by Calculated Risk on 7/28/2008 02:05:00 AM

Monday, July 28, 2008

Miles Driven Off 3.7% in May

The WSJ has some details from the DOT report due tomorrow: Funds for Highways Plummet As Drivers Cut Gasoline Use

A report to be released Monday by the Transportation Department shows that over the past seven months, Americans have reduced their driving by more than 40 billion miles. Because of high gasoline prices, they drove 3.7% fewer miles in May than they did a year earlier, the report says, more than double the 1.8% drop-off seen in April.More demand destruction for oil.

Sunday, July 27, 2008

Q2: Homeownership and Vacancy Rates

by Calculated Risk on 7/27/2008 08:26:00 PM

This week the Census Bureau reported the homeownership and vacancy rates for Q2 2008. Here are a few graphs and some analysis ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Although the homeownership rate increased slightly (just noise), the homeownership rate is now back to the levels of the summer of 2001. Note: graph starts at 60% to better show the change.

The second graph shows the homeowner vacancy rate since 1956. The homeownership vacancy rate decreased slightly to 2.8% (from a record 2.9% in Q1). A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, so perhaps the vacancy rate has stabilized in the 2.7% to 2.9% range.

A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, so perhaps the vacancy rate has stabilized in the 2.7% to 2.9% range.

This leaves the homeowner vacancy rate almost 1.1% above normal, and with approximately 75 million homeowner occupied homes; this gives about 825 thousand excess vacant homes.

The rental vacancy rate decreased slightly to 10.0% in Q1 2008, from 10.1% in Q1. The rental vacancy rate had been trending down slightly for almost 3 years (with some noise). It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are 35.5 million rental units in the U.S. If the rental vacancy rate declined from 10.0% to 8%, there would be 2.0% X 35.5 million units or about 710,000 units absorbed.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are 35.5 million rental units in the U.S. If the rental vacancy rate declined from 10.0% to 8%, there would be 2.0% X 35.5 million units or about 710,000 units absorbed.

This would suggest there are about 710 thousand excess rental units in the U.S.

There are also approximately 200 thousand excess new homes above the normal inventory level (for home builders) - plus some uncounted condos.

If we add this up, 710 thousand excess rental units, 825 thousand excess vacant homes, and 200 thousand excess new home inventory, this gives about 1.75 million excess housing units in the U.S. that need to be absorbed over the next few years. (Note: this data is noisy, so it's hard to compare numbers quarter to quarter, but this is probably a reasonable approximation).

These excess units will keep pressure on housing starts and prices for some time.

For Mall Owners: "An ebbing tide"

by Calculated Risk on 7/27/2008 04:00:00 PM

From the TimesUnion on upstate New York: An ebbing retail tide (hat tip Justin)

Consider, for a moment, some of the national chains that in recent months have closed stores, declared bankruptcy or gone out of business entirely: Linens 'n Things, Steve & Barry's, Sharper Image, Starbucks, CompUSA, The Disney Store, Wilson's Leather, Talbots, Ann Taylor, Bombay Co.Justin noted that he spoke to Mr. Pfeil at the end of last year, and at that time he was still "quite optimistic on local real estate". Times have definitely changed for CRE -especially for mall owners.

...

"It's not a very happy time to be building a new shopping center, that's for sure," said Jeffrey Pfeil, co-owner of J.W. Pfeil & Co. Inc. in Saratoga Springs, a company with a long history in retail and commercial leasing.

If This Is Victory

by Anonymous on 7/27/2008 12:21:00 PM

Then I don't want to know what defeat would be. Even I am getting tired of writing about Gretchen Morgenson columns, but this one cries out for demystification. Anyone who wants to claim that any homeowner who stops foreclosure and keeps her home has necessarily "won" anything or received any particular financial benefit needs to read this post. This is a profoundly important issue: the whole "stop foreclosure" movement is based on the assumption that stopping a foreclosure is always and everywhere a "win" for homeowners. Morgenson appears to buy this idea so much that her reporting crosses the line from its typical tendentiousness to outright distortion in order to sustain the myth. I suggest that no actually useful and successful response to the "foreclosure crisis" will ever come about as long as this kind of distortion goes unchallenged.

*************

Here's Morgenson:MAMIE RUTH PALMER isn’t a celebrity. People magazine doesn’t chronicle her every move. The paparazzi don’t wait for a photo op outside of the modest Atlanta home where she has lived since 1987.

This case is not "about" who owns a note. It just isn't. Certainly, among the tens of thousands of dollars worth of objections and motions made by Palmer's attorneys over the course of six years, there was some question about the standing of the mortgage servicer. It appears that the servicer produced some pretty sloppy paperwork for the court. It appears that the Debtor's attorney also filed some pretty sloppy paperwork with the court, too, which dragged out the challenge to the servicer's standing for months. (If you want to read a first-rate judicial slapdown and you have a PACER account, don't miss Judge Massey's "Order Directing Debtor's Counsel to Withdraw Objection to Claim of HomeEq Servicing Corporation or To Litigate The Objection Properly," In re Palmer, Case No. 02-81333, docketed 3-31-03, US Bankruptcy Court, Northern District of Georgia.)

But in some mortgage circles, Ms. Palmer, a 74-year-old former housekeeper, has earned her moment of fame. After enduring six years in foreclosure hell, almost losing her home twice, Ms. Palmer has escaped intact.

Last month she received a settlement from the Bank of New York, the trustee for a vast pool of mortgages that included hers. Under the terms of the deal, the bank reduced Ms. Palmer’s loan balance to $59,000 from about $100,000 and has agreed to accept the proceeds of a reverse mortgage in full satisfaction of her obligation.

The settlement also eliminated about $12,000 in foreclosure fees added to her debt and called for the installation of central air-conditioning in Ms. Palmer’s home.

Roughly $10,000 in legal fees billed over five years by Ms. Palmer’s lawyer, Howard D. Rothbloom, will be covered by payments she has made toward her mortgage while she was battling foreclosure.

“I feel good,” Ms. Palmer said last week. “It’s been a long time coming.” To celebrate, she said, she is going to Florida to fish with her nephew.

Ms. Palmer’s case is hardly unique. It’s just one of a swelling number that revolve around the thorny issue of who owns the note on a home when it’s forced into foreclosure proceedings.

At the end of it, the mortgage servicer withdrew its proof of claim and the trustee of the security owning this loan (Bank of New York) entered the case directly. I do not see from my review of the documents on PACER that there was ever any question that Bank of New York as trustee for the MBS had standing in bankruptcy or was owed money.

The final complaint that resulted in a settlement of this case alleged that Bank of New York charged inappropriate fees. There was no challenge at all to BNY as the creditor.

At no time, it seems, was there ever any question about the fact that Palmer had a mortgage loan and did not make payments either pre- or post-petition. Documents in this case indicate that the mortgage loan in question was originated in October of 1996, and that Palmer began making late payments by June of 1997. Palmer failed to pay taxes and insurance on the property. She filed prior bankruptcies in 1999, 2000, and 2002, each of which was dismissed. When this $52,000 loan was first originated on what was then a $78,000 property, the monthly payment exclusive of taxes and insurance was $554.97, and it became clear within a year that Palmer could not afford that.

By November of 2005, Palmer owed (according to her servicer) $50,611.70 in principal, $10,104.98 in escrow advances, $19,802.60 in accrued but unpaid interest, and $11,379.90 in legal fees, late charges, etc. During most of this period she does not appear to have made any mortgage payments, or any payments for taxes and insurance.

The final complaint made by Palmer's attorneys alleged that some fees were inappropriate. By this time there was no question that Bank of New York had a proof of claim; the argument was about how much the debtor owed. I have no idea whether the $10,000 Morgenson reports as being the cost of Palmer's own attorney's efforts is "appropriate" or not. It appears that BNY just got seriously tired of all of this and did, indeed, decide to settle. But Morgenson's description of that settlement leaves a lot to be desired. I quote from Judge James E. Massey's Interim Consent Order of May 5, 2008:The parties have reached a settlement of any and all claims that were or could have been raised in this case.

So this is how Mamie Palmer came out "intact": she began her case owing $51,000 in principal and around $76,500 in total, including interest, escrow, and legal fees. She now owes $79,530. She will also have to pay $10,000 to her attorney out of payments she made to the bankruptcy trustee. She gets $7300 worth of repairs to her home. Although her new mortgage, being a reverse mortgage, will not require her to make monthly payments, she will still have to pay taxes, insurance, and maintentance out of pocket, since the initial disbursement for this loan was equal to its full principal limit. If she does not make those payments, she can face foreclosure from IndyMac. Or, well, the FDIC. If the FDIC is willing ever to foreclose on any IndyMac loans.

Plaintiff has been approved by Financial Freedom, a subsidiary of Indymac Bank, for a reverse mortgage to be secured by her residence. Plaintiff will receive approximately $79,530.00 in a principal limit. The lender will deduct approximately $6,436.00 for the cost of closing the loan and approximately $5,946.98 for servicing the loan. Approximately $7,300.00 must be set aside for repairs to be made as a condition of the loan. After all deductions, Plaintiff will receive approximately $59,847.02.

From the proceeds of the reverse mortgage, Plaintiff will pay the sum of $57,800.00 to Defendants and Defendants shall accept the sum of $57,800.00 in settlement and as full and final satisfaction of the entire debt owed by Plaintiff to Defendants. Upon receipt of these funds, Defendants shall cause the deed to secure debt on Plaintiff’s residence to be released and will withdraw the proof of claim filed by them in this case.

The Trustee shall not disburse any additional funds whatsoever to Defendants for ongoing mortgage payments or for any proof of claim filed by Defendants in the case.

The parties shall bear their own respective costs incurred in this adversary proceeding.

I guess that punishes the investors in Palmer's mortgage loans and her mortgage servicer for having made an error on a mortgage assignment: they'll be writing off most of their accrued interest and all their legal expenses.

I suppose it's just more of the crashing irony of this story that Palmer's new loan now belongs to us taxpayers, unless the FDIC can find a buyer for IndyMac. That and the fact that a homeowner left the bankruptcy system owing more, not less, than she did when she started. One of our regular commenters likes to tell me this is called "rough justice," and I should "get used to it."

I'm not sure I'd call this "rough justice." I certainly will not call this a "victory" for a homeowner in "foreclosure hell." Whatever Morgenson is smoking, she needs to give it up.

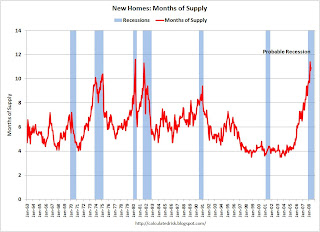

Graphs: June New Home Sales

by Calculated Risk on 7/27/2008 09:01:00 AM

Since I was out of town on Friday, here is a somewhat belated look at the New Home sales report from the Census Bureau.

According to the Census Bureau report, New Home Sales in June were at a seasonally adjusted annual rate of 530 thousand. Sales for May were revised up to 533 thousand (from 512 thousand).  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for June since the recession of '91. (NSA, 49 thousand new homes were sold in June 2008, just above the '91 recession low of 47 thousand homes).

As the graph indicates, there was no spring selling season in 2008. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in June 2008 were at a seasonally adjusted annual rate of 530,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.6 percent below the revised May rate of 533,000 and is 33.2 percent below the June 2007 estimate of 793,000.And one more long term graph - this one for New Home Months of Supply.

"Months of supply" is at 10.0 months.

"Months of supply" is at 10.0 months. Note that this doesn't include cancellations, but that was true for the earlier periods too. The months of supply is down from the peak of 11.2 months in March 2008.

The all time high for Months of Supply was 11.6 months in April 1980.

And on inventory:

The seasonally adjusted estimate of new houses for sale at the end of June was 426,000. This represents a supply of 10.0 months at the current sales rate.Inventory numbers from the Census Bureau do not include cancellations - and cancellations are near record levels. Actual New Home inventories are probably much higher than reported - my estimate is around 90K higher. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Still the 426,000 units of inventory is well below the levels of the last year, and inventory is now falling fairly quickly. It appears the home builders are selling more homes than they are building, and it is very possible that months of supply has peaked for this cycle.

I now expect that 2008 will be the peak of the inventory cycle (in terms of months of supply) and could be the bottom of the sales cycle for new home sales. But the news is still grim for the home builders. Usually new home sales rebound fairly quickly following a bottom (see the 2nd graph above), but this time I expect a slow recovery because of the overhang of existing homes for sales (especially distressed properties). If the recession is more severe than I currently expect, new home sales might fall even further.

Looking forward, I'm much more pessimistic about existing home sales, and existing home prices, than new home sales.

Saturday, July 26, 2008

Summary and Text: Foreclosure Prevention Act of 2008

by Calculated Risk on 7/26/2008 07:22:00 PM

UPDATE: This appears to be an up-to-date version of the bill.

Senate Passes Housing Bill

by Calculated Risk on 7/26/2008 06:01:00 PM

From the NY Times: Congress Sends Housing Relief Bill to Bush

Here is the WSJ version: Congress Passes Housing Bill

First, I think the impact of the original part of the housing bill will be minimal. The provision allows the FHA to insure up to $300 billion in new mortgages for certain borrowers. The key is that the current lender has to voluntarily agree to write down the loan balance to 85% of the current appraised value before the FHA will insure the new loan.

The CBO has estimated that the FHA will only insure $68 billion in loans for about 325,000 homeowners. The number will be limited because only certain homeowners actually qualify, and also because lenders probably will not be eager to write down loans to 85% of the current appraised value.

My biggest concerns with this provision are appraisal fraud and adverse selection.

The other major provision of the housing bill is the Paulson Plan to support Fannie and Freddie. The cost to taxpayers is very uncertain, although I doubt it will be zero (the CBO's base case). The GSE support does appear to be almost unlimited (limited only by the debt ceiling that was increased to $10.6 trillion from $9.815 trillion).

The actual cost of the Paulson Plan is a huge concern.

There are many other provisions. As the NY Times mentions:

There are provisions, for example, that grant or extend Section 8 federal housing subsidy eligibility to residents of specific properties in Malden, Mass., and San Francisco. And there is a provision tailored narrowly for Chrysler to ensure that it can benefit from a corporate tax incentive even though the company is now structured as a partnership not a corporation. The bill does not name Chrysler but rather describes an unnamed automobile manufacturer “that will produce in excess of 675,000 automobiles” between Jan. 1 and June 30, 2008.Weird.

The bill also has a tax credit for new home buyers (up to $7,500). This appears to be structured as a no interest loan that has to be repaid within 15 years.

The bill has many other provisions too, including permanently increasing the conforming loan limit to 115% of the local area median home price (with a ceiling of $625,000, from $417,000), and eliminating FHA related Downpayment Assistance Programs (DAPs). Tanta and I have been advocating eliminating DAPs for years.

Note: I could have some of the specifics wrong - I've read several stories, and the details vary.

I think the bill doesn't match the heated rhetoric on the internets (I've seen people write this is the "end of capitalism" and the "dollar is doomed"). Although I'm sure some commenters will confuse me with Pollyanna!

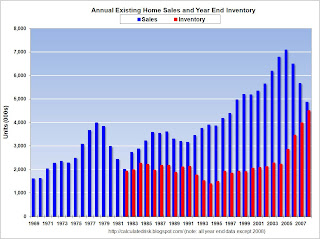

Graphs: Existing Home Sales

by Calculated Risk on 7/26/2008 02:08:00 PM

Here are some graphs (and analysis) based on the Existing Home sales report from the National Association of Realtors (NAR). (note: I was out of town this week, and couldn't post these earlier) Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June 2008 (4.86 million SAAR) were the weakest June since 1998 (4.78 million SAAR).

It's important to note that a large percentage of these sales were foreclosure resales (banks selling foreclosed properties). The NAR suggested that "short sales and foreclosures [account] for approximately one-third of transactions". Although these are real transactions, this means that normal activity (ex-foreclosures) is running around 3.3 million SAAR.

***************************** The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased slightly to 4.49 million homes for sale in June. The typical pattern is for inventory to decline in December, and then to slowly rebound in January and February, and really start to increase from March through mid-Summer.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased slightly to 4.49 million homes for sale in June. The typical pattern is for inventory to decline in December, and then to slowly rebound in January and February, and really start to increase from March through mid-Summer.

Some people are hoping that inventory is stabilizing at this level, however there is probably a significant "shadow inventory" waiting to come on the market.

Most REOs (bank owned properties) are including in the inventory because they are listed - but not all. Many houses in the foreclosure process are listed as short sales - so those would be counted too.

But there is some evidence lenders are holding off foreclosing, perhaps trying for workouts, or maybe the lenders are just overwhelmed - and many of these units are probably not included in inventory. And there are definitely homeowners waiting for a "better market" - and those homeowners will probably keep the supply high for a few years. The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.

Months of supply increased to 11.1 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply). Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales decline later this year. I still expect to see 12 months of supply sometime later this year. The fourth graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales are sharply lower in June 2008 compared to the previous three years.

The fourth graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales are sharply lower in June 2008 compared to the previous three years.

NSA sales were reported at 504 thousand in June, however about one-third of those were foreclosure resales. This means regular sales are less than half the level of June 2005 and 2006.

Note that June is an important month for existing home sales; existing home sales usually peak in the June through August period. This is usually about as good as it gets for sales on a NSA basis.

The next graph shows annual existing home sales and year end inventory. Note: for 2008 I used the June sales and inventory numbers. All other numbers are annual sales, and year-end inventory. If the red columns (inventory) rises above the blue column (sales) - something that is likely to happen this summer - then the "months of supply" number will be over 12.

If the red columns (inventory) rises above the blue column (sales) - something that is likely to happen this summer - then the "months of supply" number will be over 12.

The final graph shows the annual sales and year end inventory since 1982 (sales since 1969), normalized by the number of owner occupied units.

The graph shows that inventory is at an all time record level by this key measure. This also shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year. Currently 6% of owner occupied units would be about 4.6 million existing home sales per year.

This also shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year. Currently 6% of owner occupied units would be about 4.6 million existing home sales per year.

This indicates that the turnover of existing homes - June sales were at a 4.86 million Seasonally Adjusted Annual Rate (SAAR) - is still above the historical median. The reason sales are so high is because of all the foreclosure resales.

This suggests to me that sales will fall further later this year and in 2009.

Why the FDIC Fears Bloggers

by Calculated Risk on 7/26/2008 11:50:00 AM

Foreclosure Suicide Update: The Vultures Circle

by Anonymous on 7/26/2008 09:43:00 AM

I checked Google news this morning to see if there were any follow-up stories on Carlene Balderrama's suicide. There wasn't anything new, except this "press release" from some illiterate do-it-yerself PR website:

(Atlanta, Georgia) - Ransom Enterprizes, LLC a national real estate consulting firm has been consistent with training foreclosure consulting businesses how to properly assist homeowners with stopping foreclosures. Today the consulting firm announced to offer a free information report to homeowners facing foreclosures, an effort to prevent suicide attempts to stop foreclosure.One is then directed to Ransom Enterprizes' website for this "free information report."

According to Kyle Ransom president of Ransom Enterprizes, LLC he was extremely sadden when he learned about homeowner Carlene Balderrama actually taking her life because she was unable to resolve her foreclosure problem.

The Foreclosure Rescue Kit™ comes fully loaded with information that you must know before approaching the bank to stop your foreclosure! Important forms to help make your forbearance package look professionally prepared. Answers and solutions to help you save your home from foreclosure fast! Complete step-by-step guide to surefire you STOP Your Foreclosure in 72 Hours or Less!Apparently the "free" part involves the wise counsel on this webpage, such as this:

Ransom Foreclosure Rescue Kit™ Includes:

Blank Financial Statement Forms

Account Number and Property Address Placements

Required Documents Checklist

Foreclosure Process Overview

Foreclosure Prevention Overview

Hardship Letter Overview and Samples

Mortgage Financing Overview

Credit and Budgeting Overview

Professional Fax Coversheets

Make sure that you have all of the right knowledge to save your home from being foreclosed on by the bank. Your home is an investment that you must protect and you must act fast today to prevent the bank from foreclosing on it. Time is your worst enemy and the longer you wait the closer your home remains in danger of foreclosure.

Special Offer! Get Foreclosure Rescue Kit™ Today $99 Regularly $349 (Limited Time Offer)

If you file a bankruptcy the bank will not allow you to do a special forbearance or loan workout plan! Be careful of bankruptcy attorneys who encourage you to file bankruptcy before trying to work something out with the bank first. Once you see the fees that go directly to the bankruptcy attorney you will know exactly why they want you to file a bankruptcy.It is, of course, simply false that filing BK means the bank will never work something out with you. But the chutzpah of someone who charges $349 for some blank forms, information that is freely available on the web or at a non-profit housing counseling agency, and a fax coversheet accusing BK attorneys of looking to enrich themselves is quite stunning.

Madre de Dios. If you or someone you know is seriously depressed because of financial matters and is contemplating suicide, you need to call your local suicide prevention hotline, your doctor, your priest or rabbi or minister, or if you have no other resources, 911. Ask whoever answers the phone for an emergency referral to a qualified counselor. The first priority here is to save a life, not deal with foreclosure paperwork.

Absolutely the last thing you need to do is send $99 or 99 cents to some huckster on the Internet who is simply offering to sell you a packet of papers that puts the onus back on you to try to solve a terribly stressful and complex problem. Someone who is trying to get you to pay for "professional fax cover sheets" is not trying to help you. If you are feeling suicidal, you are no longer in a position to try to do this yourself, with or without some "kit."

And if you aren't suicidal, you don't need to spend a dime on this "kit" either. I normally try not to make absolute claims about the world, but I will make one now: no mortgage workout negotiation has ever been turned down by a lender because your fax cover sheet wasn't pretty enough. Not now, not ever, not a happening kind of thing. Anyone who says or implies different is lying to you in order to make a fast buck off of you. And even if you want to believe that a pretty fax cover sheet could make a difference, you would want to obtain one from someone who can write grammatical and correctly-spelled English. Which would not be "Ransom Enterprizes."

I am not willing to hold the media outfits who have been flogging the Balderrama story responsible for its co-optation by sleazeballs. I am, however, suggesting that the media exploiters of this story just created a narrative line that lets the "stop foreclosure" hustlers position themselves as caring folk who just want to prevent suicides. And that makes me want to throw up.