by Calculated Risk on 8/26/2008 06:10:00 PM

Tuesday, August 26, 2008

Contest: Predict New Home Sales

UPDATE: I remain very bearish on housing, especially on prices and existing home sales.

***bumped*** have fun!

There is wide disagreement in the comments on how much further New Home Sales will decline. Last year we had a contest on existing home sales (winners here). Note: although I didn't enter the contest, I predicted, at the end of 2006, existing home sales of 5.6 to 5.8 million for 2007.

So, for fun, here is a little contest to predict New Home sales for 2008 and 2009.

First, a little help ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows annual New Home sales vs. New Home sales through July for each year.

Through July this year, there have been 327K New Homes sold (subject to revision). For the last 45 years, the median number of new homes sold through July is 61%, so 2008 is currently on pace for 534K homes sold.

The rate of sales (SAAR) has been declining all year, just like the previous two years, so I think sales will be below the normal ratio of July to Annual sales, and I'm going to pick 515K for 2008.

For 2009, I think sales will be about the same as 2008 or pick up slightly. My guess is a slight pick-up in sales or about 540K in 2009 (although I will not change my contest pick, I might change my view).

If you'd like to enter, please just post a comment in a format like this:

CR's picks:

2008: 515K

2009: 540K

Best of luck to all (winners each year will be announced in February of the following year - before all revisions).

Carteret Mortgage to Close

by Calculated Risk on 8/26/2008 05:31:00 PM

From Bloomberg: Carteret Mortgage Will Close, Chief Executive Says (hat tip Dave)

Carteret Mortgage Corp., a closely held mortgage broker that originated more than $4 billion in loans in 2006, plans to close in several weeks, said Chief Executive Officer Eric Weinstein.Just a reminder that Mortgage brokers are still going out of business. Carteret had more than 4,500 employees at one time, and operated in 45 states.

``We ran out of money,'' Weinstein, 49, said in an interview today. ``We're not technically out of business yet, but we're winding it down and trying to do the best we can for everybody.''

Weinstein said the ... company has about 800 employees ...

FDIC Problem Bank List Increases

by Calculated Risk on 8/26/2008 03:42:00 PM

UPDATE: FDIC Press Release: Insured Bank and Thrift Earnings Fell to $5.0 Billion in the Second Quarter

From Bloomberg: FDIC Says Banks on `Problem List' Rose 30% in Second Quarter

The U.S. Federal Deposit Insurance Corp. said its ``problem list'' of banks increased [to] 117 ``problem'' banks as of June 30, up from 90 in the first quarter and the highest since mid 2003 ... FDIC-insured lenders reported net income of $4.96 billion, down from $36.8 billion in the same quarter a year ago.Also CNBC reported that the FDIC insurance fund ratio fell to 1.01%, below the 1.15% required by law. So the FDIC will probably have to raise rates for insurance.

``Quite frankly, the results were pretty dismal, and we don't see a return to the high earnings levels of previous years any time soon,'' FDIC Chairman Sheila Bair said at a news conference.

...

Lenders on the FDIC's ``problem list'' had assets of $78 billion at the end of the second quarter, an increase from the $26.3 billion at the end of the first quarter, the agency said.

Case Shiller: Real National Prices Decline to Q4 2002 Levels

by Calculated Risk on 8/26/2008 11:40:00 AM

The first graph compares real and nominal Case-Shiller Home Prices through Q2 2008 (real is current index adjusted using CPI less Shelter). Click on graph for larger image in new window.

Click on graph for larger image in new window.

In real terms, the Case-Shiller National Home price index is off 25% from the peak. Real prices are now back to the Q4 2002 level (nominal prices are back to mid-2004).

With existing home inventory at record levels, and tighter lending standards, prices will probably continue to decline over the next few years - perhaps another 15% to 25% in real terms on a national basis. The second graph compares the year-over-year (YoY) change in real Case-Shiller house prices with the YoY change in Personal Consumption Expenditure (PCE) from the BEA GDP report.

The second graph compares the year-over-year (YoY) change in real Case-Shiller house prices with the YoY change in Personal Consumption Expenditure (PCE) from the BEA GDP report.

There is some correlation, but there are other factors that impact PCE such as changes in income, consumer borrowing and other assets prices (like the stock market). I still think YoY PCE growth will turn negative in the coming quarters, but so far PCE has held up pretty well given the sharp decline in real house prices.

July New Home Sales

by Calculated Risk on 8/26/2008 10:00:00 AM

According to the Census Bureau report, New Home Sales in July were at a seasonally adjusted annual rate of 515 thousand. Sales for June were revised down to 503 thousand.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

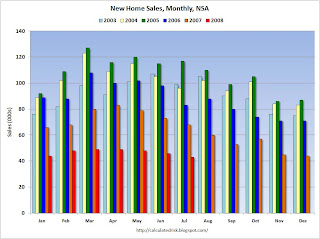

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for July since the recession of '91. (NSA, 43 thousand new homes were sold in July 2008, the same as in July '91).

As the graph indicates, there was no spring selling season in 2008.

********************************  The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff. Sales of new one-family houses in July 2008 were at a seasonally adjusted annual rate of 515,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.4 percent (±11.6%)* above the revised June rate of 503,000, but is 35.3 percent (±7.3%) below the July 2007estimate of 796,000.

And one more long term graph - this one for New Home Months of Supply. "Months of supply" is at 10.1 months.

"Months of supply" is at 10.1 months.

Note that this doesn't include cancellations, but that was true for the earlier periods too. The months of supply is down from the peak of 11.2 months in March 2008.

The all time high for Months of Supply was 11.6 months in April 1980.

And on inventory:

The seasonally adjusted estimate of new houses for sale at the end of July was 416,000. This represents a supply of 10.1months at the current sales rate.

Inventory numbers from the Census Bureau do not include cancellations and cancellations are falling, but still near record levels. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

I now expect that 2008 will be the peak of the inventory cycle (in terms of months of supply) and could be the bottom of the sales cycle for new home sales. But the news is still grim for the home builders. Usually new home sales rebound fairly quickly following a bottom (see the 2nd graph above), but this time I expect a slow recovery because of the overhang of existing homes for sales (especially distressed properties). If the recession is more severe than I currently expect, new home sales might fall even further.

Looking forward, I'm much more pessimistic about existing home sales, and existing home prices, than new home sales.

More Advice on Hardship Letters

by Anonymous on 8/26/2008 09:43:00 AM

Loyal readers, or just people with too little mental stimulation in their lives, will remember a post I did way back in May on how not to write a hardship letter. In that post, I suggested, quite explicitly, that anyone writing a hardship letter to a servicer in aid of getting a workout proposal approved should:

*Focus on establishing that a workout is necessary, meaning establishing that you cannot afford to pay your mortgage under its original terms.

*Not focus on explaining why all this happened or seeking sympathy, since it doesn't matter why it happened--servicers do workouts when they make sense for the servicer, not when they are moved to feel sorry for anyone.

*Write in your own voice about your own situation, rather than relying on elegant form letters or rhetorical flourishes. Nobody cares about polish; they care about your verified monthly budget and the terms of the workout you are requesting. If the math is correct there, you can misspell most of the words and dangle all the modifiers and you'll still get your workout. This is not an essay contest.

*Present a proposal that will work. You may be the most sympathetic borrower ever to cross Loss Mit's desk, but if your proposal does not work out, it is not a "workout" (did you wonder where that term came from?).

So what did I find in my inbox this morning?

The following missive:Hi, Tanta.

As I am committed to the notion that names should be changed to protect the unwary, I left that part off. We shall refer to my correspondent as Ms. Short Sale. Sure, I could have written the following to Ms. Short Sale personally, but apparently the public service message I was trying to get across in the original post didn't work for everyone, so as a public service I shall repeat some of it again in hopes that it will take this time.

I read your article "How Not to Write a Hardship Letter" on the website Calculated risk. I am finding writing my hardship letter to be the most challenging part of my short-sale package. I can't help but laugh at that things that have led up to my hardship, and it seems that one thing leads to another and it's just a big can of messy worms that I've somehow opened and can't get cleaned up to figure out how to articulate concisely in the letter in a way that will make an impact in my favor to get the short-sale approved.

I need help, and am wondering if I could hire you to hear out my story and write mine? If not, do you have any advice on how I can go about finding someone to write it?

Thank you very much!!!

Dear Ms. Short Sale:

I am happy to hear that you are in one of those hardship situations that is actually pretty amusing. Most people who write to Loss Mit aren't exactly chuckling.

However, if you had read my post with a bit more attention, you would have noticed that my advice is not to spend any time "explaining" your circumstances. Whether they are funny or not. I pointed out that your purpose in a hardship letter is to 1) document the financial necessity of a workout and 2) propose a plan that will work. You are caught up in the idea of making an "impact" on your servicer. You need to ditch that idea right now. This is not a resume cover letter. It is not a sales pitch. It is not an essay-writing contest. It is a business letter that needs to be concise and to the point.

Sadly, you could not possibly afford what I would charge to hear your story and write your letter. If you could, I suspect you could bring cash to closing to settle your loan for the full amount due. Since you are requesting a short sale, I must believe that you don't have that kind of money sitting around.

I will, however, once again give you some good free advice. It may not be what you want to hear, but this is a chronic problem in the advice-giving gig.

You want the servicer to approve a short sale. You therefore need to establish that:

1. You cannot afford to keep the home or you must move for some good reason and cannot afford to pay the difference between the sales proceeds and your loan amount. It does not really matter at this point why this situation has arisen. You simply need to document that it is what it is. Explain what your income is, what your expenses are, what savings you have, why you have to move, etc. If you are asking for a short sale because you have to move, simply say that. For example, say that you have been relocated by your employer or you need to move closer to family in order to reduce your expenses. This is not an invitation to open your funny can of worms and tell everyone all about your situation that is totally unique and high-impact and all that. If you cannot document that you cannot afford to repay your loan--and you don't actually have to move--then I don't know what business you have asking for a short sale.

2. Provide evidence that you have attempted to list your property at a price at least equal to your indebtedness, and that this has not been possible. Your realtor can supply your listing history, a price opinion, or other information to establish that you will have to list the property for less than the loan amount in order to get it sold. If you are not working with a realtor, your servicer will question how hard you are trying to sell this house.

3. Propose a sales price that you wish the servicer to approve. No one will give you "blanket approval" for a short sale as such; you will only get approved to sell at a specified minimum price. The servicer will not suggest this price; you have to. That is how negotiations work in this case. Do not expect the servicer to put any cards on the table until you have. They are not that stupid. Your requested price should be backed up by a broker price opinion. The servicer will probably get one, too, if it takes your request seriously.

4. If you already have an offer on your property, as long as this offer came out of some good-faith effort to market the property for as high a price as the market will bear, then request approval to execute a sales contract at this price. If you have never listed the property and the offer is from your brother-in-law, you are not likely to be approved. You need to demonstrate that you have made all practical attempts to fetch the highest sales price possible, in order to protect the lender's interests as much as possible. If you cannot demonstrate that, there's no point in writing your letter at all.

5. Explain clearly that either you have no subordinate liens on this property, or you are seeking approval from any second mortgage holder for the short sale as well. If the existence of a second lien is part of your "can of worms," you will have to address that. If you want your first mortgage servicer to negotiate on your behalf with your second mortgage servicer, you will need to say so. You will need to bear in mind that this negotiation may not be very successful if you are simply asking the second lien lender to wipe out its entire loan with no cost to you. Offering to pay the second lien lender a couple thousand dollars for its trouble--or to sign a note so that you can pay a couple thousand in installments--would be appropriate. If you cannot possibly afford to contribute anything to the junior lien, your first mortgage servicer may have to do that in order to get the deal approved. This will increase the first servicer's loss. You will have to take that into account when you propose your sales price.

6. If you must use exclamation points, one is sufficient.

It is possible that you are having trouble drafting your letter simply because you are not clear about the purpose of the letter. The above advice should help you get clear on that. It is also possible, of course, that you are having trouble drafting your letter because what you want doesn't actually make much sense or because you haven't actually tried listing your property or talking to a realtor and are just trying to float a trial balloon to see what the servicer will do. You want to be very honest with yourself if this is the case, because you won't get anywhere with your servicer if it is. As I said in my original post, you are writing a business letter with a business proposition in it, and you need to demonstrate that you are doing your part to resolve this situation.

Sadly, the world is full of people who would take your money to write a letter for you. You are actually probably quite fortunate that you asked someone who won't. If you have money to spend, get yourself an appraisal or a broker price opinion from a reputable RE agent who has experience with short sales. Once you have that, you'll know how to write your letter because you will have the basis for a concrete proposal. And that is all the "impact" you need to have on your lender.

Good luck and best wishes,

Tanta

Case-Shiller: House Prices Decline in June

by Calculated Risk on 8/26/2008 09:24:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for June this morning. This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national house price index - I'll have more on that later. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index was off 7.0% annual rate in June (from May), and is off 20.3% from the peak.

The Composite 20 index was off 5.9% annual rate in June (from May), and is off 18.8% from the peak.

Prices are still falling, but the rate of monthly price declines has slowed a little. Some of this may be seasonal, and prices will probably continue to decline for some time. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 17.0% over the last year.

The Composite 20 is off 15.9% over the last year.

More on prices later ... including Q2 data, selected cities, and real prices.

Monday, August 25, 2008

WSJ: Regulators Step Up Bank Actions

by Calculated Risk on 8/25/2008 10:07:00 PM

From the WSJ: Regulators Step Up Bank Actions

The Federal Reserve and the Office of the Comptroller of the Currency, two of the nation's primary bank regulators, have issued more ... memorandums of understanding so far this year than they did for all of 2007 ...It will be interesting to see how many banks are on double secret probation!

The depth of problems in the banking sector will become clearer Tuesday when the Federal Deposit Insurance Corp. updates its list of "problem" institutions. ...

Take A Load Off Fannie

by Calculated Risk on 8/25/2008 06:05:00 PM

"The story of Fannie Mae, as narrated by The Band"

WaMu Offering 5% 12 Month CDs

by Calculated Risk on 8/25/2008 03:50:00 PM

From WaMu: a 5% 12 month FDIC insured CD. (hat tip Anthony)

Just saying ... WaMu is paying 5% in an environment when few banks are paying over 4.25% and most banks are under 4% for one year CD.