by Calculated Risk on 7/26/2008 02:08:00 PM

Saturday, July 26, 2008

Graphs: Existing Home Sales

Here are some graphs (and analysis) based on the Existing Home sales report from the National Association of Realtors (NAR). (note: I was out of town this week, and couldn't post these earlier) Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June 2008 (4.86 million SAAR) were the weakest June since 1998 (4.78 million SAAR).

It's important to note that a large percentage of these sales were foreclosure resales (banks selling foreclosed properties). The NAR suggested that "short sales and foreclosures [account] for approximately one-third of transactions". Although these are real transactions, this means that normal activity (ex-foreclosures) is running around 3.3 million SAAR.

***************************** The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased slightly to 4.49 million homes for sale in June. The typical pattern is for inventory to decline in December, and then to slowly rebound in January and February, and really start to increase from March through mid-Summer.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased slightly to 4.49 million homes for sale in June. The typical pattern is for inventory to decline in December, and then to slowly rebound in January and February, and really start to increase from March through mid-Summer.

Some people are hoping that inventory is stabilizing at this level, however there is probably a significant "shadow inventory" waiting to come on the market.

Most REOs (bank owned properties) are including in the inventory because they are listed - but not all. Many houses in the foreclosure process are listed as short sales - so those would be counted too.

But there is some evidence lenders are holding off foreclosing, perhaps trying for workouts, or maybe the lenders are just overwhelmed - and many of these units are probably not included in inventory. And there are definitely homeowners waiting for a "better market" - and those homeowners will probably keep the supply high for a few years. The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.

Months of supply increased to 11.1 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply). Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales decline later this year. I still expect to see 12 months of supply sometime later this year. The fourth graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales are sharply lower in June 2008 compared to the previous three years.

The fourth graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales are sharply lower in June 2008 compared to the previous three years.

NSA sales were reported at 504 thousand in June, however about one-third of those were foreclosure resales. This means regular sales are less than half the level of June 2005 and 2006.

Note that June is an important month for existing home sales; existing home sales usually peak in the June through August period. This is usually about as good as it gets for sales on a NSA basis.

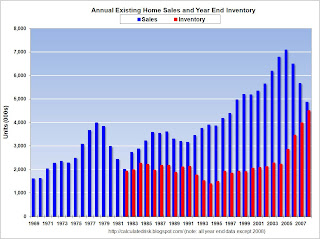

The next graph shows annual existing home sales and year end inventory. Note: for 2008 I used the June sales and inventory numbers. All other numbers are annual sales, and year-end inventory. If the red columns (inventory) rises above the blue column (sales) - something that is likely to happen this summer - then the "months of supply" number will be over 12.

If the red columns (inventory) rises above the blue column (sales) - something that is likely to happen this summer - then the "months of supply" number will be over 12.

The final graph shows the annual sales and year end inventory since 1982 (sales since 1969), normalized by the number of owner occupied units.

The graph shows that inventory is at an all time record level by this key measure. This also shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year. Currently 6% of owner occupied units would be about 4.6 million existing home sales per year.

This also shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year. Currently 6% of owner occupied units would be about 4.6 million existing home sales per year.

This indicates that the turnover of existing homes - June sales were at a 4.86 million Seasonally Adjusted Annual Rate (SAAR) - is still above the historical median. The reason sales are so high is because of all the foreclosure resales.

This suggests to me that sales will fall further later this year and in 2009.

Why the FDIC Fears Bloggers

by Calculated Risk on 7/26/2008 11:50:00 AM

Foreclosure Suicide Update: The Vultures Circle

by Anonymous on 7/26/2008 09:43:00 AM

I checked Google news this morning to see if there were any follow-up stories on Carlene Balderrama's suicide. There wasn't anything new, except this "press release" from some illiterate do-it-yerself PR website:

(Atlanta, Georgia) - Ransom Enterprizes, LLC a national real estate consulting firm has been consistent with training foreclosure consulting businesses how to properly assist homeowners with stopping foreclosures. Today the consulting firm announced to offer a free information report to homeowners facing foreclosures, an effort to prevent suicide attempts to stop foreclosure.One is then directed to Ransom Enterprizes' website for this "free information report."

According to Kyle Ransom president of Ransom Enterprizes, LLC he was extremely sadden when he learned about homeowner Carlene Balderrama actually taking her life because she was unable to resolve her foreclosure problem.

The Foreclosure Rescue Kit™ comes fully loaded with information that you must know before approaching the bank to stop your foreclosure! Important forms to help make your forbearance package look professionally prepared. Answers and solutions to help you save your home from foreclosure fast! Complete step-by-step guide to surefire you STOP Your Foreclosure in 72 Hours or Less!Apparently the "free" part involves the wise counsel on this webpage, such as this:

Ransom Foreclosure Rescue Kit™ Includes:

Blank Financial Statement Forms

Account Number and Property Address Placements

Required Documents Checklist

Foreclosure Process Overview

Foreclosure Prevention Overview

Hardship Letter Overview and Samples

Mortgage Financing Overview

Credit and Budgeting Overview

Professional Fax Coversheets

Make sure that you have all of the right knowledge to save your home from being foreclosed on by the bank. Your home is an investment that you must protect and you must act fast today to prevent the bank from foreclosing on it. Time is your worst enemy and the longer you wait the closer your home remains in danger of foreclosure.

Special Offer! Get Foreclosure Rescue Kit™ Today $99 Regularly $349 (Limited Time Offer)

If you file a bankruptcy the bank will not allow you to do a special forbearance or loan workout plan! Be careful of bankruptcy attorneys who encourage you to file bankruptcy before trying to work something out with the bank first. Once you see the fees that go directly to the bankruptcy attorney you will know exactly why they want you to file a bankruptcy.It is, of course, simply false that filing BK means the bank will never work something out with you. But the chutzpah of someone who charges $349 for some blank forms, information that is freely available on the web or at a non-profit housing counseling agency, and a fax coversheet accusing BK attorneys of looking to enrich themselves is quite stunning.

Madre de Dios. If you or someone you know is seriously depressed because of financial matters and is contemplating suicide, you need to call your local suicide prevention hotline, your doctor, your priest or rabbi or minister, or if you have no other resources, 911. Ask whoever answers the phone for an emergency referral to a qualified counselor. The first priority here is to save a life, not deal with foreclosure paperwork.

Absolutely the last thing you need to do is send $99 or 99 cents to some huckster on the Internet who is simply offering to sell you a packet of papers that puts the onus back on you to try to solve a terribly stressful and complex problem. Someone who is trying to get you to pay for "professional fax cover sheets" is not trying to help you. If you are feeling suicidal, you are no longer in a position to try to do this yourself, with or without some "kit."

And if you aren't suicidal, you don't need to spend a dime on this "kit" either. I normally try not to make absolute claims about the world, but I will make one now: no mortgage workout negotiation has ever been turned down by a lender because your fax cover sheet wasn't pretty enough. Not now, not ever, not a happening kind of thing. Anyone who says or implies different is lying to you in order to make a fast buck off of you. And even if you want to believe that a pretty fax cover sheet could make a difference, you would want to obtain one from someone who can write grammatical and correctly-spelled English. Which would not be "Ransom Enterprizes."

I am not willing to hold the media outfits who have been flogging the Balderrama story responsible for its co-optation by sleazeballs. I am, however, suggesting that the media exploiters of this story just created a narrative line that lets the "stop foreclosure" hustlers position themselves as caring folk who just want to prevent suicides. And that makes me want to throw up.

Two FDIC Insured Banks Fail

by Calculated Risk on 7/26/2008 02:57:00 AM

From the FDIC: Failed Bank Information

First National Bank of Nevada, Reno, NV

First Heritage Bank, N.A., Newport Beach, CA

As of June 30, 2008, First National of Nevada had total assets of $3.4 billion and total deposits of $3.0 billion. First Heritage Bank had total assets of $254 million and total deposits of $233 million.I go away for a few days and two banks fail!

...

The cost of the transactions to the Deposit Insurance Fund is estimated to be $862 million.

Friday, July 25, 2008

Weekend Posts on Housing

by Calculated Risk on 7/25/2008 09:00:00 PM

Hi All. I'm returning tonight from San Francisco - and I will be post on housing over the weekend.

There will be plenty of graphs - interesting times!

Best to all.

One Fourth of Orange County Class A Office Space Available

by Calculated Risk on 7/25/2008 06:46:00 PM

From Jon Lansner at the O.C. Register: Tenant shortage plagues 25% of O.C.’s office towers

Studley Inc. reports that 25.1% of the office space in O.C.’s most prized buildings was available for rent during the second quarter — a rate not seen since the second quarter of 2002 in the last recession. A year ago, it was 18%.See through buildings!

The real estate services firm, which represents tenants, blamed a flood of space coming on line from “mistimed construction” and sublet supply from companies, particularly in the mortgage sector, that have closed up shop and vacated their offices.

“You drive through Orange County and you see all these buildings with no people in them,” says Caitlin Zimmer, Studley’s research director. “And it has not plateaued."The CRE slump is here - and this will significantly impact construction related employment and non-residential investment in structures.

Appraisal Fraud at IndyMac

by Anonymous on 7/25/2008 03:25:00 PM

A very interesting post today at The Big Picture.

Hopefully this means the FDIC will be monitoring Barry more closely and I can get some sleep.

Chrysler Lending Arm Stops Leases

by Calculated Risk on 7/25/2008 03:17:00 PM

From the WSJ: Chrysler to Stop Offering Leases Through Lending Arm

Chrysler LLC has started telling dealers it will no longer offer auto leases through its lending arm Chrysler Financial, people familiar with the matter said Friday.More ripples ...

...

Chrysler's announcement also comes as Chrysler Financial has been trying to persuade more than 20 banks to renew a $30 billion credit facility -- backed by car loans, leases and loans to dealers -- that was issued by the auto-finance company last year when it was carved out of the former DaimlerChrysler AG. The debt represents a sizable chunk of Chrysler Financial's $70 billion portfolio in working capital. The higher financing costs could further complicate the attempt by private-equity firm Cerberus Capital Management LP to turn around the auto maker.

Chrysler Financial is likely to see its borrowing costs rise in early August when it rolls over about $30 billion of short-term debt backed by the loans and leases it makes. That, in turn, will make it harder for the company to offer low-interest loans to buyers and for dealers to hold inventory.

The "Foreclosure Crisis" and Exploitation of a Suicide

by Anonymous on 7/25/2008 11:50:00 AM

This is an extremely distressing story: a woman faxes a suicide note to her mortgage servicer on the day the foreclosure sale is scheduled, and is dead by the time the police arrive.

Distressing for anyone with what I take to be a normal sense of human decency, that is. To the local and now national media, it seems to be catnip. Carlene Balderrama's personal tragedy is in danger of becoming an indelible urban legend of the Great Predatory Foreclosure Crisis, uncomfortable facts be damned. The tenor of the reporting, of course, makes anyone who expresses any skepticism about the media's line on this sad event sound inhuman. I have been telling myself since I first saw this story that only a fool would try to steer a course through the rock of credulousness or the hard place of callousness. But I guess it's my job to be a fool today.

***************

The Boston Globe got the thing underway on Thursday:TAUNTON - The housing crunch has caused anguish and anxiety for millions of Americans. For Carlene Balderrama, a 53-year-old wife and mother, the pressure was apparently too much.

Those appear to be facts. Then we get this:

Police say that Balderrama fatally shot herself Tuesday afternoon, 90 minutes before her foreclosed home was scheduled to be sold at auction. Chief Raymond O'Berg said that Balderrama faxed a letter to her mortgage company at 2:30 p.m., saying that "by the time they foreclosed on the house today she'd be dead."

The mortgage company notified police, who found her body at 3:30 p.m. The auction had been scheduled to start at 5 p.m., when bidders showed up at the house and found it surrounded by police cruisers.

But, unbeknownst to buyers and to Balderrama, the auction had been postponed by the time she grabbed her husband's high-powered rifle, O'Berg said.

Balderrama left a note for her family, saying they should "take the [life] insurance money and pay for the house," O'Berg said. The chief said he did not know, however, if the family would be able to collect on the policy in the event of a suicide.Joe Whitney, who works with Balderrama's husband, said that she handled the bills in the household and that the husband was unaware of the foreclosure.

Something doesn't add up here. Nonetheless, the reporter is undeterred:

"John didn't even know about it; that's the surprise," Whitney said outside the home, where he had come to comfort the family. "It's just one of those awful, awful, tragic events."

John Balderrama did, however, file for Chapter 13 bankruptcy three times from 2004 to 2006, but the courts dismissed the petitions. Debtors who declare bankruptcy under Chapter 13 generally can keep their homes while paying off their debts under a court-approved reorganization plan.As Congress rushed yesterday to help 400,000 strapped homeowners avoid foreclosure and prevent Fannie Mae and Freddie Mac from collapsing, the suicide underscored the potentially devastating toll of the housing crunch.

We have Bruce Marks, who should be ashamed of himself, labelling Balderrama's mortgage lender a predator. We have a cop making claims about the terms of the mortgage loan and the sequence of events leading to the default--claims that the reporter could have verified by searching the public records. (Note: I have not examined the Balderrama's recorded mortgage documents, because the North Bristol MA Registry of Deeds requires creation of an account with an account fee and a $1.00 per page charge for the documents. I am not inclined to spend $15 to see a copy of their mortgage, but I'm inclined to wonder why the Boston Globe isn't so inclined.) But we get even more from the co-worker and the cop:

Bruce Marks, chief executive of the Neighborhood Assistance Corporation of America, said it is not uncommon for homeowners to contemplate suicide when they cannot keep up their mortgage payments. Marks's group counsels homeowners in crisis and responds to such crises by immediately notifying the police, he said.

"What gets us so angry is that people blame themselves," Marks said. "They can't see past their sense of responsibility to see the responsibility and the predatory nature of these lenders. The fact of the matter is, unless something dramatic happens, there's going to be more and more people like her taking their lives."

Police believe that when the Balderramas bought the house in a stronger market, the family chose an adjustable rate mortgage, confident they would be able to keep up the payments. But as the housing market plummeted and the rates rose, the family fell behind, O'Berg said.Whitney said he did not believe that Carlene Balderrama had a history of mental illness.

Why are two people who are neither psychologists nor economists so eager to convince us that the primary cause of this suicide was "the foreclosure crisis"? Since when do the local cops become your go-to sociologists?

"It looked like a happy couple," Whitney said. "That's why John was so blown away. Nothing medically ever came up, and I've known them for 20 years."

O'Berg said he was troubled that the pressures of foreclosure had triggered suicide on a street that he described as solidly middle-class.

"That's the real sad part: This is a middle-class family, a husband working, the son is working," O'Berg said. But the housing crunch, he said, "is inflicting real pain on middle-class Americans.

"Put yourself in her shoes," he added. "You handle the finances, and you're hiding everything from family. It's a lot of pressure."

The Boston Herald on the same day provided some facts that rather confound this narrative:John Balderrama bought the three-bedroom house at 103 Duffy Drive in October 2002, using a $220,255 mortgage to cover most of the $232,000 purchase price, public records show.

The Herald does not confirm that the mortgage loan in question was an ARM, but it certainly casts doubt on the idea that rising interest rates and plummeting house prices had anything to do with the Balderramas' difficulties with their mortgage.

But less than eight months later, PHH initiated foreclosure proceedings - usually a sign that a borrower is at least 90 days delinquent.

According to the Herald, John Balderrama filed Chapter 13 bankruptcy petitions in 2004, 2005, and 2006. I did spend some time looking at these bankruptcy filings, which are available to anyone with a PACER account and the willingness to spend 8 cents a page. In all three filings, the only debts listed for Balderrama were a single mortgage on the house and a car loan. There are no unsecured debts and no undischargeable or "priority" debts. There are no catastrophic (or even modest) medical expenses or debts. In fact, in all three filings, the only debt to be paid through the Chapter 13 plan is the arrearage on the mortgage, which seems to have been around $27,000 in the first filing and around $44,000 by the last one (in April 2006). Otherwise, each plan indicated that Balderrama would pay his approximately $1700 house payment (that figure includes taxes and insurance) and $289 car loan directly to the creditors during the BK. Each plan indicated that there were no assets above exempt amounts.

The only real difference among the three filings is that Balderrama's income kept increasing substantially, meaning that in each filing the required payment to the trustee kept increasing. In the first filing, he claimed gross monthly income of $6,202, which resulted in a monthly repayment plan requirement of $527 (in addition to the regular monthly car and house payment). (The Herald story reports his net (after tax) income instead of gross.) By the third filing, the gross monthly income was $10,461 and the plan payment was $1066. As far as I can tell, Balderrama never made more than one plan payment during any of these BKs. It's hard to tell whether the mortgage payment was made post-petition, but in at least two of the BKs the post-petition car payment didn't get made. All the bankruptcies were dismissed due to either failure to make payments to the trustee or failure to attend hearings or creditors' meetings.

I have to say that these were a very strange set of BK filings. Carlene Balderrama never appears as a debtor, or even as a spousal signatory. (Did Carlene even know about the BK filings? It makes more sense that she would be in the dark about the BKs than that her husband was in the dark about the mortgage arrearage.) Although the household income keeps rising, there are no increases in bank accounts or other debts or assets that can account for where the money goes every month. In the first BK, filed just over a year and half after the purchase of the home and a year after the first foreclosure attempt, Balderrama's debt-to-income ratio as a mortgage lender would calculate it was 41%, including the Chapter 13 payment. By the last BK, the DTI was 29%. There is no indication that Balderrama's mortgage payment increased; in fact if the debtor's filing is correct it decreased (from $1740 in the first filing to $1703 in the last).

It seems quite obvious that these filings were intended solely to stay foreclosure rather than to deal with crippling debt payments and reduced income. Yet Balderrama never cooperated with the court or made an effort to make payments, resulting in serial dismissals. Even on the assumption that the household budget in a Chapter 13 is often unrealistically tight, I just can't see from the paperwork why the Balderramas couldn't pay their house and car payment and the arrearage installments.

Are these folks debt-bingers? Apparently not. They've had exactly two debts in the last six years: a house payment and a car payment. Did they buy an overpriced home with a mortgage that instantly went upside down? It doesn't look like it. If Zillow is to be believed, the mortgage has never been upside down and was probably quite close to break-even when the foreclosure was completed (including arrearages in the loan amount). Victims of job loss or serious illness? Doesn't look like it. Victims of a predatory lender squeezing them with an exploding ARM in a falling RE market? The BK paperwork suggests that that claim is ridiculous.

Nonetheless, by this morning ABC news got ahold of the story. A new detail:But for one reason or another, it appeared that Carlene Balderrama decided to deal with the family's flagging finances on her own. O'Berg [our ubiquitous cop quote-bot] said that according to Balderrama's husband, John, Carlene handled all of the family's financial matters.

Mr. Balderrama filed two bankruptcies during the last 42 months. But he had no idea his mortgage payments were in arrears? Are we supposed to believe that Carlene Balderrama forged her husband's signature on the BK filings and suborned the perjury of at least one attorney? How else do we square this claim of ignorance with the BK records?

"I had no clue," John Balderrama told The Associated Press on Wednesday, adding that Carlene had hidden from him the fact that she hadn't paid the mortgage in 42 months.

Little details like that, however, don't stop the ABC reporter or his psychologist quote-bots:"Suicide is certainly a response to hard economic times," noted Dr. Harold Koenig, professor of psychiatry and behavioral sciences at Duke University Medical Center in Durham, N.C. "Consider what happened when the stock market fell in 1929. There was a rash of suicides."

Well, John Kenneth Galbraith labelled that "rash of suicides" a "myth" in 1955, and if anyone has more recent hard data that says otherwise, I'd like to see it. Before we construct another myth about the Great RE Crash of 2008 with the same kind of "data."

I do not doubt for a moment that Carlene Balderrama was under severe psychological stress. Whatever kept her going through six years of an inability to make her mortgage payments, clearly the reality of the day of foreclosure sale was too much to bear. What I do object to is the transformation of this story into an urban legend about "predatory lenders" and the effects of an RE downturn based on no evidence whatsoever. I object to these reporters' unwillingness to deal with the facts available to them that surely complicate this currently popular narrative. I object to cops running off at the mouth with unsubstantiated claims and a husband and his co-worker heaping blame for the family's financial woes on a dead woman who can no longer defend herself, and I surely object to it when it gets used to slander a mortgage servicer who was, apparently, the only party involved who ever took this woman seriously enough to call 911.

If anybody can explain to me how this series of reports on Carlene Balderrama's suicide are anything other than exploitation of her tragedy in order to support an overwrought rhetoric that sees every foreclosure that has occurred in the last year or so as "predatory" and "unnecessary," then please do so in the comments. I am not seeing it.

Cost of WaMu Debt Protection Increases Sharply

by Calculated Risk on 7/25/2008 11:21:00 AM

From Reuters: Washington Mutual debt protection costs jump

The cost of protecting Washington Mutual's debt for five years rose to $1.85 million on an upfront basis, plus $500,000 in annual premiums, up from about $1.35 million plus $500,000 annually on Thursday, according to a trader.This is the cost to insure $10 million in debt.