by Calculated Risk on 8/20/2008 02:03:00 PM

Wednesday, August 20, 2008

FDIC: Loan Modification Program for Distressed Indymac Mortgage Loans

From the FDIC: Loan Modification Program for Distressed Indymac Mortgage Loans. A couple of excerpts:

What loans are eligible?This seems to provide an incentive for IndyMac borrowers to stop making their mortgage payments until they are "seriously delinquent or in default". Then the borrower - especially Alt-A borrowers who stated their income originally - would apply for a loan modification based on their actual income. The borrower could then receive an interest rate reduction and principal forbearance.

The streamlined loan modifications will be available for most borrowers who have a first mortgage owned or securitized and serviced by IndyMac Federal where the borrower is seriously delinquent or in default. IndyMac Federal also will seek to work with others who are unable to pay their mortgages due to payment resets or changes in the borrowers’ repayment capacities. This streamlined approach applies only to mortgages for the borrower’s primary residence. As with all modifications, borrowers will have to demonstrate their financial hardship by documenting their income.

...

What modification options will be available to borrowers?

Under the IndyMac Federal program, eligible mortgages would be modified into sustainable mortgages permanently capped at the current Freddie Mac survey rate for conforming mortgages (now about 6.5%). Modifications would be designed to achieve sustainable payments at a 38 percent debt-to-income (DTI) ratio of principal, interest, taxes and insurance. To reach this metric for affordable payments, modifications could adopt a combination of interest rate reductions, extended amortization, and principal forbearance.

Note: I didn't see any restriction on borrowers that overstated their income originally.

Moody's: CRE Prices Continue to Decline

by Calculated Risk on 8/20/2008 12:55:00 PM

From CEP News: U.S. Commercial Real Estate Prices Down for Fourth Straight Month, Moody's Says (hat tip Michael)

Commercial real estate prices continued falling in June, according to the Moody's/REAL Commercial Property Price Indices (CPPI), which recorded a 3.3% monthly decline ... The CPPI now stands 11.8% below its peak in October 2007.Next up, a decline in new CRE investment.

...

The CPPI is based on the repeat sales of the same properties across the U.S. ...

MBA: Purchase Index Moving Lower

by Calculated Risk on 8/20/2008 10:41:00 AM

The MBA Purchase Index wasn't useful during 2007 when so many lenders were going out of business. The primary reason was the MBA surveyed lenders that accounted for about half the volume of applications, and most of the failed lenders were not included in the survey. So, even though the housing market was in free fall, the surviving lenders actually saw an uptick in applications - distorting the Purchase Index.

At that same time many borrowers started filing multiple applications too, also distorting the survey results.

However it now appears the MBA Purchase Index might be useful again.

The MBA reports that the Purchase Index decreased slightly to 314 this week. The four week moving average (removes the weekly noise) declined to 314, and is now at the lowest level since 2002. Because of the changes to the index, we can't compare directly to 2002, but clearly the index is weak. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the MBA Purchase Index and four week moving average.

Although we can't compare directly to earlier periods because of the changes in the index, this does suggest that sales of homes are continuing to decline.

Zelman on Bank Write-Offs for Residential Construction and Land

by Calculated Risk on 8/20/2008 09:30:00 AM

This WSJ article has some interesting stats and comments: Wachovia Unloads Troubled Loans

Over the next five years, U.S. banks could write off as bad debt between $65 billion and $165 billion loans tied to residential construction and land assets, according to research firm Zelman & Associates.The article also has data on delinquency rates:

Foresight Analytics estimates that land- and construction-loan delinquencies reached 8% in the second quarter for commercial banks, up from 7.1% in the first quarter and 2.3% in the year-earlier period.The confessional will be busy.

Tuesday, August 19, 2008

Downward Pressure on Rents

by Calculated Risk on 8/19/2008 08:41:00 PM

Here are a couple of articles on apartments (hat tip Les):

From Tammy Joyner at the The Atlanta Journal-Constitution: As more share space, apartments take a hit

In these tough economic times, some metro Atlantans are bunking with family and friends, doubling up in rental apartments, homes or condos.And from Kerry Fehr-Snyder at The Arizona Republic: Apartments offering freebies, other deals

...

The anemic housing market should be a boost to Atlanta’s apartment market. But the emerging shift in living arrangements is creating an unusual set of challenges for the industry.

Leasing agents are having to contend more with the “shadow market,” an industry term that refers to the glut of unsold homes, condos and townhomes that have become rental property.

Renters can thank the struggling real-estate market and its deflated housing prices, increased foreclosure rates and depressed rents on single-family homes, condominiums and apartments. Add to that the condominium-conversion flop, which has led to condos reverting to rental apartments.Even though the homeownership rate has fallen sharply, the rental vacancy rate is still at 10.0%, just below the all time record of 10.4% in 2004.

...

With a glut of cheap rental homes on the market, apartments are facing more competition than ever and many are sitting with empty units as vacancy rates soar.

That has prompted 68 percent of apartment landlords to offer concessions worth several months of rent, [Pete TeKampke, vice president of investments for Marcus & Millichap] said.

...

During the Valleywide condo craze, 30,616 apartment units were converted or sold to investors who planned to convert them to condos, TeKampke said. By the middle of last year, 18,000 units had reverted to apartment rental units and many investors had scrapped their conversion projects.

A combination of people doubling up (happens in every recession), condo reversions, more apartment construction (the lone bright spot for housing starts), and some homeowners renting their homes instead of selling, has kept the rental vacancy rate high even while the homeownership rate has fallen.

DataQuick: California Bay Area Sales Increase, Prices Decline

by Calculated Risk on 8/19/2008 04:25:00 PM

From DataQuick: Bay Area home sales climb above last year; median price falls hard

Bay Area home sales eked out their first year-over- year gain since early 2005 last month as buyers responded to price cuts and snapped up more inland foreclosures. The median sales price dove to a 53- month low, a real estate information service reported.The median price is being distorted by the mix of homes being sold. Since most of the foreclosures have been at the low end, and the foreclosure resale market makes up 33% of all sales, the median price has fallen sharply. A better measure of price is a repeat sales index like Case-Shiller.

A total of 7,586 new and resale houses and condos sold across the nine- county Bay Area in July. That was up 5.7 percent from 7,178 in June and up 2.2 percent from 7,423 in July 2007, according to San Diego-based MDA DataQuick.

July sales were the highest for any month since June 2007 and marked the first annual sales gain for any month since January 2005. However, last month's sales still fell 22 percent short of the average July sales total since 1988, when MDA DataQuick's statistics begin, and were the second- lowest for a July since 1995.

Sales of distressed properties played a major role in most areas logging annual sales gains last month.

Foreclosure resales -- homes sold in July that had been foreclosed on in the prior 12 months -- made up 33 percent of all resales. That was up from 29.9 percent in June and 4.2 percent in July 2007. Foreclosure resales ranged from 4.6 percent of the resale market in San Francisco to 65.9 percent in Solano County.

...

"So much of today's market is driven by distress. Unless interpreted in that context, the stats give a rather distorted view of the overall market. We know one-third of the Bay Area's resales in July were homes fresh off foreclosure. Who knows how many more involved a desperate seller and a lender who accepted a short sale," said John Walsh, MDA DataQuick president.

...

[T]he Bay Area's median sales price down to $470,000 in July. That was 3.1 percent lower than $485,000 in June this year and 29.3 percent lower than the peak $665,000 median reached in July and June of 2007.

The median has not been lower than July's since March 2005, when it was $469,500.

emphasis added

CMBX Cliff Diving

by Calculated Risk on 8/19/2008 04:09:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The CMBX is a CMBS (Commercial Mortgage-Backed Securities) credit default index just like the ABX - except up is down for the CMBX indices. The CMBX is quoted as spreads, whereas ABX is quoted as bond prices. When the spreads increase - chart going up - the bond prices are going down.

Most of the CMBX indices are setting new record lows again.

This graph is the CMBX-NA-BB-4 close today.

Single Family Homes: Quarterly Data on Starts and Sales

by Calculated Risk on 8/19/2008 01:29:00 PM

It is difficult to compare monthly housing starts directly to sales. The monthly housing starts report from the Census Bureau includes apartments, owner built units and condos that are not included in the New Home sales report. However, every quarter, the Census Bureau releases Starts by Intent, and it is possible to compare "Single Family Starts, Built for Sale" to New Home sales. Click on graph for larger image in new window.

Click on graph for larger image in new window.

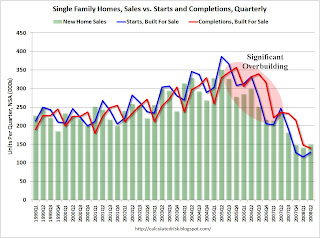

This graph compares quarterly starts of single family homes built for sale (and completions of single family homes built for sale in red) with New Home sales.

This data is not seasonally adjusted for any series. There are clear seasonal patterns for all series, and completions lag starts by about 6 months.

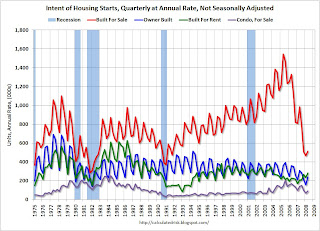

The period of significant overbuilding in recent years is highlighted. It now appears that starts and completions are running below sales. Note that most new home sales occur before a housing unit is started, so completions lag sales. The second graph shows the quarterly starts by intent at an annual rate through Q2 2008. This shows 1) Single Family starts built for sale, 2) Owner built units, 3) Units built for rent, and 4) Condos built for sale.

The second graph shows the quarterly starts by intent at an annual rate through Q2 2008. This shows 1) Single Family starts built for sale, 2) Owner built units, 3) Units built for rent, and 4) Condos built for sale.

As of Q2, Single Family starts built for sale, had rebounded slightly to 512 thousand on a non seasonally adjusted annual rate. As noted above, this level of starts is below the current level of New Home sales.

Note the minor seasonal rebound for Single family starts built for sale. There was no Spring for housing in 2008.

Also, starts for condos has fallen significantly - just slightly above the average level of the '90s.

Rental units are the lone bright spot (other than minor seasonal upswings), and it was rental units that accounted for the increase in overall starts for June (somewhat because of the changes in the NY construction code). With the rental vacancy rate at 10.0%, the rental construction will probably decline in Q3.

There is still a huge overhang of existing home inventory for sale (especially distressed inventory including short sales and REOs), and until that inventory declines significantly, starts and housing prices will remain under pressure. However this report does provide some evidence that the home builders are starting fewer homes than they are selling.

Mortgage Fraud News From Orange County, Nigeria

by Anonymous on 8/19/2008 09:02:00 AM

Here we have a detailed two-parter (part one and part two) on a sorry case of mortgage fraud from the OC Register. Dogged local cop pursues small-balance fraud case, nails crook, unveils huge regulatory failure. But . . .

*********

I have to confess to being as fascinated by the victims in this case as by the perp. Before everybody starts in on me about "blaming the victim," let me point out that yes, fraud is fraud, even when the victim is so lacking in common sense and elementary skepticism as to pass into Darwin Award territory. I do not excuse anyone who preys on the vulnerable, the foolish, or the ignorant.

Nonetheless, it's hard to prevent certain kinds of fraud against homeowners if you do not deal with the extent to which they "work" only because the victim colludes with them, up to and beyond the point where they become so outlandish as to defy belief. The case before us seems to me less a case of "mortgage fraud" than a classic confidence scam that simply takes as its incidental starting point a dubious mortgage offer. In other words, it's like a Nigerian scam email. From part one:Nobody believed in Osborn more than Steve Ryancarz.

My sense is that there will always be someone--a customer of his business who is allowed to rack up a $1.2MM receivable, a mortgage broker, somebody else--able and willing to part Mr. Ryancarz from his money. I am all in favor of prosecuting fraud and tightening up mortgage broker regulations, but I suspect we're kidding ourselves if we think there is any kind of workable law or regulation that will assure that the Ryancarzes of the world are protected from scammers.

Ryancarz, 62, an Ohio businessman, wanted to refinance his 5,000-square-foot luxury house on a 5-acre lot to get some cash out for his refrigeration company. A major customer had gone belly up, owing Ryancarz's firm $1.2 million, he said.

Ryancarz wasn't just trying to get a loan for himself. He also was trying to do a favor for a friend, Kim Koslovic.

Ryancarz was engaged to Koslovic's mother. Koslovic, 38, and her husband had filed for Chapter 13 bankruptcy protection while he was unable to work because of an injury. In order to keep her modest, $107,000 house, she needed to refinance, but she couldn't find a lender in Ohio who would take a chance on her.

Ryancarz said he found Osborn online in 2003 through HomeLoanAdvisors.com. Ryancarz, who had good credit, figured that by bundling a loan for himself with one for Koslovic, Osborn might find a lender willing to take both.

"No matter how much money I had, I always help people out," Ryancarz said. "That's just how I am. Everybody needs a break. What I could do to help them – could help them get to a point where they turn their lives around, it's worth it."

There were warning signs, even early on. The first loan Osborn delivered for Ryancarz was bungled, resulting in much higher payments than Ryancarz had expected. Osborn blamed the problem on his boss.

Ryancarz said he called Osborn's boss, but the man wouldn't speak to him, so Ryancarz believed Osborn.

"It just snowballed after that," Ryancarz said.

Osborn said he would help Ryancarz sue the first lender, but he wanted money up front to pay for the lawsuit. Ryancarz sent thousands in fees.

Here's how much sway Osborn was able to exert over his victim: Ryancarz sent Osborn money to bail him out of jail when he was arrested for driving without a license. He also sent Osborn money to pay off a purported fine from the Department of Real Estate, according to records Ryancarz provided.

Ryancarz even sent $5,000 to pay for Osborn, his girlfriend and their children to take mini-vacations at the Loews Coronado Bay Resort.

"He said, 'I've done all this work for you. You owe me a favor. How about putting us up for the weekend?'" Ryancarz recalled.

Ryancarz said he believed that Osborn was working very hard trying to get loans for him and Koslovic, and if these loans didn't come through, well, that was understandable.

"I just thought they were axing the loans because of Kim's credit," he said.

Ryancarz never met Osborn in person. Over the phone, he sometimes heard Osborn use abusive language to office assistants, calling them nasty names if they made a mistake or didn't have the right paperwork.

"He was smooth to the clients, but as far as the people that done his work for him, he wasn't too kind," Ryancarz said.

To dispel any doubts about Osborn, Ryancarz would call the lenders that Osborn said he was working with.

Each time, Ryancarz said, he got confirmation.

"You gotta figure he's gotta be on the up and up. He's not going to be jeopardizing his reputation talking to these people or lying to you and saying he did," Ryancarz said. "You fall back on the sense of well, he's doing his job, it's just a little tougher than you thought it would be and blah blah blah."

Or, as Koslovic put it, "It's easy to push time away with the excuse of paperwork and glitches and technicalities, with all those words that everyone uses."

Ultimately, Ryancarz and Koslovic lost their houses.

It turned out that Ryancarz could have done a much better deed for Koslovic if he'd simply paid off her mortgage rather than trying to get her a new loan through Osborn.

Her house was worth $107,000. Ryancarz paid Osborn more than $370,000, court records show.

"I almost done it and I decided, no, that's not getting them where they want to be," Ryancarz said. "So I didn't do that. Hindsight indicates I should have."

I argued last year in this post, Unwinding the Fraud for Bubbles, that it was getting a bit difficult during the boom to tell the difference between the victimizers and the victims in a lot of cases. Now that we're deep into the horrors of the unwind, it is becoming increasingly fashionable in a lot of quarters to accept at face value many people's claims to have been nothing but innocent victims of the mortgage industry, and certainly with poster children like this Osborn character, the mortgage industry doesn't have much of a case for the defense. But some frauds just won't work without the greed, irresponsibility, or outright collusion of the mark. And not all of these cases are as blatantly clear as the Osborn-Ryancarz debacle. Reader Gary sent me this one, from Crain's New York Business: Noel, a 28-year-old math teacher from Harlem who asked that his last name not be used, always thought it would be smart to invest in real estate. So when his cousin introduced him to a mortgage broker who promised he wouldn't have to put a penny down on a $1 million piece of property in New Rochelle, he jumped at the chance. Then, the same broker told him about a home in Yonkers. Again, he didn't have to put any money down.

I agree that Noel should never have been approved for the loan. I am perfectly willing to believe that the broker misrepresented Noel's income without his knowledge. But I am not quite willing to believe that Noel did not realize that mortgage loans have to be paid back. How did he think he was going to make payments on $1.5MM in loans out of a $50,000 salary? I mean, the lender probably didn't know what Noel's actual income was, but surely Noel did. Noel is a math teacher.

Before he realized what he was getting into, Noel says, he was scammed into signing two mortgages totaling more than $1.5 million. The mortgage broker even provided a lawyer for the closing.

"I make $50,000 as a schoolteacher," he says. "There's no way I should have been approved for loans that big."

Hemmed in by monthly payments totaling more than $10,000 and bills for maintaining a third property on Long Island, Noel had no choice but to file for bankruptcy, he says. He filed without the help of a lawyer—he couldn't afford one—and he plans to walk away from the three homes and get a fresh start, this time without dreams of making it big.

"I thought real estate was a good business," he says. "But I guess it's not for me. I'm not buying property again—ever again."

Noel could be scammed because Noel bought into the idea that real estate investing is a magical kind of business unlike any other kind of business in which you can put nothing down and make no loan payments and strike it rich. This does not excuse Noel's mortgage broker. It explains Noel's mortgage broker.

Single Family Housing Starts: Lowest Since 1991

by Calculated Risk on 8/19/2008 08:30:00 AM

First, the headline number was distorted by a change in the construction code in New York City that was effective July 1, 2008. Many builders filed for permits prior to this deadline, especially for multifamily construction. This boosted both permits and starts in June, and this distortion has been partially unwound in the July numbers.

So the key is to focus on single family starts.

Single-family starts were at 641 thousand in July; the lowest level since January 1991. Single-family permits were at 584 thousand in July, suggesting starts will fall even further next month.

Also employment in residential construction tends to follow completions. Completions will follow starts lower over the next few months. Single-family completions are still at 791 thousand - well above the level of single-family starts.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The graph shows total housing starts vs. single family housing starts.

Note that the current recession on the graph is not official.

Here is the Census Bureau reports on housing Permits, Starts and Completions.

Building permits decreased:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 937,000.The declines in single family permits suggest further declines in starts next month.

This is 17.7 percent (±1.3%) below the revised June rate of 1,138,000 and is 32.4 percent (±1.5%) below the revised July 2007 estimate of 1,386,000.

Single-family authorizations in July were at a rate of 584,000; this is 5.2 percent (±1.4%) below the June figure of 616,000. Authorizations of units in buildings with five units or more were at a rate of 318,000 in July.

On housing starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 965,000. This is 11.0 percent (±9.0%) below theAnd on completions:

revised June estimate of 1,084,000 and is 29.6 percent (±5.1%) below the revised July 2007 rate of 1,371,000.

Single-family housing starts in July were at a rate of 641,000; this is 2.9 percent (±10.9%)* below the June figure of 660,000. The July rate for units in buildings with five units or more was 309,000.

Privately-owned housing completions in July were at a seasonally adjusted annual rate of 1,035,000. This is 8.7 percent (±10.0%)*Notice that single-family completions are still significantly higher than single-family starts.

below the revised June estimate of 1,134,000 and is 31.7 percent (±6.6%) below the revised July 2007 rate of 1,515,000.

Single-family housing completions in July were at a rate of 791,000; this is 7.2 percent (±9.3%)* below the June figure of 852,000. The July rate for units in buildings with five units or more was 229,000..