by Calculated Risk on 5/06/2008 08:39:00 AM

Tuesday, May 06, 2008

Fannie Visits the Confessional

From the WSJ: Fannie Mae Swings to Loss, To Seek Fresh $6 Billion

The latest results include $4.4 billion in losses on derivatives and trading securities, as well as $3.2 billion in credit-related expenses ...Here is the press release.

Fannie's loan-loss provision soared to $5.2 billion from $249 million, with the increase from the fourth quarter being 53%.

Looking forward, Fannie said it expects "severe weakness in the housing market to continue in 2008," with the weakness projected to "lead to increased delinquencies, defaults and foreclosures on mortgage loans, and slower growth in U.S. residential mortgage debt outstanding."

Treasury Meets With Servicers

by Anonymous on 5/06/2008 08:08:00 AM

Wherein voluntary non-binding criteria are established in order to forestall actual regulation. No, really. Saith the WSJ:

Officials have called a six-hour meeting Tuesday with banking officials to discuss adopting a uniform, but voluntary, set of criteria to speed the time it takes qualified borrowers to modify mortgages they can't afford. Officials also want to make the modification process more consistent across institutions. . . .Let's see. Kicking out a form letter within five days to acknowledge the request? That's easy enough; servicing systems are superb at kicking out form letters. What will it say, other than "we got your request"? Until we finally work through this business about "across the board" versus "case by case" processing of these deals, putting a hard and fast timeline on them seems like a problem to me.

The new industry guidelines, if adopted, wouldn't be binding and couldn't be enforced by the government. But, if effective, they could help forestall aggressive action from congressional Democrats, who have lashed out at loan servicers for acting too slowly and threatened to push tougher oversight of the banking industry if results don't improve. . . .

One possible industry "best practice" would have lenders acknowledge the receipt of any request for a modification within five days of a request by homeowners. Some struggling homeowners have complained that it takes two months or longer to hear back from lenders. Also, the companies are considering a policy that would direct lenders to notify borrowers of a decision about whether to modify a loan within five days.

Another tricky issue slowing loan modifications has been the conflict between companies that hold the first and second mortgage on the same home. Treasury officials are also trying to broker a truce between these groups that would make it easier for borrowers with two mortgages on one home to modify the terms of their loans. . . .

Loan servicers are also looking for clarification about the role of Fannie Mae and Freddie Mac. The two government-chartered mortgage companies made it easier for lenders to modify the terms of certain qualified loans, such as the interest rate. But they have been stricter about writing down mortgage principals [sic], saying they will generally do so only on a case-by-case basis.

If you think there's one consistent mechanical approach that works for any and all loans and borrowers, and you assume that the hold-up is lack of direction from management, then all we need is for the mechanical process to be laid out and the big guys meeting with Treasury to come back to the office and hand out the memos to everyone.

If you think, as I do, that the vast majority of these things have to work on a case-by-case basis, and the hold-up is lack of senior loss mitigation staff who can manage cases all the way through with enough time in their day to take phone calls directly from borrowers in the process, plus the problem of first mortgage loss mit people trying to get somewhere with the second lien people, then we need to be setting "best practice" standards for how and with whom these loss mit departments are staffed at both shops (first lien and second lien).

Furthermore, I really don't see the point of continuing to talk about first mortgage servicers agreeing to do principal write-downs until we have talked more seriously than I have heard heretofore about what junior lien servicers are going to do, exactly, and how they're going to do it. I keep seeing plans--this includes Frank's FHA plan as well as Sheila Bair's "HOP" proposal--that go into great detail about the first lien holder writing down principal but just kinda mention junior liens as an afterthought. Practically speaking, this isn't doing anyone any good: first lien holders can "voluntarily" agree to do just about anything, but if the second lien holders don't agree to modify, subordinate, or charge off and release their liens at the same time in the same time-frame, the whole thing is pointless. But the economics of the two parties are very different: second lien lenders, by and large, don't have big loss mit staffs. You can't afford to on a second lien, not the way the business model of second lien lending was written in the recent past. If you're looking at 100% loss in a foreclosure, but only 110% loss if you spend a lot of time and money negotiating with a first lien lender who ends up pressuring you into charging off the loan anyway, you gain most by doing exactly nothing.

This is not a sympathy trip for second lien lenders; it's a reality trip. Unless this great summit meeting at the Treasury comes up with a public answer to what the second lien lenders are expected to do, and how they're expected to do it, this isn't going to work. Even with Barney Frank issuing none-too-subtle threats:

In a speech to the Mortgage Bankers Association in Boston, House Financial Services Committee Chairman Barney Frank (D., Mass.) warned Monday that if the industry doesn't do more to avert foreclosures, "you're going to see a much tougher set of rules" on mortgage lending emerge from Congress later. He said such changes would be "politically irresistible" if foreclosure problems continue to build up.

Monday, May 05, 2008

Bernanke on Mortgage Delinquencies and Foreclosures

by Calculated Risk on 5/05/2008 09:13:00 PM

From Fed Chairman Ben Bernanke: Mortgage Delinquencies and Foreclosures

[C]onditions in mortgage markets remain quite difficult, and mortgage delinquencies have climbed steeply. The sharpest increases have been among subprime mortgages, particularly those with adjustable interest rates: About one quarter of subprime adjustable-rate mortgages are currently 90 days or more delinquent or in foreclosure. Delinquency rates also have increased in the prime and near-prime segments of the mortgage market, although not nearly so much as in the subprime sector. As a consequence of rising delinquencies, foreclosure proceedings were initiated on some 1.5 million U.S. homes during 2007, up 53 percent from 2006, and the rate of foreclosure starts looks likely to be yet higher in 2008.The rate of foreclosures looks to be higher in 2008? That is an understatement!

Bernanke presented these graphs (note that the price graph is based on OFHEO and not Case-Shiller):

Bernanke presented a couple of other graphs, but it appears that the delinquency rate is related to declines in house prices (other research supports this). From Bernanke:

What are the implications of these relationships, particularly the linkage of mortgage payment problems and falling house prices? ... [W]hen the source of the problem is a decline of the value of the home well below the mortgage's principal balance, the best solution may be a write-down of principal or other permanent modification of the loan by the servicer, perhaps combined with a refinancing by the Federal Housing Administration or another lender. To be effective, such programs must be tightly targeted to borrowers at the highest risk of foreclosure, as measured, for example, by debt-to-income ratio or by the extent to which the mortgage is "underwater."Once again Bernanke is calling for mortgage servicers to reduce the principal amount of underwater loans.

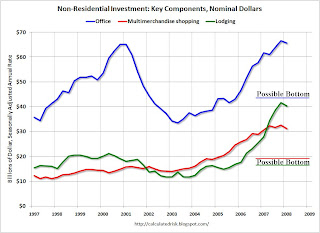

Key Components of Non-Residential Investment, Nominal Dollars

by Calculated Risk on 5/05/2008 08:49:00 PM

This morning I posted a graph of three key components of non-residential structure investment - office buildings, multimerchandise shopping, and lodging - as a percent of GDP. Click on graph for larger image.

Click on graph for larger image.

This graph shows the same information, except this graph is in nominal dollars (as opposed to a percent of GDP).

Note: data from the BEA. The BEA started breaking out office and multimerchandise shopping in 1997.

The possible investment bottoms, discussed in the earlier post, are marked in red, green and blue and labeled "possible bottom".

Note that the Fed Loan survey released earlier today supports this CRE investment bust forecast.

Casino Operator Tropicana to file BK

by Calculated Risk on 5/05/2008 04:31:00 PM

From the WSJ: Casino Operator Tropicana To File for Bankruptcy Protection

Struggling casino operator Tropicana Entertainment LLC is expected to file for bankruptcy protection as soon as today ... It would be the largest corporate bankruptcy of the year, and the latest blow to Las Vegas, which has seen gambling revenues decline and major building projects canceled or delayed in the last few months.

...

"Gaming operators overall are facing headwinds from the broader economy. And unlike some past recessions, casinos are not proving to be recession proof this time around," [Peggy Holloway, Moody's vice president and senior credit officer] said.

TED Spread Improves

by Calculated Risk on 5/05/2008 04:24:00 PM

The TED Spread from Bloomberg:

The TED spread has declined to 1.17%. Still high, but falling.

Note: the TED spread is the difference between the three month T-bill and the LIBOR interest rate. Usually the TED spread is less than 0.5%. The higher the spread, the greater the perceived credit risks (compared to "risk free" treasuries).

Fed: Lending Standards Tighten, Loan Demand Declines

by Calculated Risk on 5/05/2008 03:37:00 PM

From the Fed: The April 2008 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the April survey, domestic and foreign institutions reported having further tightened their lending standards and terms on a broad range of loan categories over the previous three months. The net fractions of domestic banks reporting tighter lending standards were close to, or above, historical highs for nearly all loan categories in the survey. Compared with the January survey, the net fractions of banks that tightened lending standards increased significantly for consumer and commercial and industrial (C&I) loans. Demand for bank loans from both businesses and households reportedly weakened further, on net, over the past three months, although by less than had been the case over the previous survey period.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Of particular interest is the increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

Note that any reading below zero for loan demand means less demand than the previous quarter, but the good news is demand in April wasn't falling quite as fast as in January!

This is strong evidence of an imminent slump in CRE investment.

More charts here for residential mortgage, consumer loans and C&I.

Non-Residential Investment: Key Components

by Calculated Risk on 5/05/2008 12:38:00 PM

If the imminent slowdown in non-residential structure investment is similar to the percentage declines during the '90/'91 and '01 recessions, then non-residential investment could decline as much as 15% to 20% over the next four quarters, from the $501 billion seasonally adjusted annual rate (SAAR) in Q4 2007, to about $400 billion to $425 billion in Q4 2008. (see: CRE Bust: How Deep, How Fast?)

Most of that possible decline will probably come from three key categories: office buildings, multimerchandise shopping, and lodging. Click on graph for larger image.

Click on graph for larger image.

This graph shows the investment in these three categories over the last ten years (as a percent of GDP). Note: data from the BEA. The BEA started breaking out office and multimerchandise shopping in 1997.

Lodging and multimerchandise shopping saw the largest booms, while office space was less than the office boom in the late '90s. If all three categories decline to the recent cycle lows (as a percent of GDP), this will be a decline of about $60 billion in non-residential investment (SAAR). This breaks down to a $22 billion decline for office investment, $13 billion for multimerchandise shopping, and $25 billion for lodging.

Multimerchandise shopping tends to be closely associated with residential investment (developers add strip malls and shopping centers as new communities are built), so the bust in shopping center and strip mall investment is the most predictable (strip mall vacancy rates have risen sharply). Also, a sharp decline in lodging investment also seems very likely given the significantly tighter lending standards for hotels. And office investment will probably slump too based on the recent Grubb & Ellis forecast: Big rise seen in unoccupied office space

Other areas of non-residential structure investment might hold up: such as hospitals, manufacturing (because of exports), and power and mining investment. But overall the decline in non-residential structure investment will probably be significant.

ResCap: May not Meet Debt Obligations

by Calculated Risk on 5/05/2008 11:32:00 AM

From Bloomberg: ResCap Says It May Not Be Able to Meet Debt Obligations in June

Residential Capital LLC, the mortgage- finance company owned by GMAC LLC, said it will still need to come up with $600 million by the end of June to meet its debt requirements even if its bond exchange offer is successful.

...

``There is a significant risk that we will not be able to meet our debt service obligations, be unable to meet certain financial covenants in our credit facilities, and be in a negative liquidity position in June 2008,'' ResCap said in a filing to the Securities and Exchange Commission today.

BofA to Walk Away from Countrywide?

by Calculated Risk on 5/05/2008 09:03:00 AM

From Reuters: BofA may renegotiate Countrywide deal price: Friedman

Bank of America Corp is likely to renegotiate its deal to buy Countrywide Financial Corp down to the $0 to $2 level or completely walk away from it, said Friedman, Billings, Ramsey, [analyst Paul Miller] ...Oh no, not negative equity! Hoocoodanode?

Countrywide's loan portfolio has deteriorated so rapidly that it currently has negative equity ...

"We estimate that if fair-value adjustments to the loan portfolio could exceed approximately $22 billion, this would increase the odds of Bank of America renegotiating the transaction or walking away," Miller said.