by Calculated Risk on 4/22/2008 12:41:00 PM

Tuesday, April 22, 2008

DataQuick: California Foreclosure Activity Up Sharply in Q1

Update: press release added at bottom.

From DataQuick: The number of mortgage default notices (NODs) filed against California homeowners in Q1 2008 increased by 39% over Q4 2007, to the highest level on record.

This graph shows the annual NODs filed in California since 1992. For Q1 2008, a record 113,676 NODs were filed in California, compared to 254,824 total NODs in 2007. This is more than double the 46,670 NODs filed in Q1 2007. Click on graph for larger image.

Click on graph for larger image.

For 2008, the number of NODs was estimated at 4 times the Q1 rate. Based on recent experience - with NODs increasing every quarter for the last 3 years - this is probably conservative.

As bad as 2007 was, 2008 will be much much worse.

Not all NODs go to foreclosure, but the percentage has been increasing (well over 50% now).

From DataQuick: Another Jump in California Foreclosure Activity

Lending institutions sent homeowners 113,676 default notices during the January-to-March period. That was up by 39.4 percent from 81,550 the previous quarter, and up 143.1 percent from 46,760 for first-quarter 2007, according to DataQuick Information Systems.Wow, now 2/3 of NODs are going to foreclosure!

Last quarter's number of defaults was the highest in DataQuick's statistics, which go back to 1992.

"The main factor behind this foreclosure surge remains the decline in home values. Additionally, a lot of the 'loans-gone-wild' activity happened in late 2005 and 2006 and that's working its way through the system. The big 'if' right now is whether or not the economy is in recession. If it is, the foreclosure problem could spread beyond the current categories of dicey mortgages, and into mainstream home loans," said Marshall Prentice, DataQuick's president.

Most of the loans that went into default last quarter were originated between August 2005 and October 2006. The median age was 23 months, up from 16 months a year earlier.

...

Last quarter's default numbers were a record in almost all of the state's 58 counties. The notable exception being Los Angeles County, which was particularly hard hit by the recession of the early 1990s. During last quarter, the county's 20,339 defaults represented 94.8 percent of its peak quarter back in Q1 of 1996, which saw 21,444 defaults.

...

Of the homeowners in default, an estimated 32 percent emerge from the foreclosure process by bringing their payments current, refinancing, or selling the home and paying off what they owe. A year ago it was about 52 percent. The increased portion of homes lost to foreclosure reflects the slow real estate market, as well as the number of homes bought during the height of the market with multiple-loan financing, which makes 'work-outs' difficult.

emphasis added

More on March Existing Home Inventory

by Calculated Risk on 4/22/2008 12:12:00 PM

For more, see my earlier post: March Existing Home Sales

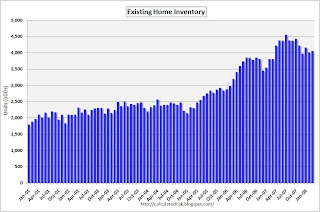

For forecasting, probably the most important number in the existing home sales report is inventory; houses listed for sale. This tells us nothing about the number of distressed homes for sale (REOs, short sales). It also doesn't tell us about homeowners waiting for a 'better market'.

But the NAR inventory report does provide a general idea of the supply side of the 'supply and demand' equation.  Click on graph for larger image.

Click on graph for larger image.

This graph shows the inventory by month since 2002.

There are two key points: During the boom years (2002 through mid-way 2005), inventory levels stayed fairly steady. During the bust years, the inventory level has increased to a new record level for each month.

March 2008 was no exception. Even though inventories increased only slightly from February, inventory is at an all time record high for March.

Now that the Spring selling season has arrived, the question is: Will inventory levels keep setting new records, or will inventories hold steady (or even decline)? The next few months will tell us if inventory is stabilizing, or if, as I expect, existing home inventories will reach new record levels this summer.

Note: the NAR doesn't seasonally adjust inventory.

BofA, Countrywide to Curtail Risky Mortgage Lending

by Calculated Risk on 4/22/2008 11:04:00 AM

From Reuters: Bank of America-Countrywide to curb risky mortgages

Bank of America said on Tuesday it plans to stop offering some riskier mortgage loans after it finishes buying Countrywide... the combined businesses will not offer "option" adjustable-rate mortgages ...I'm a little surprised they are still offering Option ARM and stated income loans now.

It also plans to "significantly curtail" other non-traditional mortgages, including some loans that don't require borrowers to fully document income or assets.

March Existing Home Sales

by Calculated Risk on 4/22/2008 10:07:00 AM

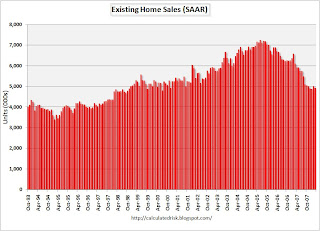

The NAR reports: Existing-Home Sales Slip in March

Existing-home sales – including single-family, townhomes, condominiums and co-ops – were down 2.0 percent to a seasonally adjusted annual rate of 4.93 million units in March from a level of 5.03 million in February, and remain 19.3 percent below the 6.11 million-unit pace in March 2007.

Click on graph for larger image.

Click on graph for larger image. The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March 2008 (4.93 million SAAR) were the weakest March since 1998 (4.87 million SAAR).

The following is a graph of Not Seasonally Adjusted existing home sales for 2005 through 2008.

| This graph shows that sales have plunged in March 2008 compared to the previous three years. March is an important month for existing home sales, and marks the beginning of the Spring selling season. |  |

The third graph shows nationwide inventory for existing homes. According to NAR, inventory increased to 4.058 million homes for sale in March.

The third graph shows nationwide inventory for existing homes. According to NAR, inventory increased to 4.058 million homes for sale in March. Total housing inventory rose 1.0 percent at the end of March percent to 4.06 million existing homes available for sale, which represents a 9.9-month supply at the current sales pace, up from a 9.6-month supply in February.The typical pattern is for inventory to decline in December, and then to slowly rebound in January and February, and really start to increase in March.

I'll have more on inventory later today.

The third graph shows the 'months of supply' metric for the last six years.

Months of supply decreased to 9.9 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply). Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales continue to decline. More later ...

RBS: £5.9 billion in Write Downs, to Raise Capital

by Calculated Risk on 4/22/2008 09:29:00 AM

From the WSJ: RBS Takes Further Write-Downs, Plans $23.78 Billion Rights Issue

Royal Bank of Scotland PLC Tuesday said it took a further £5.9 billion in pretax write-downs and will take steps to shore up its balance sheet, asking shareholders to approve a £12 billion ($23.78 billion) rights issue in addition to seeking disposals of noncore assets.The confessional is very busy.

Update: Here is more info on the RBS Rights Issue. The table under Credit Market Exposures lists the components of their write down. This includes more Alt-A than subprime - and £201 million in commercial loans.

Monday, April 21, 2008

Fortune: What Warren thinks...

by Calculated Risk on 4/21/2008 09:23:00 PM

From an interview with Warren Buffet in Fortune Magazine: What Warren thinks...

Q: Are we a long way from turning a corner?Buffett talks about not timing the market based on macroeconomics, but he did time the housing market perfectly. He bought a Laguna Beach, CA house in 1996 for $1.05 million (at the market bottom), and sold in 2005 for $3.5 million. It's not like he needed the money.

Buffett: "I think so. I mean, it seems everybody says it'll be short and shallow, but it looks like it's just the opposite. You know, deleveraging by its nature takes a lot of time, a lot of pain. And the consequences kind of roll through in different ways. Now, I don't invest a dime based on macro forecasts, so I don't think people should sell stocks because of that. I also don't think they should buy stocks because of that."

Here was Buffett's comment at the time:

"People go crazy in economics periodically. Residential housing has different behavioral characteristics, simply because people live there. But when you get prices increasing faster than the underlying costs, sometimes there can be pretty serious consequences."

Burning Away Joins Walking Away

by Anonymous on 4/21/2008 06:50:00 PM

I have been trying to ignore this story in the LA Times all day, but people will keep sending it to me. I excerpt the relevant parts:

Some folks . . . some people . . . what appears to be . . . a jump in . . . believed to have been . . . The numbers are small, but . . . a dramatic increase . . . surprising some officials . . . making nationwide figures elusive. Still . . . a significant increase . . . questionable home fires, with foreclosure as a possible factor . . . potential fraud . . . would not provide further details . . . has not identified a rise in . . . does not support that . . . But some observers say . . . That's the question.Yes, people have been known to engage in insurance fraud before. Yes, some of these people are probably emotionally disturbed--like a lot of amateur arsonists--in ways that both predate their mortgage loans and may well have little to do with those loans. No, I don't think this is one more thing for lenders to be afraid of--the lender being the loss payee on the hazard insurance policy, actually, that's the first place I'd look. I have no evidence that lenders are out torching homes instead of foreclosing on them, but then again I bet I could get an unnamed source to opine that it's possibly a dangerous trend . . .

Downey Financial Reports Loss, Suspends Future Dividends

by Calculated Risk on 4/21/2008 06:41:00 PM

Press Release: Downey Announces First Quarter 2008 Results and Dividend

Downey Financial Corp. reported a net loss for first quarter 2008 of $247.7 million or $8.89 per share ... The Board also decided to suspend future dividend payments.The increase in NPAs is stunning.

During the current quarter, the provision for credit losses totaled $236.9 million, up $236.3 million from a year ago.

Non-performing assets increased during the quarter by $521 million to $1.562 billion and represented 11.90% of total assets, compared with 7.77% at year-end 2007 and 0.94% a year ago.

More Dilution for Financial Shareholders

by Calculated Risk on 4/21/2008 06:16:00 PM

From Reuters: Citigroup launches $6 billion preferred share sale: IFR

Citigroup on Monday will sell $6 billion in non-cumulative perpetual preferred shares, said International Financing Review, a Thomson Reuters publication.And from the WSJ on CIT Group (a commercial finance company): CIT Plans $1 Billion Stock Offering

The shares are expected to pay a fixed 8.4 percent dividend for 10 years and pay a floating rate after that.

CIT Group Inc. said it plans to offer $1 billion in common and convertible preferred shares, in a move that will seriously dilute current shareholders' holdings.To the shareholders: the good news is your companies might survive, the bad news is you don't own as much of the company as before. But something is better than nothing.

More Jingle Mail Stories

by Calculated Risk on 4/21/2008 03:10:00 PM

From The Arizona Republic: More homeowners mailing keys to lenders instead of payments

Joan Shaffer is turning in the keys of the north Phoenix Tatum Ranch home she bought with her daughter in late 2005. They put nothing down on the home, took out a loan that let them pay less than they owed each month and now their loan is $200,000 more than the house is worth.It's amusing that she is a real estate agent. Still the article has no hard figures:

"We paid $585,000. It was the peak of the market, but no one told us," said Shaffer, a real-estate agent from Colorado. "We would probably have to spend the next 20 years trying to get right on the mortgage. That's crazy."

The mortgage industry is struggling to estimate how many homes are going into foreclosure because of people who don't want to pay, rather than because of people who can't afford to pay.What industry estimates?

Industry estimates and anecdotes suggest the figure is climbing ...