by Anonymous on 6/11/2008 06:40:00 PM

Wednesday, June 11, 2008

OCC Mortgage Metrics Report

The OCC has inaugurated a new report, which will be issued quarterly, on mortgage delinquency, loss mitigation, and foreclosure activity drawn from the servicing databases of nine large banks:

The report analyzes data submitted on each of the more than 23 million loans held or serviced by these nine banks from October 2007 through March 2008. The $3.8 trillion portfolio represents 90 percent of mortgages held by national banks and about 40 percent of mortgages overall. The participating national banks are Bank of America, Citibank, First Horizon, HSBC, JPMorgan Chase, National City, USBank, Wachovia, and Wells Fargo.Of this aggregated servicing portfolio, about 90% of loans are securitized either through the GSEs or private label issuers. The mix is 62% prime, 9% Alt-A, and 9% subprime, with the remaining 20% "other" being largely loans with insufficient or missing data that does not allow assignment into one of the three categories. The OCC indicates that data scrubbing will continue, and hopefully future reports will have a smaller "other" bucket.

It's a big database, and the OCC has made a real effort to standardize its own definitions, based on reported data elements rather than servicer descriptions, so that the credit and loss mitigation categories are consistent across all nine servicers.

The full report is available here. From the summary:

• The proportion of mortgages in the total portfolio that was current and performing remained relatively constant during the reporting period at approximately 94 percent.

• Serious delinquencies, defined as bankrupt borrowers who are 30 days delinquent and all delinquencies greater than 60 days, increased just one-tenth of a percentage point during the period, from 2.1 percent to about 2.2 percent.

• As in other studies, the report confirms that foreclosures in process are plainly on the rise, with the total number increasing steadily and significantly through the reporting period from 0.9 percent of the portfolio to 1.23 percent. Interestingly, the number of new foreclosures has been quite variable. While one month does not make a trend, new foreclosures in March declined to 45,696, down 21 percent from January’s high and down about 4.5 percent from the start of the reporting period last October.

• The majority of serious delinquencies was concentrated in the highest risk segment – subprime mortgages. Though these mortgages constituted less than 9 percent of the total portfolio, they sustained twice as many delinquencies as either prime or Alt-A

mortgages.

• Consistent with other reports, payment plans predominated, outnumbering loan modifications in March by more than four to one. But loan modifications increased at a much faster rate during the period.

• Although subprime mortgages constituted less than 9 percent of the total portfolio, subprime loss mitigation actions constituted 43 percent of all loss mitigation actions in March.

• The emphasis on loss mitigation for subprime mortgages corresponds to the nationwide focus on this higher risk sector. Total loss mitigation actions exceeded newly initiated foreclosure proceedings by a margin of nearly 2 to 1.

REOs make up almost 2/3 of Home Sales in Sacramento

by Calculated Risk on 6/11/2008 05:37:00 PM

From the WSJ: Foreclosures Make Up Majority of Sales in Sacramento

The Sacramento Association of Realtors says that a whopping 65.5% of 1,654 homes sold by Realtors in May were bank-owned, foreclosed, homes.Is it any wonder pending home sales clicked up a little?

...

In Las Vegas, for example, about half of recent sales have been lender sales.

WaMu Denies Rumors of Regulatory Action

by Calculated Risk on 6/11/2008 04:21:00 PM

You know it's bad when ... (hat tip Brian)

From WaMu: WaMu Statement Regarding Rumors of Regulatory Action

While it is the policy of Washington Mutual not to comment on speculation and market rumors, the company released the following statement to address recurring speculation about regulatory activity:We are in denial season.

"Neither our primary federal regulator, the OTS, nor any other bank regulatory agency has taken any enforcement action against WaMu that we have not previously disclosed. Further, the company is not currently in such discussions with any regulatory agency."

Merrill CEO: Economic environment 'tougher than we thought'

by Calculated Risk on 6/11/2008 03:07:00 PM

Record U.S. Government Budget Deficit in May

by Calculated Risk on 6/11/2008 02:44:00 PM

From AP: Economic stimulus payments push May budget deficit to an all-time high of $165.9 billion.

The economic slowdown is definitely impacting receipts.

A key question is how much those stimulus checks are boosting consumer spending in May and June. According to the Fed's beige book, consumer spending was weak in May.

And yet the WSJ reported last week: Some Chains Posts Strong Sales Despite Gas Prices, Low Confidence

Retailers posted stronger-than-expected same-store sales for May [despite a] surge in gasoline prices and tumbling consumer confidence.With the conflicting reports on consumer spending, the Census Bureau's retail sales for May might be interesting (to be released tomorrow).

It definitely appears the budget deficit will set a record this year - and this is the unified deficit - the General Fund deficit will be significantly worse (excludes the Social Security surplus).

Fed's Beige Book: Economic Activity Remains Generally Weak

by Calculated Risk on 6/11/2008 01:58:00 PM

From the Fed's Beige Book.

Reports from the Federal Reserve Districts suggest that economic activity remained generally weak in late April and May. ... Consumer spending slowed further since the last report.The last report was fairly negative on consumer spending, so to say "spending slowed further" is significant.

On Real Estate and Construction:

Residential real estate markets were generally weak across most of the nation. ... Inventory levels of new and existing homes remained high or were rising in New York, Philadelphia, Cleveland, Richmond, and San Francisco. Home sales prices decreased somewhat in Boston, Atlanta, Kansas City, and San Francisco, but remained relatively stable in Richmond and Chicago. The New York and Chicago Districts noted that some potential buyers had difficulty in obtaining financing. ... Richmond and San Francisco noted an increase in home foreclosures.Commercial Real Estate (CRE) is just starting to slump, and the residential bust is continuing.

Commercial real estate conditions varied in April and May, with some Districts reporting that activity had softened. Leasing activity eased in Boston, New York, Philadelphia, Richmond, and San Francisco. Minneapolis, however, reported that market activity was up modestly, while activity was mixed across the St. Louis District. Vacancy rates edged higher in Boston, Kansas City, and San Francisco, as well as in pockets of the Richmond and St. Louis Districts. Absorption was negative in Boston and in Minneapolis for both office and manufacturing space. Overall rents were on the rise in New York, but were stable or beginning to slip in Boston, Philadelphia, Richmond, and Kansas City. Sales trended downward according to the New York, Philadelphia, and Kansas City Districts.

On rising prices:

Business contacts in most Districts reported increases in input prices since the last report, especially prices for energy, petroleum derivatives, metals, plastics, chemicals, and food. Manufacturing contacts in several Districts reported some ability to pass along the higher costs to customers and contacts in the Cleveland District noted that they are considering additional price increases in the near future if input costs continue to rise.Overall this is a pretty negative Beige Book with a weakening economy and rising prices.

JPM Analyst: House Prices may fall 30%

by Calculated Risk on 6/11/2008 11:55:00 AM

Important note: Reuters has corrected the story. It now reads:

Home prices may fall 25 percent to 30 percent from their peak in 2006 and not hit bottom until 2010 ...This is much more in line with my thinking. Note that nominal prices are off 16.1% according to Case-Shiller, so we are about half way to JPM's forecast.

Here was the orginal post:

From Reuters: US home prices may dip 30 pct, junk bonds weaken-JPM

[Peter Acciavatti, credit analyst and managing director at JP Morgan Securities Inc, said] Home prices may fall another 25 percent to 30 percent over the next four years, with greater drops still in subprime mortgage debt markets, he said.I think we will see price declines for several more years, but this seems a little too bearish to me. An additional 25% to 30% decline in nominal prices over four years would be close to an additional 40% decline in real prices - and that would put real prices at the lowest level since the Case-Shiller Index started in 1987. Note that real prices are already off 21% according to the Case-Shiller national index.

In a separate interview, the analyst said junk bond spreads will push past 800 basis points and may top 900 basis points as the crisis drags out.

Wow. And I thought I was bearish on housing!

Note: My comments were based on the original article forecasting an additional 30% decline in prices.

MBA Purchase Applications

by Calculated Risk on 6/11/2008 10:18:00 AM

It appears the MBA Purchase Index might be useful again. Note: the index wasn't useful when lenders were going out of business because of the method used to calculated the index.

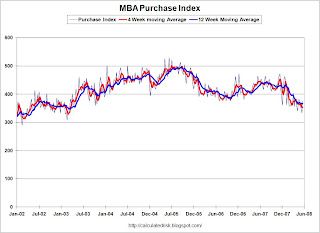

The MBA reports that the Purchase Index increased 12.8 percent to 376.2 from 333.6 one week earlier. The four week moving average (removes the weekly noise) declined, and is at the lowest level since early 2003. Because of the changes to the index, we can't compare directly to 2003, but clearly the index is weak. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the MBA Purchase Index, and four week and twelve week moving averages.

Although we can't compare directly to earlier periods because of the changes in the index, this does suggest that sales of homes are continuing to decline.

Tim Duy: Fed Between a Rock and ...

by Calculated Risk on 6/11/2008 09:52:00 AM

From Professor Duy: Fed Watch: Between a Rock and a Hard Place

Fedspeak turned decidedly hawkish this week, and market participants responded accordingly, moving up expectations for a rate hike to as early as this August. But is Federal Reserve Chairman Ben Bernanke really ready to follow through? The answer could make or break the Dollar in the coming weeks.Tim covers the current situation, the recent Fedspeak, the arguments for and against raising rates and keep rates steady - and the politic issues. Duy concludes:

Bottom Line: The Fed has no one to blame for their predicament but themselves. Bernanke & Co. cut rates too deeply, fighting a battle against deflation that never was. Now they are backed into a corner; either raise rates and risk upsetting a very fragile economy, or stay the path and risk the inflationary consequences. If the Fed is truly concerned about the Dollar and commodity prices – and their open talk about currency values implies real and serious concerns – Bernanke will have to follow through with his newfound hawkish side. The bluntness of Fedspeak looks to signal a dramatic shift in thinking on Constitution Ave., and that argues for a rate hike by September, earlier than I had previously expected, and I cannot rule out an August move. Such a move is not without considerable risk for the economy.The Fed is still data dependent, and unless the economic numbers improve, it seems unlikely the Fed will raise rates. But, as Tim notes, the Fedspeak has turned decidedly hawkish.

Tuesday, June 10, 2008

Housing: Buy and Bail

by Calculated Risk on 6/10/2008 11:04:00 PM

From the WSJ: Some Buy a New Home to Bail on the Old

Next month, Michelle Augustine plans to walk away from her four-bedroom house in a Sacramento, Calif., subdivision and let the property fall into foreclosure. But before doing so, she hopes to lock in the purchase of another home nearby.So far there are only a few anecdotal reports of "buy and bail", so this might be much ado about nothing. This is certainly fraud (if they sign a false loan document). But just like fraud for housing (when people lie about their income to buy a home), this type of fraud is almost never prosecuted - and extremely difficult to prove, unless someone tells a reporter what they're going to do.

"I can find the same exact house as what I live in right now for half the price," says Ms. Augustine ...

In markets hit hardest by falling home prices and rising foreclosures, lenders and brokers are discovering a new phenomenon: the "buy and bail," in which borrowers with good credit buy a new home -- often at a much lower price -- then bail out of the "upside down" mortgage on their first home.

...

The mortgage industry is starting to wise up to the practice and is scrambling to fight back. Buy-and-bail is "certainly fraudulent and unfortunately on an uptick," says Gwen Muse-Evans, vice president for credit policy and controls at Fannie Mae.

...

Under revised Fannie Mae guidelines, which could take effect next week, loan applicants who claim they will rent out their first home will have to produce supporting evidence, including an executed lease agreement. Borrowers also will have to prove that they can pay the mortgage, property taxes and insurance for both residences.