by Calculated Risk on 9/04/2008 02:38:00 PM

Thursday, September 04, 2008

Fed's Yellen: Crisis "ongoing and perhaps deepening"

From San Francisco Fed President Janet Yellen: The U.S. Economic Situation and the Challenges for Monetary Policy

Regrettably, the nation's economy has been in rough waters for over a year now. Last summer, a precipitous slide in house prices triggered a crisis in financial markets and a credit crunch that is making it hard for consumers and some firms to borrow. These developments are ongoing and perhaps deepening, as banks and other financial intermediaries are continuing to delever by scaling back their balance sheets and shrinking their lending activity. Indeed, some sources of funding have completely dried up. In the face of these developments, firms and consumers have also been pulling back, causing unemployment to rise.And on the U.S. outlook:

Turning to the national economy, it was recently reported that growth in the second quarter came in at a fairly robust rate of 3¼ percent.Dr. Yellen has probably been the most bearish Fed President, especially on housing. Her focus on unemployment (and exports) and the potential

...

While one might be tempted to interpret the recent strong numbers as a sign that things are turning around, there are three important reasons to think that the strength will not hold up, and that economic performance will be decidedly subpar in the second half of the year. First, consumer spending in the second quarter came in at only a moderate rate, even though it was boosted by substantial tax rebates. But there are no plans in place to repeat those rebates, so by the fourth quarter, the economy will no longer benefit from that fiscal stimulus.

Second, export growth alone contributed one-half of the total real GDP growth registered in the second quarter. This element has been an important source of strength in our economy for over a year, being buoyed by strong growth abroad and by the weakening of the dollar. However, as I discussed, in recent months the dollar has risen somewhat and economic growth in many of our industrialized trading partners has slowed or even turned negative, suggesting that we can no longer count on exports as an important source of strength.

Third, the problems in the housing markets, financial markets, and labor markets continue to be a drag on growth and employment. Fortunately, the recent fall in commodity prices should help to cushion some of this downward pressure on activity. Overall, I anticipate that real GDP growth in the second half of this year will come in below the growth of potential output which implies that the unemployment rate will rise. On its own, this obviously is not good news. And its interaction with the housing and financial markets raises the potential for worse news—a deepening of the adverse feedback loop I've been describing: more unemployment causing more people to fall behind on their mortgage payments, leading to further delinquencies and foreclosures, tighter credit conditions and further downward pressure on activity and employment. This kind of process represents a downside risk for the economy, especially if it intensifies the sagging consumer and business confidence we've seen.

all emphasis added

Fed's Fisher: Economy to Stay Sluggish

by Calculated Risk on 9/04/2008 01:47:00 PM

"I think it likely that our movement through the muck and the flotsam and jetsam of the credit and housing debacle will be sluggish, and it may take some time into 2009 for us to get the economy back up to a snappier cruising speed."From Dallas Fed President Richard W. Fisher: Economic Challenges

Dallas Fed President Richard W. Fisher

The housing market has yet to find its bottom; credit markets remain tempestuous; creditors are tightening their standards; consumers and businesses are battening down the hatches and reefing in their sails. The prices of Chinese and other emerging country labor and inputs we have come to depend on have been rising; business margins are being squeezed; consumers are suffering from declining real incomes; savers and investors are confronted with negative real rates of return. These are hardly fortuitous circumstances.My view is Fisher has been behind the curve on the economic slowdown, although he is clearly more pessimistic now.

Price to Rent Ratio

by Calculated Risk on 9/04/2008 11:36:00 AM

Peter Viles at the LA Times (L.A. Land blog) has some excerpts from a Credit Suisse report projecting that house prices might bottom in late 2009. See: Credit Suisse: Home price declines likely until late '09

The report, using two separate methods of predicting home price trends, says both methods "point to home prices moving back in line with past historical 'equilibrium' levels in 12 to 18 months..." The report notes that housing prices could "overshoot" their equilibrium levels, and fall for even longer than 12 to 18 months, in which case, "'cheap' housing is still about two years away."I think price to rent ratios are helpful, but have flaws. I wouldn't use median house prices because the mix of homes impacts the median price.

Also the Credit Suisse projection of prices declining for another 12 to 18 months is based on prices continuing to fall at the current rate. Historically, during a housing bust, price fall slowly at first, then decline more rapidly for a couple of years, and then slowly for several more years until the eventual bottom. Right now we are in the rapid price decline phase. So I'm still expecting prices to fall for some time (although I expect price declines to start to slow), with a price bottom in the 2010 to 2012 period in the bubble areas, and perhaps sooner in other areas (less bubbly areas and certain low end areas).

One thing is pretty certain - as long as inventory levels are elevated, prices will continue to decline. And right now the inventory of existing homes (especially distressed properties) is at an all time high.

On price to rent ratios, back in October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter: House Prices and Fundamental Value.

Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

I've posted on this before, and here is an update to their graph through Q2 2008:

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the price to rent ratio (Dec 1982 = 1.0) for both the OFHEO House Price Index and the Case-Shiller National Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used.

The Fed letter used the OFHEO index (Blue), but this index includes refinances and has other problems. The OFHEO index shows that prices have barely fallen from the recent peak, and therefore the price-to-rent ratio has barely declined.

Data is available quarterly for the Case-Shiller National Index starting in 1987. For this graph, the price-to-rent ratio for Case-Shiller in Q1 1987 was set to the OFHEO price-to-rent for Q1 1987.

Looking at the price-to-rent ratio based on the Case-Shiller index, the adjustment in the price-to-rent ratio is probably 60% complete as of Q2 2008 on a national basis. This ratio will probably continue to decline with some combination of falling prices, and perhaps, rising rents. And, as Credit Suisse analysts noted, the ratio may overshoot too.

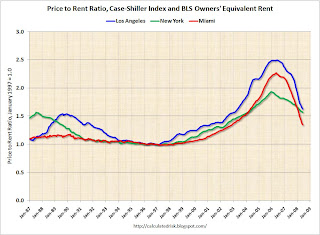

The second graph shows the price-to-rent ratio for three cities: Los Angeles, Miami, and New York. On this monthly graph, January 1987 = 1.0. The OER from the BLS for each individual city is used.

The second graph shows the price-to-rent ratio for three cities: Los Angeles, Miami, and New York. On this monthly graph, January 1987 = 1.0. The OER from the BLS for each individual city is used.Some combination of falling prices, and perhaps rising rents, will probably push the ratio back towards 1.0. By this measure of housing fundamentals, it appears that Miami has corrected about 75% of the way to the eventual bottom, Los Angeles about 60%, and New York about 40%.

Some people are seeing the start of a price bottom in Florida, from Bloomberg: Florida Real Estate Bottom Signaled by Sale of Distressed Condo

Sales of distressed Miami properties have begun, signaling a bottom for south Florida's real estate market and the end of waiting for vulture funds armed with about $30 billion to spend.The price-to-rent ratio would suggest that parts of Florida are indeed "almost there". But with the high level of inventory, prices will probably decline further, and the bottom in real terms is probably still a few years away.

...

``There's a purging going on,'' [Jack McCabe, McCabe Research & Consulting LLC] said. ``It's my belief that the vulture buyers would form the bottom of the real estate market, and we're almost there. That bottom may last for three years as foreclosure sales go on.''

Price-to-rent ratios are useful, but somewhat flawed. They give a general idea about house prices, but there are other important factors (like inventory levels, price to income and credit issues). We are getting closer on prices, but I think we still have a ways to go.

ISM: Non-manufacturing Economic Activity Increased Slightly

by Calculated Risk on 9/04/2008 10:06:00 AM

"Respondents' comments remain mixed about business conditions and reflect concern about the uncertainty of the economy."From the Institute for Supply Management (ISM):

Anthony Nieves, ISM Vice President

Economic activity in the non-manufacturing sector grew in August, say the nation's purchasing and supply executives ...The index increased 1.1 percentage points in August to 50.6 percent. Anything above 50 indicates expansion. So this report suggests modest expansion in the service sector in August after two months of contraction.

The employment index declined to 45.4.

NY Times: Cerberus Auto Investments Faltering

by Calculated Risk on 9/04/2008 12:24:00 AM

From Michael J. de la Merced and Vikas Bajaj at the NY Times: Investments Are Faltering in Chrysler and GMAC

Mr. Feinberg’s giant investment fund, Cerberus Capital Management, is racing to salvage multibillion-dollar investments in Chrysler, the smallest of the Detroit automakers, and GMAC, the financing arm of General Motors.The mythical Cerberus - an unfortunate choice of names - had two tasks: to keep the living and righteous out of hell, and to ensure that no one exits. Perhaps the founders forgot about the second task, because it appears GMAC and Chrysler are now in hell, and based on mythology, there is no escape.

But for Cerberus, named after the mythological three-headed dog who guards the gates of hell, the news keeps getting worse.

On Wednesday, Chrysler ... said its sales in the United States fell by a third in August — nearly twice the industry average ... Honda eclipsed Chrysler as the nation’s No. 4 seller of cars, and Nissan is closing in fast.

The same day, GMAC, in which Cerberus holds a 51 percent stake, said it was trying to stanch the bleeding from ... home mortgage lending. GMAC and its home loan unit, Residential Capital, announced that they would dismiss 5,000 employees, or 60 percent of the unit’s staff, and close all 200 of its retail mortgage branches.

Wednesday, September 03, 2008

Cartoon of the Day

by Calculated Risk on 9/03/2008 11:00:00 PM

Q2 MBA Delinquency and Foreclosure Report Due Friday

by Calculated Risk on 9/03/2008 08:20:00 PM

The Mortgage Bankers Association (MBA) delinquencies and foreclosures report is scheduled to be released on Friday at 10 AM ET.

Goldman Sachs released a research note tonight in advance of the report (no link). Goldman analysts expect a slight rise in delinquencies (seasonally adjusted), and "well over 1% of mortgages" to have entered the foreclosure process in the 2nd quarter.

Goldman sees mixed signals on subprime loans - perhaps even a decline in delinquencies - but rising delinquencies for prime loans (and Alt-A). This is similar to Tanta's post: Subprime and Alt-A: The End of One Crisis and the Beginning of Another

If Goldman's analysis is correct, this will continue the trend reported by Housing Wire last quarter: Primed for Trouble: Pace of Mortgage Distress Shifts to Prime Borrowers

While foreclosure activity hit an all-time record in the first quarter, according to statistics released Thursday morning by the Mortgage Bankers Association, a shift of the mortgage mess towards prime borrowers appears to be taking place as well — signaling that the credit crunch that began among those with less-than-perfect credit may now be marching onward towards borrowers usually deemed better credit risks.Expect more foreclosure records on Friday, but the details will be interesting too.

Stiglitz: What's our economy based on?

by Calculated Risk on 9/03/2008 05:05:00 PM

Professor Stiglitz writes in the New Republic: Falling Down. (hat tip Justin)

Stiglitz makes several thought provoking arguments. He points out that financial manager incentives encouraged gambling:

Perhaps the worst problems--like those in the subprime mortgage market--occurred when non-transparent fee structures interacted with incentives for excessive risk-taking in which financial managers got to keep high returns made one year, even if those returns were more than offset by losses the next.Professor Hamilton and others have been warning about these incentives for several years (see Hamilton's Hedge fund risk and Wharton Professor Dean Foster and Oxford Professor Peyton Young's Hedge Fund Wizards).

But the following passage is key (and very optimistic!). I hear the argument all the time that the U.S. needs to increase it's manufacturing base. I agree with Stiglitz:

Some looking at the U.S. economy's decreasing reliance on manufacturing and increasing dependence on the service sector (including financial services) have long worried that the whole thing was a house of cards. After all, aren't "hard objects"--the food we eat, the houses we live in, the cars and airplanes that we use to transport us from one place to another, the gas and oil that provides heat and energy--the "core" of the economy? And if so, shouldn't they represent a larger fraction of our national output?Exactly. Innovation is the key.

The simple answer is no. We live in a knowledge economy, an information economy, an innovation economy. Because of our ideas, we can have all the food we can possibly eat--and more than we should eat--with only 2 percent of the labor force employed in agriculture. Even with only 9 percent of our labor force in manufacturing, we remain the largest producer of manufactured goods. It is better to work smart than to work hard, and our investments in education and technology have enabled us to enjoy higher standards of living--and to live longer--than ever before.

Chrysler Sales off 34%

by Calculated Risk on 9/03/2008 03:57:00 PM

Press Release via MarketWatch: Chrysler LLC Reports August 2008 U.S. Sales

Chrysler LLC today reported total August 2008 U.S. sales of 110,235 units, down 34 percent from the same period last year.GM sales were off 20%. Toyota off 9.4%. From the WSJ: GM, Ford, Toyota Report Weak August Sales

U.S. auto sales continued their slide in August despite stepped-up incentives to buyers, highlighted by General Motors Corp.'s 20% drop and Ford Motor Co.'s 27% decline.

...

Japan's Toyota Motor Corp. ... reported a 9.4% decline in August sales.

As in June and July, Honda Motor Co. was a bright spot, with its U.S. sales declining just 7.3% ...

Fed's Beige Book: Economic Activity Slow

by Calculated Risk on 9/03/2008 02:30:00 PM

From the Fed Beige Book:

Reports from the twelve Federal Reserve Districts indicate that the pace of economic activity has been slow in most Districts. Many described business conditions as "weak," "soft," or "subdued."And on Real Estate:

...

Consumer spending was reported to be slow in most Districts, with purchasing concentrated on necessary items and retrenchment in discretionary spending.

Residential real estate conditions weakened or remained soft in all Districts, except Kansas City, which reported a modest increase in sales since the last report.A pretty weak report.

...

Commercial real estate activity moved down or remained weak in all Districts except Dallas.