by Anonymous on 8/01/2008 09:19:00 AM

Friday, August 01, 2008

IndyMac Holding Company Files BK

This is not helpful reporting:

Aug. 1 (Bloomberg) -- IndyMac Bancorp Inc., the second- largest U.S. independent mortgage lender before it was seized by federal bank regulators three weeks ago, filed to liquidate its remaining assets under bankruptcy protection.FDIC did not "seize" IndyMac Bancorp, it seized IndyMac Bank, F.S.B., which is owned by IndyMac Bancorp. Rather than continuing to write things that just sound contradictory, perhaps Bloomberg can help us understand the implications of this legally important distinction? I'm just askin' . . .

IndyMac's liabilities are between $100 million and $500 million, according to the Chapter 7 filing yesterday in U.S. Bankruptcy Court in Los Angeles. The bank holding company said it has less than 50 creditors, which it didn't list.

IndyMac was seized by U.S. regulators on July 11 after a run by depositors left the mortgage lender strapped for cash. The Federal Deposit Insurance Corp. is running a successor institution, IndyMac Federal Bank, and regulators have said they intend to eventually sell the seized bank.

The FDIC ``has been in sole possession custody and control of all of the books and records of'' IndyMac Bancorp and the court filing was made without access to information that bankruptcy laws typically require, Chief Executive Officer Michael W. Perry said in court papers.

While banks are prohibited from filing for U.S. bankruptcy protection, bank holding companies aren't. Perry is Pasadena, California-based IndyMac Bancorp's sole remaining employee, according to the filing. The company has $50 million to $100 million in assets.

GM: $15.5 Billion Loss

by Calculated Risk on 8/01/2008 09:14:00 AM

From the WSJ: GM Swings to $15.5 Billion Loss Amid Write-Downs, Sales Slump

General Motors Corp. recorded a stunning $15.5 billion second-quarter net loss, slammed by sinking auto sales, money lost on bad lease deals and costs tied to its North American restructuring.

Thursday, July 31, 2008

FT: Fears Growing Concerning CMBS Defaults

by Calculated Risk on 7/31/2008 09:09:00 PM

From the Financial Times: Real estate sector fears huge increase in CMBS defaults (hat tip Raymond)

Defaults on [recent] commercial mortgage-backed securities ... will more than quadruple from their current levels under conditions in the US economy expected by the commercial real estate industry, according to a report from Fitch Ratings.Higher defaults and lower property values is one side of the commercial real estate (CRE) bust; this is the impact on existing CRE.

...

Borrowers would default on an average of 17.2 per cent of securitised commercial mortgages over 10 years if the US economy dips into a recession ... compared with current very low default rates of 4 per cent ...

[The problem is] inflated property values and weaker underwriting standards. .. in 2006 and 2007, as well as the weaker economy. Those bonds make up about 49 per cent of the outstanding CMBS market of more than $800bn.

As discussed this morning, the CRE bust will also result in less new investment in non-residential structures, especially hotels, malls and office buildings (since those were the most overbuilt).

Freddie Mac Changes Servicer Guidelines

by Calculated Risk on 7/31/2008 06:09:00 PM

HousingWire has the story: Freddie Mac Pushes Out Foreclosure Timelines

Perhaps the boldest move by Freddie Mac on Thursday — and one that won’t get much press attention — was its decision to eliminate foreclosure timeline compensation altogether for servicers, effective immediately. In other words, servicers will no longer earn a bonus based on how quickly they can foreclose.There is much more.

If that doesn’t scream “modify more loans,” then the GSE’s decision to double compensation for servicers in completing workouts certainly will. Freddie said it will now pay servicers $800 for a loan modification, $2,200 for a short payoff or make-whole preforeclosure sale, and $500 per repayment plan. Deeds-in-lieu of foreclosure didn’t get Freddie’s same endorsement, however, and will remain at the current incentive level of $250, the GSE said.

The decision to eliminate timeline compensation, however, was only part of a much broader program change rolled out by Freddie; the mortgage finance giant also said that it was increasing its allowable foreclosure timeline in 21 states to a whopping 300 days from last of date payment, and 150 days from initiation of foreclosure, effective on Friday.

CA Governor Orders Layoffs, Pay Cuts

by Calculated Risk on 7/31/2008 04:36:00 PM

From the SF Gate: Governor orders layoffs, steep pay cuts for thousands of state workers (hat tip Hernan)

Gov. Arnold Schwarzenegger ... today ordered the layoffs of thousands of state workers and steep pay cuts for most other state employees ... Cutting the pay of about 200,000 state workers to the federal minium wage of $6.55 an hour would save California as much as $1.2 billion a month, the governor's office said. Such workers would get regular pay plus back pay once a new budget is approved.Many states are struggling, but California is in especially deep trouble because of rapidly falling house prices and a weakening economy.

The layoffs of nearly 22,000 temporary, seasonal and student workers would save the state as much as $28.5 million a month, the governor's office added.

The Coming Hotel Bust

by Calculated Risk on 7/31/2008 12:17:00 PM

From Abha Bhattari and Fred Bernstein at the NY Times: Terrible Timing for a Hotel Boom

A record number of hotels are opening this year, and the timing could not be worse.Back in May I relayed a conversation I had with well known hospitality attorney Jim Butler. At that time it was clear that financing for hotels was becoming significantly tighter (see earlier post for his comments). For anyone interested, Jim writes a blog on hotel legal issues: Hotel Law Blog

...

Until recently, the industry was in the midst of a major boom, and it was during those good times that the hotel companies made plans to build many of the new rooms. ... Nationwide, hotel occupancy levels have been hovering around 65 percent, down about 5 percentage points from last year, according to Smith Travel Research.

...

The industry now has about 6,000 new hotels, with nearly 800,000 rooms, under development, a 27 percent increase from last year, according to Lodging Econometrics ...

I also posted this graph comparing investments in lodging vs investments in other non-residential structures:

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the strong growth in lodging in recent years (from the BEA supplemental tables). I'll have an update soon for Q2.

Clearly lodging investment has been in a quite a boom (as the NY Times story noted). But occupancy

Lodging is one of the three key components of non-residential investment that I expect to decline sharply. The other two are office buildings and multimerchandise shopping (malls!).

GDP and Investment

by Calculated Risk on 7/31/2008 10:09:00 AM

The BEA reported that GDP increased 1.9% in Q2 2008 at a seasonally adjusted annual rate (SAAR). But the underlying details - especially for investment - are weak.

Residential investment (RI) declined at a 15.6% (SAAR).

Investment in equipment and software declined 3.4% (SAAR).

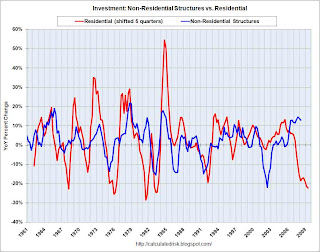

The lone bright spot for investment was non-residential investment in structures. Non-RI structure investment increased at a 14.4% SAAR. But all evidence suggests this investment is about to slow sharply. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This first graph shows the typical relationship between residential investment and non-residential investment in structures. Note that residential investment is shifted 5 quarters into the future on the graph (non-residential investment usually follows residential by about 4 to 7 quarters).

The current non-residential boom has gone on a little longer than normal, probably for two reasons: 1) there was a slump in investment following the bursting of the tech bubble, and 2) loose lending standards kept non-residential investment lending strong until mid-year 2007, and it takes time to build non-residential structures.

All signs suggest that the bust is now here, and non-residential investment will probably be a drag on GDP for the next year or more. The second graph shows non-residential investment as a percent of GDP. This shows the current boom is even greater than the boom in the late '90s.

The second graph shows non-residential investment as a percent of GDP. This shows the current boom is even greater than the boom in the late '90s.

Some of the current investment boom is energy related, and I'll break out the three key areas that will soon go bust - office buildings, multimerchandise shopping, and lodging - as soon as the underlying detail tables are available. The third graph shows residential investment (RI) as a percent of GDP.

The third graph shows residential investment (RI) as a percent of GDP.

RI as a percent of GDP is at 3.5%, just above the cycle lows in 1982 and 1991. It is possible that RI, as a percent of GDP, will bottom later this year (or possibly in early 2009) since inventory is finally declining (housing starts are now below housing sales).

When RI finally bottoms, the good news is RI will no longer be a drag on GDP, but the bad news is RI will probably not recovery quickly because of the huge overhang of inventory. Unfortunately, by the time RI bottoms, non-residential investment will probably have taken over as a significant drag on GDP - suggesting the recession will linger.

Investment is usually the key to the economy, and investment remains weak.

Recession May Have Started in Q4, 2007

by Calculated Risk on 7/31/2008 09:52:00 AM

From Bloomberg: U.S. Recession May Have Begun in Last Quarter of 2007

The U.S. economy may have tipped into a recession in the last three months of 2007 ... The world's largest economy contracted at a 0.2 percent annual pace in the fourth quarter of last year compared with a previously reported 0.6 percent gain ...I've been showing Dec 2007 as the start of the recession on most of my graphs.

The revisions now reinforce measures such as employment and production that already signaled the economy was shrinking.

News of the Weird: Credit Union Failure

by Anonymous on 7/31/2008 09:05:00 AM

The failure of New London Security FCU the other day rather got lost in the news shuffle. This is probably because it had 365 members and reported assets of $12.7 million, which means it doesn't rank very high on the "systemic risk to the banking system" hot news alert scale. I must say, however, that for sheer weirdness this story delivers.

From The Day of New London, Connecticut:

A former manager of the credit union, who retired last year after decades and spoke on condition of not being identified, admitted Wednesday to being “computer illiterate.” She had been posting information manually for decades, she said.I feel that as a public service I should point out that a sound financial institution cannot "just basically sit on" a "lot of money" and still pay interest rates that are "better than what banks are offering." When you "just basically sit on" money, you get warm, flattened piles of money that retain the imprint of your buttocks. What you do not get is a competitive rate of return.

Edwin F. Rachleff, the 82-year-old broker who handled the credit union's investments and who committed suicide on the day the institution was declared insolvent, also reportedly did not feel comfortable with computers.

Members seemed to view manual postings as part of the charm of the tiny credit union, which had only 365 members and $12.7 million in assets.

”It was a little hole in the wall,” said Jim Mallove, owner of Mallove Jewelers in Waterford, who opened accounts there several years ago for his two children. “But the deposits earned very good interest ... better than banks were offering.”

A quirk of the institution, Mallove remembers, is that the credit union would not accept monthly deposits of more than $100 per account. He had little idea why the credit union would limit deposits.

”My impression at the time was that they had a lot of money and were just basically sitting on it,” said Mallove, who received annual statements as a credit union member.

So what was New London Security doing with those miserly deposits it allowed its members to make?

Emerson added that its ratio of assets to loan amounts was extremely low. He said many credit unions have loans totaling 50 to 80 percent of their assets, though some are as low as 20 percent; New London Security, by comparison, had only about 2 percent of its assets in loans.Of course no one at this point is quite sure what these investments actually were, what with the suicide of broker and all the records being apparently handwritten on green ledger paper. It is hinted that they may be mortgage-backed securities, although for all we know it could be time-shares in the Poconos. Or postal coupons.

New London Security had more than $10 million of its assets in various investment vehicles, Emerson pointed out.

”They were into investments,” Emerson said, adding that he “wouldn't disagree” with the notion that New London Security had turned into a kind of investment club, a notion that was seconded by another credit union official who didn't want to be named.

I feel that as a public service I should point out that an institution that does not make loans to its members in the normal course of business can be many things, but a "credit union" it is not. No matter how charming and small-town cute those hand-written passbook entries are.

(Thanks, Matt!)

Weekly Claims Hit 5 Year High

by Calculated Risk on 7/31/2008 08:30:00 AM

Here is the data from the Department of Labor for the week ending July 26th.

In the week ending July 26, the advance figure for seasonally adjusted initial claims was 448,000, an increase of 44,000 from the previous week's revised figure of 404,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the continued claims since 1989.

Notice that following the previous two recessions, continued claims stayed elevated for a couple of years after the official recession ended - suggesting the weakness in the labor market lingered. The same will probably be true for the current recession (probable).

The second graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989.

The second graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. Weekly unemployment claims were the highest since April 2003.

The four week moving average has been trending upwards for the last few months, and the level is now solidly above the possible recession level (approximately 350K).

Labor related gauges are at best coincident indicators, and this indicator suggests the economy is in recession.

Note: I'll have a post on GDP and investment later this morning.