by Calculated Risk on 8/12/2008 03:37:00 PM

Tuesday, August 12, 2008

Analyst Bove: "Close to Perfect Storm" for JPM

Update: Here is the story from Bloomberg: JPMorgan Shares Plunge on $1.5 Billion Mortgage Loss Since July (hat tip Ministry of Truth and TJ) Click on image for larger image in new window.

Click on image for larger image in new window.

Ladenburg analyst Richard Bove is being quoted (headlines only) that JP Morgan's "original concept" has "broken down". And that the issues will not be resolved until "well into 2009."

We're All Not Golfers Now

by Anonymous on 8/12/2008 12:55:00 PM

While we're on the subject of trouble at the housing high end . . . here's a report on golf club developments in the DC area from the Washington Post:

It wasn't long ago that real estate developers could build a golf course community and collect a $30,000 premium from customers who might not have even played golf, but aspired to the country club lifestyle.I suspect that means it's never going to work.

Not anymore. Projects have been put on hold or canceled because potential buyers are no longer willing to pay extra, can't qualify for a mortgage or can't sell their homes to trade up. Courses that were too far along to stop are struggling to find customers.

"People just can't afford the luxury of a country club. It's become much more aspirational," said Marc Montgomery, a developer who opened his third Washington area golf course community this summer. Like the other two, River Creek in Virginia and Cross Creek in suburban Maryland, his latest, Oak Creek, is the centerpiece of an exclusive luxury community. He has brought in a company from Pennsylvania to manage the golf operations but, he said, "it's hard to spend $12 million [on a course] and make it back at $50 to $100 a round."

"If you don't have enough people buying houses fast enough, it's never going to work," Montgomery said.

WSJ: Freddie Mac to Stop Buying NY Subprime Mortgages

by Calculated Risk on 8/12/2008 12:31:00 PM

From the WSJ: Freddie Mac Will Stop Buying New York Subprime Mortgages

Freddie Mac said it will not purchase subprime mortgages secured by properties in New York state with note dates on or after Sept. 1.This is in response to a new New York law aimed at curbing abusive lending practices.

Freddie said the pending law "creates the potential for heightened legal and business risk exposures for the purchasers or assignees of these loans," ...

Foreclosures: Movin' on Up

by Calculated Risk on 8/12/2008 11:39:00 AM

From the San Diego Union Tribune: High-end homes join county's foreclosure fray (hat tip Teak111)

DataQuick searched public records to identify the most expensive foreclosures in the county, using Zillow as well as its own findings, and came up with the 23 most expensive properties.When I spoke at the Inman Real Estate conference last month, I suggested that real estate agents should expect increasing foreclosures in high end areas. As I've previous mentioned, my comments were greeted with incredulity.

They include five properties each in La Jolla and Rancho Santa Fe, four in Carmel Valley, two each in Del Mar and Encinitas and one each in Bonita, downtown San Diego, Jamul, Point Loma and Poway.

The homes were purchased between August 1997 and December 2006 with prices from $635,000 to $7,450,000, according to county records.

A check of addresses, court records and employment data revealed that the owners included business executives, real estate experts, partnerships, a teacher and others. Most could not be reached, and none would speak on the record.

But I think this will be the trend. The next wave of defaults will be from Alt-A loans, and Alt-A defaults will hit the mid to high end areas hard.

Fed: Banks Tighten Consumer Lending

by Calculated Risk on 8/12/2008 10:30:00 AM

This was released yesterday, but this chart is worth posting. Click on table for larger image in new window.

Click on table for larger image in new window.

The Home ATM is drying up. And now lending standards are being tightened for credit cards and other consumer loans.

From the Fed:

About 65 percent of domestic banks—up notably from about 30 percent in the April survey—indicated that they had tightened their lending standards on credit card loans over the past three months, and about the same fraction of respondents—up from roughly 45 percent in the April survey—reported having tightened standards on consumer loans other than credit card loans. In addition, considerable fractions of respondents reported having increased minimum required credit scores on both types of consumer loans and reduced the extent to which such loans were granted to customers who did not meet their bank’s credit-scoring thresholds. Finally, large net fractions of banks noted that they had lowered credit limits on credit card accounts over the past three months, and increased interest rate spreads on consumer loans other than credit card loans. On balance, about 35 percent of domestic banks—up from roughly 25 percent in the April survey—expressed a diminished willingness to make consumer installment loans relative to three months earlier. Regarding loan demand, about 30 percent of respondents, on net, indicated that they had experienced weaker demand for consumer loans of all types over the past three months, up from about 20 percent in the April survey.

June Trade Deficit: $56.8 billion

by Calculated Risk on 8/12/2008 08:54:00 AM

The Census Bureau reports:

[T]otal June exports of $164.4 billion and imports of $221.2 billion resulted in a goods and services deficit of $56.8 billion, down from $59.2 billion in May, revised. June exports were $6.4 billion more than May exports of $158.0 billion. June imports were $3.9 billion more than May imports of $217.2 billion.Non-petroleum imports (corrected) are dropping sharply, although petroleum imports (in dollars) were up in June. Import oil prices hit a record $117.13 per barrel in June, and will increase further in July (when spot prices peaked).

Note: import oil prices are calculated when oil is delivered, so there is a lag between future prices and import prices.

Click on table for larger image in new window.

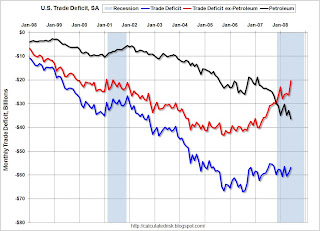

Click on table for larger image in new window.This graph shows the U.S. trade deficit through June. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. The current probable recession is marked on the graph.

The oil deficits in July and probably August will be ugly, but it now looks like the oil deficit will decline sharply later this year. As I noted last week, there are other factors that impact exchange rates, but this decline in oil prices will have a significant impact on the overall deficit, and this might mean the dollar has finally bottomed.

Monday, August 11, 2008

JPMorgan: Mortgage Market "substantially deteriorated" in July

by Calculated Risk on 8/11/2008 11:23:00 PM

From the Financial Times: JPMorgan struck by $1.5bn writedown (hat tip Geoffrey)

In a regulatory filing, JPMorgan said since the beginning of July, trading conditions in the mortgage market “had substantially deteriorated . . . causing the company to incur losses” of $1.5bn, excluding hedges.Here is the full quote from the SEC filing:

Bankers said July was the worst month for mortgage-backed bonds since the beginning of the crisis, as a combination of cut-price sales and waning demand from large investors helped to depress prices.

... people close to the company said it had been forced to write down the value of its $33bn in mortgage-backed securities as prices continued to drop in July.

They said the writedowns were partly driven by Merrill Lynch’s decision to sell $6.7bn in toxic securities ... for just 22 cents on the dollar.

For the third quarter to date, trading conditions have substantially deteriorated versus the second quarter. In particular, spreads on mortgage-backed securities and loans have sharply widened causing the company to incur losses (net of hedges) of approximately $1.5 billion for the quarter to date.The confessional is still busy ...

Tanta on Alt-A

by Calculated Risk on 8/11/2008 09:59:00 PM

For our late night readers, please don't miss Tanta's post today: Reflections on Alt-A. A brief excerpt:

"Residential mortgage lending never, of course, limited itself to considering creditworthiness; we always had "Three C's": creditworthiness, capacity, and collateral. "Capacity" meant establishing that the borrower had sufficient current income or other assets to carry the debt payments. "Collateral" meant establishing that the house was worth at least the loan amount--that it fully secured the debt. It was universally considered that these three things, the C's, were analytically and practically separable.

...

Alt-A is sort of a weird mirror-image of subprime lending. If subprime was traditionally about borrowers with good capacity and collateral but bad credit history, Alt-A was about borrowers with a good credit history but pretty iffy capacity and collateral. That is to say, while subprime makes some amount of sense, Alt-A never made any sense. It is a child of the bubble."

Vineyard National: "Going Concern" Statement, Regulators Impose Limitations

by Calculated Risk on 8/11/2008 08:51:00 PM

"significant doubt on our ability to continue as a going concern"

Vineyard National, Aug 11, 2008

Last week, the LA Times reported that regulators ordered Vineyard to stop accepting brokered deposits. Now from the Vineyard 10-Q filed today with the SEC:

On May 5, 2008, the Bank was informed in writing by the Office of the Comptroller of the Currency (the “OCC”) that the Bank has been designated to be in “troubled condition” for purposes of Section 914 of the Financial Institutions Reform, Recovery and Enforcement Act of 1989. ...Insurance premiums will increase:

On July 22, 2008, in cooperation with and at the request of the OCC, the Bank consented to the issuance of a Consent Order. The Consent Order established timeframes for the completion of remedial measures which have been previously identified and are in process towards completion as part of the Board of Directors’ internally developed and independently implemented Risk Mitigation Action Plan. Under the Consent Order, the Bank agreed, among other things, to establish a compliance committee to monitor and coordinate compliance with the Consent Order; identify experienced and competent individuals to serve on a permanent, full-time basis as chief executive officer and chief credit officer; maintain capital ratios above the statutory minimums and develop a three-year capital plan; suspend the payment of dividends without regulatory approval; limit annual loan growth; establish a program for the maintenance of adequate allowances for loan losses; adopt a written asset diversification program; review, revise and adhere to the Bank’s loan policy; ensure the use and reporting of appropriate risk rating of assets; establish an effective, independent and ongoing loan review system; take appropriate action to protect the Bank’s interest in its problem assets; ensure the maintenance of sufficient liquidity to sustain current operations and withstand anticipated or extraordinary demand; and improve the management of the Bank’s information technology activities and to address various deficiencies cited by the OCC.

As a result of the issuance of the Consent Order, among other things, the Bank is no longer deemed to be “well-capitalized” and will be prohibited from renewing existing brokered deposits or accepting new brokered deposits without a waiver from the FDIC. Additionally, as a result of not being deemed “well capitalized,” the Bank’s borrowing costs and terms from the FRB, the Federal Home Loan Bank (“FHLB”) and other financial institutions, as well as the Bank’s premiums to the Deposit Insurance Fund and the Bank’s assessments and application fees paid to the OCC, are expected to increase.Liquidity issues:

Negative publicity relating to our financial results and the financial results of other financial institutions, together with the seizure of IndyMac Bank by federal regulators in July 2008, has caused a significant amount of customer deposit withdrawals, thus affecting our liquidity and our ability to meet our obligations as they have come due. During the second quarter of 2008, we obtained $266.3 million in brokered deposits to offset the $226.9 million in run-off of savings, NOW, and money market deposit accounts. As a result of the issuance of the Consent Order by the OCC on July 22, 2008, however, we can no longer accept, renew or rollover brokered deposits unless and until such time as we receive a waiver from the FDIC. The Bank has requested a waiver from the FDIC, but there can be no assurance that such a waiver will be granted, granted on the terms requested, or granted in time for the Bank to effectively utilize brokered deposits as a source of required liquidity. If the Bank does not receive such a waiver, we will be unable to employ the use of readily available brokered deposits as a source of liquidity.Going concern issues:

The conditions and events discussed above cast significant doubt on our ability to continue as a going concern. We have determined that significant additional sources of liquidity and capital will be required for us to continue operations through 2008 and beyond. We have engaged a financial advisor to explore strategic alternatives, including potential significant capital raises, to address our current and expected liquidity and capital deficiencies. However, there can be no assurance that we will be able to arrange for sufficient liquidity or to raise additional capital in time to satisfy regulatory requirements and meet our obligations as they come due. In addition, our regulators are continually monitoring our liquidity and capital adequacy. Based on their assessment of our ability to continue to operate in a safe and sound manner, our regulators may take other and further action, including assumption of control of the Bank, to protect the interests of depositors insured by the FDIC.

emphasis added

Downey Financial: Regulators Impose Limitations, Raise Insurance Premiums

by Calculated Risk on 8/11/2008 07:20:00 PM

From Downey's 10-Q SEC filing today:

In light of the current operating environment and Downey’s recent quarterly losses, the Holding Company and the Bank have been working closely with the Bank’s federal banking regulators. In that regard, the OTS, the Bank’s principal regulator, has also imposed the following limitations on the Holding Company and the Bank: the Bank may not pay dividends to the Holding Company without prior OTS approval, and the Holding Company may not pay dividends without prior non-objection of the OTS; the Bank may not increase its assets during any quarter in excess of an amount equal to net interest credited on deposit liabilities without prior OTS approval; the Holding Company may not issue or renew debt without the prior non-objection of the OTS; the Holding Company and the Bank must provide prior notice to the OTS regarding any additions or changes to directors or senior executive officers (or changes in the responsibilities of senior executive officers); the Holding Company and the Bank may not pay certain kinds of severance and other forms of compensation without regulatory approval; the Bank may not enter into, renew, extend or revise any contract related to compensation or benefits with any director or senior executive officer without prior regulatory approval; the Bank must provide prior notice to the OTS (and not receive any objection) before engaging in transactions with any affiliate or subsidiary. In addition, Downey is subject to higher regulatory assessments and FDIC deposit insurance premiums than those prevailing in prior periods.Update: Downey has $1.207 billion of uninsured deposits as of the June 30, 2008 TFR, but no brokered deposits (hat tip Mark)

In response to the challenges facing Downey in the current operating environment, Downey has formed a special Board committee to explore a range of strategic alternatives, including the raising of additional capital to levels deemed by the Board to be appropriate under the circumstances.

emphasis added