by Calculated Risk on 8/14/2008 09:13:00 PM

Thursday, August 14, 2008

WSJ: World Economy Shows New Strain

From the WSJ: World Economy Shows New Strain

The global economy -- which had long remained resilient despite U.S. weakness -- is now slowing significantly, with Europe offering the latest evidence of trouble.The decoupling argument - that the rest of the world would remain healthy while the U.S. was in recession - is proving wrong. Exports have been a bright spot for the U.S. and the key is that any slowdown in exports is offset by falling oil prices. Interesting times.

On Thursday, the European Union's statistics agency said gross domestic product in the euro zone contracted 0.2% in the second quarter, the equivalent of a 0.8% annual rate of decline. It marked the first time since the early 1990s that GDP has fallen overall in the 15 countries that use the euro.

...

For the U.S., economic sluggishness abroad is both blessing and curse. Weak growth is tempering the torrid rise in prices of commodities such as oil, copper and corn ... But weaker foreign economies also undercut one of the few remaining bright spots in the U.S. economy: exports.

Note: I'll be out hiking the next two days. Tanta and Paul Jackson of Housing Wire will be handling the posts. Best to all.

On Greenspan, What Krugman Says

by Calculated Risk on 8/14/2008 06:25:00 PM

From Paul Krugman: Greenspan: not a mensch Click on graph for larger image in new window.

Click on graph for larger image in new window.

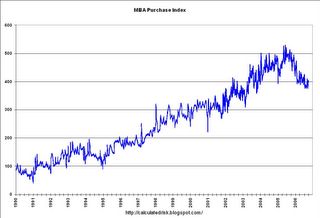

This graph shows the MBA Purchase Index as of when Greenspan claimed this was flattening out. On a long term scale, I didn't see any significant "flattening out".

And how could Greenspan think this was "the most important series"? That was absurd and is probably why Greenspan was consistently wrong on housing.

Wachovia's BluePoint Insurance Files BK

by Calculated Risk on 8/14/2008 05:36:00 PM

From Bloomberg: Wachovia's BluePoint Insurance Unit Files Bankruptcy

Wachovia Corp.'s BluePoint Re Ltd. unit, which insures structured finance and municipal transactions, filed for bankruptcy protection, citing defaults on securitized mortgages.This is a small reinsurer, but it's interesting that Wachovia has decided not to provide additional funding.

S&P: Junk Bond Default Rate Increases

by Calculated Risk on 8/14/2008 03:13:00 PM

From Reuters: Global junk bond default rate rises to 1.79 pct-S&P

The U.S. default rate rose to 2.37 percent in July from 1.92 percent in June ...S&P is forecasting the U.S. default rate will to 4.9 percent over the next year.

Altig: What the Fed did during macroblog's vacation

by Calculated Risk on 8/14/2008 01:03:00 PM

Dr. David Altig, now director of research at the Federal Reserve Bank of Atlanta, returns to blogging. Welcome back!

From Macroblog: What the Fed did during macroblog's vacation

To state the very obvious, it has been quite an eventful twelve months since I last committed fingers to laptop. I might well have titled this post "Four Fed programs that did not exist one year ago." Over the four months from December to March, the Federal Reserve Board of Governors and the Federal Open Market Committee, or FOMC, introduced an alphabet soup of new lending programs to address acute stress in financial markets, some of which required the invocation of emergency powers based on "unusual and exigent circumstances."Much more at the link.

I know that in some quarters—maybe the one where you reside—all this activity had a certain frenetic, whack-a-mole feel to it. But I think it appropriate to view the Fed's actions over this period as what I believe them to be: A measured and logical sequence of steps to address very specific liquidity distress in financial markets.

On a personal note, when I first started blogging (a long time ago!), Dr. Altig gave Calculated Risk some wider exposure, especially on housing. Altig wasn't as pessimistic as me at the time, but he was very open to the possibilities of a major housing correction. Thanks Dave and Welcome Back!

S&P Downgrades Downey Financial

by Calculated Risk on 8/14/2008 11:06:00 AM

From S&P: Downey Financial Corp. Downgraded To 'B+/C'; Still On CreditWatch Negative

... deposit outflows in July and the recent drawing down of most of its FHLB lines have reduced Downey's liquidity and available lines of credit. ... We are concerned that depositors in Downey's footprint (think California and Arizona) have a heightened sensitivity to potential bank failures after recent experience and publicity (think IndyMac), which increases the possibility that Downey could experience further material deposit outflows.S&P also suggests withdrawals could "overwhelm Downey's liquidity" and possibly trigger an "adverse regulatory action" (FDIC?). S&P is also concerned that further NPA growth may "overwhelm" Downey.

Housing: Huge Shadow Inventory?

by Calculated Risk on 8/14/2008 10:08:00 AM

Sacramento Real Estate Statistics has some excerpts from a Deutsche Bank research report by research analyst Nishu Sood: "An inventory overhang builds in the shadows" (no link)

Peter Viles at the LA Times covers the story: Bank sees huge "shadow inventory" of foreclosed houses

This is interesting data, and worth reading the excerpts. In the report, Sood argues: "MLS listings do not fully reflect distressed inventory." and then he provides some tables (see the above link).

But it's not as bad as it first seems. I've chatted with Max at Sacramento Real Estate Statistics (thanks Max!), and in the notes, Nishu Sood writes:

Source: Realtytrac, Housingtracker, Deutsche BankSo these are not all REOs; in fact most of these homes are probably in the foreclosure process.

Note: Foreclosure inventory includes pre-foreclosures, auctions and REO. 2/3 of pre-foreclosures are assumed to become foreclosures.

Yes, Sood makes a good point - there are many homes not listed that are probably future foreclosures. And I'd add, there are many homeowners waiting for a "better market" to list their homes. So inventory will probably stay elevated for some time.

But, just to be clear, Sood's stats are not unlisted REOs held by some bank in the shadows.

Consumer Prices Increase Sharply

by Calculated Risk on 8/14/2008 08:57:00 AM

From MarketWatch: Consumer prices jump 0.8% in July

U.S. consumer prices jumped a greater-than-expected 0.8% in July, marked by big increases in energy, food, clothing and cigarettes, the Labor Department reported Thursday.

The core consumer price index - which excludes volatile food and energy prices - rose 0.3% for the second straight month.

...

Consumer prices are up 5.6% in the past year, the biggest year-over-year increase since January 1991. The CPI has surged at a 10.6% annualized rate in the past three months.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year change in inflation, both CPI and Core inflation (less food and energy). Using CPI, inflation is at the highest level in 17 years.

Also note that CPI has persistently been running ahead of Core for most of the last 5+ years. This is mostly due to the huge increase in energy prices (and food too).

The good news is inflation should slow as energy prices fall (if they continue to decline). And inflation helps with real house prices too!

RealtyTrac: Foreclosures Up 55% from July 2007

by Calculated Risk on 8/14/2008 02:15:00 AM

From AP: US foreclosure filings surge 55 percent

The article quotes RealtyTrac as reporting more than 272,000 homeowners received foreclosure notices in July, up 55% from July 2007. And up 8% from June 2008.

Also, according to RealtyTrac, there are more than 750 thousand foreclosed homes for sale in the U.S., or 16.7% of the 4.49 million total U.S. homes for sale.

Wednesday, August 13, 2008

Hummer Dealer Out, Smart Dealer In

by Calculated Risk on 8/13/2008 10:06:00 PM

Check out this photo sequence from the Shnapster: Hummer Dealer Out, Smart Dealer In. Times change quickly ...