by Calculated Risk on 5/06/2008 06:45:00 PM

Tuesday, May 06, 2008

Building Castles to the Sky

Here are a couple of interviews with analysts that were wrong about housing (emphasis added) ...

From a Newsweek interview with ex-NAR economist David Lereah: It’s Going to Get Worse

"[I] just didn't realize the scope, the extent, the magnitude of the loose underwriting—not looking at incomes and wages, just providing so many mortgage loans based on [expected] future price appreciation rather than the creditworthiness of the borrower," Lereah says. "That got so out of hand, and none of us realized the magnitude of it until it was too late."And from Jon Lansner at the O.C. Register: Insider Q&A learns how a housing expert goofed

Note: this is the "expert" that was mentioned on the front page of the O.C. Register in 2005 - see Lansner's Emblem of O.C.’s $600,000 home market, now a short sale)

Us: Where did you go wrong?Hoocoodanode?

Walter: Along with almost everyone else, I didn’t recognize that the 2003 thru mid-2006 housing market boom was caused almost exclusively by the introduction (and pushing) of low-teaser-rate loans.

...

Us: What was it you didn’t foresee? Where did the demand go?

Walter: Shame on me! After 40 years of analyzing my way through four economic and housing market booms and busts, I knew that the fuel for every boom also eventually burns it up and causes it to go bust. I had my head in the sand and wasn’t paying attention.If I had been paying attention I would have known that a high percentage of those low-teaser-rate loans would go into foreclosure and bring the whole house of greed tumbling down. But I wasn’t paying attention.

New Home Inventory and Cancellations

by Calculated Risk on 5/06/2008 03:44:00 PM

Inventory numbers from the Census Bureau do not include cancellations - and although cancellation rates are still above normal, the rate has declined from the record levels of last year.

As examples, D.R. Horton reported a cancellation rate of 33% for the most recent quarter, down from 48% in the Fall of 2007. And Centex reported a cancellation rate of 29%, below the mid-30s of 2007.

Each builder has their own downpayment and cancellation policies. Some builders require much higher downpayments and therefore have lower cancellation rates. For Centex, a cancellation rate in the low 20s was normal during good times. For D.R. Horton, a cancellation rate below 20% was common during the boom.

Cancellation rates are important when analyzing the New Home data from the Census Bureau. What matters is the change in cancellation rates, not the absolute level. Falling cancellation rates mean the Census Bureau is probably underestimating sales, and underestimating the decline in inventory. This graph shows my adjusted inventory estimate using cancellation rates from several of the large public builders. This suggests that inventory levels are now declining. Unfortunately this number can only be calculated on a quarterly basis, and not until several of the homebuilders file their quarterly reports with the SEC.

This graph shows my adjusted inventory estimate using cancellation rates from several of the large public builders. This suggests that inventory levels are now declining. Unfortunately this number can only be calculated on a quarterly basis, and not until several of the homebuilders file their quarterly reports with the SEC.

My inventory estimate is 560 thousand (as opposed the Census Bureau reported 468 thousand) as of the end of March. This is actually positive news, since the inventory level decreased by 42 thousand in Q1 by this method. This also suggests the Census Bureau understated sales slightly in Q1.

Also note that most condominiums are not included in new home inventory (or new home sales) from the Census Bureau. Areas with significant condominium developments probably have higher levels of inventory.

Is the Housing Crisis Over?

by Calculated Risk on 5/06/2008 12:19:00 PM

From an opinion piece in the WSJ this morning, hedge fund manager Cyril Moulle-Berteaux argues: The Housing Crisis Is Over

The dire headlines coming fast and furious in the financial and popular press suggest that the housing crisis is intensifying. Yet it is very likely that April 2008 will mark the bottom of the U.S. housing market. Yes, the housing market is bottoming right now.Mr. Moulle-Berteaux appears to be arguing that new home sales have bottomed, not prices or new home construction. He ignores the existing home market (with the huge overhang of supply, especially distressed supply), and that leads Moulle-Berteaux to an inaccurate conclusion.

It is actually possible that new home sales may be nearing the bottom of this cycle, however that doesn't mean the "housing crisis is over" - far from it.

I'm not here to correct all the errors in this piece. As an example, Moulle-Berteaux writes "residential construction" when he means "residential investment" (RI) - there is a difference, since RI includes home improvement, broker's commissions and a some other components, while Moulle-Berteaux appears to be focusing on the new home market.

But, in addition to the crisis being far from over, there is another major logical error in the piece (this flawed argument was made by many housing bulls during the bubble). Moulle-Berteaux writes:

[I]f one buys a house with a mortgage, the most important factor in deciding what to pay for the house is how much of one's income is required to be able to make the mortgage payments on the house.No.

Imagine that income was steady, but the available mortgage rate varied every year - during odds years the mortgage rate was low, in even years it was much higher - high enough to double the monthly payment. In Moulle-Berteaux' world, home buyers would be willing to pay twice as much during odd years than even years. That is laughable.

Although some buyers behave this way, the correct way to measure affordability is price to income, not price to monthly payment. Interest rates do have some impact on price - lower rates can lead to more demand because they change the ratio of the buy-rent decision, but the impact is pretty minor.

Moulle-Berteaux concludes:

[H]ousing led us into this credit crisis and this recession. It is likely to lead us out. And that process is underway, right now.Yes, housing led us into the credit crisis, but because of the huge overhang of existing home supply (especially distressed supply that is growing as prices fall), housing will not be an engine of recovery any time soon.

Felix Salmon at Market Movers has more.

Mr Moulle-Berteaux's prognostications are based on the idea that this housing crunch will resemble previous crunches. But we already know that it won't: it's become a cliché to say that this is the biggest housing crunch since the Depression. Even if prices come back down to where people are willing to buy, those people might well still not be able to buy. And if we have to wait for them to save up their downpayment, it's going to be a long time until there's a housing-market recovery.

Home Builder D.R. Horton: $1.3 Billion Loss

by Calculated Risk on 5/06/2008 09:25:00 AM

From MarketWatch: D.R. Horton swings to $1.3 billion loss

D.R. Horton's latest quarterly results included $834.1 million in pretax charges related to inventory impairments and land options it's walking away from.A little good news: This is lowest cancellation rate for Horton in a year. The cancellation rate peaked at 48% last fall.

...

Reflecting ongoing weakness in the residential market, D.R. Horton's net sales orders fell to 7,528 homes from 9,983 homes a year ago. The cancellation rate, measured by cancelled sales orders divided by gross sales orders, was 33% in the fiscal second quarter.

Fannie Visits the Confessional

by Calculated Risk on 5/06/2008 08:39:00 AM

From the WSJ: Fannie Mae Swings to Loss, To Seek Fresh $6 Billion

The latest results include $4.4 billion in losses on derivatives and trading securities, as well as $3.2 billion in credit-related expenses ...Here is the press release.

Fannie's loan-loss provision soared to $5.2 billion from $249 million, with the increase from the fourth quarter being 53%.

Looking forward, Fannie said it expects "severe weakness in the housing market to continue in 2008," with the weakness projected to "lead to increased delinquencies, defaults and foreclosures on mortgage loans, and slower growth in U.S. residential mortgage debt outstanding."

Treasury Meets With Servicers

by Anonymous on 5/06/2008 08:08:00 AM

Wherein voluntary non-binding criteria are established in order to forestall actual regulation. No, really. Saith the WSJ:

Officials have called a six-hour meeting Tuesday with banking officials to discuss adopting a uniform, but voluntary, set of criteria to speed the time it takes qualified borrowers to modify mortgages they can't afford. Officials also want to make the modification process more consistent across institutions. . . .Let's see. Kicking out a form letter within five days to acknowledge the request? That's easy enough; servicing systems are superb at kicking out form letters. What will it say, other than "we got your request"? Until we finally work through this business about "across the board" versus "case by case" processing of these deals, putting a hard and fast timeline on them seems like a problem to me.

The new industry guidelines, if adopted, wouldn't be binding and couldn't be enforced by the government. But, if effective, they could help forestall aggressive action from congressional Democrats, who have lashed out at loan servicers for acting too slowly and threatened to push tougher oversight of the banking industry if results don't improve. . . .

One possible industry "best practice" would have lenders acknowledge the receipt of any request for a modification within five days of a request by homeowners. Some struggling homeowners have complained that it takes two months or longer to hear back from lenders. Also, the companies are considering a policy that would direct lenders to notify borrowers of a decision about whether to modify a loan within five days.

Another tricky issue slowing loan modifications has been the conflict between companies that hold the first and second mortgage on the same home. Treasury officials are also trying to broker a truce between these groups that would make it easier for borrowers with two mortgages on one home to modify the terms of their loans. . . .

Loan servicers are also looking for clarification about the role of Fannie Mae and Freddie Mac. The two government-chartered mortgage companies made it easier for lenders to modify the terms of certain qualified loans, such as the interest rate. But they have been stricter about writing down mortgage principals [sic], saying they will generally do so only on a case-by-case basis.

If you think there's one consistent mechanical approach that works for any and all loans and borrowers, and you assume that the hold-up is lack of direction from management, then all we need is for the mechanical process to be laid out and the big guys meeting with Treasury to come back to the office and hand out the memos to everyone.

If you think, as I do, that the vast majority of these things have to work on a case-by-case basis, and the hold-up is lack of senior loss mitigation staff who can manage cases all the way through with enough time in their day to take phone calls directly from borrowers in the process, plus the problem of first mortgage loss mit people trying to get somewhere with the second lien people, then we need to be setting "best practice" standards for how and with whom these loss mit departments are staffed at both shops (first lien and second lien).

Furthermore, I really don't see the point of continuing to talk about first mortgage servicers agreeing to do principal write-downs until we have talked more seriously than I have heard heretofore about what junior lien servicers are going to do, exactly, and how they're going to do it. I keep seeing plans--this includes Frank's FHA plan as well as Sheila Bair's "HOP" proposal--that go into great detail about the first lien holder writing down principal but just kinda mention junior liens as an afterthought. Practically speaking, this isn't doing anyone any good: first lien holders can "voluntarily" agree to do just about anything, but if the second lien holders don't agree to modify, subordinate, or charge off and release their liens at the same time in the same time-frame, the whole thing is pointless. But the economics of the two parties are very different: second lien lenders, by and large, don't have big loss mit staffs. You can't afford to on a second lien, not the way the business model of second lien lending was written in the recent past. If you're looking at 100% loss in a foreclosure, but only 110% loss if you spend a lot of time and money negotiating with a first lien lender who ends up pressuring you into charging off the loan anyway, you gain most by doing exactly nothing.

This is not a sympathy trip for second lien lenders; it's a reality trip. Unless this great summit meeting at the Treasury comes up with a public answer to what the second lien lenders are expected to do, and how they're expected to do it, this isn't going to work. Even with Barney Frank issuing none-too-subtle threats:

In a speech to the Mortgage Bankers Association in Boston, House Financial Services Committee Chairman Barney Frank (D., Mass.) warned Monday that if the industry doesn't do more to avert foreclosures, "you're going to see a much tougher set of rules" on mortgage lending emerge from Congress later. He said such changes would be "politically irresistible" if foreclosure problems continue to build up.

Monday, May 05, 2008

Bernanke on Mortgage Delinquencies and Foreclosures

by Calculated Risk on 5/05/2008 09:13:00 PM

From Fed Chairman Ben Bernanke: Mortgage Delinquencies and Foreclosures

[C]onditions in mortgage markets remain quite difficult, and mortgage delinquencies have climbed steeply. The sharpest increases have been among subprime mortgages, particularly those with adjustable interest rates: About one quarter of subprime adjustable-rate mortgages are currently 90 days or more delinquent or in foreclosure. Delinquency rates also have increased in the prime and near-prime segments of the mortgage market, although not nearly so much as in the subprime sector. As a consequence of rising delinquencies, foreclosure proceedings were initiated on some 1.5 million U.S. homes during 2007, up 53 percent from 2006, and the rate of foreclosure starts looks likely to be yet higher in 2008.The rate of foreclosures looks to be higher in 2008? That is an understatement!

Bernanke presented these graphs (note that the price graph is based on OFHEO and not Case-Shiller):

Bernanke presented a couple of other graphs, but it appears that the delinquency rate is related to declines in house prices (other research supports this). From Bernanke:

What are the implications of these relationships, particularly the linkage of mortgage payment problems and falling house prices? ... [W]hen the source of the problem is a decline of the value of the home well below the mortgage's principal balance, the best solution may be a write-down of principal or other permanent modification of the loan by the servicer, perhaps combined with a refinancing by the Federal Housing Administration or another lender. To be effective, such programs must be tightly targeted to borrowers at the highest risk of foreclosure, as measured, for example, by debt-to-income ratio or by the extent to which the mortgage is "underwater."Once again Bernanke is calling for mortgage servicers to reduce the principal amount of underwater loans.

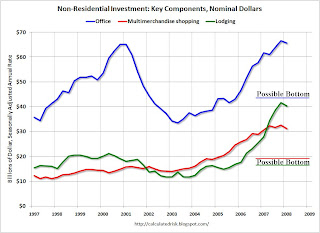

Key Components of Non-Residential Investment, Nominal Dollars

by Calculated Risk on 5/05/2008 08:49:00 PM

This morning I posted a graph of three key components of non-residential structure investment - office buildings, multimerchandise shopping, and lodging - as a percent of GDP. Click on graph for larger image.

Click on graph for larger image.

This graph shows the same information, except this graph is in nominal dollars (as opposed to a percent of GDP).

Note: data from the BEA. The BEA started breaking out office and multimerchandise shopping in 1997.

The possible investment bottoms, discussed in the earlier post, are marked in red, green and blue and labeled "possible bottom".

Note that the Fed Loan survey released earlier today supports this CRE investment bust forecast.

Casino Operator Tropicana to file BK

by Calculated Risk on 5/05/2008 04:31:00 PM

From the WSJ: Casino Operator Tropicana To File for Bankruptcy Protection

Struggling casino operator Tropicana Entertainment LLC is expected to file for bankruptcy protection as soon as today ... It would be the largest corporate bankruptcy of the year, and the latest blow to Las Vegas, which has seen gambling revenues decline and major building projects canceled or delayed in the last few months.

...

"Gaming operators overall are facing headwinds from the broader economy. And unlike some past recessions, casinos are not proving to be recession proof this time around," [Peggy Holloway, Moody's vice president and senior credit officer] said.

TED Spread Improves

by Calculated Risk on 5/05/2008 04:24:00 PM

The TED Spread from Bloomberg:

The TED spread has declined to 1.17%. Still high, but falling.

Note: the TED spread is the difference between the three month T-bill and the LIBOR interest rate. Usually the TED spread is less than 0.5%. The higher the spread, the greater the perceived credit risks (compared to "risk free" treasuries).