by Calculated Risk on 8/27/2008 09:40:00 AM

Wednesday, August 27, 2008

FDIC Increases Loss Estimate for IndyMac

From Reuters: FDIC says IndyMac failure costlier than expected

The Federal Deposit Insurance Corp said on Tuesday it now expects IndyMac's failure in July to cost its insurance fund $8.9 billion, compared with the previous expected range of $4 billion to $8 billion.This is quite an increase in the expected loss.

...

Diane Ellis, the FDIC's associate director of financial-risk management, said IndyMac's expected hit to the fund blossomed because analysts have had more time to value IndyMac's assets and have assigned some higher loss rates.

Also, some deposits that the FDIC originally thought were uninsured are actually insured, Ellis said.

Some Plan

by Anonymous on 8/27/2008 08:29:00 AM

Dean Baker is highly annoyed by this line from Sheila Bair, as paraphrased by the New York Times:

The swelling tide of toxic home loans is proving to be even more worrisome than initially feared, Ms. Bair said.I think I've become more or less impervious to the hoocoodanode line, given too much exposure to it. I'm actually rather more blown away by the following quote:

She is struggling to clean up the mess and forestall home foreclosures with a plan to ease loan terms for hard-pressed homeowners.People ask me all the time something like this: "So, well, you think you're so smart, what's your solution for this problem?" And I tell people all the time, "There is no 'solution' to this problem. That's why it sucks so bad. That's why you don't let problems like this develop in the first place."

“It is going to be slog to work though this, but there is no easy way to do it,” Ms. Bair said about her plan during an interview in her office here. “We haven’t seen the trough of the credit cycle yet.”

I might even be willing to grant Bair an occasional indulgence in hoocoodanode if she'd just quit trying to pretend that she--or anyone else--can "work through this" in any meaningful way, "this" being the deflation of the housing bubble. I mean, one does what one can. I don't object to anyone making lemonade where the opportunity presents itself, nor do I fault anyone for taking whatever limited measures are possible to ease the pain for individual homeowners. But anyone who continues to pretend that "preventing foreclosure" is a "solution" to the problem here is lying to the public. Trying to "prevent" the results of a home-mortgage credit bubble isn't "solving" anything, it's keeping your finger in the dike and waiting for a miracle.

Besides the fact that Sheila Bair is still, as far as I know, the head of the FDIC, not the National Homeowners Association. Her concern for homeowners is nice and everything, but she's supposed to be regulating banks and thrifts. The FDIC needs to be worrying about "foreclosing" on some troubled banks, not pretending that troubled banks can avoid the consequences of a bubble by refusing to let mortgage loans fail.

We Get Mail

by Anonymous on 8/27/2008 07:21:00 AM

It used to be, whenever I had no inspiration for a blog post at all, I could just go slumming over at one of the broker boards and find something for edification of my readers or just comic relief. These days, it seems, I just have to check my email.

Yesterday I was being asked to help write a hardship letter, which was certainly an understandable request since I have offered advice on that subject in the past and so, you might say, I asked for it. Today I am being asked to do somebody else's homework. I publish the following in its entirety with the exception of the name:

hiSince I have examined my conscience and discovered that I have no scruples about subjecting people who ask me to do their story problems for them to a high degree of risk, I hereby invite the Calculated Risk commenting community to assist. Please explain to "A" here how to derive a VaR of 419. You may of course assume as many can openers--or as much convexity--as you need to. Remember that your answer could be going into A's frat house files, so please approach this with the appropriate degree of seriousness.

i saw in your blog that you are a risk expert.

for university purpose i am supposed to calculate a value at risk of an option.

the optoin is a call option on 1000 shares for one year with strike price at 10$. the delta of this option is 1.5, meaning that if the share price goes up by 1bp the option by 1.5bp

daily volatilty is 12cents, the value at risk for 95% is supposed to be 419. how do i get this? oh it is delta normal

thank you

A____

Tuesday, August 26, 2008

Olive Garden Warns

by Calculated Risk on 8/26/2008 08:27:00 PM

Another casual dining chain feels the pinch ...

From the WSJ: Olive Garden's Parent Warns on Profit

A surprise warning on earnings by Darden Restaurants Inc. suggests that sit-down restaurants will continue struggling through the fall after a dismal summer.Just more evidence that the 2nd half recovery has been cancelled.

...

"The environment was weaker this quarter than it's been for a while," Darden Chief Executive Clarence Otis said in an interview. Asked how the overall industry will perform during the next few months, he said "We're not counting on it getting a whole lot better."

In coming months, restaurants are expected to close more locations, build fewer new ones, offer more low-priced promotions and tighten worker scheduling to contain labor costs ...

emphasis added

Contest: Predict New Home Sales

by Calculated Risk on 8/26/2008 06:10:00 PM

UPDATE: I remain very bearish on housing, especially on prices and existing home sales.

***bumped*** have fun!

There is wide disagreement in the comments on how much further New Home Sales will decline. Last year we had a contest on existing home sales (winners here). Note: although I didn't enter the contest, I predicted, at the end of 2006, existing home sales of 5.6 to 5.8 million for 2007.

So, for fun, here is a little contest to predict New Home sales for 2008 and 2009.

First, a little help ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows annual New Home sales vs. New Home sales through July for each year.

Through July this year, there have been 327K New Homes sold (subject to revision). For the last 45 years, the median number of new homes sold through July is 61%, so 2008 is currently on pace for 534K homes sold.

The rate of sales (SAAR) has been declining all year, just like the previous two years, so I think sales will be below the normal ratio of July to Annual sales, and I'm going to pick 515K for 2008.

For 2009, I think sales will be about the same as 2008 or pick up slightly. My guess is a slight pick-up in sales or about 540K in 2009 (although I will not change my contest pick, I might change my view).

If you'd like to enter, please just post a comment in a format like this:

CR's picks:

2008: 515K

2009: 540K

Best of luck to all (winners each year will be announced in February of the following year - before all revisions).

Carteret Mortgage to Close

by Calculated Risk on 8/26/2008 05:31:00 PM

From Bloomberg: Carteret Mortgage Will Close, Chief Executive Says (hat tip Dave)

Carteret Mortgage Corp., a closely held mortgage broker that originated more than $4 billion in loans in 2006, plans to close in several weeks, said Chief Executive Officer Eric Weinstein.Just a reminder that Mortgage brokers are still going out of business. Carteret had more than 4,500 employees at one time, and operated in 45 states.

``We ran out of money,'' Weinstein, 49, said in an interview today. ``We're not technically out of business yet, but we're winding it down and trying to do the best we can for everybody.''

Weinstein said the ... company has about 800 employees ...

FDIC Problem Bank List Increases

by Calculated Risk on 8/26/2008 03:42:00 PM

UPDATE: FDIC Press Release: Insured Bank and Thrift Earnings Fell to $5.0 Billion in the Second Quarter

From Bloomberg: FDIC Says Banks on `Problem List' Rose 30% in Second Quarter

The U.S. Federal Deposit Insurance Corp. said its ``problem list'' of banks increased [to] 117 ``problem'' banks as of June 30, up from 90 in the first quarter and the highest since mid 2003 ... FDIC-insured lenders reported net income of $4.96 billion, down from $36.8 billion in the same quarter a year ago.Also CNBC reported that the FDIC insurance fund ratio fell to 1.01%, below the 1.15% required by law. So the FDIC will probably have to raise rates for insurance.

``Quite frankly, the results were pretty dismal, and we don't see a return to the high earnings levels of previous years any time soon,'' FDIC Chairman Sheila Bair said at a news conference.

...

Lenders on the FDIC's ``problem list'' had assets of $78 billion at the end of the second quarter, an increase from the $26.3 billion at the end of the first quarter, the agency said.

Case Shiller: Real National Prices Decline to Q4 2002 Levels

by Calculated Risk on 8/26/2008 11:40:00 AM

The first graph compares real and nominal Case-Shiller Home Prices through Q2 2008 (real is current index adjusted using CPI less Shelter). Click on graph for larger image in new window.

Click on graph for larger image in new window.

In real terms, the Case-Shiller National Home price index is off 25% from the peak. Real prices are now back to the Q4 2002 level (nominal prices are back to mid-2004).

With existing home inventory at record levels, and tighter lending standards, prices will probably continue to decline over the next few years - perhaps another 15% to 25% in real terms on a national basis. The second graph compares the year-over-year (YoY) change in real Case-Shiller house prices with the YoY change in Personal Consumption Expenditure (PCE) from the BEA GDP report.

The second graph compares the year-over-year (YoY) change in real Case-Shiller house prices with the YoY change in Personal Consumption Expenditure (PCE) from the BEA GDP report.

There is some correlation, but there are other factors that impact PCE such as changes in income, consumer borrowing and other assets prices (like the stock market). I still think YoY PCE growth will turn negative in the coming quarters, but so far PCE has held up pretty well given the sharp decline in real house prices.

July New Home Sales

by Calculated Risk on 8/26/2008 10:00:00 AM

According to the Census Bureau report, New Home Sales in July were at a seasonally adjusted annual rate of 515 thousand. Sales for June were revised down to 503 thousand.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

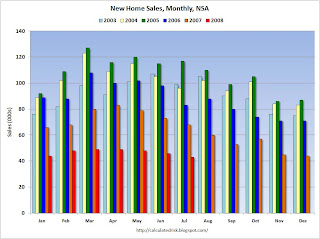

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for July since the recession of '91. (NSA, 43 thousand new homes were sold in July 2008, the same as in July '91).

As the graph indicates, there was no spring selling season in 2008.

********************************  The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff. Sales of new one-family houses in July 2008 were at a seasonally adjusted annual rate of 515,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.4 percent (±11.6%)* above the revised June rate of 503,000, but is 35.3 percent (±7.3%) below the July 2007estimate of 796,000.

And one more long term graph - this one for New Home Months of Supply. "Months of supply" is at 10.1 months.

"Months of supply" is at 10.1 months.

Note that this doesn't include cancellations, but that was true for the earlier periods too. The months of supply is down from the peak of 11.2 months in March 2008.

The all time high for Months of Supply was 11.6 months in April 1980.

And on inventory:

The seasonally adjusted estimate of new houses for sale at the end of July was 416,000. This represents a supply of 10.1months at the current sales rate.

Inventory numbers from the Census Bureau do not include cancellations and cancellations are falling, but still near record levels. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

I now expect that 2008 will be the peak of the inventory cycle (in terms of months of supply) and could be the bottom of the sales cycle for new home sales. But the news is still grim for the home builders. Usually new home sales rebound fairly quickly following a bottom (see the 2nd graph above), but this time I expect a slow recovery because of the overhang of existing homes for sales (especially distressed properties). If the recession is more severe than I currently expect, new home sales might fall even further.

Looking forward, I'm much more pessimistic about existing home sales, and existing home prices, than new home sales.

More Advice on Hardship Letters

by Anonymous on 8/26/2008 09:43:00 AM

Loyal readers, or just people with too little mental stimulation in their lives, will remember a post I did way back in May on how not to write a hardship letter. In that post, I suggested, quite explicitly, that anyone writing a hardship letter to a servicer in aid of getting a workout proposal approved should:

*Focus on establishing that a workout is necessary, meaning establishing that you cannot afford to pay your mortgage under its original terms.

*Not focus on explaining why all this happened or seeking sympathy, since it doesn't matter why it happened--servicers do workouts when they make sense for the servicer, not when they are moved to feel sorry for anyone.

*Write in your own voice about your own situation, rather than relying on elegant form letters or rhetorical flourishes. Nobody cares about polish; they care about your verified monthly budget and the terms of the workout you are requesting. If the math is correct there, you can misspell most of the words and dangle all the modifiers and you'll still get your workout. This is not an essay contest.

*Present a proposal that will work. You may be the most sympathetic borrower ever to cross Loss Mit's desk, but if your proposal does not work out, it is not a "workout" (did you wonder where that term came from?).

So what did I find in my inbox this morning?

The following missive:Hi, Tanta.

As I am committed to the notion that names should be changed to protect the unwary, I left that part off. We shall refer to my correspondent as Ms. Short Sale. Sure, I could have written the following to Ms. Short Sale personally, but apparently the public service message I was trying to get across in the original post didn't work for everyone, so as a public service I shall repeat some of it again in hopes that it will take this time.

I read your article "How Not to Write a Hardship Letter" on the website Calculated risk. I am finding writing my hardship letter to be the most challenging part of my short-sale package. I can't help but laugh at that things that have led up to my hardship, and it seems that one thing leads to another and it's just a big can of messy worms that I've somehow opened and can't get cleaned up to figure out how to articulate concisely in the letter in a way that will make an impact in my favor to get the short-sale approved.

I need help, and am wondering if I could hire you to hear out my story and write mine? If not, do you have any advice on how I can go about finding someone to write it?

Thank you very much!!!

Dear Ms. Short Sale:

I am happy to hear that you are in one of those hardship situations that is actually pretty amusing. Most people who write to Loss Mit aren't exactly chuckling.

However, if you had read my post with a bit more attention, you would have noticed that my advice is not to spend any time "explaining" your circumstances. Whether they are funny or not. I pointed out that your purpose in a hardship letter is to 1) document the financial necessity of a workout and 2) propose a plan that will work. You are caught up in the idea of making an "impact" on your servicer. You need to ditch that idea right now. This is not a resume cover letter. It is not a sales pitch. It is not an essay-writing contest. It is a business letter that needs to be concise and to the point.

Sadly, you could not possibly afford what I would charge to hear your story and write your letter. If you could, I suspect you could bring cash to closing to settle your loan for the full amount due. Since you are requesting a short sale, I must believe that you don't have that kind of money sitting around.

I will, however, once again give you some good free advice. It may not be what you want to hear, but this is a chronic problem in the advice-giving gig.

You want the servicer to approve a short sale. You therefore need to establish that:

1. You cannot afford to keep the home or you must move for some good reason and cannot afford to pay the difference between the sales proceeds and your loan amount. It does not really matter at this point why this situation has arisen. You simply need to document that it is what it is. Explain what your income is, what your expenses are, what savings you have, why you have to move, etc. If you are asking for a short sale because you have to move, simply say that. For example, say that you have been relocated by your employer or you need to move closer to family in order to reduce your expenses. This is not an invitation to open your funny can of worms and tell everyone all about your situation that is totally unique and high-impact and all that. If you cannot document that you cannot afford to repay your loan--and you don't actually have to move--then I don't know what business you have asking for a short sale.

2. Provide evidence that you have attempted to list your property at a price at least equal to your indebtedness, and that this has not been possible. Your realtor can supply your listing history, a price opinion, or other information to establish that you will have to list the property for less than the loan amount in order to get it sold. If you are not working with a realtor, your servicer will question how hard you are trying to sell this house.

3. Propose a sales price that you wish the servicer to approve. No one will give you "blanket approval" for a short sale as such; you will only get approved to sell at a specified minimum price. The servicer will not suggest this price; you have to. That is how negotiations work in this case. Do not expect the servicer to put any cards on the table until you have. They are not that stupid. Your requested price should be backed up by a broker price opinion. The servicer will probably get one, too, if it takes your request seriously.

4. If you already have an offer on your property, as long as this offer came out of some good-faith effort to market the property for as high a price as the market will bear, then request approval to execute a sales contract at this price. If you have never listed the property and the offer is from your brother-in-law, you are not likely to be approved. You need to demonstrate that you have made all practical attempts to fetch the highest sales price possible, in order to protect the lender's interests as much as possible. If you cannot demonstrate that, there's no point in writing your letter at all.

5. Explain clearly that either you have no subordinate liens on this property, or you are seeking approval from any second mortgage holder for the short sale as well. If the existence of a second lien is part of your "can of worms," you will have to address that. If you want your first mortgage servicer to negotiate on your behalf with your second mortgage servicer, you will need to say so. You will need to bear in mind that this negotiation may not be very successful if you are simply asking the second lien lender to wipe out its entire loan with no cost to you. Offering to pay the second lien lender a couple thousand dollars for its trouble--or to sign a note so that you can pay a couple thousand in installments--would be appropriate. If you cannot possibly afford to contribute anything to the junior lien, your first mortgage servicer may have to do that in order to get the deal approved. This will increase the first servicer's loss. You will have to take that into account when you propose your sales price.

6. If you must use exclamation points, one is sufficient.

It is possible that you are having trouble drafting your letter simply because you are not clear about the purpose of the letter. The above advice should help you get clear on that. It is also possible, of course, that you are having trouble drafting your letter because what you want doesn't actually make much sense or because you haven't actually tried listing your property or talking to a realtor and are just trying to float a trial balloon to see what the servicer will do. You want to be very honest with yourself if this is the case, because you won't get anywhere with your servicer if it is. As I said in my original post, you are writing a business letter with a business proposition in it, and you need to demonstrate that you are doing your part to resolve this situation.

Sadly, the world is full of people who would take your money to write a letter for you. You are actually probably quite fortunate that you asked someone who won't. If you have money to spend, get yourself an appraisal or a broker price opinion from a reputable RE agent who has experience with short sales. Once you have that, you'll know how to write your letter because you will have the basis for a concrete proposal. And that is all the "impact" you need to have on your lender.

Good luck and best wishes,

Tanta