by Calculated Risk on 4/27/2008 01:14:00 PM

Sunday, April 27, 2008

CRE Bust: How Deep, How Fast?

A key historical investment pattern is for non-residential investment in structures to follow residential investment by about 4 to 7 quarters (both up and down). See Investment Matters for some graphs on this subject.

Clearly the CRE slump is here. Now the questions is how deep and how fast will CRE investment fall. One way to think about this is to look at previous declines in non-residential investment. Click on graph for larger image.

Click on graph for larger image.

This graph shows non-residential investment in structures as a percent of GDP since 1960. Over time there has been a decline in spending (as a percent of GDP), probably related to globalization (more factories were being built overseas).

The non-residential investment boom related to the S&L crisis is obvious on the graph, and we should probably ignore that period when looking at a typical CRE bust.

The two light green circles show the investment busts during the '90/'91 and '01 recessions.

The decline in non-residential investment was fairly rapid during the previous two recessions (a decline in non-residential investment is usually more rapid than a decline in residential investment). In fact most of the decline in investment happened within four quarters.

During the '90/'91 investment slowdown, non-residential investment declined 17% in total, and about 14% in the first year. For the '01 investment slowdown, non-residential investment declined almost 20%, and 19% in the first four quarters.

It is very possible - based on tighter lending standards (see graph 3 in Investment Matters) - that the decline in non-residential investment will be greater (on a percentage basis) than the previous two busts. However, based on commercial vacancy rates, it doesn't appear that some segments of commercial are as overbuilt as in the '90/'91 and '01 periods.

These two factors somewhat balance out, and my guess - based on these two previous busts - is that non-residential investment will decline about 15% to 20% over the next four quarters, from a $501 billion seasonally adjusted annual rate (SAAR) in Q4 2007, to about $400 billion to $425 billion in Q4 2008 - and that most of the bust will happen during 2008.

Saturday, April 26, 2008

Vandos and Bandos

by Calculated Risk on 4/26/2008 08:18:00 PM

Bandos - squatters in abandoned homes.

Vandos - vandals that damage abandoned homes.

This is becoming a frequent story - from the WaPo: Foreclosed Homes Attract Vandalism

The growing foreclosure crisis has forced suburban law enforcement agencies to tackle a new challenge: policing empty houses.And here is the source of "bandos", from the AP: Some homeless turn to foreclosed homes

As evictions mount and many houses remain unsold for months, even years, vacant properties have become havens for squatters, vandals, thieves, partying teenagers and worse, officials said.

Bandos is a funny name, but abandoned homes are a real pain for the neighbors; a classic negative externality.

Layout Changes

by Calculated Risk on 4/26/2008 05:41:00 PM

I'm working on a new layout for the blog. Hopefully I'll make the changes in early May. Thanks to all who have commented before (I've been sharing the proposed layout in the comments). There is still more to do, but here is a preliminary layout - all comments are appreciated.

Best to all, CR

Roubini on CNBC

by Calculated Risk on 4/26/2008 02:46:00 PM

[On CNBC] I fleshed out my arguments on why the US recession will be severe and protracted, lasting four to six quarters.Here is the Financial Times piece by Mohamed El-Erian: Why this crisis is still far from finished

... later in the CNBC program Nobel Prize winner Joe Stiglitz explicitly agreed with my view that this will be the worst U.S. recession since the Great Depression. In some ways Stiglitz was even gloomier than I have been.

Later that morning on CNBC Mohamed El-Erian, co-CEO of Pimco, fleshed out the arguments on why this crisis is not over. That interview followed up his excellent op-ed column on the FT today where he argued that we are now moving to a new stage of the economic and financial downturn.

... During the next few months there will be a reversal in the direction of causality: the unusual adverse contamination by the financial sector of the real economy is now morphing into the more common phenomenon of recessionary forces threatening to undermine the financial system.

Economic data in the US have taken a notable turn for the worse. Most importantly, the already weakening employment outlook is being further undermined by a widely diffused build-up in inventory and falling profitability. History suggests that the latter two factors lead to significant employment losses.

... The sharp slowdown in the US real economy will occur in the context of continued global inflationary pressures. As such, the Federal Reserve’s dual objectives – maintaining price stability and solid economic growth – will become increasingly inconsistent and difficult to reconcile. Indeed, if the Fed is again forced to carry the bulk of the burden of the US policy response, it will find itself in the unpleasant and undesirable situation of potentially undermining its inflation-fighting credibility in order to prevent an already bad situation from becoming even worse.

It is still too early for investors and policymakers to unfasten their seatbelts. Instead, they should prepare for renewed volatility.

Milken Conference: Where is the Real Estate Bottom?

by Calculated Risk on 4/26/2008 01:21:00 PM

I will be attending the Milken Institute Global Conference on Monday April 28th. There are a couple of sessions of special interest related to real estate:

Real Estate: Where Is the Bottom?

9:35 AM - 10:50 AM (PT) (includes Sam Zell)

The Future of the Mortgage Market: Where Do We Go From

Here?

4:00 PM - 5:15 PM (includes Lewis Ranieri)

Also at 4:00 PM is a session with several prominent economics bloggers:

Econobloggers: Real-Time Information and Analysis From

the Keyboard Next Door

The panel includes several bloggers that Tanta and I frequently reference:

Felix Salmon, "Market Movers" at Portfolio.com

Yves Smith, "Naked Capitalism"

Professor Mark Thoma, "Economist's View"

Hopefully - laptop willing - I'll be blogging live from the conference.

Best to all.

Miss Busta and the Death of Satire

by Anonymous on 4/26/2008 07:57:00 AM

Regulars may remember this little post about Accredited Home Lender's new Chief Advisor of Things Both Relevant and Interesting in the Non-Conforming Loan Market, Miss Busta.

Well, Miss Busta's website is up and running. I confess to complete and utter disappointment; after the build-up in the announcement email, I really expected this to be funnier:

Dear Miss Busta,$150MM since January might be a lot of clams, but it isn't very many mortgage loans. In Q1 2006 Accredited originated $3.6 billion.

Given the crazy events of the last year or so, it seems that the subprime loan market is dead. Please tell me the truth. I can take it.

—Grieving in Grand Rapids

Dear Grand,

Dry your tears and stop that annoying sniveling. The rumors that Subprime is dead are greatly exaggerated. Granted, it was tough going there for a while and some serious intervention was needed, but it’s been brought back from the brink. Seems Subprime was hanging around with a bad crowd and fell victim to some wicked peer pressure. After the deadbeats were run off and a few warts were removed, things have started to get a lot better, thank you very much. In fact, Accredited has closed more than $150 million in subprime loans since January. That’s a lot of clams. And we’re back doing business with some solid friends—nice brokers who predict steady growth over the next year. So enough with the hand-wringing. Let’s get to work. Something you might want to try.

Accredited may be targeting the "nice broker" demographic, but if this kind of thing either amuses or reassures their broker base, then they're also dealing with the dim broker demographic. There is a long and storied history in the mortgage business of both overpaying the sales force and simultaneously treating them like not very bright fifth graders. Fly them to Hawaii, put them up in an expensive hotel, and then send them to pep rallies with the intellectual content of an episode of The Brady Bunch. That sort of thing. My own view is that people tend to live up to the expectations you have of them, which is why there are so many overpaid fifth graders in the business.

You'd think Accredited might have reflected a bit on that strategy, but apparently not. I am not known as a humorless person, but I'm actually mildly surprised that any subprime lender thinks the time has already come to be merely cute about the whole thing. I would have thought they might still be trying to prove to the world that the grownups are, in fact, in charge now. Perhaps investing some time into actual training of brokers in credit analysis, acceptable loan documentation, and responsible disclosure practices. Putting some honest effort into understanding what went wrong and why. Guess not. It's all about attitude and platitude, any fleeting breakthrough of seriousness instantly stifled with chicken casserole recipes. The warts have been removed, the clams are back, and the same anti-intellectual drivel that papered over the problem in the first place returns to cheer everyone up.

On the other hand, at $150MM a quarter, that "overpaid" thing will no longer be a problem.

Friday, April 25, 2008

Major Land Partnership in Default

by Calculated Risk on 4/25/2008 11:30:00 PM

From the WSJ: Calpers-Linked Land Partnership Gets Default Notice

A large California land partnership involving one of the largest U.S. pension funds has received a notice of default on a $1 billion loan after failing to meet certain terms of its lenders.Here come the defaults and builder bankruptcies.

LandSource Communities Development LLC, a partnership that involves the California Public Employees' Retirement System, received the default notice Tuesday, amid talks to restructure $1.24 billion of debt. The partnership ... owns 15,000 acres in Southern California ...

LandSource's trouble followed mounting stress at two large joint ventures in Las Vegas ... One partner in these ventures said Friday that it is unlikely that it will meet its obligations to the deals. The partner, home builder Kimball Hill Homes, announced Wednesday that it had filed for Chapter 11 bankruptcy protection.

UPDATE: Remember this photo from January 1, 2008? Anyone think housing bubble?

Click on photo for larger image.

Click on photo for larger image.This is a photo taken at the Sacramento Airport by Itamar

Why Haven't Existing Home Sales Fallen Further?

by Calculated Risk on 4/25/2008 05:25:00 PM

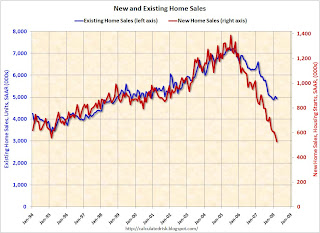

The first graph compares New Home sales vs. Existing Home sales since January 1994. Click on graph for larger image.

Click on graph for larger image.

Clearly new home sales have fallen faster than existing home sales.

Based on various reports, it appears new home builders cut their prices quicker than most existing home sellers. So why have new home sales fallen faster than existing home sales?

There could be a number of possible explanations:

Perhaps new homes were more overpriced than existing homes, so the larger price cuts haven't been enough to motivate buyers.

Or maybe there was more speculative buying in the new home market. During the boom, many buyers could put down 1% or less and hold a house for 6 to 9 months; essentially a call option on the house. But if that was the reason, wouldn't new home sales have increased quicker than existing home sales during the boom? It appears the ratio of sales tracked pretty closely from '94 through '05.

Or maybe all the REO sales (bank Real Estate Owned) are boosting the number of existing home transactions. Note: It is my understanding that banks taking possession of foreclosed properties are not counted in the NAR's existing home sales report, but the resale of REOs are counted.

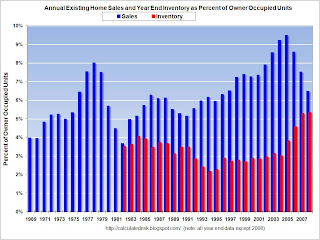

Whatever the reason - and I'm always a little skeptical of the NAR's numbers - existing home sales are still above the normal range. The second graph shows annual existing home sales and year end inventory. As the NAR recently noted 2007 was the fifth highest sales year on record.

The second graph shows annual existing home sales and year end inventory. As the NAR recently noted 2007 was the fifth highest sales year on record.

Note: for 2008 I used the March sales and inventory numbers. All other numbers are annual sales, and year-end inventory.

If the red columns (inventory) is as high as the blue column (sales) - something I expect to happen this summer - then the "months of supply" number will be 12.

The third graph shows the annual sales and year end inventory since 1982 (sales since 1969), normalized by the number of owner occupied units. This graph shows that inventory is at an all time record level by this key measure.

This also shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year. Currently 6% of owner occupied units would be about 4.6 million existing home sales per year. This indicates that the turnover of existing homes - March sales were at a 4.93 million Seasonally Adjusted Annual Rate (SAAR) - is still above the historical median.

This suggests that sales of existing homes could fall significantly more in 2008.

Stiglitz: "One of the worst economic downturns since the Great Depression"

by Calculated Risk on 4/25/2008 01:54:00 PM

From CNBC: Nobel Winner Stiglitz: US Facing Long Recession (hat tip squeezed)

The U.S. economy is already in recession -- and may echo the 1930s, Nobel Laureate Joseph Stiglitz said Friday.See video at CNBC: "Roubini is not far off."

...

"This is going to be one of the worst economic downturns since the Great Depression," said Stiglitz.

Genworth: Hoocoodanode?

by Calculated Risk on 4/25/2008 12:05:00 PM

Here is another comment from Genworth Conference Call (hat tip Scott):

Question Eric Berg, Lehman Brothers: Is there anything that sort of stands out in this whole experience - whatever inning we are in here - whether it’s what’s happening in California or the extent of the decline in Florida, the willingness of certain high fico score borrowers to walk away. If there is one or two things that really jump off the pages of data that you have looked at and have led you say "Wow I would have never expected that" what has surprised you the most about lets say what’s going on or customer behavior in whole complicated situation?Hoocoodanode?

Kevin at Genworth: I continue to get surprised every day. The biggest change to me has been the rapid deterioration of both the Florida and the California experience, uh, nobody ever would have predicted the extent of the home price downgrade in those markets But if I step back from that, the other thing we’ve all learned through this period is it gets back to the fundamentals of sound, prudent underwriting, if you are underwriting properly, and you had good linkage between those underwriting standards and what the investors are paying for those loans in the secondary market. It’s all about liquidity, when the liquidity dried up and went away things jumped off the charts - I really think at the end of the day that is probably one of the biggest drivers of this once liquidity exited the market everything accelerated, or decelerated, or whatever you want to call it.

emphasis added