by Calculated Risk on 6/10/2008 06:09:00 PM

Tuesday, June 10, 2008

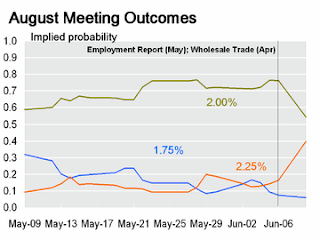

Will the Fed Raise Rates in August?

The buzz on the street is that the Fed might raise the Fed Funds rate 25 bps at the August meeting. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here are the probabilities from the Cleveland Fed. As of yesterday, the market was still expecting no move in June - with the odds of a 25 bps rate hike increasing only slightly.

But all the tough talk about inflation and supporting the dollar is getting some attention.

The 2nd graph shows the August meeting probabilities as of yesterday.

As of yesterday, the implied probability of a 25 bps rate hike in August was below 40%. However, according to a private calculation (using the August Fed Funds future contract), the odds of a 25 bps rate hike increased to over 70% today!

However, according to a private calculation (using the August Fed Funds future contract), the odds of a 25 bps rate hike increased to over 70% today!

Raising rates with unemployment rising, and the economic risks to the downside, seems very unusual - but that is what the market expects.

Richardson Update: This Workout Smells

by Anonymous on 6/10/2008 02:29:00 PM

Our soberer readers (I know we have them) will remember California Congresswoman Laura Richardson (D-Speculator), who is facing foreclosure proceedings on three homes. The uproar began with the foreclosure of sale her unoccupied "second home" in Sacramento, which Richardson claimed was an "error" on WaMu's part, since (she claimed) she had worked out a last-minute modification agreement with WaMu the week before the sale. According to the Daily Breeze, WaMu has filed paperwork to rescind the foreclosure sale, and the man who bought the home is not happy:

The real estate broker who bought Rep. Laura Richardson's house at a foreclosure sale last month is accusing her of receiving preferential treatment because her lender has issued a notice to rescind the sale.Richardson continues to refuse to authorize WaMu to release any information on her case, although frankly I'm not sure if I were WaMu I'd want to talk about it. This smells terrible, indeed. Perhaps reporters could simply ask some general questions of WaMu about its foreclosure workout policies. Like:

James York, owner of Red Rock Mortgage, said he would file a lawsuit against Richardson and her lender, Washington Mutual, by the end of the week, and has every intention of keeping the house.

"I'm just amazed they've done this," York said. "They never would have done this for anybody else."

York bought the Sacramento home at a foreclosure auction on May 7 for $388,000. Richardson had not been making payments on the property for nearly a year, and had also gone into default on her two other houses in Long Beach and San Pedro.

Richardson, D-Long Beach, has said that the auction should never have been held, because she had worked out a loan modification agreement with her lender beforehand and had begun making payments.

- How often are modifications or repayment plans offered to owners of vacant investment properties with no or negative equity that have never been listed or rented?

- How often are modifications offered to borrowers with two other properties currently in foreclosure?

- How often are modifications arranged in the week before the scheduled trustee's sale, following nearly a year of no contact?

- Does WaMu's policy on modifications make any reference to requiring a "commitment to homeownership" on the borrower's part? How, normally, is that established?

- Does WaMu's policy on modifications make any reference to establishing that the borrower does not display a "disregard for debt obligations"? How, normally, is that established?

In 2005, when she was still on the Long Beach City Council, she left one mechanic in a lurch with an unpaid bill, then later had her badly damaged BMW towed to an auto body shop but didn't pay for any work and abandoned the car there, owners of the businesses said this week.So in January of 2007, WaMu gave Richardson a 100% loan to purchase a second home, when her credit report would have shown recent derogatories related to the car repair bills, plus the payments on two other homes, on a State Assembly salary that I can't quite see being equal to her existing debts, let alone a new house payment. In other words, she got your basic subprime loan that relied on nothing other than a fervent belief in endless house price appreciation--in January of 2007. Or else she got a loan because she's a VIP.

The next day, Richardson began using a city-owned vehicle - putting almost 31,000 miles on it in about a year - and continued driving the car five days after she had left the council to serve in the state Assembly, city records show. . . .

Labreche said he spent months leaving messages on Richardson's cell phone voice mail, then he got a collection agency involved, but still the bill went unpaid. . . .

In December 2005, Lillegard filed for a mechanic's lien on Richardson's car to pay the towing, storage and administrative costs, he said. Lillegard said the lien was finalized in February 2006 and he sold the car to a junkyard, though a few days later - too late - Richardson sent him money to put toward the bill.

I continue to want to know why WaMu is bailing out a deadbeat and a speculator at the expense of a good-faith buyer of a foreclosure property, and wasting operational capacity on a deal like this instead of working with struggling owner-occupants who might actually pay back the modified loan. I will leave it to the citizens of California to explain why you want this woman anywhere near fiscal, budgetary, or housing policy power.

(Hat tip to Brian!)

FDIC on the Use of Interest Reserves

by Calculated Risk on 6/10/2008 12:37:00 PM

There is a growing concern that interest reserves are masking problems with Construction & Development (C&D) and Commercial Real Estate (CRE) loans. In their Summer 2008 Supervisory Insights released today, the FDIC provides a primer on interest reserves.

Interest reserves are common for new construction projects. Basically the lender loans the developer enough to build the project, and then loans the developer the interest payment each month during the development phase.

Although potentially beneficial to the lender and the borrower, the use of interest reserves carries certain risks. Of particular concern is the possibility that an interest reserve could mask problems with a borrower’s willingness and ability to repay the debt consistent with the terms and conditions of the loan obligation. For example, a project that is not completed in a timely manner or falters once completed may appear to perform if the interest reserve keeps the troubled loan current. This is a much different scenario from most credit transactions in which cash flow problems are eventually reflected in late or past-due payments and sometimes even in nonpayment. A loan with a bank-funded interest reserve would not exhibit these warning signs.This happens every down cycle. The interest reserves are masking the problems with C&D loans - usually because of the inability of the developer to sell or lease the developed property - and suddenly the noncurrent loans at financial institutions increase dramatically. This has just started happening:

With little potential for monetary default during the interest reserve period, some lenders may delay recognizing and evaluating the financial risks in a troubled ADC loan. In some cases, lenders may extend, renew, or restructure the term of certain ADC loans, providing additional interest reserves to keep the credit facility current. As a result, the true financial condition of the project may not be apparent and developing problems may not be addressed in a timely manner. Consequently, a bank may end up with a matured ADC loan where the interest reserve has been fully advanced, and the borrower’s financial condition has deteriorated. In addition, the project may not be complete, its sale or lease-up may not be sufficient to ensure timely repayment of the debt, or the value of the collateral may have declined, exposing the lender to increasing credit losses.

emphasis added

[The acquisition, development, and construction] loan segment almost tripled, from $231 billion to more than $600 billion, and grew from 9 percent to 13 percent of total real estate loans from 2001 to 2007. Delinquency rates for the ADC portfolio were historically low during much of this time. However, credit quality began to show signs of weakening in 2006 as the level of noncurrent ADC loans began to rise. By year-end 2007, noncurrent loans had reached 3.15 percent—the highest level in more than 10 years—and more than triple the rate for other commercial real estate loans.A rapid rise in noncurrent ADC loans, combined with the heavy concentration at certain institutions of CRE and C&D loans, will probably be the main reason for a large number of bank failures over the next couple of years.

As an aside, the FDIC argues interest reserves "might not be appropriate" for certain transactions, including:

Loans secured by income-producing rental properties (residential or commercial) that should be amortizing.It was just yesterday that we discussed the interest reserve in Lehman's investment in Archstone-Smith. If Lehman was regulated by the FDIC that structure would probably be considered too risky and inappropriate.

FHA Going After DAP Again?

by Anonymous on 6/10/2008 11:28:00 AM

Well Glory Be. FHA Commissioner Brian Montgomery, that well-known Ownership Society Koolaid drinker, went before the National Press Club yesterday and made noises to the effect that FHA will resurrect its efforts to rid the world of the DAP scourge:

The Federal Housing Administration expects to lose $4.6 billion because of unexpectedly high default rates on home loans, officials said Monday.The Times writer notes that FHA has tried for years on end to get rid of this practice without success. However, the explanation of what these programs really do isn't very helpful. I call them "DAP" (Downpayment Assistance Program) because that's the term HUD uses, and the term you will find in the HUD-sponsored research on the performance of these loans. The term "seller financed" isn't exactly helpful; if we are to use our own term for these deals, I'd suggest "seller money laundered" instead.

Brian D. Montgomery, the F.H.A. commissioner, attributed the unanticipated losses primarily to the agency’s seller-financed down payment mortgage program, which has suffered from high delinquency and foreclosure rates in recent years. . . .

But Mr. Montgomery warned that the F.H.A. would have to renew its efforts to end the seller-financed down payment program, which accounted for 35 percent of its loans in 2007.

He said the mortgages had foreclosure rates three times those of traditional loans and would push the F.H.A. to the brink of insolvency.

“Let me repeat: F.H.A. is solvent,” Mr. Montgomery said on Monday in a speech at the National Press Club. “However, no insurance company can sustain that amount of additional costs year after year and still survive. Unless we take action to mitigate these losses, F.H.A. will soon either have to shut down or rely on appropriations to operate.”

I have written about DAP loans and the effort to get rid of them before. Here's an UberNerdly post explaining how the loans work. Here's a post from a year ago summarizing the long tedious and ultimately unsuccessful efforts of the HUD Inspector General to get rid of the program. Let us all devoutly hope that it will work this time.

From Flipping to Foreclosure

by Calculated Risk on 6/10/2008 10:50:00 AM

From the NY Times: A Shift in Real Estate Books

A few years ago, when the housing market was white-hot, companies that publish how-to books were tripping over themselves to pump out titles about buying property and making money in the real estate business.

Now that the bottom has fallen out of the housing market, the opposite is true: publishers are updating their backlist titles as well as rushing out newly acquired manuscripts to advise consumers who may have stumbled in the housing game.

These two covers tell the story.

From "Flipping Houses" to "Foreclosure Investing" in just a couple of years.

And, yes, both books are by the same authors.

Trade Deficit Increases

by Calculated Risk on 6/10/2008 09:13:00 AM

From the WSJ: Oil Prices Push Trade Gap Wider

The U.S. deficit in international trade of goods and services increased by 7.8% to $60.90 billion from March's revised $56.49 billion, the Commerce Department said Tuesday.The average price per barrel of oil was $96.81 in April - and the current world spot price is around $136 per barrel - so oil import prices will increase over the next few months.

...

The U.S. bill for crude oil imports in April increased. It totaled $29.34 billion, up from $25.03 billion in March. The average price per barrel increased by $6.96 to a record $96.81 from $89.85.

...

The U.S. paid $38.19 billion for all types of energy-related imports, up from $33.15 billion in March.

...

The U.S. trade deficit with China expanded to $20.24 billion from March's $16.08 billion.

The following graph shows import prices vs. U.S. spot prices (shifted one month into the future).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Since import prices lag spot prices by about one month, import prices will probably jump to around $102 per barrel for May - and $116 per barrel in June (based on May spot prices).

Any progress on reducing the trade deficit, due to the weak dollar, is now being offset by rising oil prices.

Shanghai Market: Cliff Diving

by Calculated Risk on 6/10/2008 12:38:00 AM

Click on graph for larger image in ewn window.

Click on graph for larger image in ewn window.

The Shanghai Composite Index is off over 5% tonight to 3140.

From MarketWatch: China, Hong Kong drop in reaction to new bank rule

Asian markets traded broadly lower Tuesday, led down by Shanghai and Hong Kong, where banking and property shares fronted declines as investors fretted about the impact of the latest round of anti-inflationary measures announced over the weekend.And also from MarketWatch: China takes aim at inflation, speculative fund flows

The People's Bank of China said over the weekend that it would require banks must put aside 17% of deposits as reserves, effective June 15. A second hike to 17.5% will go into effect June 25, for a total rise of 100 basis points above the current requirement of 16.5%.

Monday, June 09, 2008

Lehman's Bad Real Estate Investments

by Calculated Risk on 6/09/2008 10:29:00 PM

From the WSJ: Lehman's Property Bets Are Coming Back to Bite

Lehman joined with Tishman Speyer Properties last year to pay $22 billion for real-estate investment trust Archstone-Smith ... And ... it teamed up with Irvine, Calif.-based land developer SunCal Cos. to develop and sell thousands of house lots to builders across Southern California. ...This deal was announced in May 2007, but wasn't closed until October - after the credit crisis started. I bet Lehman and their partners wish they had paid the $1.5 billion break up fee!

In both cases, Lehman dove into already heated markets, overpaid for the properties and, the firm says, has taken big markdowns. ...

In the deal for Archstone, which owns roughly 80,000 apartments ... Lehman put up $250 million in equity and led a group of banks that brought an added $4.6 billion in so-called bridge equity that the banks planned to sell to other investors. The banks have had trouble selling the equity as real-estate values dropped about 20% since then.

The Archstone-Smith acquisition was a negative cash flow deal from the start. To cover the interest on the $16 billion in debt financing, there was a $500 million interest reserve created. The WSJ notes:

As of the end of 2007, three months after the purchase closed and the latest numbers available, Archstone had already tapped $72 million of the reserve.This suggests that Archstone is burning through the interest reserve very quickly. Not mentioned in the WSJ article was that Fannie Mae and Freddie Mac acquired a total of $9 billion of the $16 billion in debt. Something to remember if this deal really goes south.

Lehman's other troubled deal was with SunCal to sell house lots to builders in California, including in the so-called Inland Empire east of Los Angeles, where land values have plummeted as much as 60% in some areas.Land values have probably fallen closer to 80% in parts of the Inland Empire. I've heard of bids right now at 20 cents on the dollar for some of these properties.

Bernanke: "Risk of Substantial Downturn Diminished"

by Calculated Risk on 6/09/2008 09:22:00 PM

From Bloomberg: Bernanke Says Risk of `Substantial Downturn' Receded

Federal Reserve Chairman Ben S. Bernanke said the economic outlook has improved from a month ago, and central bankers will ``strongly resist'' any waning of public confidence in stable prices.Here is Bernanke's speech: Outstanding Issues in the Analysis of Inflation

``The risk that the economy has entered a substantial downturn appears to have diminished over the past month or so,'' Bernanke said today in remarks to a Boston Fed conference in Massachusetts. ``The Federal Open Market Committee will strongly resist an erosion of longer-term inflation expectations.''

Why Pending Home Sales are Negative for the Housing Market

by Calculated Risk on 6/09/2008 03:08:00 PM

I've read a number of articles and blogs on the Pending Home Sales Index (PHSI) numbers this morning. I believe most of the analysis is missing the two key points.

Let's start with the usual caveat that this is just one month of data.

As noted earlier, the NAR Pending Home sales index (PHSI) showed a 6.3% increase in April as compared to March.

These pending sales (for April) are supposed to predict actual sales about 45 days later (about half for May, half for June). The May existing home sales report will be released June 26th, and sales for June will be released on July 24th. So we have to wait to see if there is a small increase in actual sales.

The following graph from the WSJ (with pending home sales advanced one month) shows that the existing home sales do track the PHSI pretty well. Source: WSJ Real Time Economics

Source: WSJ Real Time Economics

This is a typical (via the WSJ):

Pending home sales [were] well above expectations and the biggest monthly increase since December 2001. This index leads existing home sales by one to two months, and as such the April figure is another sign that existing home sales are leveling out. – J.P. Morgan ChaseYes, the PHSI does suggest existing home sales will be higher in May and June than in April, but it doesn't mean sales are "leveling out".

Here is another view from CNBC: Housing Market Is Showing Signs of a Turnaround

We are seeing an acceleration in foreclosures. As foreclosures have taken off, they put pressure on prices. Banks have become more aggressive with sales on homes they have foreclosed," said Christopher Low, chief economist at FTN Financial in New York.The first part of Low's analysis is correct. There has been a surge in REO (lender Real Estate Owned) sales, and the banks have become much more aggressive on pricing, especially at the low end. The increase in REO sales probably more than accounts for the increase in activity in the PHSI.

Low said the pickup in pending home sales could be a sign that the housing market could soon be stabilizing.

"Sales will stabilize in the next few months and that will set the stage for inventories turning to normal sometime next year and maybe even for prices to appreciate a bit," he said. "For now, prices will continue to fall. There is still an inventory overhang that will take 18 months to work through. The end game of the housing bust is near."

But what does that mean for prices? The most recent data from Case-Shiller was for March (and Q1 2008 for the National Index). This surge in REO sales suggests that when the Case-Shiller prices are released for May and June, well, look out below for prices in these low end neighborhoods. That is what "aggressive" pricing means!

But what about the market "leveling out" or "stabilizing"? This depends on how you view sales. If we looked at existing home sales ex-REOs, we'd see that sales are still collapsing. And based on the recent MBA data, there is a flood of foreclosures coming. So maybe it will appear that sales are leveling out as the market is taken over by foreclosure sales, but that just puts more pressure on prices.

So the two key points from the Pending Home sales report are that prices are probably falling quickly, especially in the low end areas, and that sales are being propped up as REO sales start to dominate that existing home market. Neither point is good news for housing.