by Calculated Risk on 6/13/2008 12:32:00 PM

Friday, June 13, 2008

Existing Home Sales: Turnover Will Slow

The foreclosure article this morning contained an estimate from Lehman economists on foreclosure sales this year:

Foreclosures will account for 30 percent of national home sales this year as 1.2 million foreclosed single-family homes will eventually enter the market, [Michelle Meyer and Ethan Harris, economists at Lehman Brothers] said.This is another reminder that the only reason existing home sales appear to have "stabilized" is because of the high number of REO sales. Sales excluding REOs have plummeted.

Click on graph for larger image in new window.

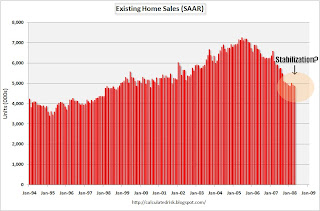

Click on graph for larger image in new window. Here is a graph of existing home sales since 1994. Imagine how much further sales activity would have fallen without the significant REO activity.

Of course REO sales are real sales and should be included, but I suspect these REO buyers might hold these properties longer than recent turnover would suggest. If these are owner occupied buyers, they have probably been waiting to buy, and they have saved a down payment and qualified under the tighter lending standards. They probably won't sell until they can make a reasonable profit to buy a move up home - and it will probably be a number of years before prices recover.

If they are investors, they are likely buying REOs for cash flow - not appreciation, like the speculators in recent years - and these investors will probably hold the properties for a number of years too.

This suggests to me that turnover will slow further.

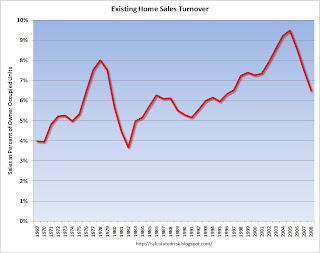

The second graph shows existing home turnover as a percent of owner occupied units. Turnover for 2008 is the rate of the first four months of the year (just over 4.9 million units).

The second graph shows existing home turnover as a percent of owner occupied units. Turnover for 2008 is the rate of the first four months of the year (just over 4.9 million units).The turnover rate was boosted in recent years by:

Although slowing, the turnover rate is still above the median for the last 40 years (about 6% per year). Both types of speculative buying are over for now. And the Baby Boomers have probably bought move up homes, and the next major move will be downsizing in retirement (still a number of years away).

And finally - and probably the most important point - homeowners with negative equity, who manage to avoid foreclosure, will be stuck in their homes for years.

All of the above suggests the turnover rate will fall further.

RealtyTrac: Foreclosures Continue to Rise

by Calculated Risk on 6/13/2008 09:21:00 AM

From Bloomberg: Foreclosures Rise 48% in May as U.S. Bank Repossessions Double

One in every 483 U.S. homeowners lost their houses to foreclosure or received either a default warning or notice that their home would go up for sale at auction, RealtyTrac said.Update: here are the actual stats from RealtyTrac (hat tip many)

...

The number of national foreclosure filings grew 7 percent from April, according to RealtyTrac.

...

Lenders took possession of 73,794 houses in May, more than doubling the 28,548 REOs in May 2007, RealtyTrac said. That pushed total REOs to more than 700,000, RealtyTrac said.

...

Foreclosures will account for 30 percent of national home sales this year as 1.2 million foreclosed single-family homes will eventually enter the market, [Michelle Meyer and Ethan Harris, economists at Lehman Brothers] said.

The total REOs available increasing to 700,000 is a key number, as is the estimate that foreclosures will account for 30% of sales this year.

The beat goes on ...

OCC Report vs. Hope Now

by Anonymous on 6/13/2008 08:39:00 AM

The Washington Post picks up the brewing controversy over the rather significant mis-match between the foreclosure and loss mitigation statistics reported in the new OCC Mortgage Metrics Report and the Hope Now reports we've been seeing since January. Of course they got seriously scooped on this by Housing Wire, who had this story on Wednesday, but I guess now that it's in the newspapers it's got legs:

John C. Dugan, comptroller of the currency, which oversees national banks, said his agency found "significant limitations with the mortgage performance data reported by other organizations and trade associations."I have already gone on record accusing Hope Now of using "weird numbers," and I hope the OCC eventually comes up with a clean enough database (the OCC database currently has 20% of loans classified for credit quality as "other" because they're missing FICO scores) and better definition of credit quality (currently they're using FICO only, not such things as documentation type or LTV/CLTV) that its numbers can provide a better baseline for measuring loss mit activities. I am also willing to observe that if the OCC is only noticing here in Q2 2008 that big bank databases are sloppy and inconsistent, the OCC certainly should "temper the strong language" a touch.

"Virtually none of the data had been subjected to a rigorous process to check for consistency and completeness -- they were typically responses to surveys that produced aggregate, unverified results from individual firms," Dugan said in a speech in New York on Wednesday. "That lack of loan-level validation raised real questions about the precision of the data, at least for our supervisory purposes."

Dugan said in an interview that he was referring to information provided by groups such as the Mortgage Bankers Association, which reports a foreclosure rate widely cited by regulators and the media. A report by the Office of the Comptroller of the Currency calculated that the rate was higher based on raw data it collected from nine of the country's largest banks.

Dugan's comments also raised questions about the accuracy of the reporting from Hope Now, an alliance of mortgage firms and banks that was formed to help financially troubled holders of subprime mortgages. Leaders of the coalition, which was put together by the Bush administration, contend they have aided more than 1 million homeowners. Those figures were self-reported by lenders in response to the kind of surveys Dugan has faulted. . . .

In an interview yesterday, Dugan tempered the strong language he used in his speech. "It was not intended to be a criticism of what they are doing," he said of MBA and other industry associations. Their figures, he added, "get you in the ballpark . . . but we wanted to have a much more specific level of detail."

Banks and mortgage firms have widely varying definitions for what constitutes a loan modification for a struggling borrower and even define subprime mortgages differently. The lack of standards leave the data open for interpretation or manipulation.

Ultimately, this is going to come down to new regulatory rules on data reporting and management for supervised institutions, as it should. The industry will whine about regulatory burdens, as it always does, but it will be hard to avoid the conclusion that "voluntary" reporting via the MBA or Hope Now is not producing reliable numbers. It will of course also occur to some of us that the OCC's supervision of these banks over the last several years has apparently been based in part on data that it never until now seemed to realize needed some cleaning up.

Thursday, June 12, 2008

Boston Fed: Negative Equity and Foreclosure

by Calculated Risk on 6/12/2008 11:18:00 PM

Here is a new research paper with some important conclusions about the percentage of foreclosures among homeowners with negative equity. From Christopher L. Foote, Kristopher Gerardi, and Paul S. Willen at the Boston Fed: Negative Equity and Foreclosure: Theory and Evidence

As a consequence of the recent nationwide fall in house prices, many American families owe more on their home mortgages than their houses are worth—a situation known as “negative equity.” The effect of negative equity on the national foreclosure rate is of obvious interest to policymakers, but this effect is difficult to study with datasets that are commonly used in housing research. In this paper, we exploit unique data from the Massachusetts housing market to make three points. First, during a specific historical episode involving a downturn in housing prices—Massachusetts during the early 1990s—less than 10 percent of a group of homeowners likely to have had negative equity eventually defaulted on their mortgages. Thus, current fears that a large majority of today’s homeowners in negative equity positions will soon “walk away” from their mortgages are probably exaggerated. Second, we show that this failure to default en masse is entirely consistent with economic theory.The authors present a model to explain why homeowners with negative equity, but sufficient cash flow, will not walk away. See section 3: The basic economics of default from the borrower’s perspective

...

A foreclosure requires both negative equity and a household-level cash-flow problem that makes the monthly mortgage payment unaffordable to the borrower. Cash-flow problems without widespread negative equity do not cause foreclosure waves. Even if borrowers are having trouble making payments, they will always prefer to sell their homes rather than default, as long as equity in their homes is positive so they can pay off their outstanding mortgage balances with the proceeds of the sales. Similarly, widespread negative equity will not result in a foreclosure boom in the absence of cash-flow problems. Borrowers with negative equity and a stable stream of income will, in most cases, prefer to continue making mortgage payments. Thus, we argue that negative equity does play a key role in the prevalence of foreclosures, but not because (as is commonly assumed) it is optimal for borrowers with negative equity to walk away from affordable mortgages.

emphasis added

I think this model is helpful for understanding the behavior of homeowners with minimal negative equity, but may be flawed for a simple reason: the probabilities in the two state model are what the homeowner believes will happen, and homeowners deep in negative equity will assign probabilities of zero to the good outcome and one to the bad outcome.

Here are the equations as presented by the authors (see paper for description):

But notice what happens when we make the good outcome zero for deep underwater homeowners (instead of 3/4) and the bad outcome 1 instead of 1/4 (and adding stigma term). The choice simplifies to the obvious:

Where Stigma includes "moving costs, default penalties that take the form of limited future access to credit markets, sentimental attachment to the home, or even the presence of moral qualms associated with defaulting on one’s debts".

This is really the problem: deep underwater homeowners who perceive the probabilities of a negative outcome as 1 (and are probably mostly correct), will walk away from their homes unless Stigma is greater than (mpay - rent). And Stigma for many of these homeowners really depends on if it becomes socially acceptable for middle class Americans to walk away (ruthless default).

Finally, there may be problems when comparing to the Boston housing bust of the early '90s - although prices did decline about 30% from the peak in real terms (according to Case-Shiller), lending standards were tighter in the late '80s compared to the recent bubble, and few homeowners bought at the peak with no or negative equity (like during the current boom). Also, the current bubble was much larger than the late '80s bubble in Boston, and some areas in the U.S. will probably see real price declines in excess of 40% (maybe even 50% or more), and these homeowners will be deeply underwater.

This is an interesting paper. I believe it is like that a majority of homeowners with negative equity will not walk away from their homes. But I believe we need to know the number of homeowners deeply underwater, and try to understand their probable behavior.

When Jumbos Freeze Over

by Anonymous on 6/12/2008 06:20:00 PM

According to the LA Times, the jumbo market is showing "signs of a thaw," which isn't really great news but isn't terrible either and things may be looking up except perhaps not really. Or something. You read it and tell me what we're supposed to think.

As usual, though, I enjoyed the obligatory Suffering Homeowner anecdote. First three grafs:

When the federal government enacted rules in February to help borrowers get big mortgages, Rick Garcia hoped he'd finally be able to refinance his West Hills home.Last four grafs:

The 35-year-old veterinarian started looking for a new mortgage six months ago but says he hasn't been able to find an affordable one.

"We're in June, and I still haven't done it," Garcia said. "How long do you wait?"

He has a good job -- he opened his own veterinary practice three years ago, working out of a mobile van throughout Los Angeles County -- and a strong credit history.I hate to break it to Garcia, but he's going to be waiting a long time for a jumbo cash-out stated income loan on an LA property at a rock-bottom interest rate.

He wants to borrow about $650,000 to pay off his mortgage and student loans, replacing his current adjustable-rate loan with a 30-year fixed-rate.

But Garcia is looking for a loan for which he doesn't have to fully document his income, and he's not sure when he'll find one.

"When things drag on for six months it becomes stressful," he said. "You start to feel like it's not going to come through."

BMW hit by MEW

by Calculated Risk on 6/12/2008 05:08:00 PM

From Bloomberg: BMW Buyers in U.S. See a Ford in Their Future (hat tip James)

Purchases of luxury autos were down nearly 100,000 units, or 14 percent, through May 31, compared with an 8.4 percent drop in all U.S. sales.Gas prices have probably played a role, but I think the decline in MEW (mortgage equity withdrawal) is a more important factor in the decline in luxury car sales.

...

``This gas panic has extended even to luxury buyers who are deciding they'd rather step down to a Ford with all the amenities rather than get a new Mercedes,'' said David Healy, an equity analyst with Burnham Securities Inc.

(see previous post on MEW)

Q1 2008 Mortgage Equity Withdrawal: $51.2 Billion

by Calculated Risk on 6/12/2008 03:00:00 PM

Here are the Kennedy-Greenspan estimates (NSA - not seasonally adjusted) of home equity extraction for Q1 2008, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q1 2008, Dr. Kennedy has calculated Net Equity Extraction as $51.2 billion, or 1.9% of Disposable Personal Income (DPI). Note that net equity extraction for Q4 2007 has been revised upwards to $92.3 billion.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

MEW declined sharply in Q1 2008, however these numbers are not seasonally adjusted. MEW in Q1 2007 was $135.7 Billion, so MEW has fallen over 60% from Q1 2007.

How important is MEW?

********************

Here is what I wrote last year: As homeowner equity continues to decline sharply in the coming quarters, combined with tighter lending standards, equity extraction should decline significantly and impact consumer spending.

So far homeowner equity has declined sharply, lending standards are tighter, and equity extraction has declined significantly.

But that still leaves the most important link; the impact on consumer spending. No one really knows how much MEW impacts consumption, and the estimates vary widely.

I've been using some estimates from Greenspan that about half of MEW flows to consumption and the other half flows to savings and investment. MEW totaled $682 billion, in 2006 and declined to $473 billion in 2007. That is a difference of $209 billion, and if half flowed to consumption - the drag on consumption from declining MEW was about $105 billion in 2007.

Since nominal Personal Consumption Expenditures (PCE) increased $510 billion between 2006 and 2007, we can estimate that if MEW had been steady, consumption would have increased about $615 billion (another $105 billion). Still, PCE increase 2.9% in real terms between 2006 and 2007 - below the average of 3.7% for the previous 10 years - but still pretty strong. Here was my estimate for 2007: [T]he estimated drag on consumption would be $110 Billion. If we assume 2006 GDP of $13.3 trillion that would mean a drag of about 0.8% in 2007 due to the decline in MEW.

In 2008, MEW will probably decline to around $200 Billion, a decline of $273 billion from last year. So my estimate - doing the same calculation as above - is that MEW will be a drag of about $135 billion on PCE in 2008, or reduce PCE about 1%, all else being equal (of course the economic slowdown will also impact PCE).

But we also have to consider the other half of the decline in MEW; the portion that flows to investment and savings. Some of that investment went to residential investment for home improvement, and declining MEW will also impact this investment spending (I'll have more on this soon).

Fed's Plosser Calls for "Preemptively" Rate Hikes

by Calculated Risk on 6/12/2008 02:22:00 PM

From MarketWatch: Fed's Plosser pushes for quick rate hikes

"We need to take steps to insure that inflation does not get out of control," [Federal Reserve President Charles Plosser] said in an interview on the CNBC television network. "We need to act preemptively."

...

Plosser said Thursday the inflation threat facing the U.S. economy "is serious."

"Inflation has been gradually been creeping up and more than just in oil and food," he said. "The base of inflation is broadening."

30 Year Mortgage Rates vs. Ten Year Treasury Yield

by Calculated Risk on 6/12/2008 01:23:00 PM

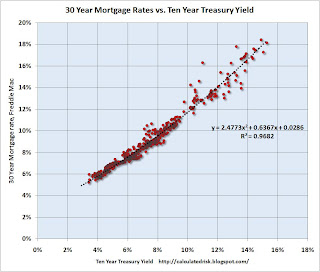

Freddie Mac reported today that 30 year mortgage rates jumped to 6.32% last week, up from 6.09% the prior week.

Housing Wire has the story: Fixed Mortgage Rates Hit Eight-Month High as Inflation Concerns Mount

The following is a comparison between the 30 year mortgage rate and the ten year treasury yield. Usually mortgage rates follow the shorter duration Ten Year treasury yield (with a spread), because most homeowners either sell or refinance before 10 years. The period that a homeowner holds a mortgage does vary over time and that does impact the spread between the 30 year rate and the ten year treasury - so it's not a perfect relationship, but it is pretty close.

The yield on the Ten Year treasury jumped to 4.215% today; up sharply from early March when the yield was 3.328%. What does this mean for 30 year mortgage rates?

The following scatter graph shows the relationship since 1971.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The ten year treasury yield is on the x-axis. The 30 year mortgage rate (from Freddie Mac) is plotted on the Y-axis. Note: this is based on monthly data.

The best fit 2nd order polynominal is plotted on the graph.

Y = 2.4773 * X2 + 0.6373 * X + 0.0286

With the Ten Year yield at 0.042, this equation yields a 30 year fixed mortgage rate of 6.0%, below the average rate of 6.32% reported by Freddie Mac today.

There are probably three reasons the mortgage rate is somewhat above the normal spread:

Whatever the reason, mortgage rates are increasing and that will probably negatively impact sales.

OCC: Bank Underwriting Standards Tighten

by Calculated Risk on 6/12/2008 12:07:00 PM

The Office of the Comptroller of the Currency (OCC) released their annual survey of underwriting standards today. Here is the Survey of Credit Underwriting Practices 2008

This is similar to the Federal Reserve Senior Financial Officer Survey except this survey is annual and is based on examiner assessments of the institutions underwriting practices, as opposed to the opinions of financial officers:

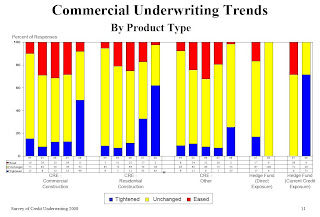

The 2008 survey included examiner assessments of credit underwriting standards at the 62 largest national banks. This population covers loans totaling $3.7 trillion as of December 2007, approximately 83 percent of total loans in the national banking system.As expected, the survey showed significantly tightening in most areas (except agricultural loans).

The Office of the Comptroller of the Currency released today its 14th annual Survey of Credit Underwriting Practices and reported that commercial and retail underwriting standards tightened after four consecutive years of eased underwriting standards.A key area of concern for 2008 is Commercial Real Estate:

...

Examiner assessments found that risk in both the commercial and retail portfolios increased over the past year and they expect portfolio risk to continue to increase over the coming year.

The most prevalent tightening occurred in CRE loans, leveraged loans, and counterparty credit exposure to hedge funds.

...

CRE products include commercial construction, residential construction, and other CRE loans. These products are offered by virtually all of the surveyed banks. Net tightening, which measures the difference between the percentage of banks tightening and those easing, was greatest in residential construction, followed by commercial construction. The following [graph] provide the breakdown by each real estate type.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph is from the OCC. The blue bar shows the percent of banks tightening lending standards for each category by year.

Note that residential construction has been tightening for two years, but commercial construction just saw a significant jump in tightening.

Examiners most often cited the following as reasons for strengthening of CRE underwriting standards:Although CRE concentrations are a concern at these larger national banks (with assets greater than $3 billion), most of the bank failures will probably be at smaller banks with even higher CRE concentrations. Update: The highest concentration of CRE loans are for institutions in the $1 billion to $10 billion range (so there is some overlap).weakening economy, specifically the downturn in residential real estate markets. Declines in market values/prices as a result of oversupply or slow-moving inventory. Existing credit concentrations, both by type of product and by location. Use of non-traditional terms and excessive investor speculation.

CRE remains a primary concern among examiners given the rapid growth of these exposures and banks’ significant concentrations relative to their capital. These concerns are compounded by elevated concerns over market conditions in select areas.