by Anonymous on 5/29/2008 07:10:00 AM

Thursday, May 29, 2008

BK Judge Rules Stated Income HELOC Debt Dischargeable

This is a big deal, and will no doubt strike real fear in the hearts of stated-income lenders everywhere. Our own Uncle Festus sent me this decision, in which Judge Leslie Tchaikovsky ruled that a National City HELOC that had been "foreclosed out" would be discharged in the debtors' Chapter 7 bankruptcy. Nat City had argued that the debt should be non-dischargeable because the debtors made material false representations (namely, lying about their income) on which Nat City relied when it made the loan. The court agreed that the debtors had in fact lied to the bank, but it held that the bank did not "reasonably rely" on the misrepresentations.

I argued some time ago that the whole point of stated income lending was to make the borrower the fall guy: the lender can make a dumb loan--knowing perfectly well that it is doing so--while shifting responsibility onto the borrower, who is the one "stating" the income and--in theory, at least--therefore liable for the misrepresentation. This is precisely where Judge Tchaikovsky has stepped in and said "no dice." This is not one of those cases where the broker or lender seems to have done the lying without the borrower's knowledge; these are not sympathetic victims of predatory lending. In fact, the very egregiousness of the borrowers' misrepresentations and chronic debt-binging behavior is what seems to have sent the Judge over the edge here, leading her to ask the profoundly important question of how a bank like National City could have "reasonably relied" on these borrowers' unverified statements of income to make this loan.

And as I argued the other day on the subject of due diligence, it isn't so much that individual loans are fraudulent than that the published guidelines by which the loans were made and evaluated encouraged fraudulent behavior, or at least made it "fast and easy" for fraud to occur. Judge Tchaikovsky directly addresses the issue of the bank's reliance on "guidelines" that should, in essence, never have been relied upon in the first place.

*************

Here follow some lengthy quotes from the decision, which was docketed yesterday and is not, as far as I know, yet published. From In re Hill (City National Bank v. Hill), United States Bankruptcy Court, Northern District of California, Case No. A.P. 07-4106 (May 28, 2008):This adversary proceeding is a poster child for some of the practices that have led to the current crisis in our housing market.

Indeed. The debtors, the Hills, bought their home in El Sobrante, California, twenty years ago for $220,000. After at least five refinances, their total debt on the home at the time they filed for Chapter 7 in April of 2007 was $683,000. Mr. Hill worked for an automobile parts wholesaler; Mrs. Hill had a business distributing free periodicals. According to the court, their combined annual income never exceeded $65,000.

In April 2006, the Hills refinanced their existing $100,000 second lien through a mortgage broker with National City. Their new loan was an equity line of $200,000; after paying off the old lien and other consumer debt, the Hills received $60,000 in cash. On this application the Hills stated their annual income as $145,716. The property appraised for $785,000.

By October 2006 the Hills were short of money again, and applied directly to National City to have their HELOC limit increased to $250,000 to obtain an additional $50,000 in cash. On this application, six months later, the Hills' annual income was stated as $190,800, and the appraised value was $856,000.

At the foreclosure sale in April 2007, the first lien lender bought the house at auction for $450,000, apparently the amount of its first lien.

The Hills claimed that they did not misrepresent their income on the April loan, and that they had signed the application without reading it. The broker testified rather convincingly that the Hills had indeed read the documents before signing them--Mrs. Hill noticed an error on one document and initialed a correction to it. No doubt because the October loan, the request for increase of an existing HELOC, did not go through a broker, the Hills admitted to having misrepresented their income on that application. The Court found that:Moreover, the Hills, while not highly educated, were not unsophisticated. They had obtained numerous home and car loans and were familiar with the loan application process. They knew they were responsible for supplying accurate information to a lender concerning their financial condition when obtaining a loan. Even if the Court were persuaded that they had signed and submitted the October Loan Application without verifying its accuracy, their reckless disregard would have been sufficient to satisfy the third and fourth elements of the Bank’s claim.

This is not an excessively soft-hearted judge who fell for some self-serving sob story from the debtors. "Reckless disregard" is rather strong language.

Unfortunately for National City, Her Honor was just as unsympathetic to its claims:However, the Bank’s suit fails due to its failure to prove the sixth element of its claim: i.e., the reasonableness of its reliance.6 As stated above, the reasonableness of a creditor’s reliance is judged by an objective standard. In general, a lender’s reliance is reasonable if it followed its normal business practices. However, this may not be enough if those practices deviate from industry standards or if the creditor ignored a “red flag.” See Cohn, 54 F.3d at 1117. Here, it is highly questionable whether the industry standards–-as those standards are reflected by the Guidelines–-were objectively reasonable. However, even if they were, the Bank clearly deviated to some extent from those standards. In addition, the Bank ignored a “red flag” that should have called for more investigation concerning the accuracy of the income figures. . . .

In short, while the Court found that the Hills knowingly made false representations to the lender, the lender's claim that it "reasonably relied" on these representations doesn't hold water, because "stated income guidelines" are not reasonable things to rely on. In essence, the Court found, such lending guidelines boil down to what the regulators call "collateral dependent" loans, where the lender is relying on nothing, at the end of the day, except the value of the collateral, not the borrower's ability or willingness to repay. If you make a "liar loan," the Judge is saying here, then you cannot claim you were harmed by relying on lies. And if you rely on an inflated appraisal, that's your lookout, not the borrower's.

Based on the foregoing, the Court concludes that either the Bank did not rely on the Debtors representations concerning their income or that its reliance was not reasonable based on an objective standard. In fact, the minimal verification required by an “income stated” loan, as established by the Guidelines, suggests that this type of loan is essentially an “asset based” loan. In other words, the Court surmises that the Bank made the loan principally in reliance on the value of the collateral: i.e., the House. If so, the Bank obtained the appraisal upon which it principally relied in making the loan. Subsequent events strongly suggest that the appraisal was inflated. However, under these circumstances, the Debtors cannot be blamed for the Bank’s loss, and the Bank’s claim should be discharged.

This is going to give a lot of stated income lenders--and investors in "stated income" securities--a really bad rotten no good day. As it should. They have managed to give the rest of us a really bad rotten no good couple of years, with no end in sight.

Wednesday, May 28, 2008

Housing Wire: S&P Confidence in Alt-A overcollateralization waning

by Calculated Risk on 5/28/2008 11:50:00 PM

Housing Wire has more on the S&P Alt-A downgrades: S&P Lowers the Boom on 1,326 Alt-A RMBS Classes

The downgrades affect an $33.95 billion in issuance value and affect Alt-A loan pools securitized in the first half of 2007 — roughly 14 percent of S&P’s entire Alt-A universe in that timeframe.

Perhaps more telling were an additional 567 other Alt-A classes put on negative credit watch by the ratings agency.

A review of affected securities by Housing Wire found that all of the classes put on watch for a pending downgrade are currently rated AAA, suggesting that S&P’s confidence in thin overcollateralization typical of most Alt-A deals is quickly waning. The total dollar of potential downgrades to the AAA classes in question would dwarf Wednesday’s downgrades, which affected only mezzanine and equity tranches.

Spam: The Ultimate Inferior Good?

by Calculated Risk on 5/28/2008 07:52:00 PM

From AP: Sales of Spam rise as consumers trim food costs

And from Monty Python: Spam

S&P Downgrades $34 Billion Alt-A Bonds

by Calculated Risk on 5/28/2008 04:54:00 PM

From Bloomberg: S&P Downgrades $34 Billion of Bonds Backed by Alt-A Mortgages (hat tip ken and SC)

Standard & Poor's lowered its ratings on $34 billion of securities backed by Alternative-A mortgages, the firm's largest downgrade for the type of debt ...

Ratings on 1,326 classes of the bonds created in the first half of 2007 were downgraded, or 14 percent of the total ...

CRE: Orange County Non-Residential Permits Value off 40%

by Calculated Risk on 5/28/2008 04:35:00 PM

From Jon Lansner at the O.C. Register: O.C.’s commercial construction down in ‘08

The Construction Industry Research Board reports ... that the estimated value of permits for non-residential construction fell nearly 40% this year so far from the same period in 2007. Permit values fell to just under $527 million so far this year. Last year, developers received permits for projects valued at $873 million from January through April.Just more evidence of the CRE bust.

Regional Bank Problems: KeyCorp

by Calculated Risk on 5/28/2008 01:04:00 PM

From Bloomberg: KeyCorp Slide Foretells Losses at `Delusional' Banks

KeyCorp ... doubl[ed] its forecast for loans that won't be repaid, prompting concern that regional banks have underestimated the cost of bad mortgages.And they are also having problem with home improvement loans. Here is the KeyCorp release from the 8-K SEC filing:

KeyCorp [said] debts may be as much as 1.3 percent of average total loans this year. The figure may rise even more, KeyCorp said, as the Cleveland-based company cuts holdings tied to homebuilders.

The revision by the Ohio bank, which last month quadrupled its provision for loan losses to $187 million, may foretell similar increases at U.S. commercial banks as home prices keep sliding, analysts said.

KeyCorp (the "Corporation") is updating its previous outlook for net loan charge-offs for 2008. The previous estimated range for net loan charge-offs was .65% to .90% of average loans. The Corporation now anticipates that net loan charge-offs will be in the range of 1.00% to 1.30% for 2008, with second quarter and potentially third quarter net charge-offs running above this range as the Corporation deals aggressively with reducing exposures in the residential homebuilder portfolio and anticipates elevated net loan charge-offs in its education and home improvement loan portfolios. The Corporation announced in the fourth quarter of 2007 that it had: (i) decided to cease conducting business with “out of footprint” nonrelationship homebuilders, (ii) recorded additional reserves to address continued weakness in the housing market, and (iii) decided to exit dealer-originated home improvement lending activities, which involve prime loans but are largely out-of-footprint.

More banks freeze home equity lines

by Calculated Risk on 5/28/2008 11:22:00 AM

From the Cleveland Plain Dealer: Banks freeze home equity lines as home values fall

While the practice started a few months ago in other parts of the country, it's just now hitting Northeast Ohio as banks from Fifth Third to Chase to AmTrust reduce their exposure to over-leveraged consumers. Most banks that haven't yet frozen home equity lines are looking at doing so.We are about to see mounting losses for lenders from HELOCs, and less consumer spending - especially for autos and home improvement - as lenders restrict HELOC borrowing.

...

AmTrust spokeswoman Donna Winfield said the bank's move to freeze equity lines here "was across the board" in areas where property values have declined and among customers who had less equity left.

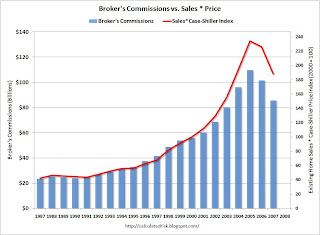

Broker's Commissions: Riding the Double Bubble

by Calculated Risk on 5/28/2008 10:47:00 AM

First, the NY Times reports on the Realtors antitrust settlement: Realtors Agree to Stop Blocking Web Listings

The Justice Department and the National Association of Realtors reached a major antitrust settlement Tuesday that government officials said should spur competition among brokers and ultimately bring down hefty sales commissions.Innovation will probably put pressure on commissions. This gives us an excuse to look at a long term graph of Broker's Commissions:

The deal frees Internet brokers and other real-estate agents offering heavily discounted commissions to operate on a level playing field with traditional brokers by using the multiple listing services that are the lifeblood of the industry, government officials said.

...

Norman Hawker, a business professor at Western Michigan University who ... predicted that the settlement would ultimately mean a drop in sales commissions of 25 percent to 50 percent as a result of increased competition.

Click on graph for larger image.

Click on graph for larger image. This graph shows broker's commissions as a percent of GDP.

Not surprisingly - giving the housing bubble - broker's commissions soared in recent years, rising from $56 billion in 2000, to $109 billion in 2005 (see 2nd graph for commissions in dollars). Commissions have declined to an annual rate of $72 billion in Q1 2008. (All data from the BEA).

Here is a simple formula: Commissions = transactions X price X commission percent.

Broker's commissions increased because of both soaring prices and soaring activity. A double bubble.

Only the percent commission held down total commissions a little. This might surprise some readers, but at the peak of the bubble, many agents were discounting commissions below 6%. Listings were like printing money, and it was common for agents in California (and probably elsewhere) to offer to list a property for 4 1/2% or 5%, with the selling agents receiving 3%, and the listing agent taking less.

The following graph compares broker's commissions with an index created by multiplying sales transactions times the Case-Shiller National Home Price Index:

UPDATE: Reader 'get sum' notes in the comments that per his discussions with the BEA, their estimate of commissions assumes a 6% rate.

Note that broker's commissions didn't completely keep up with the double bubble. Sales times prices actually rose faster than commissions, suggesting: 1) that the percent commission declined somewhat, or 2) that Case-Shiller overstated the price increase in recent years. Or some combination of both (likely).

Note that broker's commissions didn't completely keep up with the double bubble. Sales times prices actually rose faster than commissions, suggesting: 1) that the percent commission declined somewhat, or 2) that Case-Shiller overstated the price increase in recent years. Or some combination of both (likely).Now, with prices falling, transactions falling, and more competition, it is likely that total commissions will fall further over the next few years. Tough times for many real estate agents.

Appraisal Tightening: No More Mailbox Money For You!

by Anonymous on 5/28/2008 08:18:00 AM

As a general rule I do not recommend reading "Realty Times" at 6:00 a.m., but I'm blaming twist.

It's not that people don't want homes, it's that they can't buy them under the stricter lending standards. . . .In 1975, it was not unknown--it was in fact only made illegal that year by the Equal Credit Opportunity Act--to inquire about a married woman's future childbearing plans, her use of contraception, and her religion before deciding whether to "count" any income she might produce for purposes of qualifying for a loan. (If she said "Catholic," forget it.) If you think we are experiencing 1975 mortgage loan underwriting, you were born yesterday.

Lenders are turning the clock back to 1975, requiring larger downpayments and higher credit scores to qualify for low interest rates. That's only prudent, but what they're also doing is tightening appraisals on properties that are being sold or refinanced.

So why is it "prudent" to require larger downpayments and higher credit scores, but another thing entirely to tighten up on appraisals? And how is this nefarious appraisal tightening preventing people from buying homes?

*****************

There must be an anecdote, and we actually get a twofer:

Dallas Realtor Mary O'Keefe was hit with the new lending realities in a double whammy just this week.So the purchase transaction actually did close, although it was--gasp!--"delayed," but this poor lady who wanted to cash out the "equity" in a townhome she was not going to occupy was stymied by some evil bank who--get this--wouldn't use a year-old appraisal. Turn on the disco ball and haul out your lava lamps! It's the seventies!

"I had a closing that was delayed because the lender wanted a second appraisal," says Mary O'Keefe, a Dallas broker. "I told my clients absolutely no way would they pay for a second appraisal."

That deal finally closed, but O'Keefe lost another. A client wanted to take out some equity on her townhome, buy another property to live in, and save the townhome for mailbox money. The client had an 800-plus credit score, was approved by a lender, but went to her personal banker for the HELOC. She had an appraisal from the year before for $467,000 giving her about $155,000 in equity.

Because banks want to use appraisals no less than six months old, the personal banker called for a drive-by appraisal, which came in at $400,000, more than $20,000 below the lowest priced home in the community, and $75,000 below a home that sold a year ago three doors down.

I confess to being somewhat alarmed, by the way, about a Realtor who tells a buyer that "no way" are they going to pay for a second appraisal. You would not, in the current environment, even consider paying another $350-$400 to assure yourself that you are not overpaying for your property by thousands of dollars?

The real problem here is that Realty Times wants to continue to perpetrate the view that establishing reliable appraised values is not in a homebuyer's best interest as well as a lender's. For some reason this reminded me of a story we posted just a year ago, in which the Wall Street Journal waxed outraged about some poor rich doctor who was having trouble getting his loan approved to buy a property for $1.05 million when the lender had gotten a broker price opinion stating that it was only worth $750,000. I did a bit of looking in the county real estate records, and it appears that our man did indeed buy the home on April 17, 2007 for $1.05 million. On April 27, 2007, the county assessed the property for tax purposes at $793,400. Per the WSJ he borrowed $885,000. I wonder if he still feels ripped off by the lender who told him he was overpaying for that home.

Tuesday, May 27, 2008

Rent vs. Buy: NY Times Leonhardt Buys

by Calculated Risk on 5/27/2008 10:44:00 PM

From David Leonhardt at the NY Times: As Home Prices Drop Low Enough, a Committed Renter Decides to Buy

The case for renting has been simple enough. House prices rose so high in the first half of this decade that you could often get more for your money by renting. You could also avoid having a large part of your net worth tied up in a speculative bubble.Leonhardt isn't buying for appreciation, and he realizes the price will probably still decline further. He is buying because prices have fallen enough that the intangibles of homeownership (as he and his wife value them) outweigh the extra costs of owning a home compared to renting.

All this time, I have been a renter myself, ... [but] the housing market has, obviously, changed quite a bit since our last move, in 2005.

...

This month, we found a house that we really liked, and we made an offer. It was accepted.

I’m still not sure how good our timing was. Based on the backlog of houses on the market, I fully expect that our new house will be worth less in six months than it is today. ...

In fact, if you’re now renting — almost anywhere — and do not need to move, I’d probably recommend that you wait to buy. The market is still coming your way.

But it’s O.K. with me if our timing wasn’t perfect.

The article also has an interactive rent vs. buy tool with a number of options.