by Anonymous on 5/18/2008 05:25:00 PM

Sunday, May 18, 2008

The Mortgage Fraud Employee Benefit Program

Thanks to Clint for this terrifying story in The Oregonian:

Fitzsimons, of Prineville, started his first residential construction company, called Sunrise Northwest, when he was 19. In August 2004, he joined forces with close friend Shannon Egeland, co-founding Desert Sun. . . .And, of course, this all seems to have been effected by fraudulent mortgage applications. Read the whole thing, but put down your drink before the last paragraph.

At its peak, Desert Sun employed more than 110 people. The company's success enabled Fitzsimons to buy expensive toys, including a 2006 Ferrari 430 Spider, boasting a base ticket price in excess of $200,000.

Desert Sun had no retirement plan, but it did offer the employee homeownership program, which its Web site likened to a 401(k).

The plan seemed straightforward enough: Desert Sun would build a home for employees, taking care of design, materials and construction. Employees could buy the completed home from Desert Sun at cost and assume monthly mortgage payments, or sell it and split proceeds 50-50 with the company. . . .

The Desert Sun plan was not without risk for participants. The company pledged to cover all costs, but to fund the building, employees had to take out construction loans in their own names. . . .

Deschutes County property records indicate that the company enjoyed six-figure profits on the sales of some of the lots.

On July 5, 2007, for example, Desert Sun Holdings bought lot 24 in the Village Meadows subdivision in Sisters from Redmond-based Allen-Rose Homes for $155,000. That same day, the company flipped the lot to employee Roger Howell for $269,900.

Single Family Homes: Comparing Starts and Sales

by Calculated Risk on 5/18/2008 03:21:00 PM

Note: Don't miss Tanta's take this morning on: Shiller on the Psychology of Foreclosure

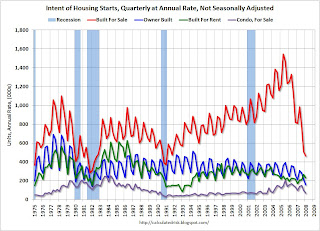

It is difficult to compare monthly housing starts directly to sales. The monthly housing starts report from the Census Bureau includes apartments, owner built units and condos that are not included in the New Home sales report. However, every quarter, the Census Bureau releases Starts by Intent, and it is possible to compare "Single Family Starts, Built for Sale" to New Home sales. Click on graph for larger image.

Click on graph for larger image.

This graph compares quarterly starts of single family homes built for sale (and completions of single family homes built for sale in red) with New Home sales.

This data is not seasonally adjusted for any series. There are clear seasonal patterns for all series, and completions lag starts by about 6 months.

The period of significant overbuilding in recent years is highlighted. It now appears that starts are running below sales, and completions have fallen to the level of sales. Note: when adjusted for cancellations, completions are probably also below sales, and the inventory of New Homes is finally declining. The second graph shows the quarterly starts by intent at an annual rate through Q1 2008. This shows 1) Single Family starts built for sale, 2) Owner built units, 3) Units built for rent, and 4) Condos built for sale.

The second graph shows the quarterly starts by intent at an annual rate through Q1 2008. This shows 1) Single Family starts built for sale, 2) Owner built units, 3) Units built for rent, and 4) Condos built for sale.

As of Q1, Single Family starts built for sale, had declined to about 460 thousand on a non seasonally adjusted annual rate (a little over 500 thousand seasonally adjusted). As noted above, this level of starts is below the current level of New Home sales.

Starts for Owner built units has fallen to the lowest level since the severe recession of 1982.

And starts for condos has fallen significantly - just slightly above the average level of the '90s.

Rental units are the lone bright spot, and it was rental units that accounted for the small increase in overall starts for April. This despite the near record rental vacancy rate of 10.1%.

There is still a huge overhang of existing home inventory for sale (especially distressed inventory including short sales and REOs), and until that inventory declines significantly, starts and housing prices will remain under pressure. However this report does provide some minor positive news for starts - especially starts for single unit structures.

Shiller on the Psychology of Foreclosure

by Anonymous on 5/18/2008 12:07:00 PM

Gather 'round, children, because Tanta is about to engage in a curiously hard-headed look at an editorial by a famous economist that demands, in every sincere and decent sentence, our kindness and compassion instead. This is blogging at its finest: nobody should get away un-pissed-off about something. And on a Sunday, too.

It's also long blogging at its finest. You knew I'd have to try to figure out how to use the Read More thingy eventually . . .

* * * * * * * *

The editorial in question is by Robert J. Shiller, who is a professor of economics and finance and famous analyst of speculative bubbles. A specialist in behavioral economics, in the application of psychology to understanding financial markets. A co-founder of Case Shiller Weiss, that house price index we talk about a lot. His editorial, "The Scars of Losing a Home," speaks not of lofty academic economic concepts but of human sympathy, of things that are "really important." With references from famous academic psychologists. I haven't taken this kind of a tiger by the tail since I went after Austan Goolsbee last year.

Yes, it was only a year ago that the distinguished Dr. Goolsbee wrote this on the same editorial page:And do not forget that the vast majority of even subprime borrowers have been making their payments. Indeed, fewer than 15 percent of borrowers in this most risky group have even been delinquent on a payment, much less defaulted.

I actually think Goolsbee's piece was the high-water-mark of the "subprime helps the poor" talking point. You certainly don't hear much about that these days. Less than two months after Dr. Goolsbee's earnest op-ed, we got an interview in the very same NYT with one Bill Dallas, CEO of the famously defunct Ownit Mortgage, effusively testifying to his own burning desire to help out the unfortunate in a way that finally put paid to the respectability of that line ("'I am passionate about the normal person owning a home,' said Mr. Dallas, who is also chairman of the Fox Sports Grill restaurant chain and manages the business interests of the Olsen twins. 'I think owning a home solves all their problems.'") Plus by now we've got some numbers on the 2007 mortgage vintage, the one that Dr. Goolsbee was afraid wasn't going to ever materialize if we tightened up lending standards too much. A year ago we were looking at a 13% subprime ARM delinquency rate. Per Moody's (no link) the Q4 07 subprime ARM delinquencies were running 20.02%. And that is not, you know, "just" another 7%. By now, those delinquent borrowers in Goolsbee's 13% have probably mostly been foreclosed upon and are off the books. The 20% or so who are now delinquent were either part of the 87% that Goolsbee thought were "successful homeowners" last year, or else they're those lucky duckies who bought homes after the publication date of Goolsbee's plea that we not tighten standards too much.

When contemplating ways to prevent excessive mortgages for the 13 percent of subprime borrowers whose loans go sour, regulators must be careful that they do not wreck the ability of the other 87 percent to obtain mortgages.

For be it ever so humble, there really is no place like home, even if it does come with a balloon payment mortgage.

Of course Shiller wasn't exactly spending his time a year ago defending the subprime mortgage industry on the grounds that it put poor and minority people into ever-so-humble homes with balloons attached. I seem to recall him mostly arguing that homebuyers were engaged in a speculative mania. In a June 2007 interview:Well, human thinking is built around stories, and the story that has sustained the housing boom is that homes are like stocks. Buy one anywhere and it'll go up. It's the easiest way to get rich.

At the time, that kind of statement struck some of us, at least, as not possibly the entire story either, but in any event a useful corrective to the saccharine silliness of the "Ownership Society" and Bill Dallas solving everyone's problems by letting them put Roots in a Community (for only five points in YSP).

So I hope I can be just a tad startled by the New Shiller:Homeownership is thus an extension of self; if one owns a part of a country, one tends to feel at one with that country. Policy makers around the world have long known that, and hence have supported the growth of homeownership.

So it's no longer irrational exuberance or plain old speculating; it's now an instinctive affirmation of some eternal verity of the human psyche? The ultimate patriotism: the definition of self so tied up in ownership of a slice of the motherland that to rent becomes not only psychologically dangerous--these people without selves can't be up to anything good--but politically dangerous as well? Is it possible that Shiller can mean what he is writing here?

MAYBE that’s why President Bush’s “Ownership Society” theme had such resonance in his 2004 re-election campaign. People instinctively understand that homeownership conveys good feelings about belonging in our society, and that such feelings matter enormously, not only to our economic success but also to the pleasure we can take in it.

If you just scanned the first few paragraphs of Shiller's op-ed you might come away with the impression of a sincere but somewhat hackneyed plea for us all to have a bit of sympathy for the foreclosed among us, foreclosure not in anyone's experience being a walk in the park. Fair enough. It being Sunday in America, I suspect millions of us are being treated to exhortations to take a kinder view of the unfortunate than we often do; we need those exhortations; we are often lacking in sympathy. Hands up all who disagree.

But you keep reading and you find Shiller trying to explain the "trauma" of foreclosure. And that's where this really gets weird:Now, let’s take the other perspective — and examine some arguments against the stern view. They have to do with the psychological effects of strict enforcement of a mortgage contract, and economists and people in business may need to be reminded of them. After all, too much attention to abstract economic statistics just might make us overlook what is really important.

We need to modify mortgage contracts to keep homeowners from becoming cynical? That's somehow more respectable an idea than the one saying we should throw them out on the street to "teach them a lesson"? If Shiller is serious that all those other parties are "to blame," then why isn't the obvious solution to throw them out on the street? There seems to be an assumption here that nothing can be done to punish those who are "really" to blame, so we're left managing the psyches of those who can be punished. And that's not cynical?

First, we have to consider that we cannot squarely place the blame for the current mortgage mess on the homeowner. It seems to be shared among mortgage brokers, mortgage originators, appraisers, regulatory agencies, securities ratings agencies, the chairman of the Federal Reserve and the president of the United States (who did not issue any warnings, but instead has consistently extolled the virtues of homeownership).

Because homeowners facing foreclosure must bear the brunt of the pain, they naturally feel indignation when all of these other parties continue to lead comfortable, even affluent lives. Trying to enforce mortgage contracts may thus have a perverse effect: instead of teaching homeowners that they should respect the contracts they sign, it may incline them to take a cynical view of the whole mess.

This the point at which Shiller dredges up the most stunningly unfortunate quote from William effing James (1890) to define the "fundamental" psychology of homeownership:Homeownership is fundamental part of a sense of belonging to a country. The psychologist William James wrote in 1890 that “a man’s Self is the sum total of all that he CAN call his, not only his body and his psychic powers, but his clothes and his house, his wife and children, his ancestors and friends, his reputation and works, his lands and horses, and yacht and bank account.”

Now, that's breath-taking. Horses. Yachts. His wife and his children. Ancestors. The whole late-Victorian wealthy male WASP defining the "Self" (with a capital!) as the wealthy male WASP surveying his extensive possessions, an oddly-assorted list that ranks the family and friends somewhere after the clothes and the house. (Yes, James did that on purpose.) The kind of sentiment that was a caricature of the late-Victorian male even in 1890. And Shiller drags this out in aid of generating sympathy for homeowners? Really? You couldn't find some psychological insight about the emotional relationship of people to their homes that doesn't speak the language of the male ego surveying his domain, sizing himself up against all the other males to see where he ranks?

(James on the psychological effect of losing one's property: " . . . although it is true that a part of our depression at the loss of possessions is due to our feeling that we must now go without certain goods that we expected the possessions to bring in their train, yet in every case there remains, over and above this, a sense of the shrinkage of our personality, a partial conversion of ourselves to nothingness, which is a psychological phenomenon by itself. We are all at once assimilated to the tramps and poor devils whom we so despise, and at the same time removed farther than ever away from the happy sons of earth who lord it over land and sea and men in the full-blown lustihood that wealth and power can give, and before whom, stiffen ourselves as we will by appealing to anti-snobbish first principles, we cannot escape an emotion, open or sneaking, of respect and dread.")

I'm actually, you know, in favor of some sympathy for homeowners, but one thing that does get in the way of that for a lot of us is, well, the rather disgusting shallowness that a lot of them displayed on the way up. There is this whole part of our culture that has sprung into being since 1890 that takes a rather severe view of conspicuous consumption, unbridled materialism, and totally self-defeating use of debt to buy McMansions, if not yachts. We were treated to a fair amount of that kind of thing in the last few years. In fact, we had Dr. Shiller explaining to us last year that a lot of folks just wanted to get rich, quick, in real estate.

It is undeniably true, I assert, that not everyone was a speculatin' spend-thrift maxing out the HELOCs to buy more toys, and that part of our problem today with public opinion is that we extend our (quite proper) disgust for these latter-day Yuppies to the entire class "homeowner." But it is surely an odd way to engage our sympathies for the non-speculator class to speak of it in Jamesian terms as the man whose self is defined by his Stuff, and whose psychological pain is felt most acutely when he recognizes that he is now just like the riff-raff.

It's worse than odd--it's downright reactionary--to then go on to that evocation of homeownership as good citizenship and good citizenship as "feel[ing] at one with [the] country." This puts a rather sinister light on Shiller's earlier insistence that we need to make sure people don't get too "cynical."

I see that Yves at naked capitalism was just as disgusted by Shiller as I am:Now admittedly, this is not a validated instrument, but a widely used stress scoring test puts loss of spouse as 100 and divorce at 73. Foreclosure is 30, below sex difficulties (39), pregnancy (40), or personal injury (53). Change in residence is 20.

I would only add that we are about five years too far into a war that has not made a majority of us "feel at one with that country." I think of another really important policy change we could be pursuing right now to shore up everyone's psychological estrangement from their patriotic self-satisfaction. But "efficiency arguments" don't apply to wars, either.

Note that if we as a society were worried about psychological damage, being fired (47) is far worse than foreclosure (30), and if it leads to a change in financial status (38) and/or change to a different line of work (36) those are separate, additive stress factors. Yet policy-makers have no qualms about advocating more open trade even though it produces industry restructurings that produce unemployment that does more psychological damage than foreclosures. As a society, we'll pursue efficiency that first cost blue collar jobs, and now that we've gotten inured to that, white collar ones as well (although Alan Blinder draws the line there).

But efficiency arguments don't apply to housing since we are sentimental about it. And it's that sentimentality that bears examination, since it engendered policies that helped produce this mess.

My fellow bleeding heart liberals like Goolsbee found themselves defending the subprime industry in the name of increasing minority homeownership. Now we're treated to the spectacle of Shiller arguing for homeowner bailout legislation in the same terms that Bush used to defend the "Ownership Society." Housing policy, I gather, makes strange bedfellows. It certainly makes strange editorials.

Saturday, May 17, 2008

HELOCs: There's Something Happening Here

by Calculated Risk on 5/17/2008 06:06:00 PM

I've reviewed a copy of a memo from Sun Trust concerning HELOCs (Home Equity Line of Credit) that I believe to be authentic. In the memo, dated yesterday, Sun Trust announced new HTLTV ("HELOC Total Loan To Value") restrictions in certain circumstances (like declining markets, new condominiums, 2nd homes), and they are apparently even eliminating their Flex Equity program completely in several key states (like Arizona, California and Nevada).

This is nothing new. A number of banks have announced HELOC restrictions this year, see Chase: Max HELOC LTV 70% in Certain Areas

Note: HousingWire has been covering the HELOC news extensively: Focus shifts to HELOCs

Bill Fleckenstein also wrote about HELOCs in his Daily Rap on Thursday (with comments from his source the "Lord of the Dark Matter). For more excerpts, see: Fleck: HELOCs: The New Subprime

"A couple of us tuned into Dexia's conference call yesterday, looking for clues on HELOCs. We got plenty, and they were important. In February Dexia said the absolute worse case loss for their monoline subsidiary FSA was going to be $125 million. Yesterday, they added $195 million to that. The reason given on the conference call for the poor guidance is that the servicer on their wrapped HELOC portfolio, Countrywide, had such a backlog that FSA didn't get the news that delinquencies were skyrocketing until very recently."Is this really the reason FSA (and BofA) provided poor guidance recently ... servicer delays?

excerpted with permission, emphasis added

Perhaps something more fundamental is happening. What if certain HELOC borrowers were using the HELOCs as ATMs, paying their HELOC (and first lien) monthly payments using borrowed money? Yes, a different bred of NegAm loans! Then, when the lenders started to rescind or reduce these HELOCs earlier this year, many of these Home ATM junkies were stuck without a fix.

Then - if this story is correct - as the Home ATM junkies have started to default, the lenders have discovered that their secured lines of credit were really unsecured (there was no "HE" in the "HELOC") - and the lenders' losses on home-equity loans started to rise rapidly. This seems more likely to me than "servicer delays".

For more on HELOCs, I recommend Tanta's HELOC Nonsense, The HELOC As Disability Insurance and Banks Freezing HELOCs.

Fed's Lockhart on "Decoupling"

by Calculated Risk on 5/17/2008 02:57:00 PM

From Atlanta Fed President Dennis Lockhart: Emerging Economies and Global Capital Flows

It used to be said that when the United States sneezes, the world catches pneumonia. A better metaphor for today would be that when the United States gets a cold, the world gets a cough and the sniffles. Questions about decoupling are frequently heard in economic discourse, and they include the following:I've highlighted the last point, because this raises an interesting question: What happens if these countries use these accumulated surpluses to stimulate their domestic economies to offset weaker exports to the U.S.? Wouldn't they have to sell U.S. assets? And wouldn't that push up interest rates in the U.S. - further weakening the U.S. economy - and further weakening exports for these same countries? I'm not sure spending these surpluses will work as well as Lockhart envisions.I won't discuss these questions in detail, but let me make a few observations. In the narrow sense, the decoupling debate has been about whether slower spending in the United States will lead to slower GDP growth in countries dependent on U.S. import demand. This concern is then broadened to a global slowdown or recession.

- Will the U.S. downturn drag the rest of the world down, especially China and other consumer product exporters?

- Is the rest of the world positioned to withstand a negative demand shock of some duration from the United States?

- Is global growth being driven by increasingly mature, independent, and sustainable sources of economic dynamism?

- Do the larger economies—BRICs included—have tools to stimulate countercyclical activity in the face of weakness on the part of the United States?

My view is the following: Global economic integration has progressed in recent years to the point that a slowdown in the United States will unquestionably be felt, but not as severely as imagined by some. Domestic growth momentum in many emerging economies will attenuate the influence of U.S. weakness. And the accumulation of foreign currency reserves by these countries—the result of trade surpluses—provides an accessible resource to stimulate their own domestic growth to offset weaker exports, should that weakness materialize.

Taxes in Process of Grieving!!!!!

by Anonymous on 5/17/2008 12:14:00 PM

Well, that's what it says.

Newsday:

Nowadays, when just touting the Jacuzzi, crown molding and new roof won't do, many home sellers have resorted to challenging their property assessments. They're contacting assessors in droves. Some pay hundreds of dollars for appraisers' reports. Others promise to forfeit half the first year's tax savings to firms that win reductions.

Some listings even reserve special punctuation for taxes: One reads "Village Tax Grievance Filed and Approved" while another says "Taxes in Process of Grieving!!!!!"

A Sorry Tale of A Second Lien Security

by Anonymous on 5/17/2008 09:49:00 AM

Floyd Norris thinks this Merrill Lynch subprime second lien security issued a year ago this month is "a candidate for the title of worst ever." I suspect there are measurably worse deals out there whatever criteria you happen to be using, but Norris's observation that this one closed right at the time when a number of ugly facts--like the bankruptcy of the major originator and Merrill's involvement in it--were actually all over the newspapers (not to mention the blogs) is quite relevant. If you were reading the daily paper, not to mention your Bloomberg terminal, you knew about the problem. But somebody bought this dog anyway.

If you care to know, the deal in question is Merrill Lynch Mortgage Investors Trust, Series 2007-SL1. Norris runs down the list of ugly characteristics of this deal, but here are a few additional uglies:

- 81% of the loans were purchase-money.

- Nearly 98% of them were fixed-rate loans (only slightly more than 2% were HELOCs).

- The weighted average Debt-to-Income ratio was 44.27%. As the overwhelming majority of the loans were stated income, and as it is likely that the first-lien mortgage payment used to calculate the DTI was based on a teaser-rate ARM, you can confidently assume that the true average DTI was significantly higher than that.

- The weighted average loan age was 7 months when the deal closed in May of 2007, meaning that most of the loans were originated in Q4 2006. By and large, this pool of loans would have had most of the "EPDs" (Early Payment Defaults) selected out of it.

- The A classes originally had 45.20% credit support and were rated Aaa by Moody's. As of last week, the A-1 bond is rated B3 and the A-2 bond is rated Caa1.

How fast did it all unwind? That, I think, is an interesting question given the reports we've seen in the last few days of an acceleration in losses on HELOC pools. Cumulative losses for the pool for its first twelve remittance months were: 0.00 0.01 0.01 0.15 0.95 2.70 5.50 7.81 10.59 13.37 16.00 19.40.

But nobody could have seen this coming.Friday, May 16, 2008

Volcker: No Reason for Complacency

by Calculated Risk on 5/16/2008 08:38:00 PM

Here is Paul Volcker's testimony to Congress this week (7 min 33 sec - just a portion of testimony):

Home Builders Pessimistic: "Pricing pressure for the foreseeable future"

by Calculated Risk on 5/16/2008 02:33:00 PM

"In general, most markets are pretty tough. We're still seeing pricing pressure out there and I think for the foreseeable future we're still going to see it."And some other recent home builder comments:

Beazer Homes CEO Ian McCarthy on conference call, May 16, 2008

"I don't think we're anywhere near a bottom in housing. We're going to have a big inventory of unsold, unoccupied homes that's going to take three or four years to clear out."From MarketWatch: Spring a bust for housing market (hat tip charts)

Eli Broad, founder, KB Homes, April 28, 2008

[Toll Brothers] chief executive, Robert Toll, said traffic levels at its communities were "the worst that we have ever seen."And from the NAHB:

"[T]he message is very clear: The single-family housing market is still deteriorating..."There is a reason home builder confidence is near record lows.

NAHB President Sandy Dunn

"[T]he housing market has shown no evidence of improvement thus far. In fact, conditions have continued to deteriorate in recent times...”

NAHB Chief Economist David Seiders

US to Halt Strategic Petroleum Reserve Purchases

by Calculated Risk on 5/16/2008 01:32:00 PM

From AP: US will stop sending oil into strategic reserves

Although 76 thousand barrels is a small percentage of the 85 million barrels per day of world demand (about 0.1%), this could make some difference in the price because both the supply and demand curves for oil are very steep.