by Calculated Risk on 6/14/2008 03:27:00 PM

Saturday, June 14, 2008

ARMs: The Next Wave of Delinquencies

Mathew Padilla at the O.C. Register has an interesting piece on rapidly rising delinquencies in Orange County, CA: Orange County’s mortgage market distress could soon top the U.S..

The report said O.C.’s delinquency rate of 3.14 percent, was less than California’s 4.34 percent and the nation’s 3.23 percent.Here are some comments from Keith Carson, a senior consultant for TransUnion, on why the delinquency rates are rising quickly in Orange County:

But, unfortunately, the county’s delinquency rate is rising more quickly than for both the state and nation.

In Orange County, ... the rate at which you are accelerating is reason for concern. I think that is probably a function of the number of adjustable-rate loans that were made in Orange County in the 2005 to 2006 time frame. Some of those have reset (the interest rate has increased) to the point where occupants can’t afford the payments.This is not a subprime problem. The reason the delinquency rate is rising rapidly in Orange County is because homes are very expensive, and a large number of recent home buyers used ARMs, especially Option ARMs, as affordability products.

...

I think it is mostly due to the price of homes in California. There were a lot more ARMs used so people could afford to get into a home. For a lot of people the only way they could get into a home was with an ARM.

Now that the interest rate is increasing - and in some cases the loans are hitting the maximum allowed principal ceiling - these loans are no longer affordable. Since these same homeowners have negative equity, selling the home is not an alternative.

The important point here is that delinquencies are starting to increase rapidly in middle to upper middle class neighborhoods where buyers used "affordability products" to buy more house than they could really afford.

We are all subprime now!

NAR Corrected: NJ Q1 Home Sales down 30%

by Calculated Risk on 6/14/2008 10:27:00 AM

The New Jersey Real Estate Report finds an error in the NAR data for New Jersey:VINDICATION - NJ Q1 Home Sales down 30%

The NAR reported New Jersey sales as flat, but now are correcting the data to show a 30% decline in sales.

This probably has some impact on the national data too. Kudos to James!

Friday, June 13, 2008

Kasriel On MEW and the Fed

by Calculated Risk on 6/13/2008 07:46:00 PM

Northern Trust chief economist Paul Kasriel discusses active MEW:

Economists refer to something called the “wealth” effect. It is hypothesized that households tend to spend relatively more of their income when their wealth is increasing and vice versa. Mind you, households do not have any more cash in hand to spend when the value of their stock portfolios or houses go up. They are just wealthier “on paper.”Note: my graphs have focused on MEW including turnover. Active MEW is a subset of the data I've presented and consists of cash out refis and HELOCs.

In this past cycle, it had become very easy for households to turn their increased “paper” housing wealth into actual cash by borrowing against their increased home equity. This borrowing is called mortgage equity withdrawal, or MEW. Active MEW can be defined as mortgage equity withdrawal consisting of refinancing and home equity borrowing. In contrast, inactive MEW consists of turnover. At an annualized rate, active MEW peaked at $576 billion in the second quarter of 2006. Active Mew has slowed to only $114 billion in the first quarter of this year – the smallest amount since the fourth quarter of 1999 (see Chart 3 [at link]). There is no doubt in my mind that active MEW, which actually puts additional cash into the hands of households, played an important role in boosting consumer spending in this past expansion. And there is no doubt in my mind that the recent and likely continued decline in active MEW will play an important role in retarding consumer spending in this recession. Because it has been easier to borrow against the increased wealth in one’s house than in one’s stock portfolio, dollar-for-dollar, falling house prices will have a more important negative effect on household spending that will falling stock prices.

And on Fed tightening:

It is conceivable the Fed could engage in a one-off 25 basis point hike in the funds rate, which could not make a material difference on business activity because the Fed has taken radical preemptive action as an insurance against the possibility of a severe economic downturn and/or continued financial market disruptions. ... But, there is a distinctly stronger probability attached to the likelihood of an unchanged federal funds rate well into 2009 ... In other words, in our estimation, the Fed may not need to translate rhetoric into action given the fragile economic environment and the likelihood that inflation will be moderating in the second half of the year.Goldman Sachs has the same view (no link): Could They? Yes. Will They? We Don't Think So.

[W]e still believe that tightening is both inappropriate and unlikely anytime soon. It is inappropriate because: (1) the economy is fundamentally weak, with tax rebates driving the surge in retail sales; (2) financial markets remain fragile; and (3) worries about inflation are overdone ...

Bank Failure Friday?

by Calculated Risk on 6/13/2008 04:31:00 PM

It's Friday the 13th, do you know if your bank has failed?

We know WaMu has issued a denial.

Downey Financial put out some ugly non-performing asset numbers.

The parent of Downey Savings and Loan Association said its total non-performing assets (NPAs) rose 14.3 percent of total assets of $12.78 billion as of May 31.Alistair Barr at MarketWatch recently mentioned Corus and IndyMac as possible candidates.

Reader Brian is also wondering about IndyMac because of the price action today.

The odds are no FDIC insured banks will fail today, and if one does, it will be some bank in Podunk. But it is Friday the 13th, so maybe the FDIC will go for two.

Roubini on Retail Sales and Recession

by Calculated Risk on 6/13/2008 01:55:00 PM

Roubini on retail sales: Click on photo for Bloomberg Interview

Click on photo for Bloomberg Interview

The retail sales figures for May - better than expected - were driven by a temporary factor, the tax rebates, whose influence will fade out by early fall.

Instead, more persistent factors will bear negatively on consumption over the summer and especially the fall: the fall in home prices and the collapse of home equity withdrawal (with their wealth effect on spending); the stressed balance sheets and high debt ratios of the household sector (such debt is up to almost 140% of disposable income); the credit crunch in mortgage markets that is now spreading to unsecured consumer credit (credit cards, student loans, auto loans); the rise in debt servicing ratios (following the reset of mortgage rates, and higher interest rates on mortgages and consumer credit); the sharp rise in gasoline and energy prices that is a serious shock to real incomes; the further erosion of real wages through the rise in the inflation rate; the sharp fall in consumer confidence; the drop in employment (now five months in a row) and thus in income generation; the negative wealth effect of the correction in equity markets and the fall in the net worth of the household sector. All these factors will have – over time – a much more significant negative effect on consumption than the temporary boost given by the tax rebates.

Existing Home Sales: Turnover Will Slow

by Calculated Risk on 6/13/2008 12:32:00 PM

The foreclosure article this morning contained an estimate from Lehman economists on foreclosure sales this year:

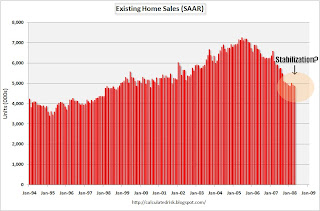

Foreclosures will account for 30 percent of national home sales this year as 1.2 million foreclosed single-family homes will eventually enter the market, [Michelle Meyer and Ethan Harris, economists at Lehman Brothers] said.This is another reminder that the only reason existing home sales appear to have "stabilized" is because of the high number of REO sales. Sales excluding REOs have plummeted.

Click on graph for larger image in new window.

Click on graph for larger image in new window. Here is a graph of existing home sales since 1994. Imagine how much further sales activity would have fallen without the significant REO activity.

Of course REO sales are real sales and should be included, but I suspect these REO buyers might hold these properties longer than recent turnover would suggest. If these are owner occupied buyers, they have probably been waiting to buy, and they have saved a down payment and qualified under the tighter lending standards. They probably won't sell until they can make a reasonable profit to buy a move up home - and it will probably be a number of years before prices recover.

If they are investors, they are likely buying REOs for cash flow - not appreciation, like the speculators in recent years - and these investors will probably hold the properties for a number of years too.

This suggests to me that turnover will slow further.

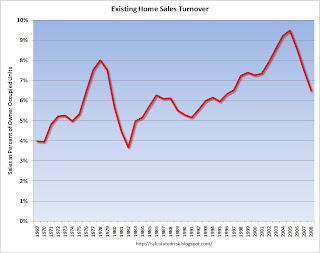

The second graph shows existing home turnover as a percent of owner occupied units. Turnover for 2008 is the rate of the first four months of the year (just over 4.9 million units).

The second graph shows existing home turnover as a percent of owner occupied units. Turnover for 2008 is the rate of the first four months of the year (just over 4.9 million units).The turnover rate was boosted in recent years by:

Although slowing, the turnover rate is still above the median for the last 40 years (about 6% per year). Both types of speculative buying are over for now. And the Baby Boomers have probably bought move up homes, and the next major move will be downsizing in retirement (still a number of years away).

And finally - and probably the most important point - homeowners with negative equity, who manage to avoid foreclosure, will be stuck in their homes for years.

All of the above suggests the turnover rate will fall further.

RealtyTrac: Foreclosures Continue to Rise

by Calculated Risk on 6/13/2008 09:21:00 AM

From Bloomberg: Foreclosures Rise 48% in May as U.S. Bank Repossessions Double

One in every 483 U.S. homeowners lost their houses to foreclosure or received either a default warning or notice that their home would go up for sale at auction, RealtyTrac said.Update: here are the actual stats from RealtyTrac (hat tip many)

...

The number of national foreclosure filings grew 7 percent from April, according to RealtyTrac.

...

Lenders took possession of 73,794 houses in May, more than doubling the 28,548 REOs in May 2007, RealtyTrac said. That pushed total REOs to more than 700,000, RealtyTrac said.

...

Foreclosures will account for 30 percent of national home sales this year as 1.2 million foreclosed single-family homes will eventually enter the market, [Michelle Meyer and Ethan Harris, economists at Lehman Brothers] said.

The total REOs available increasing to 700,000 is a key number, as is the estimate that foreclosures will account for 30% of sales this year.

The beat goes on ...

OCC Report vs. Hope Now

by Anonymous on 6/13/2008 08:39:00 AM

The Washington Post picks up the brewing controversy over the rather significant mis-match between the foreclosure and loss mitigation statistics reported in the new OCC Mortgage Metrics Report and the Hope Now reports we've been seeing since January. Of course they got seriously scooped on this by Housing Wire, who had this story on Wednesday, but I guess now that it's in the newspapers it's got legs:

John C. Dugan, comptroller of the currency, which oversees national banks, said his agency found "significant limitations with the mortgage performance data reported by other organizations and trade associations."I have already gone on record accusing Hope Now of using "weird numbers," and I hope the OCC eventually comes up with a clean enough database (the OCC database currently has 20% of loans classified for credit quality as "other" because they're missing FICO scores) and better definition of credit quality (currently they're using FICO only, not such things as documentation type or LTV/CLTV) that its numbers can provide a better baseline for measuring loss mit activities. I am also willing to observe that if the OCC is only noticing here in Q2 2008 that big bank databases are sloppy and inconsistent, the OCC certainly should "temper the strong language" a touch.

"Virtually none of the data had been subjected to a rigorous process to check for consistency and completeness -- they were typically responses to surveys that produced aggregate, unverified results from individual firms," Dugan said in a speech in New York on Wednesday. "That lack of loan-level validation raised real questions about the precision of the data, at least for our supervisory purposes."

Dugan said in an interview that he was referring to information provided by groups such as the Mortgage Bankers Association, which reports a foreclosure rate widely cited by regulators and the media. A report by the Office of the Comptroller of the Currency calculated that the rate was higher based on raw data it collected from nine of the country's largest banks.

Dugan's comments also raised questions about the accuracy of the reporting from Hope Now, an alliance of mortgage firms and banks that was formed to help financially troubled holders of subprime mortgages. Leaders of the coalition, which was put together by the Bush administration, contend they have aided more than 1 million homeowners. Those figures were self-reported by lenders in response to the kind of surveys Dugan has faulted. . . .

In an interview yesterday, Dugan tempered the strong language he used in his speech. "It was not intended to be a criticism of what they are doing," he said of MBA and other industry associations. Their figures, he added, "get you in the ballpark . . . but we wanted to have a much more specific level of detail."

Banks and mortgage firms have widely varying definitions for what constitutes a loan modification for a struggling borrower and even define subprime mortgages differently. The lack of standards leave the data open for interpretation or manipulation.

Ultimately, this is going to come down to new regulatory rules on data reporting and management for supervised institutions, as it should. The industry will whine about regulatory burdens, as it always does, but it will be hard to avoid the conclusion that "voluntary" reporting via the MBA or Hope Now is not producing reliable numbers. It will of course also occur to some of us that the OCC's supervision of these banks over the last several years has apparently been based in part on data that it never until now seemed to realize needed some cleaning up.

Thursday, June 12, 2008

Boston Fed: Negative Equity and Foreclosure

by Calculated Risk on 6/12/2008 11:18:00 PM

Here is a new research paper with some important conclusions about the percentage of foreclosures among homeowners with negative equity. From Christopher L. Foote, Kristopher Gerardi, and Paul S. Willen at the Boston Fed: Negative Equity and Foreclosure: Theory and Evidence

As a consequence of the recent nationwide fall in house prices, many American families owe more on their home mortgages than their houses are worth—a situation known as “negative equity.” The effect of negative equity on the national foreclosure rate is of obvious interest to policymakers, but this effect is difficult to study with datasets that are commonly used in housing research. In this paper, we exploit unique data from the Massachusetts housing market to make three points. First, during a specific historical episode involving a downturn in housing prices—Massachusetts during the early 1990s—less than 10 percent of a group of homeowners likely to have had negative equity eventually defaulted on their mortgages. Thus, current fears that a large majority of today’s homeowners in negative equity positions will soon “walk away” from their mortgages are probably exaggerated. Second, we show that this failure to default en masse is entirely consistent with economic theory.The authors present a model to explain why homeowners with negative equity, but sufficient cash flow, will not walk away. See section 3: The basic economics of default from the borrower’s perspective

...

A foreclosure requires both negative equity and a household-level cash-flow problem that makes the monthly mortgage payment unaffordable to the borrower. Cash-flow problems without widespread negative equity do not cause foreclosure waves. Even if borrowers are having trouble making payments, they will always prefer to sell their homes rather than default, as long as equity in their homes is positive so they can pay off their outstanding mortgage balances with the proceeds of the sales. Similarly, widespread negative equity will not result in a foreclosure boom in the absence of cash-flow problems. Borrowers with negative equity and a stable stream of income will, in most cases, prefer to continue making mortgage payments. Thus, we argue that negative equity does play a key role in the prevalence of foreclosures, but not because (as is commonly assumed) it is optimal for borrowers with negative equity to walk away from affordable mortgages.

emphasis added

I think this model is helpful for understanding the behavior of homeowners with minimal negative equity, but may be flawed for a simple reason: the probabilities in the two state model are what the homeowner believes will happen, and homeowners deep in negative equity will assign probabilities of zero to the good outcome and one to the bad outcome.

Here are the equations as presented by the authors (see paper for description):

But notice what happens when we make the good outcome zero for deep underwater homeowners (instead of 3/4) and the bad outcome 1 instead of 1/4 (and adding stigma term). The choice simplifies to the obvious:

Where Stigma includes "moving costs, default penalties that take the form of limited future access to credit markets, sentimental attachment to the home, or even the presence of moral qualms associated with defaulting on one’s debts".

This is really the problem: deep underwater homeowners who perceive the probabilities of a negative outcome as 1 (and are probably mostly correct), will walk away from their homes unless Stigma is greater than (mpay - rent). And Stigma for many of these homeowners really depends on if it becomes socially acceptable for middle class Americans to walk away (ruthless default).

Finally, there may be problems when comparing to the Boston housing bust of the early '90s - although prices did decline about 30% from the peak in real terms (according to Case-Shiller), lending standards were tighter in the late '80s compared to the recent bubble, and few homeowners bought at the peak with no or negative equity (like during the current boom). Also, the current bubble was much larger than the late '80s bubble in Boston, and some areas in the U.S. will probably see real price declines in excess of 40% (maybe even 50% or more), and these homeowners will be deeply underwater.

This is an interesting paper. I believe it is like that a majority of homeowners with negative equity will not walk away from their homes. But I believe we need to know the number of homeowners deeply underwater, and try to understand their probable behavior.

When Jumbos Freeze Over

by Anonymous on 6/12/2008 06:20:00 PM

According to the LA Times, the jumbo market is showing "signs of a thaw," which isn't really great news but isn't terrible either and things may be looking up except perhaps not really. Or something. You read it and tell me what we're supposed to think.

As usual, though, I enjoyed the obligatory Suffering Homeowner anecdote. First three grafs:

When the federal government enacted rules in February to help borrowers get big mortgages, Rick Garcia hoped he'd finally be able to refinance his West Hills home.Last four grafs:

The 35-year-old veterinarian started looking for a new mortgage six months ago but says he hasn't been able to find an affordable one.

"We're in June, and I still haven't done it," Garcia said. "How long do you wait?"

He has a good job -- he opened his own veterinary practice three years ago, working out of a mobile van throughout Los Angeles County -- and a strong credit history.I hate to break it to Garcia, but he's going to be waiting a long time for a jumbo cash-out stated income loan on an LA property at a rock-bottom interest rate.

He wants to borrow about $650,000 to pay off his mortgage and student loans, replacing his current adjustable-rate loan with a 30-year fixed-rate.

But Garcia is looking for a loan for which he doesn't have to fully document his income, and he's not sure when he'll find one.

"When things drag on for six months it becomes stressful," he said. "You start to feel like it's not going to come through."