the MBA press release: Delinquencies and Foreclosures Increase in Latest MBA National Delinquency Survey

Jay Brinkmann, MBA’s Chief Economist, Sept 5, 2008

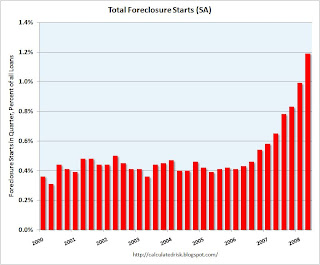

Click on graph for larger image.

Click on graph for larger image.This graphs shows the seasonally adjusted rate of all loans entering the foreclosure process each quarter.

This includes all loans, and the graph masks the underlying shift from foreclosures being dominated by subprime loans to foreclosures being dominated by Prime ARMs. See Tanta's: Subprime and Alt-A: The End of One Crisis and the Beginning of Another

This is one of the key housing themes for the next year or more.