by Calculated Risk on 5/01/2008 08:43:00 PM

Thursday, May 01, 2008

Jose Canseco Walks Away

From Peter Viles at L.A. Land: Celebrity foreclosure: Jose Canseco loses Encino home (hat tip Chris & James)

In comments to the TV show "Inside Edition," Canseco says, "It didn't make financial sense for me to keep paying a mortgage on a home that was basically owned by someone else."Is this really a "walk away"? Or was Jose having financial problems?

Sales Tax Collections Decline in Most States

by Calculated Risk on 5/01/2008 06:33:00 PM

From the Rockefeller Institute of Government: Sales Tax Collections Decline in Most States, Rockefeller Institute Survey Finds

State sales tax revenues delivered the weakest performance in six years during the first quarter of 2008, while growth in overall state tax revenues continued to deteriorate, according to preliminary data in a new report by the Rockefeller Institute of Government.

Click on map for larger image.

Click on map for larger image.Map Source: Rockefeller Institute Report.

With 36 of the 45 states that collect sales tax reporting, revenue from sales taxes declined both nationwide and in 21 states during January to March 2008, compared to the same period a year earlier. Southeastern states were hit the hardest: nine of the 21 states reporting sales tax declines were in that region. When adjusted for inflation, sales tax revenues declined in at least 27 states. For the states reporting so far, the overall level of sales tax collections fell slightly – the first time such revenues have not grown in six years.

“The widespread declines in the sales tax are a leading indicator of economic weakening, and a harbinger of further state budget troubles,” said Rockefeller Institute Senior Fellow Don Boyd, co-author of the study. “While the last recession hit states hard via a collapsing income tax, weak consumer spending and declining sales taxes may play a greater role this time around.”

Auto Sales Sharply Lower in April

by Calculated Risk on 5/01/2008 04:33:00 PM

From the WSJ: Detroit Auto Makers Post Sharply Lower April Sales

GM, hobbled by a strike at a major axle supplier, posted a 16% sales drop while Ford sales slid 12%. Chrysler reported a 23% decline. Japan's Toyota Motor Corp. ... managed to snap a fourth-month streak of weaker sales and post a 3.4% rise.Another ugly month ...

Centex: Cancellation Rate Falls

by Calculated Risk on 5/01/2008 02:54:00 PM

On cancellation rates:

"Our cancellation rate continues to fall at 29%, it's the lowest in over a year."It makes sense that cancellation rates are now falling. It takes about 6 months to build a new home, so anyone who bought after the August credit crisis was probably aware of the tighter lending standards and falling house prices, and made their plans accordingly. Still some buyers have probably been unable to sell their existing homes, and the cancellation rate remains high by historical standards.

Each builder has their own downpayment and cancellation policies. Some builders require much higher downpayments and therefore have lower cancellation rates. For Centex, a cancellation rate in the low 20s was normal during good times, and the cancellation rate increased to the mid to high 30s for most of the last couple of years.

Cancellation rates are important when analyzing the New Home data from the Census Bureau. What matters is the change in cancellation rates, not the absolute level. Falling cancellation rates mean the Census Bureau is probably underestimating sales, and underestimating the decline in inventory.

On land:

Analyst: I was wondering kind of bigger picture as you guys go to the asset-light model, and you think about that, in the near term, you're going to be buying more finished lots. How long is it going to take you to take those lots and make them buildable? Is there a delay to get final permitting on this stuff? I guess with that, when you think longer term who is going to be owning the land that's going to be delivering the land to you and what kind of returns are they going to require on that land, and do you think that's a sustainable model in, let's say, 50, 70, 80% of your markets, something like that?Centex believes these private developers are defaulting - "land and the lots are going back to banks" - and it will take some time for the banks to price the land correctly (and recognize their losses). It is interesting that Centex is going to an asset-light model - remember that nonsense about the builders being "land banks" a few years ago?

Centex: Those are good questions, and they don't have finite answers right at the moment. The land has not corrected yet. The land is largely in the hands of private developers, and those private developers have bank borrowings against that land, and we're finding now that the land and the lots are going back to banks. There's thousands and thousands of developed lots in virtually every market with the highest being Atlanta at about 145,000 vacant developed lots. Phoenix has nearly 90,000, or 60,000. Even Dallas/Fort Worth has as many as 90,000 vacant developed lots. So the supply will be there for sometime to come. We believe it needs to go back to the banks. We're already beginning to work with banks on securing some land positions for the future, but of course that's going to be a process that takes some time, and we expect the latter half of this year.

emphasis added

How times have changed!

Centex believes most of the price declines are behind them (for new homes), but they are still worried about tighter lending standards:

What's really unknown is the sales prices. While we're not trying to compete and don't try to compete with foreclosures, the credit markets are continuing to tighten. Credit underwriting standards are continuing to tighten. So as we focus on what's necessary to qualify our buyers, there may still continue to be pressure on prices from just the credit side. Again, I think we believe most of that is behind us. And much less in front of us.Overall this was a relatively positive conference call. Although they clearly stated "There are no markets improving", their markets aren't getting significantly worse - and they are making progress working down their inventory.

Home Improvement Investment

by Calculated Risk on 5/01/2008 01:53:00 PM

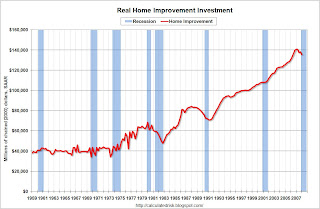

The BEA released the supplemental tables to the GDP report this morning. One of the interesting details is real spending on home improvement.

Almost exactly one year ago, I wrote that home improvement investment was holding up pretty well (see What Home Improvement Investment Slump?) - and I didn't expect that to continue. Click on graph for larger image.

Click on graph for larger image.

The BEA reports that real spending on home improvement fell 2% in Q1 2008 (from Q4 2007), and has fallen about 4% in real terms from the peak. This is probably just the beginning of the home improvement slump; if this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.

Note: This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in light blue with the current recession "probable". (source: BEA)

HOP Is Not A Plan

by Anonymous on 5/01/2008 11:55:00 AM

I think the British term "scheme" might apply, however.

And what, you ask, is HOP? It is the brainchild of the only Federal Deposit Insurance Corporation you happen to have, that's what. Formally, it is the Home Ownership Preservation Loan:

This proposal is designed to result in no cost to the government:The FDIC helpfully gives us an example of a $200,000 2/28 loan with 28 years remaining to maturity at a fully-indexed rate of 8.00%. Using the payment provided for the HOP loan of $235 ($40,000 repaid over 23 years, as the first five years require no payment from the borrower), the assumed interest rate is 4.6% or roughly the yield on the 30-year Treasury bond.

* Borrowers must repay their restructured mortgage and the HOP loan.

* To enter the program, mortgage investors pay Treasury's financing costs and agree to concessions on the underlying mortgage to achieve an affordable payment.

* Treasury would have a super-priority interest -- superior to mortgage investors' interest -- to guarantee repayment. If the borrower defaulted, refinanced or sold the property, Treasury would have a priority recovery for the amount of its loan from any proceeds.

* The government has no continued obligation and the loans are repaid in full.

Mortgage Restructuring:

* Eligible, unaffordable mortgages would be paid down by up to 20 percent and restructured into fully-amortized, fixed rate loans for the balance of the original loan term at the lower balance. New interest rate capped at Freddie Mac 30-year fixed rate.

* Restructured mortgages cannot exceed a debt-to-income ratio for all housing-related expenses greater than 35 percent of the borrower's verified current gross income ('front-end DTI').

* Prepayment penalties, deferred interest, or negative amortization are barred.

* Mortgage investors would pay the first five years of interest due to Treasury on the HOP loans when they enter the program. After 5 years, borrowers would begin repaying the HOP loan at fixed Treasury rates.

* Servicers would agree to periodic special audits by a federal banking agency.

Process:

* Mortgage investors would apply to Treasury for funds and would be responsible for complying with the terms for the HOP loans, restructuring mortgages, and subordinating their interest to Treasury.

* Administratively simple. Eligibility is determined by origination documentation and restructuring is based on verified current income and restructured mortgage payments.

Funding:

* A Treasury public debt offering of $50 billion would be sufficient to fund modifications of approximately 1 million loans that were "unsustainable at origination." Principal and interest costs are fully repaid.

Eligible Mortgages:

Applies only to mortgages for owner-occupied residences that are:

* Unaffordable – defined by front-end DTIs exceeding 40 percent at origination.

* Below the FHA conforming loan limit.

* Originated between January 1, 2003 and June 30, 2007.

So all the investor would have to do is apply for $40,000 in Treasury funds. I have to assume that the first five years of interest to the Treasury is prepaid by the investor, meaning the actual funding would be $30,800 (4.6% interest for five years of $9,200 subtracted from the funding amount). For a securitized mortgage, this would be an immediate charge to the deal's credit enhancement (presumably a write-down to the overcollateralization or most subordinate bond, possibly a partial claim against a mortgage insurance policy). I find it hard to believe that the Treasury would contemplate having mortgage-backed securities remitting monthly interest to the Treasury for five years. But then, I find a lot hard to believe these days, and the FDIC website doesn't really say.

The interest rate on the loan would be reduced to 5.88% for the remaining 28 years. The difference between the fully-indexed rate of 8% and the modified rate of 5.88%, adjusted for whatever anybody happens to think is a plausible average prepayment speed for a loan like this, would be a reduction to the "excess spread" or overcollateralization of the security.

The servicer would execute a modification of mortgage which would adjust the terms accordingly, and record that modification in a junior position to the mortgage given to the Treasury. So, assuming the value of the property was $200,000 at the time, instead of an "80/20" deal this would be a "20/80" deal. In the case of subsequent sale of the home (or default), the Treasury's $40,000 loan would be satisfied first, before any funds were available to the holder of the $160,000 "second lien." (Presumably, if there were a sale or default within the first five years, a portion of the prepaid interest could be deducted from the payoff of the Treasury's lien.)

If, on the other hand, the loan performed for five years and then the borrower sold the property for, say, $220,000, the Treasury would get $40,000, the investor would be paid the outstanding balance on the $160,000 loan (about $147,000), and the borrower would receive the rest of the proceeds. I don't see any provision for the lender to recover the interest it paid on the Treasury loan ($9,200) at this point. As far as I can tell there is no "equity sharing" arrangement on these loans.

What happens if there is lender-paid or borrower-paid MI on the loan? I have no idea. Possibly the mortgage insurer might agree to pay a partial claim when the loan is modified (to cover the investor's loss of the prepaid interest on the Treasury loan), and then the policy would be modified so that the new insured amount is equal to the reduced loan balance (in exchange for a reduced premium). That would reduce the MI's absolute loss exposure in dollar terms. (Suppose the MI coverage on the loan is 35%; the MI's dollar exposure would be $70,000 on $200,000 but only $56,000 on $160,000.) I really have no idea, although I'm sure that insured loans are a small fraction of the loans the FDIC has in mind here.

More likely they have outstanding second liens, and apparently what's supposed to happen here is that the second lien lender just writes off its entire loan amount and goes away quietly. There is only one rather stark sentence regarding second liens: "Under the proposal, the underlying loan is modified within the mortgage pool and does not worsen the position of subordinate lien holders." I gather that means that the second lien lenders are expected to subordinate their liens behind the old first-lien lender's new second lien, making the second a third. (To release the second lien entirely would surely have to be understood to "worsen" the second lienholder's position here.) There is no discussion of the possibility of using the Treasury loan to pay off or pay down the second lien, only to pay down the first lien. HOP may not worsen the second lienholder's position, but it doesn't improve it any.

In the FDIC example loan, the borrower's housing payment-to-income ratio goes from 50% at the time of modification to 35% for five years, and then increases to 39% for the remainder of the loan. These numbers already have a 1.5% annual income increase built into them. If the borrowers have no other debt, that's certainly affordable. Is it affordable enough that the reduced frequency of default in the next five years or so makes up for the increased severity of loss given default to the investor? A borrower whose HTI was 50% and whose DTI was 60% will be going to an HTI of 35% and a DTI of 45%. With the distinct possibility of further declines in home values, that's still a pretty high-risk loan. I'm guessing we will be able to judge whether investors think so by the extent to which they all line right up to participate in this voluntary program. Of course, servicers will be looking at the total debt-to-income ratio, not just the housing payment.

Bottom line: although it's silly to claim this program will have no cost to the government, it is true that the government's exposure is minimal (administrative expenses; either the Treasury services its own loan or the servicer is being asked to do so for free), assuming that I am correct that the first five years' interest will be prepaid. The losses are taken by the lenders and the borrower pays back the full loan amount, albeit at a reduced interest rate. As far as I can tell, the only party who really gets a "bailout" here is the mortgage insurers. That's the real beauty of this plan, and why I cannot for a moment imagine it's going to work.

If you made the assumption that borrowers are entirely insensitive to their equity position--that it is only a question of making the monthly payment affordable--then you could assume that borrowers would like this program and that it would substantially prevent defaults. If you do assume that equity position matters as well as affordability, then this program doesn't do much, since it doesn't change the total indebtedness--even if second lienholders are charging off their loans, if they aren't releasing their liens that money can still be collected from future sale proceeds. Having those liens still out there is likely to make voluntary sale of the property unlikely for some time to come, given the house price outlook.

And the key is a real reduction in the likelihood of default, since it's clear that in the event of default the lender is worse off under the HOP scheme than it would otherwise have been. We can certainly applaud the FDIC for coming up with a plan that protects the taxpayers' contribution in any scenario, but I'm not sure that MBS servicers (or even portfolio lenders) will see this as a sufficient improvement to the risk of default on these loans to take the bait.

Construction Spending Declines in March

by Calculated Risk on 5/01/2008 09:59:00 AM

Spending declined in March for residential, but increased to for non-residential private construction. The increase in March - to a new record high for non-residential spending - followed three straight months of spending declines.

From the Census Bureau: March 2008 Construction Spending at $1,123.5 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $827.4 billion,1.7 percent below the revised February estimate of $842.0 billion.

Residential construction was at a seasonally adjusted annual rate of $445.0 billion in March, 4.6 percent below the revised February estimate of $466.7 billion.

Nonresidential construction was at a seasonally adjusted annual rate of $382.3 billion in March, 1.9 percent above the revised February estimate of $375.3 billion.

Click on graph for larger image.

Click on graph for larger image. The graph shows private residential and nonresidential construction spending since 1993.

Over the last couple of years, as residential spending has declined, nonresidential has been very strong. It appeared - over the last three months - that the expected slowdown in non-residential spending had arrived.

However, non-residential spending in March set a new nominal record (seasonally adjusted annual rate). This is a little surprising given tighter lending standards and reduced capital spending plans - and perhaps the numbers for March will be revised downwards in the next release.

Home Depot Reduces Capital Spending Plans

by Calculated Risk on 5/01/2008 09:43:00 AM

Press Release: The Home Depot Updates Square Footage Growth Plans

The Company has determined that it will no longer pursue the opening of approximately 50 U.S. stores that have been in its new store pipeline ...Of course Home Depot is being hit hard by the slump in home improvement spending, but this is another company significantly reducing capital spending.

Aggregate new store capital spending will be reduced by approximately $1 billion over the next three years ...

The Company reiterated that its total capital spending for the current fiscal year is projected to be approximately $2.3 billion, down from $3.6 billion last year.

The Company also announced that [it] will close 15 underperforming U.S. stores that do not meet the Company's targeted returns.

Wednesday, April 30, 2008

Video of Vandalized Foreclosed Homes in Las Vegas

by Calculated Risk on 4/30/2008 07:02:00 PM

CNN Video via Yahoo: Angry owners vandalizing foreclosed homes in Las Vegas

Update: And here is a video from the O.C. Register of Riding with a sheriff’s deputy on eviction day.

Starbucks Cuts U.S. Growth Plans

by Calculated Risk on 4/30/2008 06:42:00 PM

From the WSJ: Starbucks to Cut U.S. Store Growth But Plans to Accelerate Overseas

Starbucks Corp. plans to drastically reduce the number of stores it builds in the U.S. over the next three years ...This is another company cutting investment plans related to non-residential structures.

Starbucks said Wednesday that this year, it plans to open 1,020 locations in the U.S., down from the 1,175 that it had planned for as of January. But over the next three years, Starbucks plans to cut that number by more than half, opening less than 400 net new locations per year in the U.S.