by Calculated Risk on 4/26/2008 01:21:00 PM

Saturday, April 26, 2008

Milken Conference: Where is the Real Estate Bottom?

I will be attending the Milken Institute Global Conference on Monday April 28th. There are a couple of sessions of special interest related to real estate:

Real Estate: Where Is the Bottom?

9:35 AM - 10:50 AM (PT) (includes Sam Zell)

The Future of the Mortgage Market: Where Do We Go From

Here?

4:00 PM - 5:15 PM (includes Lewis Ranieri)

Also at 4:00 PM is a session with several prominent economics bloggers:

Econobloggers: Real-Time Information and Analysis From

the Keyboard Next Door

The panel includes several bloggers that Tanta and I frequently reference:

Felix Salmon, "Market Movers" at Portfolio.com

Yves Smith, "Naked Capitalism"

Professor Mark Thoma, "Economist's View"

Hopefully - laptop willing - I'll be blogging live from the conference.

Best to all.

Miss Busta and the Death of Satire

by Anonymous on 4/26/2008 07:57:00 AM

Regulars may remember this little post about Accredited Home Lender's new Chief Advisor of Things Both Relevant and Interesting in the Non-Conforming Loan Market, Miss Busta.

Well, Miss Busta's website is up and running. I confess to complete and utter disappointment; after the build-up in the announcement email, I really expected this to be funnier:

Dear Miss Busta,$150MM since January might be a lot of clams, but it isn't very many mortgage loans. In Q1 2006 Accredited originated $3.6 billion.

Given the crazy events of the last year or so, it seems that the subprime loan market is dead. Please tell me the truth. I can take it.

—Grieving in Grand Rapids

Dear Grand,

Dry your tears and stop that annoying sniveling. The rumors that Subprime is dead are greatly exaggerated. Granted, it was tough going there for a while and some serious intervention was needed, but it’s been brought back from the brink. Seems Subprime was hanging around with a bad crowd and fell victim to some wicked peer pressure. After the deadbeats were run off and a few warts were removed, things have started to get a lot better, thank you very much. In fact, Accredited has closed more than $150 million in subprime loans since January. That’s a lot of clams. And we’re back doing business with some solid friends—nice brokers who predict steady growth over the next year. So enough with the hand-wringing. Let’s get to work. Something you might want to try.

Accredited may be targeting the "nice broker" demographic, but if this kind of thing either amuses or reassures their broker base, then they're also dealing with the dim broker demographic. There is a long and storied history in the mortgage business of both overpaying the sales force and simultaneously treating them like not very bright fifth graders. Fly them to Hawaii, put them up in an expensive hotel, and then send them to pep rallies with the intellectual content of an episode of The Brady Bunch. That sort of thing. My own view is that people tend to live up to the expectations you have of them, which is why there are so many overpaid fifth graders in the business.

You'd think Accredited might have reflected a bit on that strategy, but apparently not. I am not known as a humorless person, but I'm actually mildly surprised that any subprime lender thinks the time has already come to be merely cute about the whole thing. I would have thought they might still be trying to prove to the world that the grownups are, in fact, in charge now. Perhaps investing some time into actual training of brokers in credit analysis, acceptable loan documentation, and responsible disclosure practices. Putting some honest effort into understanding what went wrong and why. Guess not. It's all about attitude and platitude, any fleeting breakthrough of seriousness instantly stifled with chicken casserole recipes. The warts have been removed, the clams are back, and the same anti-intellectual drivel that papered over the problem in the first place returns to cheer everyone up.

On the other hand, at $150MM a quarter, that "overpaid" thing will no longer be a problem.

Friday, April 25, 2008

Major Land Partnership in Default

by Calculated Risk on 4/25/2008 11:30:00 PM

From the WSJ: Calpers-Linked Land Partnership Gets Default Notice

A large California land partnership involving one of the largest U.S. pension funds has received a notice of default on a $1 billion loan after failing to meet certain terms of its lenders.Here come the defaults and builder bankruptcies.

LandSource Communities Development LLC, a partnership that involves the California Public Employees' Retirement System, received the default notice Tuesday, amid talks to restructure $1.24 billion of debt. The partnership ... owns 15,000 acres in Southern California ...

LandSource's trouble followed mounting stress at two large joint ventures in Las Vegas ... One partner in these ventures said Friday that it is unlikely that it will meet its obligations to the deals. The partner, home builder Kimball Hill Homes, announced Wednesday that it had filed for Chapter 11 bankruptcy protection.

UPDATE: Remember this photo from January 1, 2008? Anyone think housing bubble?

Click on photo for larger image.

Click on photo for larger image.This is a photo taken at the Sacramento Airport by Itamar

Why Haven't Existing Home Sales Fallen Further?

by Calculated Risk on 4/25/2008 05:25:00 PM

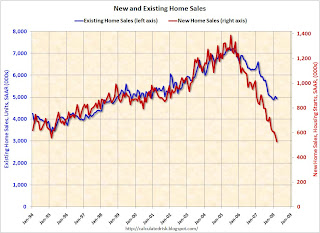

The first graph compares New Home sales vs. Existing Home sales since January 1994. Click on graph for larger image.

Click on graph for larger image.

Clearly new home sales have fallen faster than existing home sales.

Based on various reports, it appears new home builders cut their prices quicker than most existing home sellers. So why have new home sales fallen faster than existing home sales?

There could be a number of possible explanations:

Perhaps new homes were more overpriced than existing homes, so the larger price cuts haven't been enough to motivate buyers.

Or maybe there was more speculative buying in the new home market. During the boom, many buyers could put down 1% or less and hold a house for 6 to 9 months; essentially a call option on the house. But if that was the reason, wouldn't new home sales have increased quicker than existing home sales during the boom? It appears the ratio of sales tracked pretty closely from '94 through '05.

Or maybe all the REO sales (bank Real Estate Owned) are boosting the number of existing home transactions. Note: It is my understanding that banks taking possession of foreclosed properties are not counted in the NAR's existing home sales report, but the resale of REOs are counted.

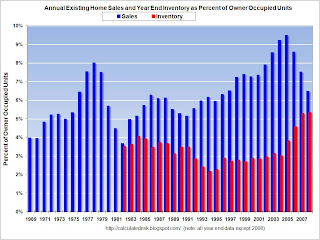

Whatever the reason - and I'm always a little skeptical of the NAR's numbers - existing home sales are still above the normal range. The second graph shows annual existing home sales and year end inventory. As the NAR recently noted 2007 was the fifth highest sales year on record.

The second graph shows annual existing home sales and year end inventory. As the NAR recently noted 2007 was the fifth highest sales year on record.

Note: for 2008 I used the March sales and inventory numbers. All other numbers are annual sales, and year-end inventory.

If the red columns (inventory) is as high as the blue column (sales) - something I expect to happen this summer - then the "months of supply" number will be 12.

The third graph shows the annual sales and year end inventory since 1982 (sales since 1969), normalized by the number of owner occupied units. This graph shows that inventory is at an all time record level by this key measure.

This also shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year. Currently 6% of owner occupied units would be about 4.6 million existing home sales per year. This indicates that the turnover of existing homes - March sales were at a 4.93 million Seasonally Adjusted Annual Rate (SAAR) - is still above the historical median.

This suggests that sales of existing homes could fall significantly more in 2008.

Stiglitz: "One of the worst economic downturns since the Great Depression"

by Calculated Risk on 4/25/2008 01:54:00 PM

From CNBC: Nobel Winner Stiglitz: US Facing Long Recession (hat tip squeezed)

The U.S. economy is already in recession -- and may echo the 1930s, Nobel Laureate Joseph Stiglitz said Friday.See video at CNBC: "Roubini is not far off."

...

"This is going to be one of the worst economic downturns since the Great Depression," said Stiglitz.

Genworth: Hoocoodanode?

by Calculated Risk on 4/25/2008 12:05:00 PM

Here is another comment from Genworth Conference Call (hat tip Scott):

Question Eric Berg, Lehman Brothers: Is there anything that sort of stands out in this whole experience - whatever inning we are in here - whether it’s what’s happening in California or the extent of the decline in Florida, the willingness of certain high fico score borrowers to walk away. If there is one or two things that really jump off the pages of data that you have looked at and have led you say "Wow I would have never expected that" what has surprised you the most about lets say what’s going on or customer behavior in whole complicated situation?Hoocoodanode?

Kevin at Genworth: I continue to get surprised every day. The biggest change to me has been the rapid deterioration of both the Florida and the California experience, uh, nobody ever would have predicted the extent of the home price downgrade in those markets But if I step back from that, the other thing we’ve all learned through this period is it gets back to the fundamentals of sound, prudent underwriting, if you are underwriting properly, and you had good linkage between those underwriting standards and what the investors are paying for those loans in the secondary market. It’s all about liquidity, when the liquidity dried up and went away things jumped off the charts - I really think at the end of the day that is probably one of the biggest drivers of this once liquidity exited the market everything accelerated, or decelerated, or whatever you want to call it.

emphasis added

Genworth Financial Conference Call Comments

by Calculated Risk on 4/25/2008 11:10:00 AM

Here are a few comments from the Genworth conference call.

First, look at the significant change in their outlook for house prices and unemployment:

“First, U.S. housing market conditions have worsened and liquidity remains constrained. At year-end, we shared the view with many in the market that the magnitude of the house price declines from the peak in Q4 2005 would be 13% to 15%. Based on what we have seen to date, we now expect the decline to be in the 20% to 25% range with significant regional variation. Second, our outlook for U.S. unemployment worsened from 5% in December to closer to 6% by year-end 2008. In addition, the probability that we will see a recession in the U.S. is now higher; however, it is unclear whether the downturn will be mild or more severe.”On Alt-A and A minus delinquencies:

emphasis added

“This quarter, we saw a significant deterioration in the 2007 flow book with 2007 reserve increases accounting for more than half of the build in total loss reserves. Delinquencies remain concentrated in alternative products like Alt-A and A minus, as well as in high loan balance states, particularly in Florida . If this adverse early development of the 2007 book continued over multiple years, we could see lifetime losses with certain lenders exhaust captive coverage, particularly those with relatively higher concentrations of Alt-A and A minus product and exposure to high loan balance states. However, it is too early to make such a determination and we are monitoring the situation while actively working on loss mitigation.”In response, they have raised their prices:

“In addition, we announced yesterday a 20% price increase on our flow mortgage Insurance product.”

Consumer Sentiment Falls to 26 Year Low

by Calculated Risk on 4/25/2008 10:19:00 AM

From Bloomberg: U.S. Consumer Sentiment Index Fell More Than Forecast

U.S. consumer confidence fell ... to its lowest level in 26 years, a sign record gasoline prices and rising unemployment will prompt Americans to curb spending.Recent research suggests that consumer sentiment is a coincident indicator, and this low reading suggests that the economy is in recession, or possibly that gas prices are high, or both. In other words, it tells us what we already know.

The Reuters/University of Michigan index of consumer sentiment decreased to 62.6, the weakest since 1982, from 69.5 the prior month.

"... consumer confidence just reflects the past. You lose your job, your confidence falls. There's not really anything new there."Still this is the lowest reading since the severe recession of the early '80s - and this probably means consumer spending in April will be especially weak.

Dr. Dean Croushore, Feb, 2005

FirstFed Reports

by Anonymous on 4/25/2008 07:26:00 AM

Coming to Jesus:

LOS ANGELES, Apr 25, 2008 (BUSINESS WIRE) -- FirstFed Financial Corp., parent company of First Federal Bank of California, today announced that they expect to substantially increase their allowance for single family loan losses at March 31, 2008. The Bank's total provision for loan losses for the current quarter is expected to be between $140 million and $160 million, resulting in an after-tax operating loss for the quarter of between $65 million and $75 million, or $4.75 to $5.50 per share.This is the same outfit--a California thrift stuffed with Option ARMs--that reserved $20-23 million for the first quarter and $4.5 million for the quarter before that.

This report finally includes some data on general credit quality and defaults. At the beginning of 2008, FED had 74 owned properties in inventory. During the quarter it acquired another 143 and sold 53. Yuk.

Subprime in Greenwich

by Anonymous on 4/25/2008 06:55:00 AM

Well, no, they're "affluent." And they're not like us.

From "Pain of Foreclosure Spreads to the Affluent," in the ever-dependable NYT:

“We never had a case that had gone through three separate sales attempts,” he said, still dazed that the auction failed to take place. “Greenwich being Greenwich, foreclosures are a rare occurrence.”And us plebes outside of Greenwich, on the other hand, fit into nice neat categories? I see.

Rare, perhaps, but not unheard-of, as the housing industry collapse starts to claim victims among the affluent. Personal traumas like business reversal, illness and divorce play a role. There’s no real pattern, with people as diverse as builders, restaurateurs and poker players at risk of losing their homes.

Well, I for once have seen this "real pattern" before:

As for the four-bedroom colonial that just avoided going on the block, Zbigniew Skwarek, the 41-year-old owner, came up with his own money to postpone the auction. Court records show he stopped paying on his mortgage on Feb. 1, 2007. But three days before the scheduled auction, he said, he gave his lender a check for $50,000.I am not sure we have established that Mr. Skwarek is "affluent," but he is clearly "subprime." He just has a rather larger subprime loan than us average Joes and Joettas--you know, the kind Mr. Skwarek failed to pay wages to, the kind who may have needed those wages to make their own mortgage nut. This does, though, create one difference--unlike your run of the mill subprime borrower, Mr. Skwarek fervently believes in the kindness and decency of lenders:

Mr. Skwarek may not live in one of Greenwich’s most coveted neighborhoods. But like many residents here, he owns other properties, including an apartment in Greenwich and a home in Florida, and he can tap into that equity.

“I don’t want to lose this house,” Mr. Skwarek said in a telephone interview.

Mr. Skwarek rented out the house after he divorced his wife, Renata, in 2004, because, he said, it felt too big to live in alone. But last year, he said, his renters, John and Arline Josephberg, stopped paying their monthly rent of $10,000.

While living there, Mr. Josephberg — who previously ran the financial firm Josephberg Grosz & Company — was put on trial, accused of not paying his taxes for 29 years. He was sentenced to 50 months in prison. By the time the couple moved out in January, they owed Mr. Skwarek $90,000. Calls made to Mrs. Josephberg and to the couple’s daughter were not returned.

But public records show that Mr. Skwarek had trouble paying his bills even before he rented out his home. Court documents show that he also owes construction and supply companies more than $200,000 for unpaid bills on his home.

In the past four years, he has been in court several times over unpaid bills. He has a felony conviction for not paying wages to his workers and a misdemeanor for issuing a bad check. He was sued in small claims court for not paying his divorce lawyer. His former wife said that his money troubles contributed to the end of their marriage.

“I was sick about how he took care of the bills,” Ms. Skwarek said. “He didn’t change.”

Mr. Skwarek has still not figured out how he will hold on to his home. He will try to rent it again, he said. If that doesn’t work, he plans to move in and rent out his apartment. He remains optimistic that foreclosure will never happen and that his lender will help him find a way to escape his financial trap.I'll bet they do.

“They want to work with people like me,” he said.