by Calculated Risk on 8/14/2008 08:57:00 AM

Thursday, August 14, 2008

Consumer Prices Increase Sharply

From MarketWatch: Consumer prices jump 0.8% in July

U.S. consumer prices jumped a greater-than-expected 0.8% in July, marked by big increases in energy, food, clothing and cigarettes, the Labor Department reported Thursday.

The core consumer price index - which excludes volatile food and energy prices - rose 0.3% for the second straight month.

...

Consumer prices are up 5.6% in the past year, the biggest year-over-year increase since January 1991. The CPI has surged at a 10.6% annualized rate in the past three months.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year change in inflation, both CPI and Core inflation (less food and energy). Using CPI, inflation is at the highest level in 17 years.

Also note that CPI has persistently been running ahead of Core for most of the last 5+ years. This is mostly due to the huge increase in energy prices (and food too).

The good news is inflation should slow as energy prices fall (if they continue to decline). And inflation helps with real house prices too!

RealtyTrac: Foreclosures Up 55% from July 2007

by Calculated Risk on 8/14/2008 02:15:00 AM

From AP: US foreclosure filings surge 55 percent

The article quotes RealtyTrac as reporting more than 272,000 homeowners received foreclosure notices in July, up 55% from July 2007. And up 8% from June 2008.

Also, according to RealtyTrac, there are more than 750 thousand foreclosed homes for sale in the U.S., or 16.7% of the 4.49 million total U.S. homes for sale.

Wednesday, August 13, 2008

Hummer Dealer Out, Smart Dealer In

by Calculated Risk on 8/13/2008 10:06:00 PM

Check out this photo sequence from the Shnapster: Hummer Dealer Out, Smart Dealer In. Times change quickly ...

Homebuilder Cautions Buyers on Foreclosed Properties

by Calculated Risk on 8/13/2008 04:54:00 PM

From Andrew Galvin at the O.C. Register Mortgage Insider: Homebuilder warns foreclosure shoppers

“A foreclosure may appear to offer the best deal on a home, but there are numerous hidden costs,” [ John Laing Homes, an Irvine-based builder] said in a press release. “A foreclosed house is sold ‘as-is.’ At times there will be a lot of time and skill involved to undertake major renovations as well as financial costs, which should be considered if you value your leisure time.”Do you think they are feeling the pain from all the distressed properties for sale?

1,300 Foreclosures Per Day in California

by Calculated Risk on 8/13/2008 02:12:00 PM

It seems like just yesterday we passed the 1,000 per day mark, but that was way back in April.

From Peter Viles at the LA Times: Estimate: 1,300 foreclosures every business day in California

Banks and lenders have now foreclosed on $100 billion worth of California homes over the past two years, and are foreclosing at the rate of 1,300 houses every business day, according to a new report from ForeclosureRadar.com.Note that the decline in defaults is related to changes at Countrywide.

The report, covering foreclosure activity in California in July, notes that new mortgage defaults are declining, but foreclosures are continuing to rise sharply. "It is clear that far fewer homeowners are finding a way out of foreclosure," the company reports.

The pace of foreclosures in California -- 1,300 every business day -- has more than tripled from the year-ago rate of 415 per day, ForeclosureRadar estimates.

U.S. Miles Driven Declines 4.7% from June 2007

by Calculated Risk on 8/13/2008 01:04:00 PM

Please don't miss Tanta's Reset Vs. Recast, Or Why Charts Don't Match

More demand destruction for oil ...

From the DOT: American Driving Reaches Eighth Month of Steady Decline

New data released today by the U.S. Department of Transportation show that, since last November, Americans have driven 53.2 billion miles less than they did over the same period a year earlier – topping the 1970s’ total decline of 49.3 billion miles.

...

Americans drove 4.7 percent less, or 12.2 billion miles fewer, in June 2008 than June 2007. The decline is most evident in rural travel, which has fallen by 4 percent – compared to the 1.2 percent decline in urban miles traveled – since the trend began last November.

Click on graph for larger image in new window.

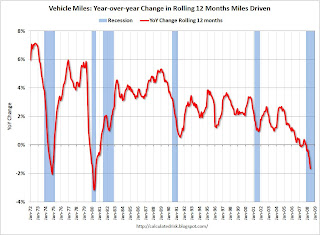

Click on graph for larger image in new window.This graph shows the YoY change in the rolling 12 month total miles driven. The rolling 12 months total is off 1.7% compared to a year ago, and with the June 2008 vs June 2007 change off 4.7%, this will probably fall significantly more.

The decline in miles driven is similar to the two oil crisis of the '70s.

Of course oil prices are falling (up a little today), and this will lead to lower gasoline prices and probably a few more miles driven.

Countrywide Option ARMs Deteriorate

by Calculated Risk on 8/13/2008 10:41:00 AM

From Reuters: Countrywide option ARM home loans deteriorate more (hat tip Brian and Branden)

Countrywide Financial Corp said thousands of borrowers with $25.4 billion in option adjustable-rate mortgages (ARMs) owe almost as much as their homes are worth ...Here is the CFC 10-Q filed with the SEC.

Another sign of borrower distress: One in eight is at least 90 days late on payments.

As of June 30, the typical borrower owed 95 percent of the value of his home, up from 76 percent when the loan was made ...

Seventy-two percent of borrowers were making less than full interest payments, and 12.4 percent were at least 90 days delinquent.

Click on table for larger image in new window.

Click on table for larger image in new window.This is the Option ARM table from the CFC 10-Q. Notice that 83% of loans were stated income.

From Reuters:

"People still don't understand what a catastrophe this is," said Christopher Whalen, senior vice president and managing director at Institutional Risk Analytics of Torrance, California. "The guys who are really on the hook are Bank of America shareholders."I think it's the CFC bondholders who are "on the hook" since BofA hasn't guaranteed the CFC debt.

Real Retail Sales

by Calculated Risk on 8/13/2008 09:21:00 AM

From the WSJ: Retail Sales Fall on Soft Auto Demand

Retail sales decreased by 0.1%, the Commerce Department said Wednesday. ... The last time sales fell was in February, when demand tumbled 0.5%.This graph shows the year-over-year change in nominal and real retail sales since 1993.

Pulling down overall retail sales were U.S. sales of automobiles and parts, which plunged 2.4% in July, Wednesday's data showed. June sales fell 2.1%. ...Sales of all other retailers excluding auto and parts dealers rose in July by 0.4%

Click on graph for larger image in new window.

Click on graph for larger image in new window.To calculate the real change, the monthly PCE price index from the BEA was used (July PCE prices were estimated based on the increases for the last 3 months).

Although the Census Bureau reported that nominal retail sales increased 2.7% year-over-year (retail and food services increased 2.6%), real retail sales declined slightly (on a YoY basis).

Despite the stimulus checks, YoY real retail sales have remained negative all year.

My How Time Flies

by Anonymous on 8/13/2008 08:17:00 AM

The Washington Post has a lengthy article up this morning on bank failures:

First the borrowers. Now the banks.Um, did we like take a Rip Van Winkle nap in late 2006 and just now wake up? As I recall the last two years, it was first the borrowers, then all the wacky securities, then the GSEs, then the banks.

Federal and state regulators have closed eight banks this year, four since the start of July, as rising borrower defaults on residential and commercial real estate loans start to push some lenders into default, too.

In fact, as I recall things, we were once pretty much encouraged not to worry too much about the banks, because the storyline was that all the risky lending involved selling and securitizing loans, not stuffin' them on the old balance sheet. Here's a blast from the past, which I fondly remember as the day the NYT editorial board first learned about this thing called securitization. From September of 2006:

The housing boom would never have lasted as long as it did if mortgage lenders had to worry about being paid back in full. But instead of relying on borrowers to repay, most lenders quickly sell the loans, generating cash to make more mortgages.Back in 2006, the fashionable thing to say was that if banks had only held their loans rather than securitizing them, they would have controlled credit risk better because they had skin in the game.

For the past few years, the most voracious loan buyers have been private investment banks, followed by government-sponsored housing agencies, like Fannie Mae. The buyers carve up the loans into mortgage-backed securities — complex i.o.u.’s with various terms, yields and levels of risk. They then sell the securities to investors the world over, at breathtaking profit. The investors earn relatively high returns as homeowners repay their mortgages.

I guess it was a bit more complicated than that.

Reset Vs. Recast, Or Why Charts Don't Match

by Anonymous on 8/13/2008 07:52:00 AM

My post yesterday featuring some rate reset charts from Clayton prompted a good deal of concern in the comments regarding the issue of Option ARMs and the differences between the Clayton chart and some others that have been published lately. Reader Greg kindly emailed me copies of two charts on Option ARMs that have been published in the WSJ and Business Week recently, with a request that I comment on the apparent differences between and among these charts in terms of the timing of "reset" problems.

As far as I'm concerned, a large part of the confusion here is that our friends in the media are not very careful about using the terms "reset" and "recast" consistently, like us UberNerds do. Take this chart from Business Week:

The chart title says "Reset Schedule," but the legends make it clear that what you have here is actually a "Recast Schedule." No wonder people are encouraged to use these terms interchangeably.

This chart from the Wall Street Journal doesn't use the term "reset" at all, which is good since it clearly explains that it is talking about "recast":

Do note, though, that the WSJ chart uses only "scheduled recast dates." The Business Week chart above contrasts "scheduled" recast with projected actual recast based on the rate of growth in actual negative amortization balances as of the chart date.

And, finally, we have our Clayton chart I posted yesterday that avoids the whole lingo problem by opting for the title "Loans With Rate Changes." Maybe the Clayton analysts got tired of the "reset vs. recast" confusion and just decided to go long-form. In any case, the Clayton chart, unlike the two above, includes but is not limited to Option ARMs; it is looking at the whole "Alt-A" pile which includes amortizing hybrid ARMs and lots of interest-only ARMs as well as OAs.

"Reset" refers to a rate change. "Recast" refers to a payment change.

On a normal fully-amortizing ARM, the interest rate resets on what is called the "Change Date" (five years out for a 5/1 ARM, three years out for a 3/27 ARM, each year thereafter for the 5/1 and every six months thereafter for the 3/27, etc.). The payment recasts exactly one month after the rate resets. Mortgage interest is paid in arrears, so first you reset the rate, then the following month you recast the payment. "Recast" is really just a shorter word for "reamortize": you take the new interest rate, the current balance, and the remaining term of the loan, and recalculate a new payment that will fully amortize the loan over the remaining term.

On an interest-only ARM with a rate change that happens during the interest-only period, the rate resets on the Change Date and then the interest payment is recalculated on the next payment date. I wouldn't tend to use the term "recast" here since with an IO, you aren't actually amortizing or "casting" a new payment, just adjusting the interest due given current balance and new rate. The big issue with IOs is the end of the IO period, when the payment has to be amortized over the remaining term. This date is what I would call the "recast" date of an IO. It may or may not coincide with the first interest rate reset date. Some 5/1 IOs, for example, reset and recast both at the end of five years. Some have a 10-year IO period, meaning they reset annually between years 5-10 but do not recast until year 10. If the rate resets to a higher rate in that period, the required IO payment increases, but not as much as it will when the recast hits and principal must also be repaid on a 20-year schedule.

On a typical Option ARM, the rate resets monthly beginning as early as the first month of the loan. The payment is adjusted, but not recast, annually; usually the payment increases by no more than 7.5% each year. It is that mismatch between rate reset and payment change that actually creates the potential for negative amortization; the "minimum payment" gets outstripped by the actual interest due because it increases much more slowly than the rate does.

Option ARMs do not "recast" until the sooner of 1) the loan reaching its balance cap or 2) the first "scheduled" recast date, which is usually 60 months from origination. What you see in the Business Week chart is the difference between the two: the recast projections come a lot earlier if you look at how close loans are actually getting to their balance caps, rather than just assuming they'll all recast on their five-year anniversary.

By and large, the biggest danger for Option ARMs and IO ARMs is the recast date, not the first or subsequent rate reset dates. However, for any ARM borrower who qualified at the highest possible debt-to-income ratio they could manage, any payment change, even one not quite as shocking as the recast on an OA or an IO, can tip the balance. As we are talking in this specific context about Alt-A, I for one believe that most of these loans did stretch too far in the beginning, and so even first rate resets on IOs or fully-amortizing ARMs will cause a marked increase in delinquencies in the absence of the borrower's ability to refinance at reset into a new discounted ARM, which will be the case for some time.

I hope that clears it up a bit, at least for the next week or two.