by Calculated Risk on 5/09/2008 11:30:00 AM

Friday, May 09, 2008

March Trade Deficit

The Census Bureau reported a goods and services deficit of $58.2 billion for March 2008. Exports, in March, decreased $2.6 billion to $148.5 billion, but are up almost 16% year-over-year. Imports decreased by over $6 billion to $206.7 billion, and excluding petroleum, are up only 4% year-over-year.

So ignoring monthly fluctuations, the story remains the same: exports are surging and imports (ex-petroleum) have slowed. A few years ago the story was how the ports could increase import capacity. Now the problem is finding enough containers for exports - see from the WSJ: Container Shortage Frustrates U.S. Exporters Click on graph for larger image.

Click on graph for larger image.

The red line is the trade deficit excluding petroleum products. (Blue is the total deficit, and black is the petroleum deficit). The current probable recession is marked on the graph.

Unfortunately the dollar amount of petroleum imports is surging, and this increase in petroleum imports (because of price, not quantity) is mostly offsetting the improvement in the non-petroleum trade deficit.

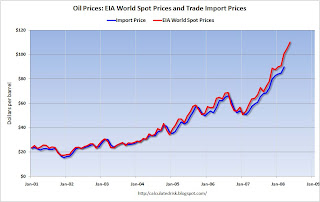

And the petroleum deficit will worsen in April and May. The second graph compares petroleum import prices with the EIA World Spot Price. This shows that import prices in April and May will be significantly higher than for March. Note that the May prices are for last week - and oil prices are setting new records again

The second graph compares petroleum import prices with the EIA World Spot Price. This shows that import prices in April and May will be significantly higher than for March. Note that the May prices are for last week - and oil prices are setting new records again every day every hour!

Fremont General may file BK

by Calculated Risk on 5/09/2008 09:37:00 AM

From Reuters: Fremont General says may file for bankruptcy

Fremont General ... on Friday said it may file for bankruptcy protection.Fremont was the recipient of an ugly Cease and Desist Order issued by the FDIC last year:

The company ... said that absent another "viable transaction" for remaining assets, it expects to file for Chapter 11 protection from creditors.

In taking this action, the FDIC found that the bank was operating without effective risk management policies and procedures in place in relation to its subprime mortgage and commercial real estate lending operations. The FDIC determined, among other things, that the bank had been operating without adequate subprime mortgage loan underwriting criteria, and that it was marketing and extending subprime mortgage loans in a way that substantially increased the likelihood of borrower default or other loss to the bank.So much for Fremont. I'd expect some more bank failures soon.

Sauce For The Goose

by Anonymous on 5/09/2008 07:38:00 AM

Exhibit 1, Floyd Norris, NYT:

Now the mortgage company is warning that it may not be able to pay its bills, and has set out to force those who lent money to it to agree to accept only a fraction of what they are owed. It appears that its lenders have little real choice. If they insist on being paid all that they are owed, they will go to the back of the payment line, with the risk they will get nothing.Exhibit 2, Ruth Simon, Wall Street Journal:

The mortgage industry has bitterly opposed legislative proposals that bankrupt homeowners be able to ask judges to reduce the amount they owe. But that is what this company hopes to accomplish through the threat of a bankruptcy filing. The lender in trouble is known as ResCap, short for Residential Capital. It is a subsidiary of GMAC, which was formerly owned by G.M. . . .

Owners of some notes issued by ResCap are being asked to trade them in for new bonds with face values of as little as 80 cents on the dollar. Other holders are being offered the chance to sell back bonds to the company, for as little as 65 cents on the dollar. GMAC has bought back some ResCap bonds in the public market, paying around 50 cents on the dollar. . . .

As part of the package, GMAC would put another $3.5 billion into ResCap. The company says that any current bondholders who reject the exchange offer would have their debt subordinated to the new loan from the GMAC parent, as well as to the new bonds being issued.

A major provision of the housing-market legislation passed by the House Thursday is getting a lukewarm reception from the mortgage industry. . . .

[T]rade groups that represent mortgage companies and investors say the provision might not help as many borrowers as some expect. They view the write-down provision as one of several options they might use to assist troubled homeowners. "I don't believe this would be a tool that would be used significantly," said Tom Deutsch, deputy executive director of the American Securitization Forum . . .

David Kittle, chairman-elect of the Mortgage Bankers Association, said at a conference earlier this week that he sees no rush by mortgage bankers to write down loans.

Mortgage companies that choose to participate in the proposed plan would be required to write down the value of a delinquent loan by 15% from the home's current appraised value. Borrowers would have to be at least 60 days late on their mortgage payments to qualify for the program. The bill excludes investors and those who lied about their income on their loan applications.

Mr. Deutsch says that in most cases, investors who hold mortgage-backed securities would be better off with other alternatives, such as temporarily reducing the borrower's interest rate or extending the term of the loan, in part because those leave open the chance that investors will get a larger return if the borrower gets back on track and home prices rebound. Mortgage companies are more likely to participate in the write-down program if they expect home prices to continue to decline steeply, he notes, increasing the chances of larger losses.

Thanks for the tip, NYT Junkie!

Severely Underwater Vehicles

by Anonymous on 5/09/2008 06:39:00 AM

Thinking about trading in that Tahoe for a Civic? Sit down.

High fuel prices are causing the value of used SUVs to plummet, often below what's listed in the buying guides many shoppers use to negotiate with dealers.I'm waiting for Gretchen Morgenson to get all over this anti-consumer behavior. Meanwhile,

As a result, some new-car buyers think they're getting cheated by dealers who are offering them little for their SUV trade-ins.

"The dealer is going to offer a price, and the customer is going to be ticked off," says Tom Webb, chief economist for Manheim, operators of auctions where car dealers buy their used-vehicle inventories. "The guidebooks have not caught up to the market," he says.

Webb's figures show wholesale prices on big SUVs such as Chevrolet Tahoes, Ford Expeditions and Toyota Sequoias are down 17% from a year ago. Full-size pickups have fallen as much as 15%, Webb says.Why, you should just hire some newly-under-employed Realtors®. They've had some practice at that kind of thing lately.

"It's a challenge," says Adam Lee, president of the Lee Auto Malls dealerships in Maine. "How do you tell a good customer, 'You paid $32,000 and now it's only worth $17,000?' "

AutoNation's Jackson says he thinks affluent buyers may be hanging on to their SUVs even after they buy newer, more fuel-efficient vehicles, banking on gasoline prices falling so they can sell their big SUVs later for a better price.Better hope you can hang on to that house with the three-car garage, then, because your HOA won't let you put it up on blocks in the yard, I'm afraid.

Thursday, May 08, 2008

Another REO Slide Show

by Calculated Risk on 5/08/2008 11:00:00 PM

Peter Viles at LA Times brings us another gallery of foreclosed properties in LA.

Peter features one on his blog L.A. Land: A foreclosure bargain: The tires are free!. Check it out.

Here is another example - yeah, bars on the windows is a "family neighborhood"! Someone paid $485,000 for this home?

734 Aragon Ave., Los Angeles 90065

Agent's description: "Bank owned. This is a charming little home in a famly neighborhood. Garage was converted. SUBMIT ALL REASONABLE OFFERS."

• Sales history (from Redfin.com): Sold for $485,000 in February 2007.

• Current listing price: $294,900

• Discount from sales price: 39.2%

Northern Trust on Continuing Claims

by Calculated Risk on 5/08/2008 08:15:00 PM

Asha Bangalore at Northern Trust presented a great chart today on continuing unemployment claims. Click on graph for larger image.

Click on graph for larger image.

This morning I noted that continuing claims had reached the 3 million level for the first time in four years.

This graph shows the increase in both initial claims and continuing claims.

Bangalore also presents a graph on the relationship between the Fed's Senior Loan Survey and GDP. This is similar to the research paper I excerpted from yesterday (see: The Impact of Tighter Credit Standards on Lending and Output), and suggests that the economy will slow over the next few quarters.

House Passes Housing "Rescue" Bill

by Calculated Risk on 5/08/2008 06:30:00 PM

From CNN: House OKs controversial housing plan

In a 266-154 vote ... lawmakers approved a proposal ... to let the Federal Housing Administration (FHA) insure up to $300 billion in new loans over four years if lenders agree to reduce the mortgage principal.This is a voluntary program on the part of lenders, and the 85% LTV is of the current appraised value.

To qualify, the lender would have to cut the debt to no more than 85% of a home's current appraised value. If the FHA-refinanced loans went into default, the FHA would pay the lender the remaining principal owed.

While 1.4 million loans are likely to be eligible for such a program, the Congressional Budget Office estimates such a measure would end up insuring 500,000 borrowers. The CBO estimates the FHA expansion program would cost taxpayers $1.7 billion.

AIG: Q1 loss of $7.8 billion

by Calculated Risk on 5/08/2008 04:36:00 PM

More details from the WSJ: AIG to Raise Capital After Big Loss

American International Group Inc. announced plans to raise $12.5 billion in capital as it posted its second straight big quarterly loss. The insurance giant took $9.11 billion in charges on its credit-default swaps and recorded $6.09 billion of investment losses.

Tennessee Governor: Tax collections "deteriorating dramatically"

by Calculated Risk on 5/08/2008 01:21:00 PM

From The Chattanoogan.com: State Cutting Over 2,000 Jobs Due To Tax Shortfall (hat tip JKB)

Gov. Phil Bredesen said Wednesday that state tax collections have been "deteriorating dramatically" in recent months...This is more evidence that the economic slowdown is spreading beyond the 'bubble' states (like California and Florida) and impacting state and local government tax revenue in other states too.

... he said April tax collections showed the largest drop since records began to be kept in 1961.

He said the first quarter was the third worst on record, and the second quarter "is certainly shaping up to be worse than that."

The article mentions that Tennessee is cutting 5% of their state workforce. This is the typical negative feedback loop at the beginning of a recession: a weak economy leads to less tax revenue leads to state and local job cuts that further weakens the economy.

Tim Duy: Misunderstanding the CPI

by Calculated Risk on 5/08/2008 10:53:00 AM

Professor Tim Duy writes at Economist's View: Misunderstanding the CPI. This is an excellent discussion of CPI, and review of David Loenhardt's article yesterday in the NY Times: Seeing Inflation Only in the Prices That Go Up.

Also, here is a great graphic showing the relative size of all of the components of CPI: All of Inflation’s Little Parts (hat tip Eyal). Notice the size of "owner's equivalent rent" (OER).

Dr. Duy discusses OER and then concludes:

[T]he debate over the use of OER in the CPI is something of a false debate. In my opinion, it misses the point entirely. The debate is not whether housing costs are miscalculated in the CPI – the BLS’s basic methodology is appropriate to achieve their objective. The debate is whether or not the Fed should include assets prices, such as home prices, in their policy objective of price stability. Just because there is a valid argument that the Fed should be using a measure other than (or in addition to) consumer prices does not imply that the CPI is flawed. It implies that the construction of monetary policy is flawed. In effect, the BLS is unfairly criticized for the Fed’s policy error.