by Calculated Risk on 5/08/2008 09:47:00 AM

Thursday, May 08, 2008

Weekly Unemployment Claims: Continuing Claims at 3 Million

Here is our monthly look at unemployment claims. Note that continuing claims has now reached a four-year high of 3 million.

From the Department of Labor:

In the week ending May 3, the advance figure for seasonally adjusted initial claims was 365,000, a decrease of 18,000 from the previous week's revised figure of 383,000. The 4-week moving average was 367,000, an increase of 2,500 from the previous week's revised average of 364,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending April 26 was 3,020,000, a decrease of 10,000 from the preceding week's revised level of 3,030,000. The 4-week moving average was 2,998,750, an increase of 16,750 from the preceding week's revised average of 2,982,000.

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now solidly above the possible recession level (approximately 350K).

Labor related gauges are at best coincident indicators, and this indicator suggests the economy is in recession. Notice that following the previous two recessions, weekly unemployment claims stayed elevated for a couple of years after the official recession ended - suggesting the weakness in the labor market lingered. The same will probably be true for the current recession (probable).

Note: There is nothing magical about the 350K level. We don't need to adjust for population growth because this indicator is just suggestive and not precise.

Feldstein: Misleading Statistics

by Calculated Risk on 5/08/2008 01:30:00 AM

Martin Feldstein writes in the Financial Times: Misleading growth statistics give false comfort

Prepositions matter. The recent government report that US gross domestic product increased 0.6 per cent in the first quarter was very misleading. It implied that economic activity was rising in January, February and March. But the increase actually refers to the rise from the average level in the fourth quarter of 2007 to the average level in the first quarter. Monthly data since January indicate that economic activity and GDP have been declining since the start of this year.This is the same point I made when using the Two Month Method to estimate PCE for each quarter. Feldstein is correct on the math and the economy is probably in a recession.

...

Although the government does not provide monthly estimates of GDP, Macroeconomic Advisers, a private forecaster, constructs them ... Although GDP declined during the first quarter, the average of the monthly figures in the first quarter ($11,711bn) is higher than the average of the monthly figures for the final quarter of 2007 ($11,675bn).

Wednesday, May 07, 2008

The Impact of Tighter Credit Standards on Lending and Output

by Calculated Risk on 5/07/2008 06:59:00 PM

The Fed's Senior Loan Officer Opinion Survey is qualitative, not quantitative, and there has been some discussion on the predictive ability of the survey.

Luckily there was a paper written in 2000 that examined 'the value of the Senior Loan Officer Opinion Survey in predicting both lending and output'. See: Listening to Loan Officers: The Impact of Commercial Credit Standards on Lending and Output by New York Fed researchers Cara S. Lown, Donald P. Morgan, and Sonali Rohatgi.

From their conclusion:

Off and on since 1967, the Federal Reserve has surveyed loan officers at a small sample of large banks about their commercial credit standards. The idea behind the survey is that the availability of bank credit depends not just on interest rates, but on credit standards as well. Notwithstanding the small and changing sample, the checkered pattern of questions, and the sometimes curious responses of lenders, the reports are informative. The changes in standards that they report help to predict both commercial bank lending and GDP, even after controlling for past economic conditions and interest rates. Standards matter even in the 1990s, when capital markets were supposed to have eclipsed the role of banks in the economy. Changes in standards also help to predict narrower measures of business activity, where commercial credit availability from banks seems most crucial. The connection between bank standards and inventories is especially promising, because inventory investment is notoriously unpredictable and heavily bank dependent.

A shock to credit standards and its aftermath very much resemble a “credit crunch.” Loan officers tighten standards very sharply for a few quarters, but ease up only gradually: two to three years pass before standards are back to their initial level. Commercial loans at banks plummet immediately after the tightening in standards and continue to fall until lenders ease up. Output falls as well, and the federal funds rate, which we identify with the stance of monetary policy, is lowered. All in all, listening to loan officers tells us quite a lot.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The authors provide these graphs that show the response of GDP, and in the amount of commercial and industrial loans, following a credit tightening shock. The impact on GDP is mostly within the first year, and peaks about 3 quarters after the shock.

The impact on lending lasts for a few years, and peaks about 2 years after the shock.

In the most recent tightening cycle (see graph here), there have been two tightening shocks: the first started in late 2006, and the 2nd was at the end of 2007. If the current cycle follows the normal pattern, the impact from the significant tightening at the end of 2007 should hit GDP later this year, and impact commercial loans for the next 2 to 3 years.

More on Home Improvement Investment

by Calculated Risk on 5/07/2008 06:27:00 PM

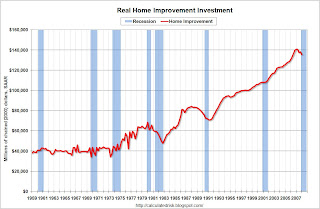

Last week I presented a chart of home improvement investment in real terms. I argued that home improvement spending could fall 15% to 20% in real terms based on previous home improvement slumps.

Here is the chart: Click on graph for larger image.

Click on graph for larger image.

The BEA reports that real spending on home improvement fell 2% in Q1 2008 (from Q4 2007), and has fallen about 4% in real terms from the peak. This is probably just the beginning of the home improvement slump; if this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.

Note: This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in light blue with the current recession "probable". (source: BEA) Here is a 2nd graph in nominal terms comparing residential investment in single family structures (left scale), with investment in home improvement (right scale).

Here is a 2nd graph in nominal terms comparing residential investment in single family structures (left scale), with investment in home improvement (right scale).

This graph shows how sharp the decline in single family structure investment has been - and how little impact (so far) the housing bust has had on home improvement spending. I don't expect the improvement investment slump to be anywhere near as severe as the single family structure collapse, but this does show there is potentially a significant downside.

Fannie Mae's 120% Refinances

by Anonymous on 5/07/2008 04:42:00 PM

Just yesterday Fannie Mae mentioned in its Q1 2008 Earnings Release that, as part of its "Keys to Recovery" initiatives, it would offer "a new refinancing option for up-to-date but 'underwater' borrowers with loans owned by Fannie Mae that will allow for refinancing up to 120 percent of a property's current value." That, so far, is all the information I have directly from Fannie Mae on this subject.

Unfortunately it got Dean Baker worked up. I respect Dr. Baker a great deal--he was calling the housing bubble long before it was cool--but I think he's got the wrong end of this:

This is a difficult move to justify from the standpoint of either taxpayers or homeowners.Baker is assuming that Fannie Mae will allow cash-out refinances in this program; although the mention in the earnings release doesn't specify that, I certainly assumed when I read it that we were talking about no-cash out refinances. (Fannie Mae's term for those, by the way, is "limited cash out" refinances. By this they mean that the loan balance can increase, but only to pay closing costs or pay off subordinate liens. That is what the rest of world means by "no cash out"--no cash disbursed to the borrower or to pay off non-mortgage debts.)

The basic point is that homeowners will start out in these mortgages hugely underwater. Fannie’s policy means that it is prepared to lend $360,000 on a home that is appraised at $300,000. This gap implies that the homeowner can effectively put $60,000 in their pocket by turning the house back to the bank the day after the loan is issued. If the price drops another 10 percent in a year (prices are currently falling at an annual rate of more than 20 percent in the Case-Shiller 20 City Index), then this homeowner will be $90,000 underwater next May. If a seller would face 6 percent transactions costs, then in this example, walking away would provide a $106,000 premium compared with the option of a short sale.

This gap provides an enormous incentive for homeowners to default on their mortgage. Many homeowners will undoubtedly choose this option rather than make excessive mortgage payments on a house that is worth far less than the mortgage. A high default rate will of course lead to large losses for Fannie Mae and increase the likelihood that it will need a taxpayer bailout.

Fannie’s policy does have the effect of aiding banks that made bad mortgages. The new mortgages will allow these mortgages to be paid off. If matters were left to the market, the banks would almost certainly suffer large losses.

Fannie does make it clear that we are talking about Fannie Mae-owned loans. That is significant for two reasons. First, if the loans are upside down, it's already Fannie Mae's problem. To use Baker's example, if the borrower already owes $360,000 on a $300,000 home, the situation isn't made worse by refinancing it into a new loan with a lower payment. For Fannie to purchase a refinance of loans it already owns--presumably at a lower rate or payment, which improves the borrower's position and thus the strength of the loan--is not to take on risk you didn't already have. Second, of course, this isn't bailing out banks or anyone else.

That is why I assumed--and will confirm as soon as I find the Announcement from Fannie Mae--that these are no-cash-out refis. It would, indeed, worsen the risk of an existing underwater loan to let the borrower take more cash out.

Finally, it is specifically limited to performing loans. These are borrowers who are not, generally, eligible for a "workout" because they're not delinquent. But if they have hybrid ARMs coming up on a reset, or fixed rates that are higher than current market rates, this gives them the opportunity to get into a lower rate and payment while other costs--gas, anyone?--are taking more out of their pocketbooks. It isn't clear to me why this would increase any incentive to default, or increase Fannie Mae's losses if the borrowers did subsequently default. The loans are already underwater; even putting them 5% more underwater by rolling in closing costs seems to me, under the circumstances, to be less frightening than letting performing underwater ARMs get to a reset that will be hard for the borrower to bear. Not every borrower who is upside down will default, but every borrower with an unaffordable payment will in the current environment.

So there's a whole lot wrong with a whole lot of pressure to make the GSEs bail out the problems of the mortgage and housing markets, but so far this one sounds to me like Fannie Mae "bailing out" Fannie Mae, and, well, they ought to do that if it makes sense. Fannie Mae certainly does need to get a press release out clarifying the cash-out issue right away, before more nothingburgers get supersized.

U.S. Consumer Debt Surges in March

by Calculated Risk on 5/07/2008 03:37:00 PM

From Bloomberg: U.S. Consumer Debt Rises More Than Forecast in March

Consumer credit increased by $15.3 billion for the month to $2.56 trillion, the biggest monthly rise since November, the Federal Reserve said today in Washington. In February, credit rose by $6.5 billion, previously reported as an increase of $5.2 billion.Say goodbye to the Home ATM, and hello to credit cards.

...

``Consumers are strapped as incomes are not keeping up with inflation and this is leading them to rely increasingly on credit to see them through the worst housing downturn since the Great Depression,'' said Chris Rupkey, chief financial economist at Bank of Tokyo-Mitsubishi in New York. ``The days of extracting cash from one's home to spend on goods and services are long gone.''

Housing: Another Day, Another WSJ Bottom Call

by Calculated Risk on 5/07/2008 12:09:00 PM

Brett Arends at the WSJ asks: Is Housing Slump at a Bottom?

[The following chart] from Wellesley College Prof. Karl E. Case, one of the leading experts on the housing market in the country. And it suggests we may be at, or near, the bottom of the housing crash.

... new housing starts have at last slumped below the seemingly magical one million mark. That happened in March. Every time that has happened in the last 50 years, it proved to be the bottom of a recession.

"It is really remarkable how much where we are today looks like the bottom we've had in the last three cycles," Mr. Case says. "Every time we've gone below a million starts, the market has cleared at that moment."

First, I think any article discussing the housing "bottom" should start by defining what they mean by "bottom". Are they talking about starts? New home sales? Residential investment? Housing prices? Or some other metric?

Most people think of the bottom in terms of price, and in most housing busts, starts, residential investment, and new home sales all bottom long before housing prices bottom. The linked article seems to confuse a bottom for housing starts with a bottom for housing prices, and that is incorrect.

Second, we can write the supply side of the equation as:

Supply = new units added - units sold + existing units for sale. Looking at just housing starts provides only one portion of the equation (this leaves out rental units too - a substitute product).

Here is a graph of inventory (new and existing) for sale at year end (March for 2008):

Click on graph for larger image.

Click on graph for larger image.In the supply-demand equation for housing, prices will be under pressure until the total supply declines significantly. So even if housing starts are near a bottom, there will no quick recovery for starts, and prices will continue to decline, until the total inventory is reduced.

Pending Home Sales Index Declines

by Calculated Risk on 5/07/2008 10:31:00 AM

From the NAR: Soft Existing-Home Sales Expected Near-Term But to Rise Midsummer

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in March, edged down 1.0 percent to 83.0 from a downwardly revised level of 83.8 in February, and was 20.1 percent lower than the March 2007 index of 103.9.Existing home sales will probably decline all year - the opposite of the NAR forecast.

Vallejo Officials Vote to File BK

by Calculated Risk on 5/07/2008 09:34:00 AM

From Bloomberg: Vallejo, California City Officials Vote to File for Bankruptcy

Vallejo, California's city council voted to go into bankruptcy, saying the city doesn't have enough money to pay its bills ... because it ran out of money amid the worst housing slump in the U.S. in 26 years.

The city of 117,000 is facing ballooning labor costs and declining housing-related tax revenue that have left it near insolvency. ... The area has been one of the hardest hit in Northern California by the housing market slump. Home prices in Solano County, where the town resides, dropped 19 percent in January from the year before, according to DataQuick ...

Fed's Hoenig: Serious Inflation Risks

by Calculated Risk on 5/07/2008 12:14:00 AM

From Bloomberg: Fed's Hoenig Says `Serious' Inflation Risk May Prompt Rate Hike

``There is a significant risk that higher inflation will become embedded in the economy and require significant monetary policy tightening to reduce it,'' Hoenig said in the prepared text of a speech in Denver. Consumers are gaining an ``inflation psychology to an extent that I have not seen since the 1970s and early 1980s.''Here is Hoenig's speech.

...

``A sharp slowdown in growth has put the economy at the brink of a recession while, at the same time, rising commodity prices have caused inflation pressures to rise considerably,'' Hoenig said to the Economic Club of Colorado.

...

The combination of slowing growth and inflation is ``troublesome,'' Hoenig said. Rising global commodity prices and higher prices of imported goods from China and other markets are pushing up prices.

``Some would dismiss these rising inflationary pressures as temporary,'' he said. ``I believe they are more serious.''

Update: here is a graph of the University of Michigan Inflation Expectations from the St Louis Fed.

Expectations are not well anchored, and inflation can become embedded in the system, even with rising unemployment. This is probably a huge concern for the Fed.