by Calculated Risk on 4/18/2008 02:43:00 PM

Friday, April 18, 2008

PIMCO's McCulley: Fed Should Regulate Investment Banks

"Minsky’s insight that financial capitalism is inherently and endogenously given to bubbles and busts is not just right, but spectacularly right. And when the financial regulators are not only asleep but actively cheerleading financial innovation outside their direct purview, a disaster is in the making, as the last year has taught us."From Paul McCulley at PIMCO: Credit, Markets, and the Real Economy: Is the Financial System Working? A Reverse Minsky Journey

Paul McCulley, April 17, 2008

[E]lementally, all institutions that have access to the Fed’s discount window must have pari passu regulatory oversight. It really is that simple. Access to the window is unambiguously a public good ... Accordingly, access to the window must – as it does in the case of conventional banks – carry the quid pro quo of prudential regulatory oversight, complete with enforcement powers.

... What I’m laying out is simply a bedrock principle: if you have access to the Fed’s discount window, the Fed should – and will, I strongly believe – have the power to supervise and regulate your business – core capital requirements, risk management, liquidity management, et al.

Home Builder NVR: Cancellation Rate Declines in Q1

by Calculated Risk on 4/18/2008 02:07:00 PM

Press Release: NVR, Inc. Announces First Quarter Results

The cancellation rate in the first quarter of 2008 was 22% compared to 16% in the first quarter of 2007 and 32% in the fourth quarter of 2007.The following graphs shows NVR's reported cancellations rates by quarter since the beginning of 2005.

Click on graph for larger image.

Click on graph for larger image.Although the current cancellation rate is still historically high, it is below the previous two quarters. This probably means that the Census Bureau is now under reporting new home sales. I discussed this in our recent newsletter:

[I]t appears cancellation rates have peaked for the homebuilders. This makes sense for two reasons: the new home cycle is typically just over six months from signed contract to the buyer taking occupancy of the home, so new home buyers who bought before August 2007 were hit by the credit crisis, and cancelled in large numbers. But now we are starting to see the cancellation rate decline because those who bought after August of last year were probably aware of the credit crisis. Also, the home builders have responded to the high cancellation rates by requiring larger deposits, actually qualifying buyers, and in some cases guaranteeing the house price (if the price declines further, the builder will rebate the difference to the buyer).

...

During periods of rising cancellation rates, the Census Bureau overstates New Home sales and understates the increase in inventory. Conversely, during periods of declining cancellation rates, the Census Bureau understates sales. For more on cancellations, see the Census Bureau statement.

By my calculations, the inventory of new homes is currently understated by about 108K. See this blog post.

The good news is cancellations appear to have peaked, and several builders have reported slightly declining cancellation rates. For example, KB Home reported that their cancellation rate improved to 53% in fiscal Q1 2008, from 58% in Q4 2007, and Lennar reported their cancellation rate declined to 26% in fiscal Q1 2008, from 33% in Q4 2007.

This improvement in cancellation rates (if it continues) means that the Census Bureau will understate sales—and also understate the decline in inventory.

The foreclosure 'discount'

by Calculated Risk on 4/18/2008 12:01:00 PM

Peter Viles at the LA Times has put together a collection of foreclosure listings in LA.

Viles features one house on his blog L.A. Land: The foreclosure 'discount': 45% in Glassel Park. Check it out! Here is another:

Source: LA Times.

FORECLOSED: GLENDALENote that the discount is to the asking price for the REO.

3732 Mayfield Ave., Glendale 91214

Agent's description: Bank-owned. Sold for $640,000 in 2007. Beautiful remodeled house on zero traffic tree lined street. Raised foundation, refinished hardwood floors, newer roof ... private yard.

• Sales history (from PropertyShark.com): Sold for $640,000 in February 2007.

• Current listing price: $449,900

• Discount from sales price: 29.7%

Here is the listing at Realtor.com. This is a 2 Bed, 1 Bath, 1,054 Sq. Ft. house, on a 5,000 sq ft. lot built in 1951.

What the heck were people thinking in Feb 2007? $640K? Ouch.

WSJ on Citi Conference Call

by Calculated Risk on 4/18/2008 10:03:00 AM

The WSJ MarketBeat Blog is Live-Blogging the Citigroup Earnings Call. Here are a few excerpts:

On headcount reductions ...

9:41 a.m.: Jason Goldberg of Lehman Brothers wants to know about the head count reductions. ... Mr. Crittenden [Citi CFO] ... notes that about 7,000 of the 9,000 eliminated comes from the consumer business. Mr. Goldberg wants to know about total headcount reductions — including attrition and job losses. Mr. Crittenden estimates it in the 16,000 range.On Earnings Visibility:

9:48 a.m.: [Meredith Whitney of Oppenheimer & Co.] wants to know about “earnings visibility” for the rest of the year, noting that the firm is going to have “persistent restructuring charges and sort of more moving parts than less moving parts.” She wants to know when “you think you’re going to turn the corner.” Mr. Crittenden first notes that if reduced values on certain assets were removed, “revenues would have been roughly flat.” He notes that the environment is rough — increases in credit-card losses, poor housing fundamentals and rising unemployment. “We are in unprecedented territory from a real-estate standpoint,” he says.

Mr. Crittenden continues. “We could, in fact, be facing head winds ... and we are dedicated to ongoing reengineering ... we’re going to try and operate the business in such a way that provides some consistency going forward but nonetheless you’re right in what you said about noise. Operating leverage is going to be a difficult thing to measure us on for awhile.” He says that difficulty will come from the continued divesture of businesses, and “that’s a lumpy process almost by definition.

“There’s no assurance that the amount of marks that we have taken in this quarter are finished. We’re three quarters into this. I think we have substantially reduced our amount of risk but there’s also the prospect that you could have additional marks, and that throws the calculation of that number pretty much out the window. What I would say is that I think you should hold us accountable for a couple things that we make significant progress on headcount and that we make significant progress that is discernible in our numbers on expenses.”

Citi: $13 billion in write-downs

by Calculated Risk on 4/18/2008 08:44:00 AM

From the WSJ: Citigroup Swings to Loss On Hefty Write-Downs

Citigroup Inc. said Friday ... it booked more than $13 billion in write-downs amid surging credit costs, results that "reflect the continuation of the unprecedented market and credit environment."Wasn't last quarter the "kitchen sink" write down quarter?

...

The latest results included $6 billion in write-downs and credit costs on subprime-related exposures, $3.1 billion on leveraged loans, $1.6 billion on Alt-A mortgages and commercial real estate and $1.5 billion each on auction-rate securities and Citigroup's exposure to monoline insurers.

Thursday, April 17, 2008

Study: Home-Remodeling Spending To Fall 4.8% through 2008

by Calculated Risk on 4/17/2008 05:07:00 PM

From Dow Jones: Home-Remodeling Spending To Fall 4.8% Through '08 - Study

Home-improvement spending is unlikely to improve until 2009, and the second half of 2008 is shaping up to be weaker than the first, according to Harvard University's Joint Center for Housing Studies.I think this might be optimistic. First, falling house prices and the inability for homeowners to borrow against their homes (mortgage equity withdrawal) are probably "inhibiting remodeling spending" more than the weakening economy and consumer confidence.

Falling consumer confidence and a weakening economy are inhibiting remodeling spending, which is expected to fall by an annual rate of 4.8% through the end of 2008, the center said Thursday. That is steeper than the 2.6% annualized decline the center projected through the third quarter when it last updated its Leading Indicator of Remodeling Activity in January.

Second, we have recently seen warnings from Home Depot and Lowe's that suggest same store sales are falling off a cliff (about 8% year-over-year).

And third, the Joint Center for Housing Studies forecast is mild compared to declines in home improvement spending during previous housing busts.

Click on graph for larger image.

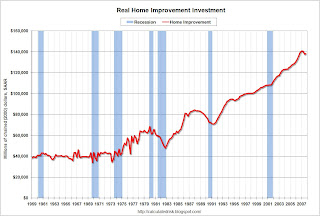

Click on graph for larger image.This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in light blue (source: BEA)

As of Q4 2007, real spending on home improvement had held up pretty well (only off 2% in real terms from the peak). If this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.

Yes, the Joint Center for Housing Studies forecast is in nominal terms, but it appears they believe this slump in home improvement will be milder than the downturns during the previous two housing busts (early '80s and early '90s).

DataQuick on Bay Area: Very Low Sales

by Calculated Risk on 4/17/2008 03:38:00 PM

From DataQuick Bay Area home sales remain at two-decade low

For the seventh month in a row, Bay Area home sales were at their lowest level in more than two decades as potential buyers and sellers continued to wait out market turbulence, a real estate information service reported.On prices:

A total of 4,898 new and resale houses and condos sold in the nine- county Bay Area in March. That was up 22.8 percent from 3,989 in February, and down 41.1 percent from 8,317 for March 2007, DataQuick Information Systems reported.

Last month was the slowest March in DataQuick's statistics, which go back to 1988. Record monthly lows have been logged in since September. The sales increase between February and March this year was the lowest on record. Normally sales increase by 40 percent.

The median price paid for a Bay Area home was $536,000 last month, down 2.2 percent from $548,000 in February, and down 16.1 percent from $639,000 in March last year. Last month's median was 19.4 percent lower than the peak median of $665,000 reached last June and July.This is why the Case-Shiller repeat home method is better than the median price method for calculating home price changes. Using the median price method, it appeared prices were holding up pretty well at the beginning of the housing bust simply because the mix changed - fewer low end homes were sold. Now it's the high end being hit. And finally ...

Last month's median price would have been closer to $597,000 if the availability of jumbo home loans had remained stable. A year ago jumbo loans, mortgages above $417,000, accounted for 62.2 percent of all Bay Area home loans. Last month they were 29.8 percent.

Foreclosure activity is at record levels ...The California foreclosure activity data should be released soon for Q1. It will probably be stunning.

Investment Matters

by Calculated Risk on 4/17/2008 02:19:00 PM

Recently many companies have announced plans to cut capital spending in 2008. This probably means non-residential fixed investments will decline in 2008, as compared to 2007.

This decline in investment is an important indicator for the economy, since changes in fixed investment correlate very well with GDP. The first graph shows the change in real GDP and Private Fixed Investment over the preceding four quarters through Q4 2007. (Source: BEA Table 1.1.1) (note these are year-over-year changes, not quarter-by-quarter).  Click on graph for larger image.

Click on graph for larger image.

The red line is the year-over-year change in fixed investment, and the blue line (scale on left axis) is the year-over-year change in GDP. Correlation is 79%.

Residential investment is the best indicator of a future recession, but that has been flashing a recession warning for some time. This is why I've been so focused lately on non-residential investment, especially on commercial real estate, to determine that the recession has started. (also consumer spending - but that is a different post). The second graph shows two components of private fixed investment: residential (shifted 5 quarters into the future) and nonresidential structures.

The second graph shows two components of private fixed investment: residential (shifted 5 quarters into the future) and nonresidential structures.

This graphs shows something very interesting: in general, residential investment leads nonresidential structure investment. There are periods when this observation doesn't hold - like '95 when residential investment fell and the growth of nonresidential structure investment remained strong.

Another interesting period was in 2001 when nonresidential structure investment fell significantly more than residential investment. Obviously the fall in nonresidential structure investment was related to the bursting of the stock market bubble.

However, the typical pattern is residential investment leads non-residential structure investment. The normal pattern would be for investment in non-residential structures to have turned negative now.

And based on construction spending, anecdotal stories, and the most recent Fed loan survey, it appears the non-residential structure investment bust is here.

Here is a graph based on the Fed senior loan officer survey in January: The January 2008 Senior Loan Officer Opinion Survey on Bank Lending Practices

Note: the April survey should be released in early May. Of particular interest is the record increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

Of particular interest is the record increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

This is strong evidence of an imminent slump in non-residential structure investment.

Credit Crisis: Third Wave

by Calculated Risk on 4/17/2008 12:29:00 PM

Professor Krugman writes: It’s my TED! Mine!

OK, OK ... Today I'll just stick with the A2/P2 spread from the Fed's commercial paper report. Here is a simple explanation of this chart: This is the spread between high and low quality 30 day nonfinancial commercial paper.

Here is a simple explanation of this chart: This is the spread between high and low quality 30 day nonfinancial commercial paper.

What is commercial paper (CP)? This is short term paper - less than 9 months, but usually much shorter duration like 30 days - that is issued by companies to finance short term needs. Many companies issue CP, and for most of these companies the risk of default is close to zero (think companies like GE or Coke). This is the high quality CP. Here is a good description.

Lower rated companies also issues CP and this is the A2/P2 rating. This doesn't include the Asset Backed CP - that is another category. (see commercial paper table).

The spread between the A2/P2 and AA paper shows the concern of default for the A2/P2 paper. Right now that concern is still pretty high.

Philly Fed Indexes Reflect Weaker Activity

by Calculated Risk on 4/17/2008 10:12:00 AM

The typical investment pattern is for residential investment to lead the economy into a recession, and then for non-residential investment to slump as the recession starts. The Philly Fed survey this month provides more evidence that the cycle is following the typical pattern (see the special question on capital spending at the bottom of this post).

Here is the Philadelphia Fed Index released today: Business Outlook Survey.  Click on graph for larger image.

Click on graph for larger image.

This graph shows the Philly index vs. recessions for the last 40 years. There are a number of times the index was below zero without a recession - so the reading today doesn't mean the economy is in recession. However it is very likely that the economy is already in recession.

From the release, weaker conditions and higher prices and lower capital spending:

Indexes Reflect Weaker Activity

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, deteriorated from -17.4 in March to -24.9 this month (see Chart). The index has remained negative for five consecutive months

...

Firms Report Higher Prices

A sizable share of the firms continued to report higher prices, both for inputs and for their own products. Fifty-five percent of manufacturers reported higher input prices this month, although the prices paid index edged slightly lower, from 54.4 in March to 51.6..

...

Six-Month Outlook Improves But Remains Cautious

The future general activity index rebounded from a reading of -0.5 in March, rising to 13.7, its highest level in five months.

Special Question on Capital Spending Plans

With regard to capital spending, the percentage of firms indicating that they had decreased their capital spending plans (27 percent) was greater than the percentage indicating they had increased them (19 percent) since January. Moreover, since January, 10 percent of the firms indicated that they had either delayed planned capital spending until later in the year or postponed it indefinitely.