by Anonymous on 5/21/2008 08:10:00 AM

Wednesday, May 21, 2008

Which Ratings Model is Broken?

Via naked capitalism, there is this ugly report in the Financial Times:

Moody’s awarded incorrect triple-A ratings to billions of dollars worth of a type of complex debt product due to a bug in its computer models, a Financial Times investigation has discovered.That's bad. That's really bad. But then there are these two paragraphs at the end of the article:

Internal Moody’s documents seen by the FT show that some senior staff within the credit agency knew early in 2007 that products rated the previous year had received top-notch triple A ratings and that, after a computer coding error was corrected, their ratings should have been up to four notches lower.

The world’s other major credit agency, Standard and Poor’s, was the first to award triple A status to CPDOs but many investors require ratings from two agencies before they invest so the Moody’s involvement supplied that crucial second rating.The implication here, that Moody's jiggered its model to arrive at the same ratings S&P had already arrived at--presumably to keep the "second opinion" business--is ugly. However, the implication that Moody's had to fudge the numbers in order to come up with AAA on these deals but S&P came up with AAA with a "correct" model is something I for one am having a hard time with.

S&P stood by its ratings, saying: “Our model for rating CPDOs was developed independently and, like our other ratings models, was made widely available to the market. We continue to closely monitor the performance of these securities in light of the extreme volatility in CDS prices and may make further adjustments to our assumptions and rating opinions if we think that is appropriate.”

Tuesday, May 20, 2008

Investors in Discussions to Buy GM Building

by Calculated Risk on 5/20/2008 10:36:00 PM

This is another followup to CRE: Bought at the top?. Basically NY developer Harry Macklowe bought seven New York office buildings at the price peak, with little down, and a personal guarantee for a portion of the loan. He was unable to refinance the short term debt, and he is now in default. Macklowe is trying to sell his other holdings - including the GM building - to satisfy the personal debt.

From the WSJ: Goldman, Boston Properties, Others In Talks to Buy Macklowe's GM Building

An investment group that includes Boston Properties Inc., Goldman Sachs Group Inc. and two Middle Eastern investors are in negotiations to buy the General Motors building along with up to three other properties from New York developer Harry Macklowe for $3.6 billion to $3.9 billion ...

... The deal would value the GM building at about $2.8 billion, $200 million less than what had been his minimum price.

The deal is designed to rescue Mr. Macklowe from financial ruin, but it isn't clear that this transaction would resolve his debts.

On the REO Trail

by Calculated Risk on 5/20/2008 06:29:00 PM

Here are a couple of recent videos from Realtor Jim in San Diego. The first video is in a run down area of Oceanside with REO after REO (2 min 19 sec).

The second video is in Valley Center (near Escondido). (2 min 21 sec) Jim mentions the Cash for Keys program (he is offering the previous owners $2500 for their keys). This house sold for $927,500 in 2005.

MMI: Fractured Fairy Tales

by Anonymous on 5/20/2008 04:00:00 PM

Caroline Baum is exercised over Fannie Mae's recent announcement that it was dropping its "declining markets" policy. Yeah, so, a lot of us didn't like that.

But the rest of us did not write a column that is titled "Mary Had a Little Lamb and a Jumbo Mortgage" and then have this thing about kings and taxes and then Fannie turns out to be the fairy godmother, which is Cinderella, not Mary and the lambs, and then admits to perfect ignorance of what "DU" is and then makes claims about what DU is and then ends up predicting that Fannie will self-insure mortgages which would be like totally surprising since it would require the king to change Fannie Mae's charter which forbids such things, and dammit if you don't get all the way to the end and there aren't any jumbos in it. Boy howdy.

Cliff Diving: CIFG Guaranty's Bond Insurer Ratings

by Calculated Risk on 5/20/2008 03:27:00 PM

From Bloomberg: CIFG Guaranty's Bond Insurer Ratings Cut to Junk (hat tip DD49)

CIFG Guaranty, the bond insurer that lost its AAA ratings in March, was downgraded to below investment grade by Moody's Investors Service, which said the company may become insolvent.From AAA to Junk in two months! Yeah, I'd call that Cliff Diving.

The ratings were cut seven levels to Ba2, two steps below investment grade, from A1 to reflect ``the high likelihood that, absent material developments, the firm will fail minimum regulatory capital requirements,'' Moody's said in a statement.

...

``CIFG demonstrates the cliff-like nature of these events,'' said Thomas Priore, chief executive officer of hedge fund Institutional Credit Partners LLC in New York. ``Depending on the language in the credit-default swap, it can set off a chain of events that creates a complete unwind of the company.''

DataQuick: California Bay Area Home Sales Up from March

by Calculated Risk on 5/20/2008 02:11:00 PM

From DataQuick: Bay Area home sales edge up in April

Bay Area home sales edged up from a seven-month run of record lows last month, indicating that mortgage availability is improving and that an increasing number of fence sitters have decided they like today's lower prices, a real estate information service reported.

A total of 6,310 new and resale houses and condos sold in the nine- county Bay Area in April. That was up 28.8 percent from 4,898 in March, and down 15.3 percent from 7,447 for April 2007, DataQuick Information Systems reported.

The month-to-month jump was the strongest for any March/April in DataQuick's statistics, which go back to 1988. Starting last September and through March, each calendar month was the slowest on record. Last month was the slowest April since 1995 when 5,636 homes were sold.

"The big issue here is that mortgages are becoming obtainable, which will reduce the pile of stacked up pending escrows. It's unclear if the financing is because of policy changes or because mortgage investors are getting more interested in securities. Probably both," said Marshall Prentice, DataQuick president.

The median price paid for a Bay Area home was $518,000 last month, down 3.4 percent from $536,000 in March, and down 21.4 percent from $659,000 in April last year. Last month's median was 22.1 percent lower than the peak median of $665,000 reached in June and July last year.

...

Foreclosure property resales accounted for 25.7 percent of last month's Bay Area market. The percentage is higher in outlying areas that absorbed spillover activity during the frenzy. While foreclosure properties were 5.9 percent of San Francisco's resale market and 8.9 percent of Marin's resale market last month, they were 44.7 percent in Contra Costa and 54.2 percent in Solano.

...

Foreclosure activity is at record levels ...

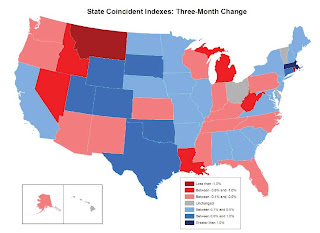

Philly Fed State Coincident Indicators for April

by Calculated Risk on 5/20/2008 12:00:00 PM

From the Philadelphia Fed:

The Federal Reserve Bank of Philadelphia produces a monthly coincident index for each of the 50 states. The indexes are released a few days after the Bureau of Labor Statistics (BLS) releases the employment data for the states.Here is the release for April:

The indexes increased in 26 states for the month, decreased in 16, and were unchanged in the remaining eight (a one month diffusion index of 20). For the past three months, the indexes increased in 25 states, decreased in 21, and were unchanged in the other four (a three month diffusion index of eight).

Click on graph for larger image.

Click on graph for larger image.This is a graph of the monthly Philly Fed data of the number of states with increasing activity.

I've added the current probable recession. About half of the U.S. was in recession in April based on this indicator.

Note: the Philly Fed calls some states unchanged with minor changes. The press release says there were 26 states with increasing activity, but including small changes, there were 28 (as graphed).

This map is from the Philly Fed report for April, and shows the Three Month change for all 50 states. If the economy is in recession, this map should turn very red over the next few months.

California is definitely in recession by most measures, but the Philly Fed Three Month change shows the state economy is still growing slightly. This is probably true for other states too, and I expect the map to turn more and more red in the coming months.

For comparison to April, here is the December 2007 map (bottom).

For comparison to April, here is the December 2007 map (bottom).Clearly there is more red in the April (top) map as the recession spreads.

Oppenheimer: Credit Crisis Will Extend Into 2009

by Calculated Risk on 5/20/2008 10:08:00 AM

From Bloomberg: Credit Crisis Will Extend Into 2009, Oppenheimer Says

The U.S. credit crisis will extend into and even beyond 2009 as banks will write off more than $170 billion of additional reserves by the end of next year, according to Oppenheimer & Co. estimates.From the report titled: Far From Over: We Believe The Credit Crisis Will Extend Well Into 2009

``The real harrowing days of the credit crisis are still in front of us and will prove more widespread in effect than anything yet seen,'' analysts led by Meredith Whitney wrote in a research note today. ``Just as strained liquidity pushed so many small and mid-sized specialty finance companies to beyond the brink, we believe it will do the same with the U.S. consumer.''

"... in our opinion the "next shoe to drop," is what became an over-reliance on the securitization market for consumer liquidity. Herein, we draw a direct correlation between a shutdown in securitization volumes and accelerating losses on bank balance sheets. As we see no near or medium term come back in securitization volumes, we believe losses will only accelerate further and far worse than even the most draconian estimates."And the opposite view: TED Spread at Nine-Month Low, Signals Credit Easing

Lending confidence at banks rose to the highest level in more than nine months, according to a key indicator, signaling the global credit crunch may be easing.

The so-called TED spread, the difference between what the U.S. government and banks pay to borrow in dollars for three months, dropped below 78 basis points for the first time since August.

...

``The worst of the fears about the liquidity crisis appear to be alleviating,'' said Peter Jolly, head of markets research in Sydney at NabCapital, the investment-banking arm of National Australia Bank Ltd. ``Liquidity is becoming more available ever since the bold moves by the Fed.''

Home Depot: "Home-improvement conditions worsened"

by Calculated Risk on 5/20/2008 09:04:00 AM

From the WSJ: Home Depot's Net Falls 66% As Homeowners Cut Projects

Home Depot Inc. reported a 66% drop in fiscal first-quarter net income, thanks in part to restructuring charges, as it continues to suffer amid economic conditions that have been discouraging homeowners from spending on home-improvement projects.This is not a surprise. And it could get much worse.

...

"The housing and home-improvement markets remained difficult in the first quarter. In fact, conditions worsened in many areas of the country," Chairman and Chief Executive Frank Blake said.

Freddie Mac's Balance Sheet

by Anonymous on 5/20/2008 08:53:00 AM

Last week--I think it was last week--CR asked me at one point if I were going to write anything about Freddie's financials and the FAS 157 Uproar and I remember saying that our blog colleague Accrued Interest had just that day remarked that he might well write about the subject. I therefore fervently hoped he would do so, and I could just link to it, which would save me the trouble of having to have my own opinion.

So he finally got around to it. Go read it. It's well worth your time.