by Calculated Risk on 8/21/2008 05:47:00 PM

Thursday, August 21, 2008

2008 Jackson Hole Economic Symposium

The 2007 Jackson Hole symposium featured several excellent papers on housing. See here for a list.

I'd recommend Shiller: Understanding Recent Trends in House Prices and Home Ownership

and Leamer: Housing is the Business Cycle

The subject last year was "Housing, Housing Finance, and Monetary Policy".

This year the subject is "Maintaining stability in a changing financial system."

I'm looking for a list of speakers. Anyone have an agenda for the symposium?

S&P: Home-Loan Delinquencies Keep Rising

by Calculated Risk on 8/21/2008 03:26:00 PM

Dow Jones reports (no link yet): Most Home-Loan Delinquencies Kept Rising In July

S&P said as of the July distribution date, delinquencies on subprime deals ... for 2006 and 2007 ... were up 2% to 7% compared with June.Also Housing Wire reports on the Clayton InFront numbers for July: Subprime Delinquencies Surge in July

For jumbo loans ... delinquency rates were up 5.6% to 13% from June, with the biggest increase from the 2006 vintage. Delinquency rates also increased for Alt-A deals, led by those originating in 2007.

An early look at subprime RMBS performance in July, courtesy of Clayton Fixed Income Services, Inc., suggests that a recent lull in subprime delinquencies may be coming to an end. The percentage of subprime borrowers 60 or more days in arrears at the end of last month surged for both the 2006 and 2007 vintages, up nearly 7 and 11 percent compared to June, respectively.And on Alt-A:

...

Part of the reason, sources told HW Thursday morning, is a that a large volume of repayment plans put into place earlier this year for troubled subprime borrowers are now failing ...

Alt-A delinquencies continued to worsen in July as well. The 2005 vintage — which should be seasoned by now — saw delinquencies jump an eye-opening 29 percent to 9.72 percent of remaining loans in the vintage ...

Borrowing Trouble: Merrill Lynch on Housing

by Calculated Risk on 8/21/2008 11:25:00 AM

Merrill Lynch released a research note earlier this week: Wall-to-wall homes. This piece was widely quoted, and - as bearish as I am on housing - I believe this analysis is incorrect.

Starting with the 3rd paragraph:

"Single starts dropped to 641k in July, the lowest since January 1991, but even this is well ahead of the pace of sales."Yes and no. It is correct that starts of one unit structures declined to 641K (SAAR) in July according to the Census Bureau. However it is a mistake to compare one unit starts directly with new home sales. The main problem is one unit starts include homes built for or directly by owners. The quarterly data from the Census Bureau mostly resolves this problem, and the quarterly data shows that starts are now running below new home sales - so inventory of new homes is declining (Note: this needs to be adjusted for cancellations too, but even then new home inventory is declining sharply).

More Merrill:

"Given our expectation for sales to decline by 1% in July to 411k units, we expect months’ supply to drop to 9.4 months from 10.4 in June."I think Merrill meant they expect new home inventory to decline to 411K units in July or about 3% (from 426K SA in June). That would put the months of supply in July near Merrill's estimate of 9.4 months - a sharp decline from the recent high of 11.2 months in March 2008.

This takes us to Merrill's first paragraph:

"[H]ome building needs to contract by another 30% ... and stay in that range through at least the end of 2009 in order to get months’ supply down, in our view."This begs the question: down to what? Merrill just argued (correctly in my view) that months of supply will probably decline in July, but in this statement they are arguing that starts need to fall another 30% to get months of supply down. Really?

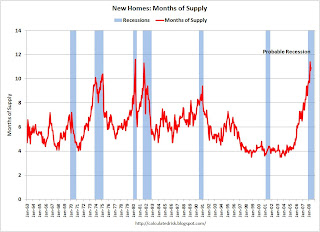

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the months of supply metric over the last 45 years. During the boom, the months of supply was around 4, but in more normal markets, the months of supply is usually around 5 to 6.

At the current rate of starts (single family, built for sale) and new home sales, the months of supply will probably decline to the low 8s by the end of 2008. That is about half way to a normal market! Yes, new home sales will probably decline a little further because of tighter lending standards, but starts will probably fall further too (based on permits) - so the bottom line is I expect inventory and months of supply to continue to decline for the rest of 2008.

The biggest problem for home builders is the huge overhang of existing homes for sale, especially distressed properties. This will keep a lid on new home sales for some time - so there won't be much of a rebound in sales, and the housing correction will probably look like an "L" (sharp drop and then flat). But, it is clear that the new home inventory correction is already under way.

And a final excerpt from Merrill:

"Housing completions remained elevated at 1035k in July (791k singles and 244k multi units), which will not help the supply situation ..."This is just confusing. Completions are important for looking at residential construction employment, but they are not as useful for supply. This is because most homes are sold early in the process, before they are started or early in the construction process. Starts are better for analyzing supply - or completions with a six month lag (time to build a home), and once again, you can't compare starts (or completions) directly to sales because many homes are not "built for sale".

I remain bearish on housing in general, and there is no question there are many negatives for the housing market. I expect prices to fall for some time in the bubble markets because prices are still too high relative to incomes and rents, and because of the huge overhang of inventory, especially REOs and other distressed properties. There are also serious problems building in the Alt-A market, see Tanta's Subprime and Alt-A: The End of One Crisis and the Beginning of Another and Reset Vs. Recast, Or Why Charts Don't Match. And there are well publicized problems with Fannie and Freddie, and other lenders are still tightening standards.

But we don't need to borrow trouble. Single family starts (built for sale) have fallen enough that new home inventory and months of supply is now declining.

FDIC Mod Plan: Welcome to the Real World

by Anonymous on 8/21/2008 10:48:00 AM

I'm going to go out on a limb here and suggest that the FDIC's plan for modifying IndyMac loans is, overall, a great thing. I am glad it is happening and I truly look forward to snickering over the results.

Housing Wire has a post up this morning encapsulating the main angry responses to the FDIC's plan. Plus one response voting for the "No Big Deal" option, which I think is really the wisest one (I'm sure it comes from an industry insider):

If the FDIC follows its stated plan, which is to maximize loan value or recovery value, a good chunk of these mods won’t go through anyway, despite the press given to it. The FDIC will find out what every other servicer already knows: for one thing, the majority of borrowers will simply ignore the offer. For another, those that do step up will give credible proof that they cannot afford their homes unless the FDIC were to undercut home value by 40 or 50 percent from current levels. And the FDIC didn’t say it was going to modify blindly here, so this is not a big deal.The fact is that Sheila Bair has spent a lot of time and energy in the last year or so castigating mortgage servicers for not doing enough to modify loans and prevent foreclosures. So now, being the proud owner of the former IndyMac Bank, Bair has a great opportunity to show the rest of us how it's done.

And so what innovative plan did the FDIC think up that has so far eluded every other mortgage servicer out there?

The goal of this streamlined loan modification program is to achieve improved value for IndyMac Federal by turning troubled loans into performing loans and, thereby, avoiding unnecessary and costly foreclosures. Accomplishing this goal will reduce the costs to the FDIC of the failure of IndyMac Bank and provide improved returns to investors in securitized mortgages.Translation: the FDIC has discovered no magic way to get around securitization rules or the basic calculus of maximizing recoveries to the investor (that is, doing a mod only when it is "less loss" to the investor compared to foreclosure). They will, however, "work to expedite" this process. Because of course no one else has tried that yet.

Some mortgages serviced by IndyMac Federal are subject to additional contractual terms governing loan modifications. While additional steps are necessary to comply with those contracts, IndyMac Federal will work to expedite approvals for modifications to help eligible homeowners keep their homes.

IndyMac Federal will only make modification offers to borrowers where doing so will achieve an improved value for IndyMac Federal or for investors in securitized or whole loans. Modification offers will be provided consistent with agreements governing servicing for loans serviced by IndyMac Federal for others. The modification program does not guarantee a modification offer for IndyMac Federal borrowers.

Oh, but the FDIC's program is "streamlined," you see. What does that mean?

Once a borrower has provided financial information to an IndyMac Federal customer service representative, IndyMac Federal will evaluate whether a loan modification may be available and, if so, provide a proposed offer to the borrower by mail.This is a whole lot faster than the way servicers have been doing mods, you see, because the FDIC goes ahead and draws up the modification agreement based on "stated" income information given by the borrower. Then the mod is mailed out, and all the borrower has to do is sign it, write a check, and, um, finally provide the documentation of the income used to qualify for the mod. If it turns out there are some, um, issues with that, then the FDIC will, um, do something else. Does this mean that the FDIC risks wasting a bunch of time and energy drawing up modification agreements that it will be unable to accept because when it finally sees those income docs, it realizes that the borrowers still don't qualify? Well, yeah. But the borrowers won't be made to wait weeks and weeks for a mod offer, unlike with those lousy private mortgage servicers. The actual ratio of successfully executed mods might be more or less the same, but nobody had to spend three weeks listening to hold music.

Once a borrower has received a proposed modification offer, all it takes for them to bring their mortgage current and qualify for a final modified mortgage is to

1. sign and return the enclosed Modification Agreement along with a check for their modified monthly mortgage payment and

2. provide verification of their income to confirm that they qualify for the proposed modification.

The borrower must then continue to make timely payments at the modified monthly payment amount and comply with all other terms of their mortgage agreements. If the borrower’s verified income information demonstrates that they do not qualify for the proposed modification, IndyMac Federal will contact them to discuss alternatives that may help them keep their home.

Do I know where the FDIC is going to get the staff to do all this lickety-split? No. But you see, the FDIC wants to do mods, unlike those lousy private mortgage servicers who just don't care and are evil. As an empirical test of the belief that attitude trumps experience and headcount, this is a public service.

So I think everyone should just quit griping and let the FDIC rip on this one. Since they've promised to use the "maximize value" test here, if they actually manage to get more successful mods done than anyone else has, they will have minimized losses to the FDIC and private investors and we can all congratulate them for that. If, as I fully expect, they don't do any better at making a silk purse out of a sow's ear than anyone else can, maybe Sheila Bair will quit pontificating about a subject that remains a lot harder than she thinks it is. That, too, we could all get behind.

Philly Fed: "Manufacturing sector remains weak"

by Calculated Risk on 8/21/2008 10:30:00 AM

Here is the Philadelphia Fed Index for August activity released today: Business Outlook Survey.

The region's manufacturing sector remains weak, according to firms polled for the August Business Outlook Survey. Indexes for general activity, new orders, shipments, and employment were all negative again this month, although slightly higher than in July. Price pressures remain but were slightly less widespread compared to recent months.Here are a couple key point:

...

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from -16.3 in July to -12.7 this month. Despite the improvement, the index has now been negative for nine consecutive months ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index vs. recessions for the last 40 years. There were a few times the index was this low without a recession - so the reading today doesn't mean the economy is in recession. However it is very likely ...

More Fannie and Freddie

by Calculated Risk on 8/21/2008 09:46:00 AM

"FNM and FRE should just have a new single consolidated ticker: FUBAR"From the WSJ: Fannie, Freddie Fears Stifle Stocks

Reader BR

Investors are increasingly concerned about the possibility of a federal bailout that could wipe out holders of the companies' common equity. The uncertainty swirling around the government-sponsored enterprises also may complicate the companies' efforts to win new financing to buy mortgages. Freddie and Fannie have been forced to pay higher yields to investors in recent debt offerings.To me, it seems that bond market participants are trying to force Paulson's hand. That is why Freddie and Fannie have had to pay more in recent debt offerings.

If Fannie and Freddie stumble, it could further cripple the U.S. housing market, a troubling scenario for banks and brokers already struggling under the weight of soured mortgage investments.

My initial reaction to the rescue plan was: "It seems the plan is bad for equity holders, but good for debt holders ... and potentially bad for taxpayers.". That still seems right. I'm not sure what the equity holders expected.

From Bloomberg: Paulson's Fannie-Freddie `Bazooka' Shakes Investors

The powers Paulson won from Congress last month enabling a government rescue of Freddie Mac and Fannie Mae -- authority he likened to a weapon whose mere existence made it unlikely it would have to be fired -- may end up making a bailout more likely, say analysts and investors.

...

``The common shareholders will probably be completely wiped out,'' Paul Miller, an analyst at FBR Capital Markets, said in a Bloomberg Television interview. ``Preferred will also see a lot of pain. But that is up in the air because a lot of banks own the preferred. You put a lot of banks in trouble if you just wipe out the preferred also.''

Wednesday, August 20, 2008

Report: Toyota Cuts 2009 Sales Forecast

by Calculated Risk on 8/20/2008 10:50:00 PM

From MarketWatch: Toyota to cut 2009 sales forecast to 9.8 million units

Toyota Motor Corp. plans to reduce its 2009 sales forecast to 9.8 million vehicles from the 10.4 million it projected earlier, reflecting a weakening demand for automobiles in world's major economies ...This is more than a U.S. slowdown; this suggests the economic slowdown is widespread.

FDIC: On Uninsured Deposts

by Calculated Risk on 8/20/2008 05:12:00 PM

When IndyMac failed, a frequent question was: Why is the FDIC paying 50% to uninsured depositors when the taxpayers are going to lose billions?

From the FDIC on IndyMac:

Based on preliminary analysis, the estimated cost of the resolution to the Deposit Insurance Fund is between $4 and $8 billion.and yet (from the same release):

The FDIC will pay uninsured depositors an advance dividend equal to 50 percent of the uninsured amount.The answer (hat tip Rick) is that the FDIC and the uninsured depositors are sort of partners after the bank fails.

From the FDIC:

When an insured institution fails, creditors of the institution have a set priority of claims, similar to priority in bankruptcies. There are two classes of claimants, secured and unsecured. Secured claims are paid in full up to the value of the pledged collateral (principal and interest to date of closure) but no post-closing investment losses are paid. Unsecured claimants are paid in the following order: administrative claims, deposit liabilities, general creditors, subordinated obligations and finally, shareholders. In a typical failure the FDIC is appointed receiver of the bank and provides coverage for insured depositors. After paying or covering insured depositors, the FDIC as insurer is subrogated for the depositors' claims and receives dividends from the proceeds of the sale of assets along with uninsured depositors. Over the closing weekend the FDIC either sells the whole bank, parts of the bank or decides to pay off the insured depositors and liquidate the assets of the bank.Although there are complications, especially if money is owed the Federal Home Loan Bank (FHLB), are is a simple example of how I think it works:

emphasis added

Say a bank has $18 billion in insured deposits and $2 billion in uninsured deposits. When the bank fails, the FDIC pays off the insured depositors and starts to liquidate the assets of the bank. At this point, I'd think of the FDIC and the uninsured depositors as partners in the liquidation. The FDIC put up 90%, the depositors 10%.

For every billion collected from the liquidation of assets, the FDIC would receive $900 million in dividends, and the uninsured depositors $100 million. If the FDIC was confident that the assets would bring in at least $10 billion, they could pay an advance dividend to the uninsured depositors of 50%.

There are many complications, but I think this is generally how this process works.

Cliff Diving: Fannie and Freddie

by Calculated Risk on 8/20/2008 03:59:00 PM

Fannie and Freddie were the story of the day. Here are the most recent quotes:

FNM 4.47 off 1.54 (25.62%)

FRE 3.23 off 0.94 (22.54%)

From Bloomberg: Fannie, Freddie Slump on Concern Bailout Is Likely

Fannie Mae and Freddie Mac tumbled in New York trading to the lowest levels since at least 1990 as speculation increased that the U.S. Treasury will bail out the mortgage-finance companies, wiping out shareholders.It seems like market participants are trying to force Paulson's hand.

...

Freddie paid its highest yields over U.S. Treasuries on record in a debt sale yesterday amid concern that credit losses are depleting the capital of the beleaguered mortgage-finance companies.

Fannie and Freddie have $223 billion of bonds due by the end of the quarter and their success in rolling over that debt may determine whether they can avoid a federal bailout. Fannie has about $120 billion of debt maturing through Sept. 30, while Freddie has $103 billion ...

Architectural Billing Index: "Business Levels Continue to Worsen"

by Calculated Risk on 8/20/2008 02:31:00 PM

From the American Institute of Architects: Architecture Billings Index Continues in Negative Territory Click on graph for larger image in new window.

Click on graph for larger image in new window.

Despite having its highest score since January, the Architecture Billings Index (ABI) continues to point to difficult conditions for the nonresidential construction market. There have been six consecutive months with negative scores, indicating that business levels at U.S architecture firms continue to worsen. As a leading economic indicator of construction activity, the ABI shows an approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the July ABI rating was 46.8, up slightly from the 46.1 mark in June (any score above 50 indicates an increase in billings). The inquiries for new projects score was 54.6.The key here is that the index fell off a cliff in early 2008, and that there is "an approximate nine to twelve month lag time between architecture billings and construction spending". We should expect weaker non-residential structure investment in the second half of 2008 and throughout 2009.

“Financing for new projects continues to be a problem,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “Many projects are being reconsidered due to construction cost increases. And while there are a good number of projects still in the queue, owners are taking longer to proceed to the next phase of the design process.”

emphasis added