by Calculated Risk on 8/18/2008 09:45:00 PM

Monday, August 18, 2008

Shanghai: Gold Medal in Cliff Diving

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Shanghai SSE composite index is now below 2320, the lowest since the amazing run up started in 2006. The index is off over 60% from the peak.

This is a stunning stock market crash. Usually a stock market crash leads to less business investment, and an economic slowdown. The second graph compares the NASDAQ (as a percent from the peak) to changes in business investment in structures and software and equipment.

The second graph compares the NASDAQ (as a percent from the peak) to changes in business investment in structures and software and equipment.

This shows that business investment in both categories went negative about 3 quarters after the stock market peaked. Of course there are major differences between the U.S. and China, but I'd expect business investment to slow in China.

Leamer: U.S. Far From Recession

by Calculated Risk on 8/18/2008 06:23:00 PM

Abstract from Professor Leamer: What's a Recession, Anyway?

Monthly US data on payroll employment, civilian employment, industrial production and the unemployment rate are used to define a recession-dating algorithm that nearly perfectly reproduces the NBER official peak and trough dates. The only substantial point of disagreement is with respect to the NBER November 1973 peak. The algorithm prefers September 1974. In addition, this algorithm indicates that the data through June 2008 do not yet exceed the recession threshold, and will do so only if things get much worse.Real Time Economics blog at the WSJ has more: UCLA Professor Says U.S. Is Still Far From Recession

Leamer is a very good forecaster, and his presentation at the Jackson Hole Symposium last year is an excellent read on how housing impacts the economy: Housing is the Business Cycle. Here is an excerpt:

The temporal ordering of the spending weakness is: residential investment, consumer durables, consumer nondurables and consumer services before the recession, and then, once the recession officially commences, business spending on the short-lived assets, equipment and software, and, last, business spending on the long-lived assets, offices and factories. The ordering in the recovery is exactly the same.If we look at Professor Leamer's temporal road map for a recession, we are starting to see weakness in equipment and software investment (off 3.4% in the Q2 advance GDP report), and we can be very confident that investment in offices and other commercial real estate will decline in the 2nd half of 2008 and into 2009. This would argue that we are already in a recession.

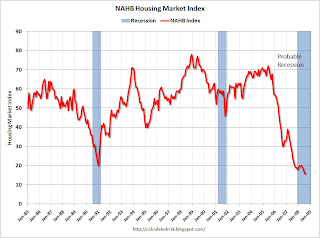

Also, Leamer is correct that housing usually leads the economy both into and out of a recession. Housing busts usually look like a "V" with a sharp decline, and a sharp recovery. This time housing will probably look like an "L" shape with little recovery for some time (until the huge overhang of inventory is reduced). We are already seeing this in the NAHB confidence report released today. And we will probably see the same pattern for single family housing starts and new home sales. No quick recovery.

So once again I disagree with Dr. Leamer: I think the economy is already in a recession (not severe), however we agree that the period of economic weakness will probably linger.

DataQuick: SoCal Home Sales Increase, Prices Decline

by Calculated Risk on 8/18/2008 03:16:00 PM

From DataQuick: Southland home sales post annual gain -- prices drop again

The number of Southern California homes sold last month edged up to its highest level in more than a year as bargain hunters swept up foreclosure properties in affordable neighborhoods, a real estate information service reported.

A total of 20,329 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 16.7 percent from 17,424 the previous month and up 13.8 percent from 17,867 for July a year ago, according to San Diego-based MDA DataQuick.

Last month's sales count was the highest since 21,856 homes were sold in March 2007, though it still fell 23 percent short of the average July sales total since 1988, when MDA DataQuick's statistics begin. From last September through June, sales for each month were at an all-time low for that particular calendar month, with the exception of April which was the next lowest. Last month's sales total was the first since September 2005 to rise above the year-ago level.

"What we're looking at is a fire sale of properties in newer affordable neighborhoods that were bought or refinanced near the price peak with lousy mortgages. What we're still not seeing is this level of distress spreading to more expensive or established neighborhoods," said John Walsh, MDA DataQuick president.

...

Foreclosure resales continue to be a dominant factor in today's Southern California market, accounting for 43.6 percent of all resales. That was up from a revised 41.8 percent in June, and up from 7.9 percent in July 2007. Foreclosure resales -- where a foreclosure had occurred at some point in the prior 12 months -- ranged from 22.2 percent of all resales in Orange County last month to 64.4 percent in Riverside County.

...

Foreclosure activity is at record levels ...

emphasis added

NAHB: Builder Confidence at Record Low

by Calculated Risk on 8/18/2008 01:20:00 PM

The NAHB reports that builder confidence was at 16 in August, unchanged from July. Usually housing bottoms look like a "V"; this one will probably look more like an "L". (this refers to activity like starts and sales, but will probably also be apparent in the confidence survey). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Current sales activity is near a record low of 16. Traffic of Prospective Buyers

is at a record low of 12.

NAHB Press Release: Builder Confidence Holds Steady In August

Anticipating positive impacts of newly enacted housing stimulus legislation, single-family home builders registered some improvement in their outlook for home sales in the next six months, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for August, released today. The overall confidence measure held even this month at 16, while the component gauging sales expectations rose two points to 25.

...

“While our overall measure of builder confidence remains at a record low at this time, it is a good sign that two out of three of the HMI’s component indexes rose in August, and this may be an indication that we are nearing the bottom of the long downswing in new-home sales,” said NAHB Chief Economist David Seiders. “Our current forecast shows stabilization of sales during the second half of this year, followed by solid recovery in 2009 and beyond.”

U.S. Banks: Higher Borrowing Costs

by Calculated Risk on 8/18/2008 09:44:00 AM

From the Financial Times: US banks scramble to refinance maturing debt (hat tip AT)

Battered US financial groups will have to refinance billions of dollars in maturing debt over the coming months, a move likely to push banks’ funding costs higher ...Higher borrowing costs for banks probably means higher lending costs for customers, negatively impacting the economy.

Mohamed El-Erian, co-chief executive of Pimco, the asset management group, said: “If banks keep borrowing at these levels, you will get a repricing of credit for the whole economy.”

...

Adding together 10 of the biggest bank borrowers, Dealogic said that maturing bonds total $27bn in August, $52bn in September, $23bn in October, $20bn in November and $86bn in December. The extent of the scramble for funds became clear last week when banks tapped central lending facilities ... US commercial banks borrowed a record daily average of $17.7bn from the Fed last week.

Lowe's: Same Store Sales decline 5.3%

by Calculated Risk on 8/18/2008 09:16:00 AM

From MarketWatch: Housing malaise eats into Lowe's net

Lowe's said while big-ticket item purchases continued to be hurt by the housing downturn, it saw relative strength in seasonal sales as homeowners restored lawns and outdoor landscaping after last year's drought in much of the country. The company said it also benefited from the stimulus checks from the U.S. government.Last quarter, Lowe's same store sales declined 8.4%. The stimulus checks probably helped some this quarter, but I expect the 2nd half of '08 will be difficult for home improvement retailers. Home Depot reports tomorrow.

...

Sales rose 2.4% to $14.5 billion as the company opened in more locations. Same-store sales, or sales at stores open at least a year, dropped 5.3%.

Sunday, August 17, 2008

Lehman: More Problems

by Calculated Risk on 8/17/2008 10:51:00 PM

A couple of articles on Lehman ...

From the WSJ: Lehman Faces Another Loss, Adding Salt To Its Wounds

With the end of the New York company's fiscal third quarter less than two weeks away, some analysts are girding for a loss of $1.8 billion or more ... [with] widely anticipated write-downs in a portfolio saddled with more than $50 billion in risky real-estate and mortgage assets ...And on some of those real estate assets, from the Financial Times: Lehman faces fight to shed real estate assets

Lehman's near-term fate depends in large part on whether it can attract buyers for the assets and securities in its commercial real estate portfolio, valued at $40bn at the end of May.In the Archstone deal, mentioned in the article, Lehman was in the riskiest position and it's very likely that their investment is now worthless.

...

Lehman's portfolio is very diverse. It consists of so-called whole loans, commercial mortgage-backed securities, risky financings such as equity bridges and individual projects.

For those interested in more details of the Archstone deal, from the NY Times (Oct 6, 2007): Deal Is Complete to Take Archstone REIT Private

And from the WSJ: Lehman's Property Bets Are Coming Back to Bite.

NY Times: Dr. Doom

by Calculated Risk on 8/17/2008 08:42:00 PM

From the Sunday NY Times magazine: Dr. Doom (a profile of Professor Nouriel Roubini) (hat tip Peter Viles, L.A. Land)

Roubini, a respected but formerly obscure academic, has become a major figure in the public debate about the economy: the seer who saw it coming.Professor Roubini may have been "obscure" to the general public, but he was very well known and respected in his field for some time.

The ’90s were an eventful time for an international economist like Roubini. Throughout the decade, one emerging economy after another was beset by crisis, beginning with Mexico’s in 1994. ... Roubini began studying these countries and soon identified what he saw as their common weaknesses. On the eve of the crises that befell them, he noticed, most had huge current-account deficits ... and they typically financed these deficits by borrowing from abroad in ways that exposed them to the national equivalent of bank runs.So far Professor Roubini has been pretty accurate and his blog is always a great read!

...

After analyzing the markets that collapsed in the ’90s, Roubini set out to determine which country’s economy would be the next to succumb to the same pressures. His surprising answer: the United States’.

FDIC Recalls the Retired

by Anonymous on 8/17/2008 08:00:00 AM

The moral of this story is, make sure to keep the interval between your banking crises short enough so that your experienced soldiers from the last one are still alive and hardy enough to travel when the next crisis starts.

Wingin' It at the IRS

by Anonymous on 8/17/2008 07:15:00 AM

I have had occasion before now to compliment Michelle Singletary's personal finance column, The Color of Money, in the Washington Post. I don't read a lot of "personal finance" stuff because, frankly, most of it is drivel. But even in a better field of competition, I think Singletary's work would stand out as a combination of no-nonsense advice and original reporting.

Today she takes on the subject of the new $7,500 tax credit for first-time homebuyers. What started out as an attempt to explain the tax credit to potential homebuyers ends up being an interesting report on the extent to which the IRS has no particular plan at this point for managing this thing.

Since this is a loan from the IRS, will the IRS be sending an annual loan statement to taxpayers?I don't exactly expect any elaborate bureaucracy like the IRS to have all its operational and procedural ducks in a row within a couple of days of the passage of this kind of "stimulus" legislation, which by definition can't exactly wait for all the details to be ironed out before passage (or it is too late to "stimulate" the market). On the other hand, the work eventually has to get done, unless the IRS is willing to promise to not penalize people who don't handle this correctly. You can't exactly make it difficult for people to know when and how much to pay you and then turn around and slap them with penalties and fines if they don't follow the rules. The IRS can tell itself it's got years to figure this out, since the first installments won't be due until the 2010 tax year for people buying this year. But that inability to handle prepayments on sale of the property is going to mess that plan up.

The details of how the IRS will collect this money or inform people have not been worked out. Smith said a line would probably be added to the standard 1040 tax form to indicate that the credit should be paid as part of your tax liability.

Can I pay off the loan early?

The IRS hasn't yet come up with a system to accommodate an early payoff. . . .

Will this be a debt that has to be settled at closing if you sell the house?

This debt isn't tied to your home but rather to you as a taxpayer. The outstanding loan will probably not be required to be paid at the closing table, Smith said. . . .

If there is not a lien on the property, how will a settlement company know the debt is due when a homeowner sells?

It probably will be up to the homeowners to inform the IRS that a sale has occurred and that they need to pay off the loan balance, Smith said.

It's this last answer that I see as an oversight nightmare for the IRS.

Let's say a homeowner sells and realizes a $7,000 profit. However, he or she still has $6,000 left on the first-time home buyer loan. This means the homeowner will have to set aside the bulk of that gain -- $6,000 -- from the sale to satisfy the tax debt, which would be due in the tax year of the sale.

If the person isn't financially disciplined and spends the money, he or she could end up with a hefty tax liability.

"We have to look at all the issues involved with this credit and figure out the best controls," Smith said.

No kidding.

If we had a dime, of course, for every story we've read lately that tells us that your average first-time homebuyer either doesn't read mortgage documents or manages to understand approximately every tenth word of them, including "the" and "and," we would be rich enough to fund a study comparing the relative comprehension on the part of the public of mortgage documents versus the tax code. If we had another dime for every story we've read about mortgage servicers making it difficult for people to prepay loans, refusing to provide clear payoff statements, fouling up servicing transfers and proofs of claim and generally making it an insurmountable challenge for people to know what they actually owe and where to send the damned payment, we would also be rich enough to buy the IRS a loan servicing platform it could manage not to use correctly, just like everyone else.

But no one is handing out dimes, so we will just have to send the IRS a cheap homemade housewarming present: a little note welcoming it to the neighborhood, Love, The Mortgage Industry.