by Calculated Risk on 8/06/2008 03:43:00 PM

Wednesday, August 06, 2008

Pimco's Gross: Treasury to Buy Fannie/Freddie Preferred by End of Quarter

From Bloomberg: Pimco's Gross Says U.S. Will Rescue Fannie, Freddie (hat tip Yal)

``By the end of the third quarter, the preferred stock in Fannie and Freddie will be issued, the Treasury will have bought it,'' Gross, co-chief investment officer at Pacific Investment Management Co., said today in an interview on Bloomberg Television. ``We'll be on our way toward a joint Treasury-agency combination.''This will probably happen the first week of September since I'll be on a hiking trip! No worries - Tanta and friends will have it covered.

...

The government will probably buy $10 billion to $30 billion of preferred stock, Gross said.

Restaurant Performance Index Shows Contraction

by Calculated Risk on 8/06/2008 01:21:00 PM

Here is another index to track; the Restaurant Performance Index from the National Restaurant Association (NRA). (hat tip Lyle)

From the NRA: Restaurant Performance Index Declined in June as Same-Store Sales and Customer Traffic Slipped

"The June decline in the Restaurant Performance Index was the result of a drop in the current situation component," said Hudson Riehle, senior vice president of research and information services for the Association. "Restaurant operators reported negative same-store sales and customer traffic levels in June, after posting somewhat stronger results in May."

"The uncertain economy and rising food costs continue to create a challenging business environment for restaurant operators," Riehle added. "A record 29 percent of restaurant operators said the economy is the number-one challenge facing their business, while 22 percent identified food costs as their top challenge."

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

The index values above 100 indicate a period of expansion; index values below 100 indicate a period of contraction.

Based on this indicator, the restaurant industry has been contracting since mid-year 2007.

Freddie: Alt-A and Default by Year

by Calculated Risk on 8/06/2008 12:18:00 PM

On Alt-A from Brian:

[Freddie has] $190B of Alt-A in the guarantee portfolio, $93B of which is in their 7 high DQ states (CA, FL, AZ, VA, NV, GA, MI, MD), and $115 of which is 06/07 vintage. 29% have current LTV>90% and 17% have current LTV >100% (chart 27 has a matrix of different cuts at the guarantee portfolio - there are quite a few high risk loan categories where the % of loans with current LTV>100% is in the range of 15-30% of the portfolio - with more to come as house prices decline further - chart 28 is worth a look too - there is going to be a lot of loss content in some of the cells on that matrix)

90+ day DQ's on their Alt-A book increased from 2.32% in Q1 to 3.72% in Q2!

They have $82B of uninsured 1st Lien subprime ABS, $65B of which is 06/07 vintage. The have $21B of ALT-A ABS.

On the credit enhancement question from before, for their guarantee portfolio as a whole, 18% has credit enhancement, but 92% of the loans with >90% LTV have enhancement, but only 16% of the Alt-A have it, only 14% of the IO loans have it, and 13% of option ARMs have it.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph from the Freddie investor's slides shows the default rates of Alt-As vs. the rest of the portfolio.

As we've been discussing, the 2nd wave of defaults it just starting, and Alt-A will be ground zero this time.

The second graph shows delinquencies by year, and shows the impact of the credit crunch.

From Brian:

From Brian: Finally, Chart 32 is a great graphical depiction of moral hazard in action. It shows delinquencies by book year and 2006 is looking very good, but 2007 (on a relative basis) is off the charts because they caved to political pressure and took on all those crappy loans when the private label MBS market shut down.

Freddie Conference Call Notes

by Calculated Risk on 8/06/2008 11:18:00 AM

A few notes from the Freddie Mac conference call (hat tip Brian):

They are now expecting nation HPD (home price depreciation) of 18-20% vs prior assumption of 15% (using their national index). They think we are halfway through the price decline.

Severity assumptions in loan loss provision increased from 22% in Q1 (ending March) to 26% in Q2 (ending June).

Until their credit raising options clarify, they will approach growth of their mortgage portfolio cautiously. They acknowledged that the market realizes that it will be difficult for them to grow and that has probably contributed to increase in mortgage spreads. Their base case forecast is that their portfolio has no growth.

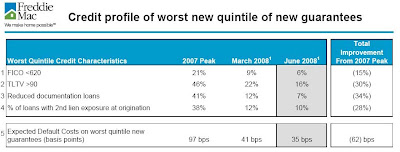

They have a chart of the credit profile of their guarantees at various points over the last year or so (chart 13 in the slide deck) that is worth a look. The worst quintile of loans (from a credit characteristics standpoint) from the 2007 peak had the following characteristics (they don’t say when the peak is, but my guess is that it would be late Q2 or early Q3):

Click on table for larger image in new window.

Click on table for larger image in new window.Their “expected default costs” on this bucket of guarantees is 97bp – it does not detail how that number is calculated, but I can’t imagine how it would be that low if its similar to a realized loss number on that portfolio (don’t know what if any PMI is on that group).

Freddie Mac: $821 million in Losses, Cuts Dividend

by Calculated Risk on 8/06/2008 09:24:00 AM

From MarketWatch: Freddie Mac loses $821 million on housing, credit markets

Freddie Mac, the second-biggest U.S. buyer of mortgages, reported Wednesday a second-quarter loss of $821 million ... [Freddie] is planning to slash its dividend to five cents a share or less for the third quarter, down from a previous payout of 25 cents a share.Here is the Bloomberg story: Freddie Mac Posts Fourth Straight Loss, Cuts Dividend

...

Freddie said provisions for credit losses in the June quarter were $2.5 billion, wider than the $1.2 billion for the first three months of 2008, reflecting increases in delinquency rates, foreclosures and the estimated severity of losses driven by the continued fall in home prices.

And from the WSJ: Freddie Swings to Loss

Tuesday, August 05, 2008

FirstFed and Option ARMs

by Calculated Risk on 8/05/2008 10:32:00 PM

From the WSJ: FirstFed Grapples With Fallout From Payment Option Mortgages

Like many mortgage lenders, FirstFed Financial Corp. is struggling with rising losses. ... Forty percent of its borrowers became at least 30 days delinquent after the payments on their adjustable-rate mortgages were recast. The number of foreclosed homes held by the bank doubled in the second quarter from the first quarter.It seems like Tanta and I have been writing about the coming wave of Option ARM defaults forever, but it's only been since 2005!

But FirstFed isn't another bank grappling with the fallout from subprime mortgages that went to less-creditworthy borrowers. ... [T]he Los Angeles bank is on the front lines of what could be the next big mortgage debacle: payment option mortgages.

Barclays Capital estimates that as many as 45% of option ARMs, as they are often called, originated in 2006 and 2007 could wind up in default. Another analysis, by UBS AG, suggests that defaults on option ARMs originated in 2006 could be as high as 48%, slightly higher than its estimate for defaults on subprime loans.The key here, for the housing market, is that the next wave of defaults will be hitting middle to upper middle class neighborhoods.

We're all subprime now! (a classic Tanta phrase)

The Slowdown in China

by Calculated Risk on 8/05/2008 06:50:00 PM

Note: Please don't miss Tanta's post this morning on the NY Times and Freddie Mac.

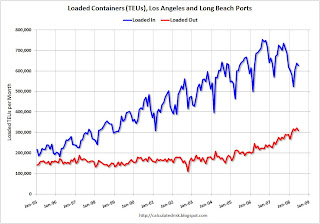

On China and trade: This first graph shows the combined loaded inbound and outbound traffic at the ports of Long Beach and Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic grew quickly for a number of years, but appears to be declining (there is a strong seasonal component). Inbound traffic is off almost 14% from June 2007.

Outbound traffic was flat for years, but has been increasing the last few years. Outbound traffic is up 12% from June 2007.

A few key points: Imports have slowed, and U.S. exports are increasing fairly rapidly. This means the trade deficit (especially ex-petroleum) is also decreasing. This change in the trade balance is probably due to the weak dollar and the weak U.S. economy.

Trade has also boosted GDP (trade contributed 2.4% to the Q2 GDP growth), and has kept U.S. manufacturing employment from falling sharply as usually happens in a recession. This last point has been important in my forecast that headline unemployment wouldn't reach 8% in this cycle.

And from the NY Times: Booming China Suddenly Worries That a Slowdown Is Taking Hold

China's post-Olympics economic slowdown has started before the Games have even begun.

New orders at Chinese factories plunged last month. Exports are barely growing, after adjusting for inflation and currency fluctuations. The real estate market is weakening, with apartment prices sinking in southeastern China, the region hardest hit by economic troubles.

"China has slowed down a lot already, but it's going to slow down more," said Hong Liang, the senior China economist at Goldman Sachs.

...

Weak demand from the United States over the past year, and now from Europe as well, is part of China's emerging problem. On Sunday evening, the port here in Hong Kong was less full of containers than usual, part of a broader slowing of export growth.

This slowdown is reflected in the Shanghai SSE composite index that is off about 54% from the peak.

This slowdown is reflected in the Shanghai SSE composite index that is off about 54% from the peak.And this slowdown is probably impacting oil prices. And that will also help the U.S. trade deficit.

The danger is that China - and the rest of the global economy - will slow down too quickly, and U.S. exports will be negatively impacted. That could lead to more unemployment in the U.S. than I'm currently forecasting, and also a deeper recession.

Morgan Stanley Freezes Some HELOCs

by Calculated Risk on 8/05/2008 05:53:00 PM

From Bloomberg: Morgan Stanley Said to Freeze Client Home-Equity Credit Lines (hat tip Brian)

Morgan Stanley ... told several thousand clients this week that they won't be allowed to withdraw money on their home- equity credit lines ...A home equity line of credit implies the borrower has some home equity left. Morgan Stanley is just the latest lender to freeze HELOCs for clients with insufficient home equity due to falling property values.

``Consistent with the terms of the HELOC, or home-equity line of credit, Morgan Stanley periodically reassesses client property values and risk profiles,'' said Christine Pollak, a Morgan Stanley spokeswoman in New York. ``A segment of clients was recently notified of a change in the status of their home equity line of credit or HELOC due to a change in the value of their property and/or their credit profile.''

Q2 Office, Hotel and Mall Investment

by Calculated Risk on 8/05/2008 03:18:00 PM

A couple more graphs based on the underlying details for the Q2 GDP report.

Based on tighter lending standards, rising vacancy rates (lower occupancy rate for hotels), and the Architectural Billing index, it appears there will be a sharp slowdown in investment in offices, malls and hotels in the 2nd half of 2008.

However, as of Q2 2008, only mall investment is declining - in fact, investment in lodging soared in Q2! Click on graph for larger image in new window.

Click on graph for larger image in new window.

Investment in multimerchandise shopping structures (malls) declined slightly in Q2 2008, after peaking in Q4 2007.

Investment in lodging soared in Q2 to $46.1 billion (SAAR) from $40.4 billion (SAAR) in Q1. This is probably due to builders rushing to finish projects.

This investment in lodging will probably decline sharply in the 2nd half of '08 as builders cancel or postpone projects. As an example, from CNNMoney: Boyd Gaming suspends Vegas casino-resort project (hat tip Erik)

[C]asino operator Boyd Gaming Corp. announced Friday that it will stop work for nine months to a year on a $4.8 billion mega development.

The Echelon [includes] nearly 5,000 guest rooms in five hotels ...

The second graph shows office investment as a percent of GDP since 1972.

The second graph shows office investment as a percent of GDP since 1972.NOTE: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

This shows the huge over investment in offices in the '80s due to the S&L lending. This graph also shows the office building boom associated with the stock market bubble. The office bubble is smaller this time, but I expect investment to decline for all three categories - offices, lodging and malls - in the 2nd half of 2008.

Fed: No Change in Fed Funds Rate

by Calculated Risk on 8/05/2008 02:13:00 PM

From the Federal Reserve:

The Federal Open Market Committee decided today to keep its target for the federal funds rate at 2 percent.

Economic activity expanded in the second quarter, partly reflecting growth in consumer spending and exports. However, labor markets have softened further and financial markets remain under considerable stress. Tight credit conditions, the ongoing housing contraction, and elevated energy prices are likely to weigh on economic growth over the next few quarters. Over time, the substantial easing of monetary policy, combined with ongoing measures to foster market liquidity, should help to promote moderate economic growth.

Inflation has been high, spurred by the earlier increases in the prices of energy and some other commodities, and some indicators of inflation expectations have been elevated. The Committee expects inflation to moderate later this year and next year, but the inflation outlook remains highly uncertain.

Although downside risks to growth remain, the upside risks to inflation are also of significant concern to the Committee. The Committee will continue to monitor economic and financial developments and will act as needed to promote sustainable economic growth and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Elizabeth A. Duke; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; Charles I. Plosser; Gary H. Stern; and Kevin M. Warsh. Voting against was Richard W. Fisher, who preferred an increase in the target for the federal funds rate at this meeting.