by Calculated Risk on 5/16/2008 12:58:00 PM

Friday, May 16, 2008

FDIC's Bair: Housing crisis is a national problem

FDIC Chairman Sheila Bair at the Brookings Institution Forum, The Great Credit Squeeze: How it Happened, How to Prevent Another

[W]e have some significant challenges ahead of us. And while some credit markets may be stabilizing, families, communities, and the economy continue to suffer.Bair goes on to call for more government action.

Frankly, things may get worse before they get better.

As regulators, we continue to see a lot of distress out there.

...

[A]ll of us can see the strain on state and local government budgets and the impact on the banking and financial systems.

And there is more uncertainty ahead.

Data show there could be a second wave of the more traditional credit stress you see in an economic slowdown.

Delinquencies are rising for other types of credit, most notably for construction and development lending, but also for commercial loans and consumer debt.

The slowdown we've seen in the U.S. economy since late last year appears to be directly linked to the housing crisis and the self-reinforcing cycle of defaults and foreclosures, putting more downward pressure on the housing market and leading to yet more defaults and foreclosures.

BTW, I wonder - are Friday bank failures about to become routine?

Consumer Confidence Falls to 28 Year Low

by Calculated Risk on 5/16/2008 10:38:00 AM

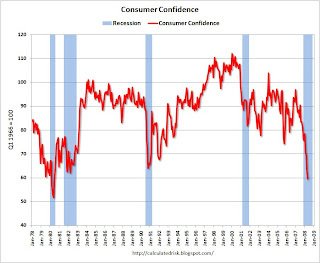

I don't spend much time looking at consumer confidence, because for the most part it tells you what you already know. And right now confidence is saying that for most Americans these are tough economic times.

But this is pretty impressive Cliff Diving ... Click on graph for larger image.

Click on graph for larger image.

According to the University of Michigan, consumer confidence in the U.S. fell to 59.5 in May, the lowest level since June 1980 (58.7). Confidence was at 62.6 in April, and 88.3 last May.

This is lower than for the recession of '81/'82 (with double digit unemployment), the recession of '90/'91, and the recession of '01. Once again, the current recession is "probable".

Housing Starts Rebound, Single Family Starts Lowest Since 1991

by Calculated Risk on 5/16/2008 08:39:00 AM

The Census Bureau reports on housing Permits, Starts and Completions.

Building permits increased:

Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 978,000. This is 4.9 percent above the revised March rate of 932,000, but is 34.3 percent below the revised April 2007 estimate of 1,489,000.Housing starts increased:

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 1,032,000. This is 8.2 percent above theHousing Completions declined:

revised March estimate of 954,000, but is 30.6 percent below the revised April 2007 rate of 1,487,000.

Privately-owned housing completions in April were at a seasonally adjusted annual rate of 1,000,000. This is 16.0 percent below the revised March estimate of 1,190,000 and is 34.9 percent below the revised April 2007 rate of 1,535,000.

The graph shows Total housing starts vs. Single family housing starts.

This graph shows that single family starts are at the lowest level since 1991.

More on starts and completions later.

Fleck: HELOCs: The New Subprime

by Calculated Risk on 5/16/2008 12:38:00 AM

From Bill Fleckenstein's Daily Rap: HELOCs: The New Subprime (Here is Fleck's Site for the Daily Rap):

Note: excerpted with permission.

The following is from Fleck's source: "The Lord of the Dark Matter"

"A couple of us tuned into Dexia's conference call yesterday, looking for clues on HELOCs. We got plenty, and they were important. In February Dexia said the absolute worse case loss for their monoline subsidiary FSA was going to be $125 million. Yesterday, they added $195 million to that. The reason given on the conference call for the poor guidance is that the servicer on their wrapped HELOC portfolio, Countrywide, had such a backlog that FSA didn't get the news that delinquencies were skyrocketing until very recently.Watch HELOCs closely! Fleck's source nailed subprime last year, as an example on January 30, 2007:

There is no doubt that US mortgage servicers are swamped right now, but I think there is a bigger story here, which ties in with BAC quietly announcing their HELOC loss estimates have gone up from a 2.0% to 2.5% range to 'over 2.5%.' Servicer backlogs could well be the reason why so many CEOs and CFOs are running around telling investors they are not seeing deteriorations in HELOC delinquencies.

The truth is their data is wrong. The market has, obviously, taken the view that the worst of the writedowns are behind us, and if anything it's now just a macroeconomic problem we face. I think that's dead wrong. We're now entering the phase where the macro impacts earnings, but also the stage where real cash losses start to hit the banks (subprime and Alt-A is primarily a mark-to-market issue, but HELOCs are going to be large, outright losses). Once WAMU, WFC, BAC and JPM start to get data through on how rapidly their HELOC portfolios are deteriorating, watch the losses pile up. I'm talking realised losses, not mark-to-market writedowns."

emphasis and link added

Turning to the subprime industry, once again I heard from my friend who has been staggeringly accurate. He continues to feel that things are about to really get worse. In an email to me, he wrote: "Scratch and dent loans are killing everybody. Bids that were 92 or 93 are now low to mid-80s. It is a bloodbath, and is pressuring even strong companies to buckle. NO ONE is making any money in the market right now. We are at a point of no return for many. The next two weeks will be wild."Note: A wild two weeks indeed as subprime blew up in early February.

Thursday, May 15, 2008

WSJ Report: Fannie Mae to Eliminate "declining market" Rules

by Calculated Risk on 5/15/2008 08:04:00 PM

From the WSJ: Fannie Is Poised To Scrap Policy Over Down Payments

Fannie Mae is expected to announce Friday that it is scrapping a policy requiring higher down payments on home mortgages in areas where house prices are falling.

The change comes in response to protests from vital political allies of the government-sponsored provider of funding for mortgages, including the National Association of Realtors, the National Association of Home Builders and organizations that promote affordable housing for low-income people.

...

The current policy, adopted in December and now due to end June 1, limits loan amounts in areas with declining home prices, including most of the densely populated parts of the country.

...

Under the new policy that is taking effect next month, Fannie will have the same maximum loan percentages across the country for people purchasing single-family homes that they intend to occupy, according to people familiar with the plan.

Fed's Mishkin: How Should We Respond to Asset Price Bubbles?

by Calculated Risk on 5/15/2008 07:42:00 PM

From Fed Governor Frederic S. Mishkin: How Should We Respond to Asset Price Bubbles?

Rex Nutting at MarketWatch has the story: Fed should deflate some bubbles, Mishkin says

The Federal Reserve should try to aggressively deflate some types of asset bubbles before they can harm the economy, Fed Gov. Frederic Mishkin said Thursday.I'll have more later ...

But raising interest rates isn't the way to prick a bubble, he said. And some types of bubbles, such as the dot-com bubble of the late 1990s, probably shouldn't be pricked at all, he said.

On the other hand, the housing bubble of this decade was the type of bubble that should have been targeted with closer supervision and tighter regulation to prevent widespread economic damage, Mishkin said.

The Fed should watch for bubbles that are associated with a fast expansion of credit, he said, because these bubbles have the potential to inflate bank balance sheets on the way up and destroy them on the way down.

Fed Loans to Banks Still Increasing

by Calculated Risk on 5/15/2008 06:30:00 PM

From Bloomberg: Fed's Direct Loans to Banks Climb to Record Level

The Federal Reserve's direct loans of cash to commercial banks climbed to the highest level on record in the past week, a sign of continued stress in financial markets that threatens to curtail credit for households and companies.

Funds provided through the so-called discount window for banks rose by $2.8 billion to a daily average of $14.4 billion in the week to May 14, the central bank said today in Washington. Separately, the Fed's loans to Wall Street bond dealers rose by $75 million to $16.6 billion.

The increase indicates financial firms' emergency needs for cash haven't receded.

Kasriel: In the Eye of the Hurricane

by Calculated Risk on 5/15/2008 05:17:00 PM

From Paul Kasriel and Asha Bangalore at Northern Trust: In the Eye of the Economic Hurricane

There seems to be sentiment developing that the U.S. has weathered the worst of the current cyclical economic storm and blue skies are ahead. We disagree. Any blue skies you see are likely to be short lived. The economy is in the relative calm of the eye of the business-cycle hurricane. The mortgage credit problems are not over. And credit problems in other sectors are just beginning as the housing recession spreads to the rest of the economy.The "eye of the hurricane" meme is definitely gaining traction! Here are some comments on Q1 GDP:

Click on graph for larger image.

Click on graph for larger image.The plus-sign in front of the Commerce Department’s preliminary estimate of the change in first-quarter real GDP was deceiving. Real final sales of domestic product, which is real GDP excluding the change in business inventories, contracted at an annual rate of 0.2% in the first quarter. Except for the negative impact of Hurricane Katrina in Q4:2005, this was the first decline in real final sales since the first quarter of 2002. Real private final domestic sales – i.e., the sum of personal consumption expenditures and private fixed investment expenditures – contracted at an annualized rate of 1.0% in the first quarter, which was the largest contraction since the fourth quarter of 1991 (see Chart 1). So, the housing recession is now spreading to consumer spending, business equipment spending and nonresidential construction spending.The worst of the "credit crisis" might be over, but the real effects of tighter lending, less capital spending, rising unemployment, and consumer defaults on credit cards and auto loans is just starting.

There is much more in the Northern Trust commentary.

USAToday: 'Foreclosures take an emotional toll'

by Calculated Risk on 5/15/2008 02:33:00 PM

This is a very sad story from the USA Today: Foreclosures take an emotional toll on homeowners (hat tip Cathy and others)

The escalating pace of foreclosures and rising fears among some homeowners about keeping up with their mortgages are creating a range of emotional problems, mental-health specialists say. Those include anxiety disorders, depression and addictive behaviors such as alcoholism and gambling. And, in a few cases, suicide.Cathy comments:

Crisis hotlines are reporting a surge in calls from frantic homeowners. The American Psychological Association (APA) and other mental-health groups are publishing tips on how to handle the emotional stress triggered by the real estate meltdown. Psychologists say they're seeing more drinking, domestic violence and marital problems linked to mortgage concerns ...

"I wonder if the mortgage brokers, securitizers, rating agencies, realtors, banks, investment banks, rating agencies and everyone else who raked in millions during the bubble ever feel even a shred of remorse or shame ..."For some reason this reminds me of this creepy advertisement (Note the title is "Debate").

NAHB: Home Builder Confidence Slides

by Calculated Risk on 5/15/2008 01:00:00 PM

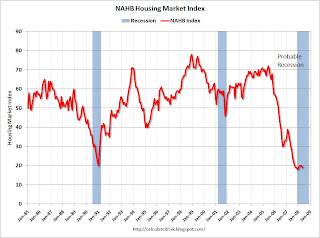

"[T]he message is very clear: The single-family housing market is still deteriorating..."

NAHB President Sandy Dunn

"[T]he housing market has shown no evidence of improvement thus far. In fact, conditions have continued to deteriorate in recent times...”

NAHB Chief Economist David Seiders

| Click on graph for larger image. The NAHB reports that builder confidence was at 19 in May, from 20 in April. Usually housing bottoms look like a "V"; this one will probably look more like an "L". (this refers to activity like starts and sales, but will probably also be apparent in the confidence survey). |  |

From NAHB: Builder Confidence Edges Downward In May

Home builders remained considerably downbeat as market conditions continued to erode in May, according to the NAHB/Wells Fargo Housing Market Index (HMI), released today. The HMI fell a single point to 19, bringing it within one point of the record low 18 set in December 2007 (the series began in January of 1985).

“With the HMI hovering in the historically low two-point range that’s prevailed over the past nine months, the message is very clear: The single-family housing market is still deteriorating ..." said NAHB President Sandy Dunn, a home builder from Point Pleasant, W.Va. ...

“Despite the Federal Reserve’s concerted efforts to lower short-term interest rates, free up credit markets and shore up the national economy, the housing market has shown no evidence of improvement thus far. In fact, conditions have continued to deteriorate in recent times,” said NAHB Chief Economist David Seiders. “The latest HMI shows that even fewer builders now foresee market conditions improving over the next six months compared with our April survey, and builder ratings of buyer traffic through model homes also have dropped off over the past month on a seasonally adjusted basis. ...”

...

The HMI’s component index gauging current sales conditions declined one point to 17 in May — its lowest level since the series began in January 1985. Meanwhile, the component gauging sales expectations for the next six months declined three points to 27, and the component gauging traffic of prospective buyers declined two points to 17.

The HMI fell in three out of four regions in May, with a four-point decline to 18 registered in the Northeast, a three-point decline to 12 registered in the Midwest (also an all-time low) and a two-point decline to 22 posted in the South. The West posted a three-point gain to 20 this month but remained well below the level of a year earlier.