by Calculated Risk on 4/22/2008 10:15:00 PM

Tuesday, April 22, 2008

Target Credit Card Net Charge-Offs Rise to 8.1% Annual Rate

From Bloomberg: Target Writes Off 8.1% of March Credit-Card Loans

Target Corp., the second-largest U.S. discount chain, said it wrote off 8.1 percent of its credit-card loans in March as consumers grappled with job losses and the biggest housing slump in a quarter century.This is pretty ugly - especially the increase in the charge-off rate from 6.8% to 8.1% over one month (this is another company pointing to significant problems in March).

Defaults during the month totaled $55.5 million, the Minneapolis-based retailer said in a regulatory filing today. The charge-off rate was 6.8 percent in February.

Note: Target didn't write off 8.1 percent in March - that is the annual charge-off rate.

Lowenstein: Triple-A Failure

by Calculated Risk on 4/22/2008 07:26:00 PM

Roger Lowenstein writes in the New York Times Magazine: Triple-A Failure (hat tip Jasper and others). This is an excellent overview of how the rating agencies failed. Here is an excerpt:

Moody’s recently was willing to walk me through an actual mortgage-backed security step by step. I was led down a carpeted hallway to a well-appointed conference room to meet with three specialists in mortgage-backed paper. Moody’s was fair-minded in choosing an example; the case they showed me, which they masked with the name “Subprime XYZ,” was a pool of 2,393 mortgages with a total face value of $430 million.Lowenstein follows XYZ through the rating process, and through the eventual downgrades.

Subprime XYZ typified the exuberance of the age. All the mortgages in the pool were subprime — that is, they had been extended to borrowers with checkered credit histories. In an earlier era, such people would have been restricted from borrowing more than 75 percent or so of the value of their homes, but during the great bubble, no such limits applied.

Moody’s did not have access to the individual loan files, much less did it communicate with the borrowers or try to verify the information they provided in their loan applications. “We aren’t loan officers,” Claire Robinson, a 20-year veteran who is in charge of asset-backed finance for Moody’s, told me. “Our expertise is as statisticians on an aggregate basis. We want to know, of 1,000 individuals, based on historical performance, what percent will pay their loans?”

The loans in Subprime XYZ were issued in early spring 2006 — what would turn out to be the peak of the boom.

Almost immediately, the team noticed a problem. Usually, people who finance a home stay current on their payments for at least a while. But a sliver of folks in XYZ fell behind within 90 days of signing their papers. After six months, an alarming 6 percent of the mortgages were seriously delinquent. (Historically, it is rare for more than 1 percent of mortgages at that stage to be delinquent.)Shocked? Homebuyer's were speculating with no money down. Mortgage brokers didn't care because they would sell the loans immediately and collect their fees. Wall Street didn't care because they could package the loans and sell them to investors. Investors would have cared, except they trusted the rating agencies. And as this article describes, the rating agencies weren't evaluating the underlying loans - they were performing statistical analysis using models based on lenders that cared if the borrower would repay the loan.

Moody’s monitors began to make inquiries with the lender and were shocked by what they heard. Some properties lacked sod or landscaping, and keys remained in the mailbox; the buyers had never moved in. The implication was that people had bought homes on spec: as the housing market turned, the buyers walked.

By the spring of 2007, 13 percent of Subprime XYZ was delinquent — and it was worsening by the month.

At the same time, regulators - despite numerous warnings - mostly ignored the problem, apparently for ideological reasons ("let the free market work"). What a mess.

Housing Wire: Moody’s Downgrades 1,923 Subprime RMBS Classes

by Calculated Risk on 4/22/2008 04:58:00 PM

From Paul Jackson at Housing Wire: Stick a Fork in It: Moody’s Downgrades 1,923 Subprime RMBS Classes — In Just Two Days

Between Monday and Tuesday, calculations by Housing Wire show that the rating agency has slashed ratings on 1,923 tranches from 232 seperate subprime RMBS deals from 2005-2007 vintages.Is it Friday yet?

That total includes hundreds of formerly Aaa-rated securities ...

The downgrades surely tally into the multiple of billions worth of subprime debt, and portend additional earnings pain for many market participants — write-downs on the value of RMBS in a portfolio usually aren’t marked up until a downgrade takes place.

Shiller: House Prices may fall more than 30%

by Calculated Risk on 4/22/2008 04:41:00 PM

From the WSJ: Yale’s Shiller: U.S. Housing Slump May Exceed Great Depression (hat tip hopeinsd)

Yale University economist Robert Shiller ... said there’s a good chance housing prices will fall further than the 30% drop in the historic depression of the 1930s. Home prices nationwide already have dropped 15% since their peak in 2006, he said.Historically housing busts take about 5 to 7 years from price peak to trough. If we date the current bust as starting in early 2006, the price bust for existing homes will probably last until 2012 or so. I suspect 2008 will see the steepest price decline, followed by a few years of smaller percentage declines in the bubble areas.

“I think there is a scenario that they could be down substantially more,” Mr. Shiller said during a speech at the New Haven Lawn Club.

Mr. Shiller, who admitted he has a reputation for being bearish, said real estate cycles typically take years to correct.

As of the end of 2007, the Case-Shiller house price index showed national prices were off 10.2%. I suppose this means Shiller is estimating prices fell 5% nationally in Q1. Very possible.

Of course according to OFHEO, house prices rose in February, and are only off 3.1% from the peak!

U.S. home prices rose approximately 0.6 percent on a seasonally adjusted basis between January and February, according to OFHEO’s new monthly House Price Index. For the 12 months ending in February, U.S. prices fell 2.4 percent. Since its peak in April 2007, the index is down 3.1 percent.The OFHEO prices don't seem to fit with the price declines being observed in most markets.

Also, Shiller's forecast is in nominal terms; a 30% price decline in real terms (inflation adjusted) is very likely. Three years of flat nominal prices would be close to a 10% decline in real terms.

DataQuick: California Foreclosure Activity Up Sharply in Q1

by Calculated Risk on 4/22/2008 12:41:00 PM

Update: press release added at bottom.

From DataQuick: The number of mortgage default notices (NODs) filed against California homeowners in Q1 2008 increased by 39% over Q4 2007, to the highest level on record.

This graph shows the annual NODs filed in California since 1992. For Q1 2008, a record 113,676 NODs were filed in California, compared to 254,824 total NODs in 2007. This is more than double the 46,670 NODs filed in Q1 2007. Click on graph for larger image.

Click on graph for larger image.

For 2008, the number of NODs was estimated at 4 times the Q1 rate. Based on recent experience - with NODs increasing every quarter for the last 3 years - this is probably conservative.

As bad as 2007 was, 2008 will be much much worse.

Not all NODs go to foreclosure, but the percentage has been increasing (well over 50% now).

From DataQuick: Another Jump in California Foreclosure Activity

Lending institutions sent homeowners 113,676 default notices during the January-to-March period. That was up by 39.4 percent from 81,550 the previous quarter, and up 143.1 percent from 46,760 for first-quarter 2007, according to DataQuick Information Systems.Wow, now 2/3 of NODs are going to foreclosure!

Last quarter's number of defaults was the highest in DataQuick's statistics, which go back to 1992.

"The main factor behind this foreclosure surge remains the decline in home values. Additionally, a lot of the 'loans-gone-wild' activity happened in late 2005 and 2006 and that's working its way through the system. The big 'if' right now is whether or not the economy is in recession. If it is, the foreclosure problem could spread beyond the current categories of dicey mortgages, and into mainstream home loans," said Marshall Prentice, DataQuick's president.

Most of the loans that went into default last quarter were originated between August 2005 and October 2006. The median age was 23 months, up from 16 months a year earlier.

...

Last quarter's default numbers were a record in almost all of the state's 58 counties. The notable exception being Los Angeles County, which was particularly hard hit by the recession of the early 1990s. During last quarter, the county's 20,339 defaults represented 94.8 percent of its peak quarter back in Q1 of 1996, which saw 21,444 defaults.

...

Of the homeowners in default, an estimated 32 percent emerge from the foreclosure process by bringing their payments current, refinancing, or selling the home and paying off what they owe. A year ago it was about 52 percent. The increased portion of homes lost to foreclosure reflects the slow real estate market, as well as the number of homes bought during the height of the market with multiple-loan financing, which makes 'work-outs' difficult.

emphasis added

More on March Existing Home Inventory

by Calculated Risk on 4/22/2008 12:12:00 PM

For more, see my earlier post: March Existing Home Sales

For forecasting, probably the most important number in the existing home sales report is inventory; houses listed for sale. This tells us nothing about the number of distressed homes for sale (REOs, short sales). It also doesn't tell us about homeowners waiting for a 'better market'.

But the NAR inventory report does provide a general idea of the supply side of the 'supply and demand' equation.  Click on graph for larger image.

Click on graph for larger image.

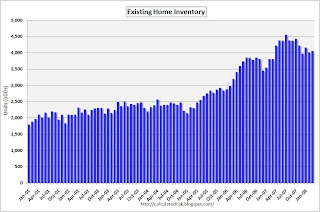

This graph shows the inventory by month since 2002.

There are two key points: During the boom years (2002 through mid-way 2005), inventory levels stayed fairly steady. During the bust years, the inventory level has increased to a new record level for each month.

March 2008 was no exception. Even though inventories increased only slightly from February, inventory is at an all time record high for March.

Now that the Spring selling season has arrived, the question is: Will inventory levels keep setting new records, or will inventories hold steady (or even decline)? The next few months will tell us if inventory is stabilizing, or if, as I expect, existing home inventories will reach new record levels this summer.

Note: the NAR doesn't seasonally adjust inventory.

BofA, Countrywide to Curtail Risky Mortgage Lending

by Calculated Risk on 4/22/2008 11:04:00 AM

From Reuters: Bank of America-Countrywide to curb risky mortgages

Bank of America said on Tuesday it plans to stop offering some riskier mortgage loans after it finishes buying Countrywide... the combined businesses will not offer "option" adjustable-rate mortgages ...I'm a little surprised they are still offering Option ARM and stated income loans now.

It also plans to "significantly curtail" other non-traditional mortgages, including some loans that don't require borrowers to fully document income or assets.

March Existing Home Sales

by Calculated Risk on 4/22/2008 10:07:00 AM

The NAR reports: Existing-Home Sales Slip in March

Existing-home sales – including single-family, townhomes, condominiums and co-ops – were down 2.0 percent to a seasonally adjusted annual rate of 4.93 million units in March from a level of 5.03 million in February, and remain 19.3 percent below the 6.11 million-unit pace in March 2007.

Click on graph for larger image.

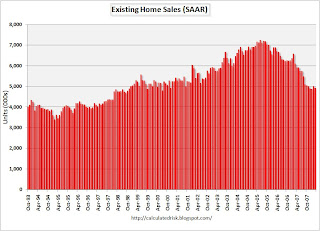

Click on graph for larger image. The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March 2008 (4.93 million SAAR) were the weakest March since 1998 (4.87 million SAAR).

The following is a graph of Not Seasonally Adjusted existing home sales for 2005 through 2008.

| This graph shows that sales have plunged in March 2008 compared to the previous three years. March is an important month for existing home sales, and marks the beginning of the Spring selling season. |  |

The third graph shows nationwide inventory for existing homes. According to NAR, inventory increased to 4.058 million homes for sale in March.

The third graph shows nationwide inventory for existing homes. According to NAR, inventory increased to 4.058 million homes for sale in March. Total housing inventory rose 1.0 percent at the end of March percent to 4.06 million existing homes available for sale, which represents a 9.9-month supply at the current sales pace, up from a 9.6-month supply in February.The typical pattern is for inventory to decline in December, and then to slowly rebound in January and February, and really start to increase in March.

I'll have more on inventory later today.

The third graph shows the 'months of supply' metric for the last six years.

Months of supply decreased to 9.9 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply). Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales continue to decline. More later ...

RBS: £5.9 billion in Write Downs, to Raise Capital

by Calculated Risk on 4/22/2008 09:29:00 AM

From the WSJ: RBS Takes Further Write-Downs, Plans $23.78 Billion Rights Issue

Royal Bank of Scotland PLC Tuesday said it took a further £5.9 billion in pretax write-downs and will take steps to shore up its balance sheet, asking shareholders to approve a £12 billion ($23.78 billion) rights issue in addition to seeking disposals of noncore assets.The confessional is very busy.

Update: Here is more info on the RBS Rights Issue. The table under Credit Market Exposures lists the components of their write down. This includes more Alt-A than subprime - and £201 million in commercial loans.

Monday, April 21, 2008

Fortune: What Warren thinks...

by Calculated Risk on 4/21/2008 09:23:00 PM

From an interview with Warren Buffet in Fortune Magazine: What Warren thinks...

Q: Are we a long way from turning a corner?Buffett talks about not timing the market based on macroeconomics, but he did time the housing market perfectly. He bought a Laguna Beach, CA house in 1996 for $1.05 million (at the market bottom), and sold in 2005 for $3.5 million. It's not like he needed the money.

Buffett: "I think so. I mean, it seems everybody says it'll be short and shallow, but it looks like it's just the opposite. You know, deleveraging by its nature takes a lot of time, a lot of pain. And the consequences kind of roll through in different ways. Now, I don't invest a dime based on macro forecasts, so I don't think people should sell stocks because of that. I also don't think they should buy stocks because of that."

Here was Buffett's comment at the time:

"People go crazy in economics periodically. Residential housing has different behavioral characteristics, simply because people live there. But when you get prices increasing faster than the underlying costs, sometimes there can be pretty serious consequences."