by Calculated Risk on 8/13/2008 12:35:00 AM

Wednesday, August 13, 2008

FDIC: Fewer Uninsured Deposits at IndyMac

From the Money & Co. blog at the LA Times: FDIC slashes estimate of IndyMac's uninsured deposits

John Bovenzi, who was named to head the Pasadena bank when the Federal Deposit Insurance Corp. took control of it July 11, said in a memo to the staff today that "it now appears that there were about $600 million in uninsured deposits" when the government seized the lender.Joint accounts are a common way to get around the FDIC insured limit. I'll have some more comments on this, but I think the FDIC will find this is common with failed banks, since the banks actively marketed this method of having more FDIC insurance.

That’s 40% less than the FDIC’s original $1-billion estimate.

An FDIC spokesman said the reduced figure stemmed from the agency’s work since July 11 to identify jointly held accounts, trust accounts and other ways that customers had structured their deposits to stay within FDIC insurance limits.

There are a few other items in the story.

Tuesday, August 12, 2008

Subprime and Alt-A: The End of One Crisis and the Beginning of Another

by Anonymous on 8/12/2008 05:00:00 PM

Clayton has kindly given us permission to excerpt some information from their monthly RMBS performance newsletter, InFront. Clayton's report suggests that we may have now seen the beginning of the end of the subprime meltdown, but we are only at the end of the beginning of the Alt-A wave that is following it.

According to Clayton, subprime delinquencies appear to have peaked in December of 2007, and subprime foreclosure starts may have peaked in January of 2008. The volume of foreclosures in process will remain elevated for a long time as these things work their way through lengthy foreclosure timelines, but the peak in FC starts is good news.

Unfortunately, Alt-A seems nowhere near its peak yet. Clayton's report, based on May data, indicates that both new delinquencies and foreclosure starts in Alt-A pools are still rising. Fannie Mae's recent conference call suggesting that Alt-A deteriorated even more sharply in July is yet more evidence that the Alt-A mess is still ramping up.

These two charts from Clayton, on subprime and Alt-A ARM resets, tell the same tale.

Based on remaining active loans, we are at about the peak for subprime rate resets. However, Alt-A is a different picture:

As Housing Wire reported yesterday:

When it comes to RMBS, it’s not about the sheer volume of securities issued; it’s about the credit enhancement that exists to protect investors once collateral defaults occur. And comparing Alt-A issues to subprime, it’s no contest: Alt-A is so much thinner in its padding for losses that a lower default rate could hurt investors in Alt-A deals far worse than anything we saw in subprime. The only saving grace here is reach; because Alt-A deals didn’t yield what subprime did, fewer got pulled into CDO issues.If the "subprime crisis" was about "exotic securities," the "Alt-A crisis" is going to be about bank balance sheets. And the fun is only beginning.

There are large chunks of Alt-A that didn’t get securitized, but instead were held in portfolio for the interest income benefits: and that would be your option ARMs. Which means that while mushrooming defaults may not hit RMBS investors, they will hit the loan portfolios of more than a few commercial banks.

A Few Housing Themes

by Calculated Risk on 8/12/2008 04:09:00 PM

There is some evidence that subprime defaults have peaked, but Alt-A defaults are picking up steam (Tanta will have more today). The next wave is here, and these defaults will impact house prices in the mid-to-high range.

In general – on a national basis - I think nominal house prices have probably fallen more than half way from the peak to the trough. There are some areas where prices are probably closer to the eventual nominal bottom than others; these are low end areas with high foreclosure rates and high demand for housing - or areas that saw little appreciation during the boom years. But in other areas, prices have really just begun to fall.

A bottom for new construction is very different than a bottom for existing home sales. For existing homes, the most important number is price. So the bottom for a particular area would be defined as when housing prices stop declining in that area. Historically, during housing busts, existing home prices fall for 5 to 7 years - so I'd expect to start looking for the bottom in the bubble areas in 2010 to 2012 or so.

For new construction, we have several possible measures of a bottom. These include Starts, New Home Sales, and Residential Investment (RI) as a percent of GDP. These measures will hit bottom much sooner than for prices for existing home sales, and one or more of these measures might even bottom in the 2nd half of this year. However ...

Usually, following a housing bust, new home sales pick up pretty quickly. However this time, with the huge overhang of excess housing inventory, new home sales and starts will probably not be an engine of recovery for the economy. Without a contribution from housing, I expect the economy will remain sluggish well into 2009 and the effects of the recession will linger.

These are some housing themes we will be discussing over the next few months.

Analyst Bove: "Close to Perfect Storm" for JPM

by Calculated Risk on 8/12/2008 03:37:00 PM

Update: Here is the story from Bloomberg: JPMorgan Shares Plunge on $1.5 Billion Mortgage Loss Since July (hat tip Ministry of Truth and TJ) Click on image for larger image in new window.

Click on image for larger image in new window.

Ladenburg analyst Richard Bove is being quoted (headlines only) that JP Morgan's "original concept" has "broken down". And that the issues will not be resolved until "well into 2009."

We're All Not Golfers Now

by Anonymous on 8/12/2008 12:55:00 PM

While we're on the subject of trouble at the housing high end . . . here's a report on golf club developments in the DC area from the Washington Post:

It wasn't long ago that real estate developers could build a golf course community and collect a $30,000 premium from customers who might not have even played golf, but aspired to the country club lifestyle.I suspect that means it's never going to work.

Not anymore. Projects have been put on hold or canceled because potential buyers are no longer willing to pay extra, can't qualify for a mortgage or can't sell their homes to trade up. Courses that were too far along to stop are struggling to find customers.

"People just can't afford the luxury of a country club. It's become much more aspirational," said Marc Montgomery, a developer who opened his third Washington area golf course community this summer. Like the other two, River Creek in Virginia and Cross Creek in suburban Maryland, his latest, Oak Creek, is the centerpiece of an exclusive luxury community. He has brought in a company from Pennsylvania to manage the golf operations but, he said, "it's hard to spend $12 million [on a course] and make it back at $50 to $100 a round."

"If you don't have enough people buying houses fast enough, it's never going to work," Montgomery said.

WSJ: Freddie Mac to Stop Buying NY Subprime Mortgages

by Calculated Risk on 8/12/2008 12:31:00 PM

From the WSJ: Freddie Mac Will Stop Buying New York Subprime Mortgages

Freddie Mac said it will not purchase subprime mortgages secured by properties in New York state with note dates on or after Sept. 1.This is in response to a new New York law aimed at curbing abusive lending practices.

Freddie said the pending law "creates the potential for heightened legal and business risk exposures for the purchasers or assignees of these loans," ...

Foreclosures: Movin' on Up

by Calculated Risk on 8/12/2008 11:39:00 AM

From the San Diego Union Tribune: High-end homes join county's foreclosure fray (hat tip Teak111)

DataQuick searched public records to identify the most expensive foreclosures in the county, using Zillow as well as its own findings, and came up with the 23 most expensive properties.When I spoke at the Inman Real Estate conference last month, I suggested that real estate agents should expect increasing foreclosures in high end areas. As I've previous mentioned, my comments were greeted with incredulity.

They include five properties each in La Jolla and Rancho Santa Fe, four in Carmel Valley, two each in Del Mar and Encinitas and one each in Bonita, downtown San Diego, Jamul, Point Loma and Poway.

The homes were purchased between August 1997 and December 2006 with prices from $635,000 to $7,450,000, according to county records.

A check of addresses, court records and employment data revealed that the owners included business executives, real estate experts, partnerships, a teacher and others. Most could not be reached, and none would speak on the record.

But I think this will be the trend. The next wave of defaults will be from Alt-A loans, and Alt-A defaults will hit the mid to high end areas hard.

Fed: Banks Tighten Consumer Lending

by Calculated Risk on 8/12/2008 10:30:00 AM

This was released yesterday, but this chart is worth posting. Click on table for larger image in new window.

Click on table for larger image in new window.

The Home ATM is drying up. And now lending standards are being tightened for credit cards and other consumer loans.

From the Fed:

About 65 percent of domestic banks—up notably from about 30 percent in the April survey—indicated that they had tightened their lending standards on credit card loans over the past three months, and about the same fraction of respondents—up from roughly 45 percent in the April survey—reported having tightened standards on consumer loans other than credit card loans. In addition, considerable fractions of respondents reported having increased minimum required credit scores on both types of consumer loans and reduced the extent to which such loans were granted to customers who did not meet their bank’s credit-scoring thresholds. Finally, large net fractions of banks noted that they had lowered credit limits on credit card accounts over the past three months, and increased interest rate spreads on consumer loans other than credit card loans. On balance, about 35 percent of domestic banks—up from roughly 25 percent in the April survey—expressed a diminished willingness to make consumer installment loans relative to three months earlier. Regarding loan demand, about 30 percent of respondents, on net, indicated that they had experienced weaker demand for consumer loans of all types over the past three months, up from about 20 percent in the April survey.

June Trade Deficit: $56.8 billion

by Calculated Risk on 8/12/2008 08:54:00 AM

The Census Bureau reports:

[T]otal June exports of $164.4 billion and imports of $221.2 billion resulted in a goods and services deficit of $56.8 billion, down from $59.2 billion in May, revised. June exports were $6.4 billion more than May exports of $158.0 billion. June imports were $3.9 billion more than May imports of $217.2 billion.Non-petroleum imports (corrected) are dropping sharply, although petroleum imports (in dollars) were up in June. Import oil prices hit a record $117.13 per barrel in June, and will increase further in July (when spot prices peaked).

Note: import oil prices are calculated when oil is delivered, so there is a lag between future prices and import prices.

Click on table for larger image in new window.

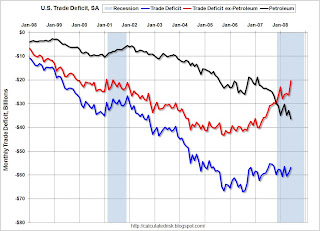

Click on table for larger image in new window.This graph shows the U.S. trade deficit through June. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. The current probable recession is marked on the graph.

The oil deficits in July and probably August will be ugly, but it now looks like the oil deficit will decline sharply later this year. As I noted last week, there are other factors that impact exchange rates, but this decline in oil prices will have a significant impact on the overall deficit, and this might mean the dollar has finally bottomed.

Monday, August 11, 2008

JPMorgan: Mortgage Market "substantially deteriorated" in July

by Calculated Risk on 8/11/2008 11:23:00 PM

From the Financial Times: JPMorgan struck by $1.5bn writedown (hat tip Geoffrey)

In a regulatory filing, JPMorgan said since the beginning of July, trading conditions in the mortgage market “had substantially deteriorated . . . causing the company to incur losses” of $1.5bn, excluding hedges.Here is the full quote from the SEC filing:

Bankers said July was the worst month for mortgage-backed bonds since the beginning of the crisis, as a combination of cut-price sales and waning demand from large investors helped to depress prices.

... people close to the company said it had been forced to write down the value of its $33bn in mortgage-backed securities as prices continued to drop in July.

They said the writedowns were partly driven by Merrill Lynch’s decision to sell $6.7bn in toxic securities ... for just 22 cents on the dollar.

For the third quarter to date, trading conditions have substantially deteriorated versus the second quarter. In particular, spreads on mortgage-backed securities and loans have sharply widened causing the company to incur losses (net of hedges) of approximately $1.5 billion for the quarter to date.The confessional is still busy ...