by Calculated Risk on 7/19/2008 09:47:00 PM

Saturday, July 19, 2008

The Accidental Landlord

This NY Times article, Landlords, if Only by Accident, is somewhat of an advice column for novice landlords. But what is interesting is the two accidental landlords mentioned in the article.

Mr. Vallance ... bought [a] house about six years ago for $270,000 but has since decided he prefers the city to the suburbs. Selling it now isn’t the best option. “Maybe I could get $340,000, but four years ago I would have gotten $400,000,” he said.Why not sell it now for $340 thousand? He would still make a profit on the property, and if house prices continue to decline - as seems likely - he might get 20% less in a couple more years.

And so he waits, leasing a one-bedroom in Midtown Manhattan while he rents out his house.

Three years ago, [Dr. Lorena Siqueira] bought as an investment a two-bedroom condominium on Brickell Key, a gated island in downtown Miami. She is concerned that the recently completed condo will not sell quickly for the price she wants — above the $1 million or so she paid at preconstruction prices. Stuck now with two homes that are near each other, she will rent out the new unit.The market will stabilize eventually, probably at prices far below what Dr. Siqueira paid.

“I would rather take a loss on the rental and wait for the market to stabilize,” Dr. Siqueira said.

Both of these accidental landlords are looking at prices from a few years ago, and deciding to wait to sell. In general this is a mistake. Owners should analyze the rent or sell decision based on current prices - and consider the probability that nominal prices will move lower or at best stay flat for several years.

This is part of the shadow inventory that will eventually be sold and will help keep inventory levels high for years.

Daily Show: It's the Stupid Economy

by Calculated Risk on 7/19/2008 06:54:00 PM

Jon Stewart's take on the economy.

U.K. Economic "Horror Movie"

by Calculated Risk on 7/19/2008 05:49:00 PM

A few stories from across the pond ...

From The Times: UK economy heads for ‘horror movie’

BRITAIN is facing an “economic horror movie” because of a “toxic mixture” of a moribund credit market and volatile oil prices, according to a leading forecasting group.Also from The Times: House prices tipped to fall 20% in two years

...

Peter Spencer, chief economist at the Item club, said: “Both on the high street and in the housing market it is going to get a great deal worse before it gets better. We have already seen a housing crisis that has morphed from a credit crunch to a general collapse in confidence as prices have tumbled.

...

“The sharp fall in overall business optimism is very worrying and points towards a recession,” said [Graeme Leach, chief economist at the Institute of Directors.

Howard Archer, of Global Insight ... said prices would plummet by a further 20 per cent, or £40,000 on average, before the market begins to recover.And from the Telegraph: Alistair Darling may face £100bn budget deficit

...

Vicky Redwood, of Capital Economics, presented an even bleaker outlook, forecasting that the housing market would not recover until well into 2011.

Morgan Stanley, the investment bank, said that if prices fall by 25 per cent in the next two years, more than two million - or one in six borrowers - would be in negative equity.

Alistair Darling may see his budget deficit balloon to a record £100bn in the coming year as a potential recession bites, experts have warned.The usual responses to an economic slowdown are for the Central Bank to cut interest rates (monetary policy) and deficit spending from the government (fiscal policy). Because of inflation fears and a ballooning budget deficit, it is difficult for the central bank and government to respond.

The alert was sounded as the public finances lurched deep into the red ... Revenues from income tax, National Insurance, corporation tax, VAT and stamp duty have suddenly dried up as the credit crisis and downturn in the housing market hit the economy ...

Financial Times: US builders forced to sell off holdings

by Calculated Risk on 7/19/2008 11:42:00 AM

From the Financial Times: US builders forced to sell off holdings (Hat tip Terry)

Demand for new homes on the outskirts of US towns has fallen spectacularly in the last three years, while foreclosures and speculative building have created a far greater supply of homes than there are buyers. At the same time, soaring fuel costs have made the long commute to work that much less attractive.

The result is that farmland close to cities that has often been the seedbed for new housing developments is becoming less valuable to builders, at the same time as farmers want more of it.

...

Lakewood Homes, a small mid-western builder, sold 290 acres of land in the Chicago suburb of Newark at $9,650 (€6,086, £4,831)) an acre in April, nearly 40 per cent below the $15,865 an acre the company paid for the land in November 2005, to a local agricultural investor. Now instead of hundreds of new homes, the land will yield a range of crops including corn and soyabeans.

Click on graph for larger image in new window.

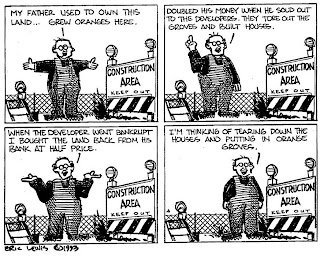

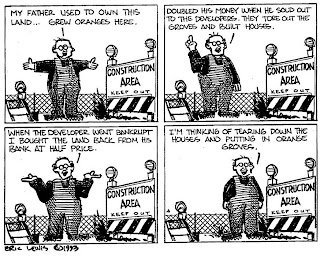

Click on graph for larger image in new window.It looks like that cartoon I posted yesterday was prescient!

This cartoon was drawn in 1993 by Eric G. Lewis, a freelance cartoonist living in Orange County, CA (used with permission).

Friday, July 18, 2008

"There is NO problem, and we are dealing with it"

by Calculated Risk on 7/18/2008 10:11:00 PM

Stu says thanks!

From Stu:

"I’d like to thank the 885 CR readers who have voted on my form so far. They were a tremendous resource whether complimenting me or challenging me to be better."Check out the 12 cartoons that made the cut: Stu's Real Estate Cartoons

Update: The $10 Trillion Man?

by Calculated Risk on 7/18/2008 05:56:00 PM

Several years ago I predicted that the National Debt would reach $10 trillion by the time President Bush left office. For a short period (thanks to the housing bubble), it looked like the deficit would be less than I projected.

Now that the housing bust is hitting government revenues, it looks like the $10 trillion projection will be close.

The current National debt is $9.518 trillion (see TreasuryDirect) as of July 17, 2008. That leaves the debt about $482 billion short of my projection with about 6 months to go.

Last year, from July 17, 2007 to Jan 20, 2008, the debt increased $297 billion. That is not a fast enough pace to make $10 Trillion by next January. But the debt is increasing faster this year.

The increase in the debt was about 50% higher over the first half of 2008 compared to the first half of 2007. If that pace continues for the next 6 months, we can estimate the debt will increase another $297 billion * 1.5, or $446 billion, before Bush leaves office.

$10 Trillion Man? It is going to be close!

Fed's Stern: Fed Can't Wait for Crisis to End to Raise Rates

by Calculated Risk on 7/18/2008 05:06:00 PM

From Bloomberg: Fed's Stern Says Rate Rise Can't Wait for Crisis End

``We can't wait until we clearly observe the financial markets at normal, the economy growing robustly, and so on and so forth, before we reverse course,'' Stern, president of the Federal Reserve Bank of Minneapolis, said in an interview today.Market participants expect no rate change through at least the September meeting. Stern is a voting member of the FOMC.

...

``We're pretty well-positioned for the downside risks we might encounter from here,'' said Stern, 63, the Fed's longest- serving policy maker. ``I worry a little bit more about the prospects for inflation.''

Agency Mortgage-Bond Spreads Increase

by Calculated Risk on 7/18/2008 01:47:00 PM

From Bloomberg: Agency Mortgage-Bond Spreads Rise as Freddie Mac Ponders Sales

The difference between yields on Fannie Mae's current- coupon, 30-year fixed-rate mortgage bonds and 10-year government notes widened 5 basis points to 206 basis points [a four-month high], according to data compiled by Bloomberg.This is still below the spread in March of 238 bps. The increase today is apparently due to comments made in a Freddie SEC filing.

Freddie Mac is considering selling assets carried below their value to maintain acceptable capital ratios, it said today in a filing with the U.S. Securities and Exchange Commission.Selling of these assets (or less buying) would put pressure on the price. The end result would probably be higher mortgage rates.

A Housing Cartoon from 1993

by Calculated Risk on 7/18/2008 11:24:00 AM

Haven't we been here before? Ah, yes ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This cartoon was drawn in 1993 by Eric G. Lewis, a freelance cartoonist living in Orange County, CA (used with permission).

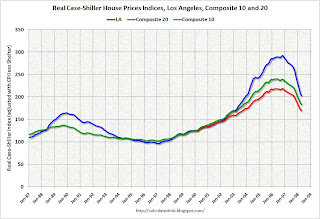

The following graph puts the cartoon into context. The graph compares real Case-Shiller house prices for Los Angeles and the Composite 10 and 20 Index (10 and 20 large cities). The indices are adjusted with CPI less Shelter.

Note that the cartoon was drawn in 1993 and real prices fell in the Los Angeles area for about four more years! The current Composite 20 bubble looks similar (although larger) to the previous Los Angeles bubble. (Note the Composite 20 index started in 2000). And prices will probably fall in real terms for several more years.

The current Composite 20 bubble looks similar (although larger) to the previous Los Angeles bubble. (Note the Composite 20 index started in 2000). And prices will probably fall in real terms for several more years.

Professor Krugman presents a similar graph today using the Case-Shiller Composite 10 index and also looking at how elevated unemployment will probably linger. His conclusion: Housing slumps last.

Yes we've been here before - although this housing bubble was larger and more geographically pervasive than the earlier Los Angeles bubble.

Citigroup: $7.2 billion write-down

by Calculated Risk on 7/18/2008 09:08:00 AM

From MarketWatch: Citigroup swings to loss on $7.2 billion write-down

Citigroup ... said on Friday that it lost money for the third consecutive quarter after writing down $7.2 billion of investments related to fixed-income weakness and consumer credit woes.

...

The consumer area showed worse performance than some other businesses on a quarter-to-quarter level, as the $3 billion second-quarter figure was down just a fraction from the $3.1 billion first-quarter figure.

"Higher credit costs reflected a weakening of leading credit indicators, including higher delinquencies in first and second mortgages, and unsecured personal and auto loans. Credit costs also reflected trends in the macro-economic environment, including the housing market downturn," Citi said.